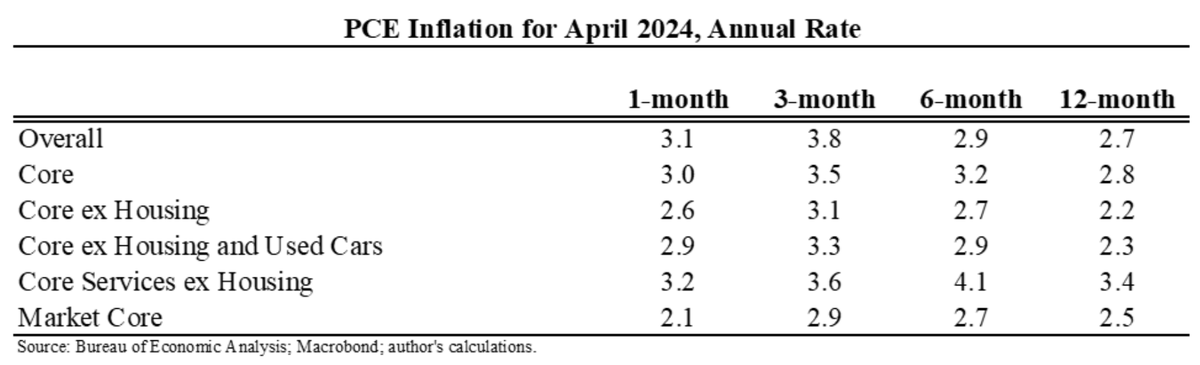

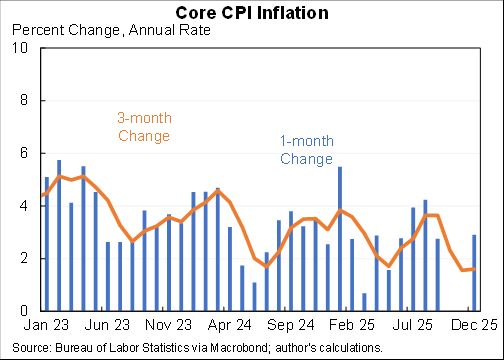

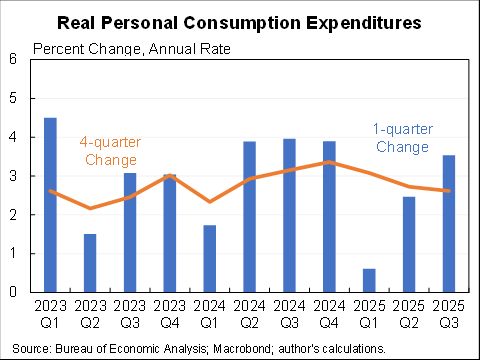

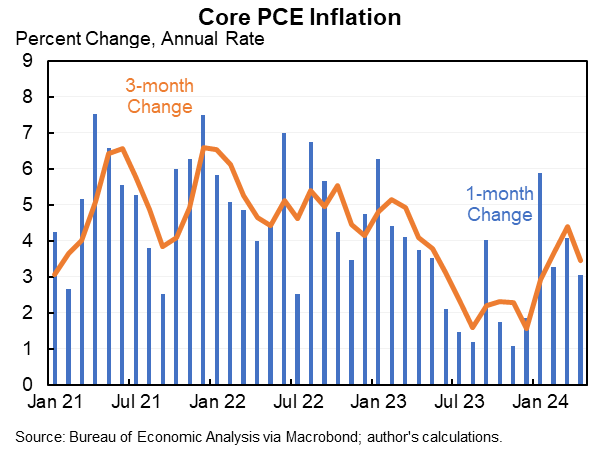

Core PCE inflation came in above the Fed's target for the 4th straight month. But it moderated from Q1 and the elevation was entirely due to imputed portfolio fees resulting from the strong stock market.

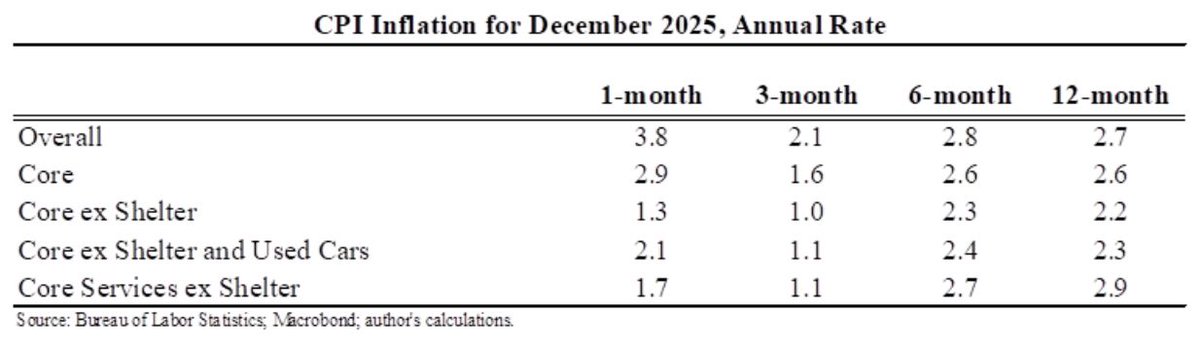

Annual rates:

1 month: 3.0%

3 months: 3.5%

6 months: 3.2%

12 months: 2.8%

Annual rates:

1 month: 3.0%

3 months: 3.5%

6 months: 3.2%

12 months: 2.8%

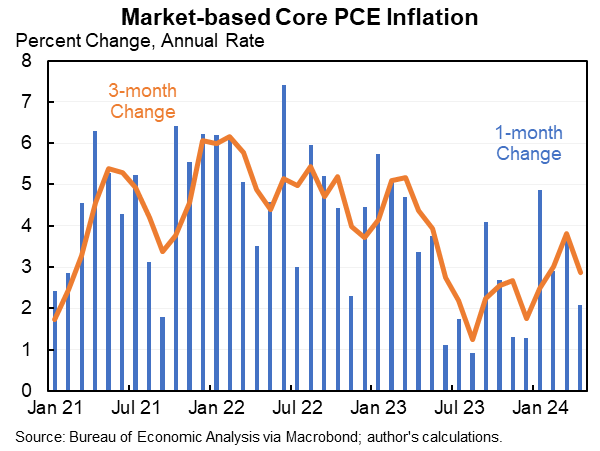

About one-sixth of the PCE is imputed items, one notable one is portfolio fees which are treated as rising in price when the value of assets rise. Statistically market-based core PCE works better.

Annual rates:

1 month: 2.1%

3 months: 2.9%

6 months: 2.7%

12 months: 2.5%

Annual rates:

1 month: 2.1%

3 months: 2.9%

6 months: 2.7%

12 months: 2.5%

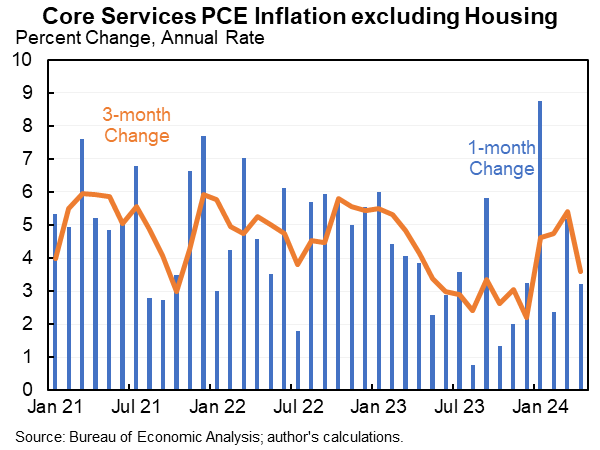

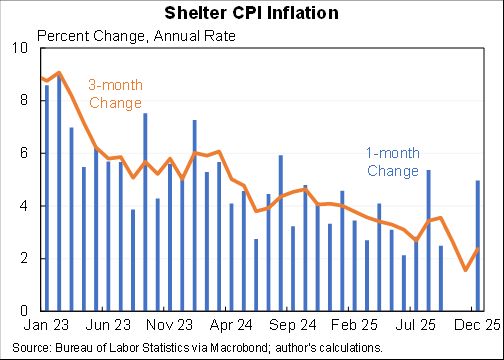

The elevation in inflation is not all housing. If you exclude housing core PCE is still well above 2% at every horizon--notably up at a 2.7% annual rate over the last six months.

(This also runs a little lower than PCE generally so that is more like 2.9% PCE growth.)

(This also runs a little lower than PCE generally so that is more like 2.9% PCE growth.)

Overall I've been of the view that underlying inflation is in the 2.5 to 3% range. Nothing in these numbers would be inconsistent with that view. It is nice to see some improvement but when even the "good" months are a bit high & the "bad" months are way too high it's a problem.

• • •

Missing some Tweet in this thread? You can try to

force a refresh