Since 2021, the number of Bitcoin L2 projects has increased 7x, from 10 to 75. With $447M invested since 2018, Bitcoin L2s are transforming BTC’s utility.

@hiroto_btc's (@glxyresearch) latest report explores the evolution of Bitcoin L2s, from key characteristics and scaling solutions to a funding breakdown and a TAM analysis.

Here's everything you need to know about this ecosystem🧵

@hiroto_btc's (@glxyresearch) latest report explores the evolution of Bitcoin L2s, from key characteristics and scaling solutions to a funding breakdown and a TAM analysis.

Here's everything you need to know about this ecosystem🧵

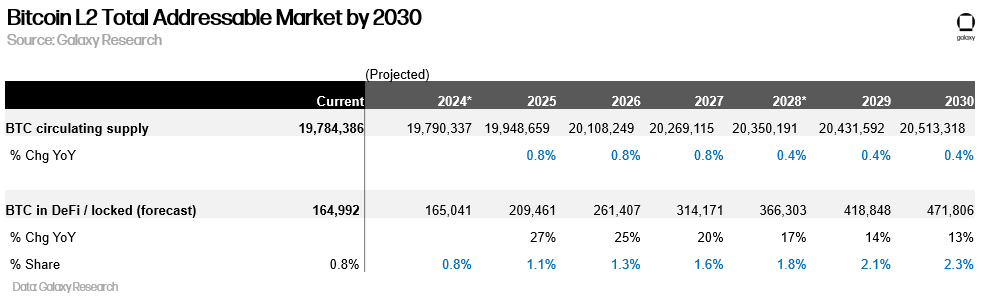

Bitcoin L2 projects have seen unprecedented growth, with 36% of all venture funding allocated in 2024 alone. By 2030, over $47B of BTC could be bridged into L2s to fuel DeFi, fungible tokens, payments, & more.

Early pioneers like Lightning Network & Liquid paved the way for Bitcoin L2s. Now, advancements in Rollups (zk & Optimistic) are unlocking new applications. Think Ethereum-like innovation but with Bitcoin’s security.

Why does this matter?

Bitcoin L2s allow users to access DeFi, staking, and apps without leaving the Bitcoin ecosystem—a game-changer for utility.

Bitcoin L2s allow users to access DeFi, staking, and apps without leaving the Bitcoin ecosystem—a game-changer for utility.

Today, only 0.8% of BTC supply is active in DeFi, L2s, & staking. By 2030, that could grow to 2.3%, representing $47B of BTC liquidity in Bitcoin-native ecosystems.

Ethereum hosts $9B+ in wrapped BTC. To compete, Bitcoin L2s must develop yield-generating apps to attract this liquidity.

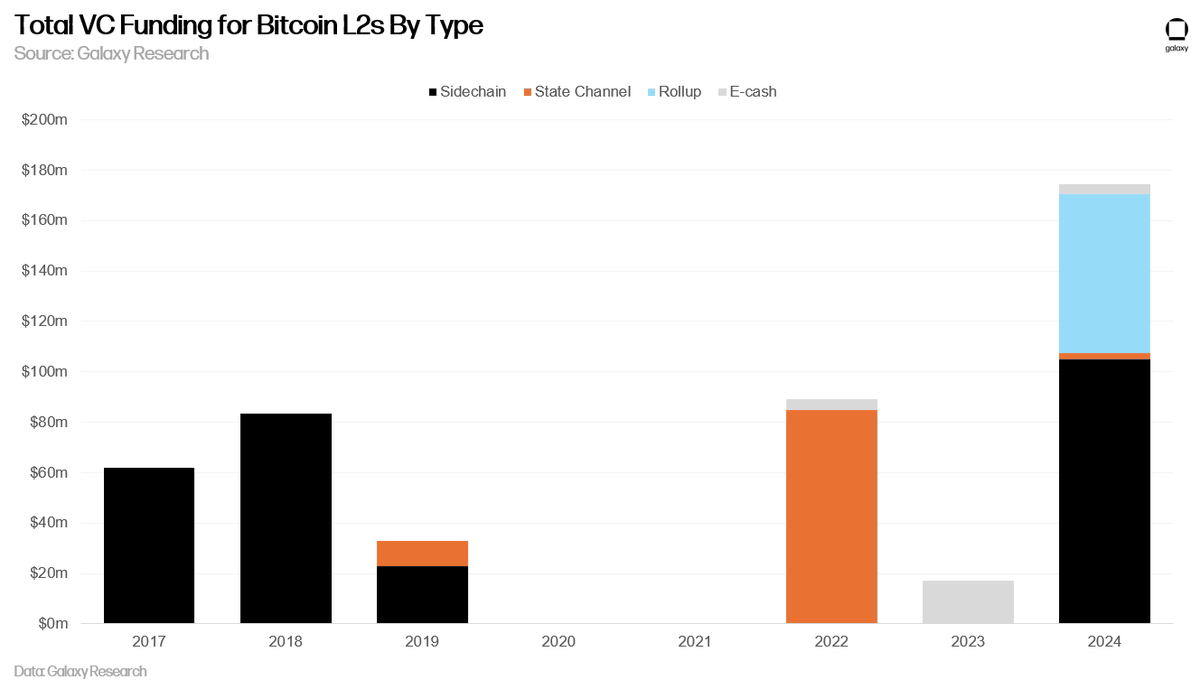

Venture capital has taken notice:

- $447M invested in Bitcoin L2s since 2018

- 2024 alone accounted for 39% of funding

Sidechains & Rollups are the leaders, with early-stage projects showing massive potential.

- $447M invested in Bitcoin L2s since 2018

- 2024 alone accounted for 39% of funding

Sidechains & Rollups are the leaders, with early-stage projects showing massive potential.

The TAM for Bitcoin L2s could hit $47B by 2030 if BTC reaches $100K. This growth depends on scaling DeFi apps, yield opportunities, & trust-minimized bridging solutions.

Key Takeaway: L2s have the potential to redefine how BTC is used, moving beyond “digital gold” to an active, versatile asset driving DeFi and more.

Explore the full report👇

Explore the full report👇

@hiroto_btc @glxyresearch Read Bitcoin L2s: A Modular Future: hubs.li/Q02Y-mpy0

• • •

Missing some Tweet in this thread? You can try to

force a refresh