Explainer: Did CBSL actually print money?

No.

@Economynext's piece on alleged “money printing” went viral and subsequently, @CBSL issued a clarification.

Want to know which is which? In simple terms?

Please keep reading.

🧵Thread.

1/ @CSE_Media

No.

@Economynext's piece on alleged “money printing” went viral and subsequently, @CBSL issued a clarification.

Want to know which is which? In simple terms?

Please keep reading.

🧵Thread.

1/ @CSE_Media

Background

@Economynext makes two key points.

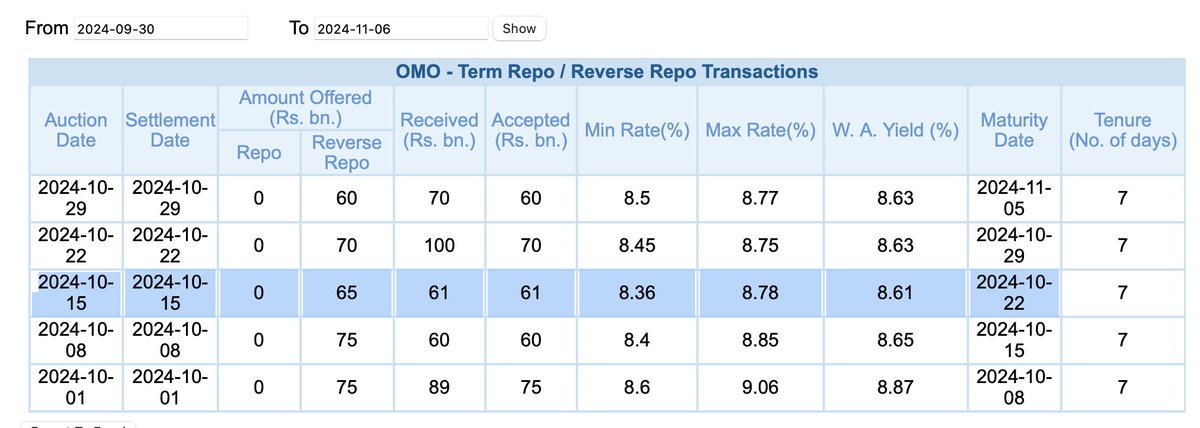

CBSL injected LKR 100 Bn by 25th Oct:

1. 70 Bn for 7 days via term auction

2. 36 Bn via an overnight auction

Also, they try to validate this by below:

3. By 25th Oct, excess liquidity deposited with CBSL was 193 Bn

2/

@Economynext makes two key points.

CBSL injected LKR 100 Bn by 25th Oct:

1. 70 Bn for 7 days via term auction

2. 36 Bn via an overnight auction

Also, they try to validate this by below:

3. By 25th Oct, excess liquidity deposited with CBSL was 193 Bn

2/

Note

I have a huge respect towards economynext’s BELLWETHER and have learned a great deal from his/her writing.

The few points I want to clarify here are based on my first-hand experience as a Bond Trader.

My regards to BELLWETHER remains as is.

3/

I have a huge respect towards economynext’s BELLWETHER and have learned a great deal from his/her writing.

The few points I want to clarify here are based on my first-hand experience as a Bond Trader.

My regards to BELLWETHER remains as is.

3/

Term Reverse (Rev) Repos

A tool where CBSL lends money to Banks, to fulfil their short-term liquidity needs.

Unlike SLF - which is overnight, Term Rev Repos ranges from 2 days to 3 months, or more.

Hence, the name "term".

4/

A tool where CBSL lends money to Banks, to fulfil their short-term liquidity needs.

Unlike SLF - which is overnight, Term Rev Repos ranges from 2 days to 3 months, or more.

Hence, the name "term".

4/

Term Rev Repos

Injection of term liquidity provides a comfort to Banks, as funding is locked-in for a longer period, compared to SLF.

They reduce the strain on the money market for overnight funds.

Also, indirectly, they provide an incentive for Banks to invest in GSecs.

5/

Injection of term liquidity provides a comfort to Banks, as funding is locked-in for a longer period, compared to SLF.

They reduce the strain on the money market for overnight funds.

Also, indirectly, they provide an incentive for Banks to invest in GSecs.

5/

Term Rev Repos

Key Point:

At the end of the term (= rev repo maturity date), term repos needs to be settled.

At that point, liquidity is drained from the money market, as money flows out to CBSL.

Therefore, this is a short-term injection of liquidity.

6/

Key Point:

At the end of the term (= rev repo maturity date), term repos needs to be settled.

At that point, liquidity is drained from the money market, as money flows out to CBSL.

Therefore, this is a short-term injection of liquidity.

6/

Money Printing vs. Term Rev Repos

Both leads to an increase in money supply, but they are NOT the same.

Money Printing

= Monetisation of fiscal deficit

= creating money to bridge the gap between Govt. revenue and expenses

7/

Both leads to an increase in money supply, but they are NOT the same.

Money Printing

= Monetisation of fiscal deficit

= creating money to bridge the gap between Govt. revenue and expenses

7/

Money Printing vs. Term Rev Repos

Term Rev Repo

= Provision of liquidity by CBSL to the money market

= Injected liquidity is reversed (drained) when the rev repo matures

8/

Term Rev Repo

= Provision of liquidity by CBSL to the money market

= Injected liquidity is reversed (drained) when the rev repo matures

8/

Point 1: Injecting 70 Bn for 7 days

BELLWETHER missed that a term rev repo maturity of 61 Bn was due on 22nd Oct.

Although 70 Bn was injected, 61 Bn of that was drained due to the settlement of last week’s term rev repo.

Hence, net injection to money market was just 9 Bn.

9/

BELLWETHER missed that a term rev repo maturity of 61 Bn was due on 22nd Oct.

Although 70 Bn was injected, 61 Bn of that was drained due to the settlement of last week’s term rev repo.

Hence, net injection to money market was just 9 Bn.

9/

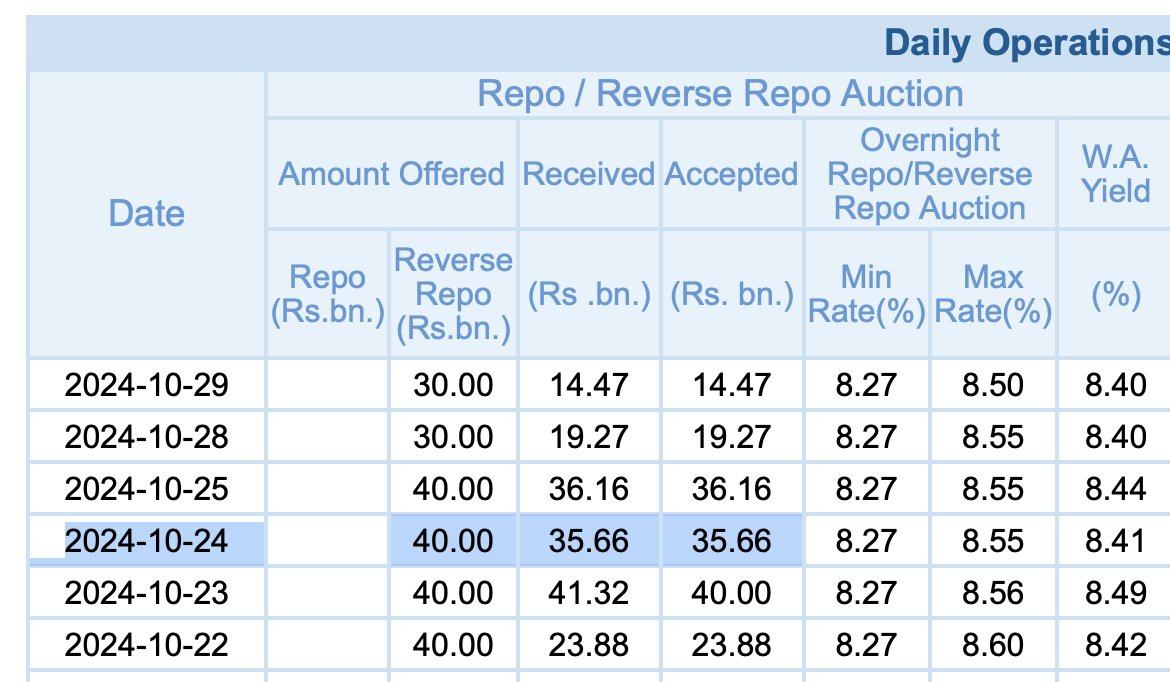

Point 2: Injecting 36 Bn Overnight

While there was an injection of 36 Bn on an overnight basis, a repayment of 35 Bn was also due, same day.

This was for the repayment of previous day’s overnight SLF injection, due today.

So, net injection was actually less than 1 Bn.

10/

While there was an injection of 36 Bn on an overnight basis, a repayment of 35 Bn was also due, same day.

This was for the repayment of previous day’s overnight SLF injection, due today.

So, net injection was actually less than 1 Bn.

10/

Point 3: 193 Bn was deposited at CBSL standing facility

As CBSL clarified, this belongs mostly to foreign Banks.

As sovereign rating is still in default, they can't lend to local Banks, due to internal restrictions.

So, CBSL needs to provide liquidity to local Banks.

11/

As CBSL clarified, this belongs mostly to foreign Banks.

As sovereign rating is still in default, they can't lend to local Banks, due to internal restrictions.

So, CBSL needs to provide liquidity to local Banks.

11/

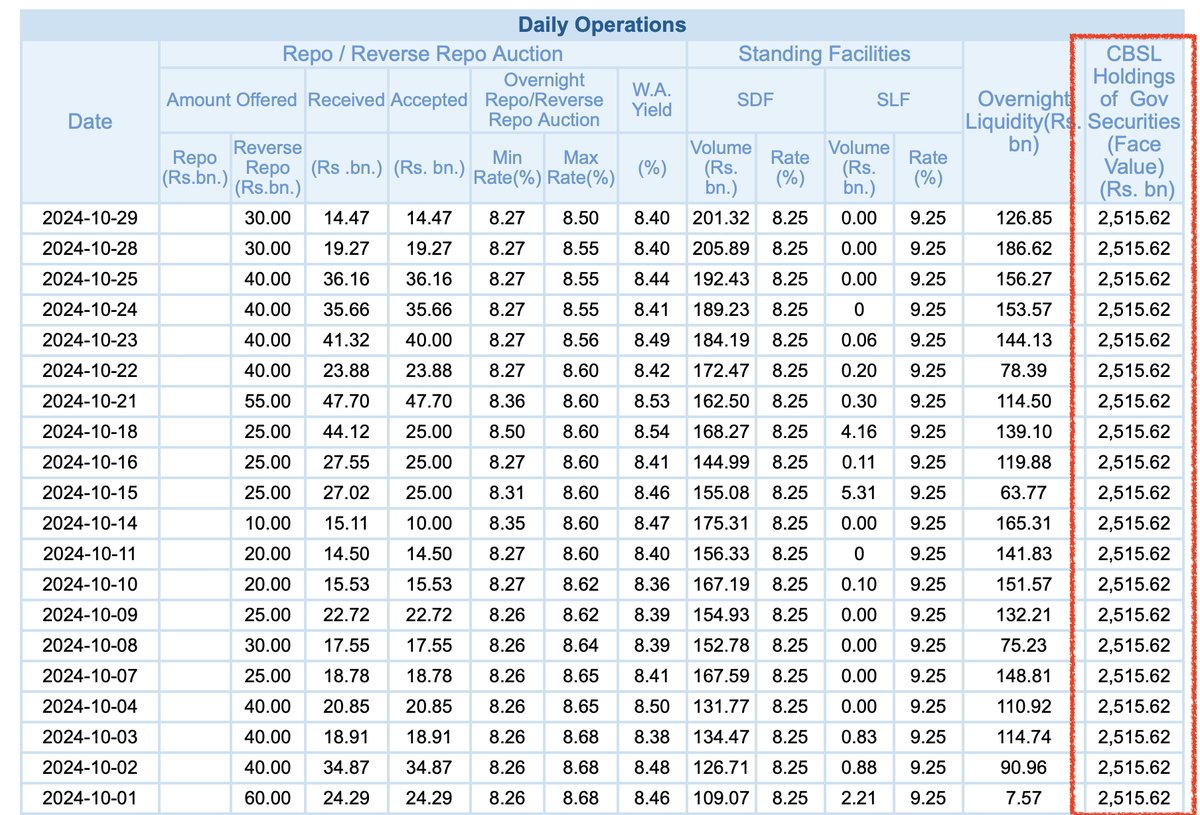

Bonus Point

Has CBSL printed money to finance Govt. fiscal deficit?

No. This is clearly visible when you look at the stock of GSec held by CBSL.

That figure has been either falling or remained flat over the year.

12/

Has CBSL printed money to finance Govt. fiscal deficit?

No. This is clearly visible when you look at the stock of GSec held by CBSL.

That figure has been either falling or remained flat over the year.

12/

TL;DR

• CBSL has NOT printed money to finance Govt. fiscal deficit.

• CBSL has provided liquidity, due to money market imbalances.

• Economynext overstates the injections (by not adjusting for outflows due to prior term and overnight rev repo settlements)

13/

• CBSL has NOT printed money to finance Govt. fiscal deficit.

• CBSL has provided liquidity, due to money market imbalances.

• Economynext overstates the injections (by not adjusting for outflows due to prior term and overnight rev repo settlements)

13/

Like, Repost and Follow

If you found this interesting:

• Like to show some love

• Repost top tweet below, to share with others

• Follow me @theGayan for more insights on investing

14/

If you found this interesting:

• Like to show some love

• Repost top tweet below, to share with others

• Follow me @theGayan for more insights on investing

14/

https://x.com/theGayan/status/1851351353777660313

• • •

Missing some Tweet in this thread? You can try to

force a refresh