🚨 Crypto Predictions for 2025 from @glxyresearch

Featuring... bitcoin and ether price, ETHBTC, both Dogecoin and D.O.G.E., stablecoins, defi, L2s, policy, VC, and more...

Here are the predictions we just sent to @galaxyhq clients and counterparties 👇

Featuring... bitcoin and ether price, ETHBTC, both Dogecoin and D.O.G.E., stablecoins, defi, L2s, policy, VC, and more...

Here are the predictions we just sent to @galaxyhq clients and counterparties 👇

01 - Bitcoin will cross $150k in H1 and test or best $185k in Q4 2025.

A combination of institutional, corporate, and nation state adoption will propel Bitcoin to new heights in 2025. Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the S&P 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of Gold’s market cap. -@intangiblecoins

A combination of institutional, corporate, and nation state adoption will propel Bitcoin to new heights in 2025. Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the S&P 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of Gold’s market cap. -@intangiblecoins

02 - The U.S. spot Bitcoin ETPs will collectively cross $250bn AUM in 2025.

In 2024, the Bitcoin ETPs collectively took in more than $36bn in net inflows, making them the best ETP launch as a cohort in history. Many of the world’s major hedge funds bought the Bitcoin ETPs, including Millennium, Tudor, and D.E. Shaw, while the State of Wisconsin Investment Board (SWIB) bought a position, according to 13F filings. After just 1 year, the Bitcoin ETPs are only 19% away ($24bn) from flipping the AUM of all the U.S. physical gold ETPs. -@intangiblecoins

In 2024, the Bitcoin ETPs collectively took in more than $36bn in net inflows, making them the best ETP launch as a cohort in history. Many of the world’s major hedge funds bought the Bitcoin ETPs, including Millennium, Tudor, and D.E. Shaw, while the State of Wisconsin Investment Board (SWIB) bought a position, according to 13F filings. After just 1 year, the Bitcoin ETPs are only 19% away ($24bn) from flipping the AUM of all the U.S. physical gold ETPs. -@intangiblecoins

03 - Bitcoin will again be among the top performers on a risk-adjusted basis among global assets in 2025.

The AUM comparison above is due to both record inflows and Bitcoin price appreciation throughout 2024. Indeed, Bitcoin is the 3rd best performing asset on a risk adjusted basis when compared to a basked of equities, fixed income securities, indices, and commodities. Notably, the best Sharpe ratio belongs to MicroStrategy, a self-described “bitcoin treasury company.” -@intangiblecoins

The AUM comparison above is due to both record inflows and Bitcoin price appreciation throughout 2024. Indeed, Bitcoin is the 3rd best performing asset on a risk adjusted basis when compared to a basked of equities, fixed income securities, indices, and commodities. Notably, the best Sharpe ratio belongs to MicroStrategy, a self-described “bitcoin treasury company.” -@intangiblecoins

04 - At least one top wealth management platform will announce a 2% or higher recommended Bitcoin allocation.

For a variety of reasons, including seasoning periods, internal education, compliance requirements, and more, no major wealth manager or asset management firm has yet officially added a Bitcoin allocation recommendation to investment-advised model portfolios. That will change in 2025, and this will further swell the flows and AUM of U.S. spot-based Bitcoin ETPs. -@intangiblecoins

For a variety of reasons, including seasoning periods, internal education, compliance requirements, and more, no major wealth manager or asset management firm has yet officially added a Bitcoin allocation recommendation to investment-advised model portfolios. That will change in 2025, and this will further swell the flows and AUM of U.S. spot-based Bitcoin ETPs. -@intangiblecoins

05 - Five Nasdaq 100 companies and five nation states will announce they have added Bitcoin to their balance sheets or sovereign wealth funds.

Whether for strategic, portfolio diversification, or trade settlement reasons, Bitcoin will begin finding a home on the balance sheets of major corporate and sovereign allocators. Competition among nation states, particularly unaligned nations, those with large sovereign wealth funds, or even those adversarial to the United States, will drive the adoption of strategies to mine or otherwise acquire Bitcoin. -JW

Whether for strategic, portfolio diversification, or trade settlement reasons, Bitcoin will begin finding a home on the balance sheets of major corporate and sovereign allocators. Competition among nation states, particularly unaligned nations, those with large sovereign wealth funds, or even those adversarial to the United States, will drive the adoption of strategies to mine or otherwise acquire Bitcoin. -JW

06 - Bitcoin developers will reach consensus on the next protocol upgrade in 2025.

Since 2020, Bitcoin Core developers have debated on which opcode(s) could safely enhance transaction programmability. As of December 2024, the two most supported pending opcodes for transaction programmability include OP_CTV (BIP 119) and OP_CAT (BIP 347). Since Bitcoin’s inception, reaching consensus on soft forks has been a time-consuming and rare feat, but consensus will emerge in 2025 to include OP_CTV, OP_CSFS, and/or OP_CAT in the next soft fork upgrade, although that upgrade will not activate in 2025. -@hiroto_btc

Since 2020, Bitcoin Core developers have debated on which opcode(s) could safely enhance transaction programmability. As of December 2024, the two most supported pending opcodes for transaction programmability include OP_CTV (BIP 119) and OP_CAT (BIP 347). Since Bitcoin’s inception, reaching consensus on soft forks has been a time-consuming and rare feat, but consensus will emerge in 2025 to include OP_CTV, OP_CSFS, and/or OP_CAT in the next soft fork upgrade, although that upgrade will not activate in 2025. -@hiroto_btc

07 - More than half the top 20 publicly traded Bitcoin miners by market cap will announce transitions to or enter partnerships with hyperscalers, AI, or high-performance compute firms.

Growing demands for compute deriving from AI will lead Bitcoin miners to increasingly retrofit, build, or co-locate HPC infrastructure alongside their Bitcoin mines. This will limit hashrate YoY hashrate growth, which will end 2025 at 1.1 zetahash. -@intangiblecoins @SimritDhinsa

Growing demands for compute deriving from AI will lead Bitcoin miners to increasingly retrofit, build, or co-locate HPC infrastructure alongside their Bitcoin mines. This will limit hashrate YoY hashrate growth, which will end 2025 at 1.1 zetahash. -@intangiblecoins @SimritDhinsa

08 - Bitcoin DeFi, recognized as the total amount of BTC locked in DeFi smart contracts and deposited in staking protocols, will almost double in 2025.

As of December 2024, over $11bn of wrapped versions of BTC are locked in DeFi smart contracts. Notably, over 70% of this locked BTC is used as collateral on lending protocols. Through Bitcoins largest staking protocol, Babylon, there is approximately $4.2bn in additional deposits. The Bitcoin DeFi market, currently valued at $15.4 billion, is expected to expand significantly in 2025 across multiple vectors including existing DeFi protocols on Ethereum L1/L2s, new DeFi protocols on Bitcoin L2s, and staking layers like Babylon. A doubling of the current market size would likely be driven by several key growth factors: a 150% year-over-year increase in cbBTC supply, a 30% rise in WBTC supply, Babylon reaching $8bn in TVL, and new Bitcoin L2s achieving $4 billion in DeFi TVL. -@hiroto_btc

As of December 2024, over $11bn of wrapped versions of BTC are locked in DeFi smart contracts. Notably, over 70% of this locked BTC is used as collateral on lending protocols. Through Bitcoins largest staking protocol, Babylon, there is approximately $4.2bn in additional deposits. The Bitcoin DeFi market, currently valued at $15.4 billion, is expected to expand significantly in 2025 across multiple vectors including existing DeFi protocols on Ethereum L1/L2s, new DeFi protocols on Bitcoin L2s, and staking layers like Babylon. A doubling of the current market size would likely be driven by several key growth factors: a 150% year-over-year increase in cbBTC supply, a 30% rise in WBTC supply, Babylon reaching $8bn in TVL, and new Bitcoin L2s achieving $4 billion in DeFi TVL. -@hiroto_btc

09 - Ether will trade above $5500 in 2025.

A relaxation of regulatory headwinds for DeFi and staking will propel Ether to new all-time highs in 2025. New partnerships between DeFi and TradFi, perhaps conducted inside new regulatory sandbox environments, will finally allow traditional capital markets to experiment with public blockchains in earnest, with Ethereum and its ecosystem seeing the lion’s share of use. Corporations will increasingly experiment with their own Layer 2 networks, mostly based on Ethereum technology. Some games utilizing public blockchains will find product-market fit, and NFT trading volumes will meaningfully rebound. -@intangiblecoins

A relaxation of regulatory headwinds for DeFi and staking will propel Ether to new all-time highs in 2025. New partnerships between DeFi and TradFi, perhaps conducted inside new regulatory sandbox environments, will finally allow traditional capital markets to experiment with public blockchains in earnest, with Ethereum and its ecosystem seeing the lion’s share of use. Corporations will increasingly experiment with their own Layer 2 networks, mostly based on Ethereum technology. Some games utilizing public blockchains will find product-market fit, and NFT trading volumes will meaningfully rebound. -@intangiblecoins

10 - Ethereum staking rate will exceed 50%.

The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, it is likely that spot-based ETH ETPs will be allowed to stake some percentage of the ETH they hold on behalf of shareholders. Demand for staking will continue to rise next year, and likely exceed half of Ethereum circulating supply by the end of 2025, which will prompt Ethereum developers to more seriously consider changes to network monetary policy. More importantly, the rise in staking will fuel greater demand and value flowing through Ethereum staking pools like Lido and Coinbase and restaking protocols like EigenLayer and Symbiotic. -@christine_dkim

The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, it is likely that spot-based ETH ETPs will be allowed to stake some percentage of the ETH they hold on behalf of shareholders. Demand for staking will continue to rise next year, and likely exceed half of Ethereum circulating supply by the end of 2025, which will prompt Ethereum developers to more seriously consider changes to network monetary policy. More importantly, the rise in staking will fuel greater demand and value flowing through Ethereum staking pools like Lido and Coinbase and restaking protocols like EigenLayer and Symbiotic. -@christine_dkim

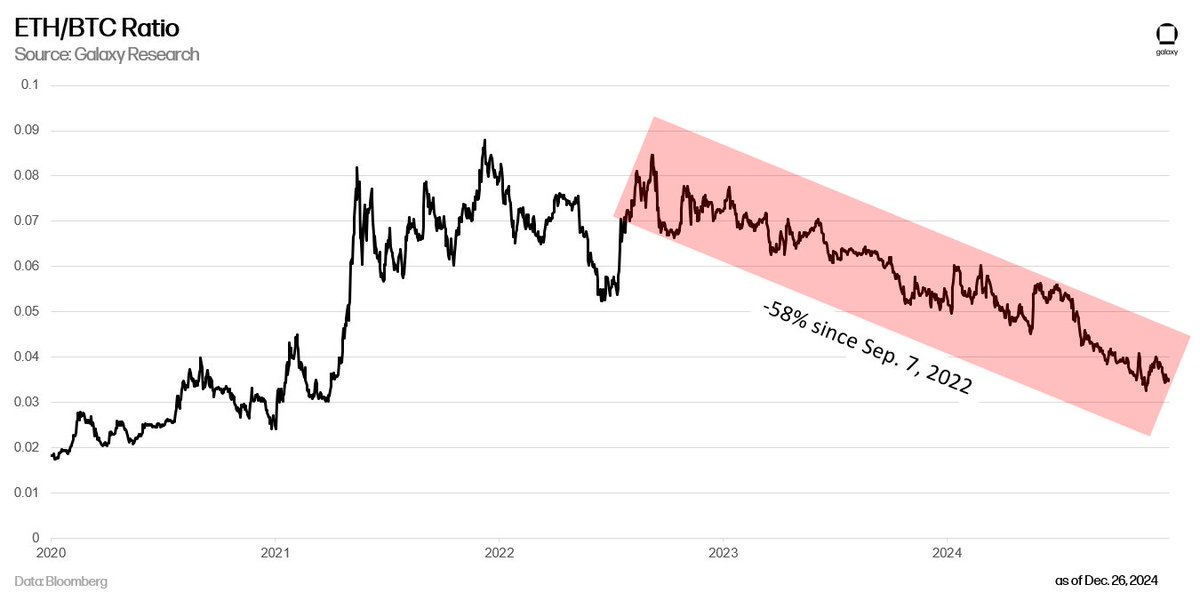

11 - The ETH/BTC ratio will trade below 0.03 in 2025 but will finish the year above 0.06.

The ETH/BTC ratio, one of the most-watched pairs in all of crypto, has been on a perilous downward trend since Ethereum switched to proof-of-stake in September 2022’s “Merge” upgrade. However, anticipated regulatory shifts will uniquely support Ethereum and its app-layer, particularly DeFi, re-igniting investor interest in the world’s second-most valuable blockchain network. -@intangiblecoins

The ETH/BTC ratio, one of the most-watched pairs in all of crypto, has been on a perilous downward trend since Ethereum switched to proof-of-stake in September 2022’s “Merge” upgrade. However, anticipated regulatory shifts will uniquely support Ethereum and its app-layer, particularly DeFi, re-igniting investor interest in the world’s second-most valuable blockchain network. -@intangiblecoins

12 - L2s as a collective will generate more economic activity than Alt L1s over 2025.

L2 fees as a % of Alt L1s fees (currently mid-single digits) will end the year above 25% of aggregate Alt L1 fees. L2s will approach scaling limits early in the year, leading to frequent surges in transaction fees that will require a change to gas limits & blob market parameters. However, other tech solutions such as (e.g., Reth client or altVMs like Arbitrum Stylus) will provide greater efficiencies for rollups to keep transaction costs at usable levels. -@FullNodeChuck

L2 fees as a % of Alt L1s fees (currently mid-single digits) will end the year above 25% of aggregate Alt L1 fees. L2s will approach scaling limits early in the year, leading to frequent surges in transaction fees that will require a change to gas limits & blob market parameters. However, other tech solutions such as (e.g., Reth client or altVMs like Arbitrum Stylus) will provide greater efficiencies for rollups to keep transaction costs at usable levels. -@FullNodeChuck

13 - DeFi will enter its “dividend era” as onchain applications distribute at least $1 billion of nominal value to users and token holders from treasury funds and revenue sharing.

As DeFi regulation becomes more defined, value sharing by onchain applications will expand. Applications like Ethena and Aave have already initiated discussionsor passed proposals to implement their fee switches—the infrastructure enabling value distribution to users. Other protocols that previously rejected such mechanisms, including Uniswap and Lido, may reconsider their stance due to regulatory clarity and competitive dynamics. The combination of an accommodative regulatory environment and increased onchain activity suggests protocols will likely conduct buybacks and direct revenue sharing at higher rates than previously observed. -@ZackPokorny_

As DeFi regulation becomes more defined, value sharing by onchain applications will expand. Applications like Ethena and Aave have already initiated discussionsor passed proposals to implement their fee switches—the infrastructure enabling value distribution to users. Other protocols that previously rejected such mechanisms, including Uniswap and Lido, may reconsider their stance due to regulatory clarity and competitive dynamics. The combination of an accommodative regulatory environment and increased onchain activity suggests protocols will likely conduct buybacks and direct revenue sharing at higher rates than previously observed. -@ZackPokorny_

14 - Onchain governance will see a resurgence, with applications experimenting with futarchic governance models.

Total active voters will increase by at least 20%. Onchain governance has historically faced two problems: 1) lack of participation, and 2) lack of vote diversity with most proposals passing by landslides. Easing regulatory tension, which has been a gating factor to voting onchain, and the recent success of Polymarket suggests these two points are set to improve in 2025, however. In 2025, applications will begin turning away from traditional governance models and towards futarchic ones, improving vote diversity, and regulatory tailwinds adding a boost to governance participation. -@ZackPokorny_

Total active voters will increase by at least 20%. Onchain governance has historically faced two problems: 1) lack of participation, and 2) lack of vote diversity with most proposals passing by landslides. Easing regulatory tension, which has been a gating factor to voting onchain, and the recent success of Polymarket suggests these two points are set to improve in 2025, however. In 2025, applications will begin turning away from traditional governance models and towards futarchic ones, improving vote diversity, and regulatory tailwinds adding a boost to governance participation. -@ZackPokorny_

15 - The world’s top four custody banks will custody digital assets in 2025.

The Office of the Comptroller of the Currency (OCC) will create a pathway for national banks to custody digital assets, leading the world’s top four custody banks to offer digital asset services: BNY, State Street, JPMorgan Chase, and Citi. -@intangiblecoins

The Office of the Comptroller of the Currency (OCC) will create a pathway for national banks to custody digital assets, leading the world’s top four custody banks to offer digital asset services: BNY, State Street, JPMorgan Chase, and Citi. -@intangiblecoins

16 - There will be at least ten stablecoin launches backed by TradFi partnerships.

From 2021 to 2024, stablecoins have experienced rapid growth, with the number of projects now reaching 202, including several with strong ties to traditional finance (TradFi). Beyond the number of stablecoins launched, their transaction volumes growth has outpaced that of major payment networks like ACH (~1%) and Visa (~7%). In 2024, stablecoins are increasingly interwoven into the global financial system. For example, the U.S.-licensed FV Bank now supports direct stablecoin deposits, and Japan's three largest banks, through Project Pax, are collaborating with SWIFT to enable faster and more cost-effective cross-border money movements. Payment platforms are also building stablecoin infrastructures. PayPal, for instance, launched its own stablecoin, PYUSD, on the Solana blockchain, while Stripe acquired Bridge to support stablecoins natively. Additionally, asset managers such as VanEck and BlackRock are collaborating with stablecoin projects to establish a foothold in this sector. Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development. -JW

From 2021 to 2024, stablecoins have experienced rapid growth, with the number of projects now reaching 202, including several with strong ties to traditional finance (TradFi). Beyond the number of stablecoins launched, their transaction volumes growth has outpaced that of major payment networks like ACH (~1%) and Visa (~7%). In 2024, stablecoins are increasingly interwoven into the global financial system. For example, the U.S.-licensed FV Bank now supports direct stablecoin deposits, and Japan's three largest banks, through Project Pax, are collaborating with SWIFT to enable faster and more cost-effective cross-border money movements. Payment platforms are also building stablecoin infrastructures. PayPal, for instance, launched its own stablecoin, PYUSD, on the Solana blockchain, while Stripe acquired Bridge to support stablecoins natively. Additionally, asset managers such as VanEck and BlackRock are collaborating with stablecoin projects to establish a foothold in this sector. Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development. -JW

17 - Total stablecoin supply will double to exceed $400bn in 2025.

Stablecoins have increasingly found a product-market fit for payments, remittances, and settlement. Increasing regulatory clarity for both existing stablecoin issuers and traditional banks, trusts, and depositories will lead to an explosion of stablecoin supply in 2025. -@intangiblecoins

Stablecoins have increasingly found a product-market fit for payments, remittances, and settlement. Increasing regulatory clarity for both existing stablecoin issuers and traditional banks, trusts, and depositories will lead to an explosion of stablecoin supply in 2025. -@intangiblecoins

18 - Tether's long-standing market dominance will drop below 50%, challenged by yielding alternatives like Blackrock's BUIDL, Ethena's USDe, and even USDC Rewards paid by Coinbase/Circle.

As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass-through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -@FullNodeChuck

As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass-through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -@FullNodeChuck

19 - Total crypto VC capital invested will surpass $150bn with more than a 50% YoY increase.

The surge in VC activity will be driven by an increase in allocator appetite for venture activity given the combination of declining interest rates and increased crypto regulatory clarity. Crypto VC fundraising has historically lagged broader crypto market trends, and there will be some amount of “catchup” over the next four quarters. -@hiroto_btc @intangiblecoins

The surge in VC activity will be driven by an increase in allocator appetite for venture activity given the combination of declining interest rates and increased crypto regulatory clarity. Crypto VC fundraising has historically lagged broader crypto market trends, and there will be some amount of “catchup” over the next four quarters. -@hiroto_btc @intangiblecoins

20 - Stablecoin legislation will pass both houses of Congress and be signed by President Trump in 2025, but market structure legislation will not.

Legislation that formalizes and creates a registration and oversight regime for stablecoin issuers in the United States will pass with bipartisan support and be signed into law before the end of 2025. Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets, and when combined with expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption. Market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law 2025. -@intangiblecoins

Legislation that formalizes and creates a registration and oversight regime for stablecoin issuers in the United States will pass with bipartisan support and be signed into law before the end of 2025. Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets, and when combined with expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption. Market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law 2025. -@intangiblecoins

21 - The U.S. government will not purchase Bitcoin in 2025, but it will create a stockpile using coins it already holds, and there will be some movement within the departments and agencies to examine an expanded Bitcoin reserve policy. -@intangiblecoins

22 - The S.E.C. will open an investigation into Prometheum, the first so-called “special purpose broker dealer.”

The abrupt emergence of a previously-unknown broker dealer that happened to specifically agree with the totality of S.E.C. Chair Gensler’s views on the securities status of digital assets raised eyebrows in 2023, particularly when the unknown firm was granted the first of a new class of broker dealer licenses. The CEO was berated before Congress by Republican members of the House Financial Services Committee, and according to FINRA records, Prometheum’s alternative trading system (ATS) has yet to conduct any trades. Republicans have called on the DOJ and SEC to investigate Prometheum for “ties to China,” while others have noted irregularities in their fundraising and reporting. Whether or not Prometheum is investigated, it’s likely that the special-purpose broker-dealer license is abolished in 2025. -@intangiblecoins

The abrupt emergence of a previously-unknown broker dealer that happened to specifically agree with the totality of S.E.C. Chair Gensler’s views on the securities status of digital assets raised eyebrows in 2023, particularly when the unknown firm was granted the first of a new class of broker dealer licenses. The CEO was berated before Congress by Republican members of the House Financial Services Committee, and according to FINRA records, Prometheum’s alternative trading system (ATS) has yet to conduct any trades. Republicans have called on the DOJ and SEC to investigate Prometheum for “ties to China,” while others have noted irregularities in their fundraising and reporting. Whether or not Prometheum is investigated, it’s likely that the special-purpose broker-dealer license is abolished in 2025. -@intangiblecoins

23 - Dogecoin will finally hit $1, with the world’s largest and oldest memecoin touching $100bn market cap.

However, Dogecoin market cap will be eclipsed by the Department of Government Efficiency, which will identify and successfully enact cuts in amounts exceeding Dogecoin’s 2025 high-water mark market cap. -@intangiblecoins

However, Dogecoin market cap will be eclipsed by the Department of Government Efficiency, which will identify and successfully enact cuts in amounts exceeding Dogecoin’s 2025 high-water mark market cap. -@intangiblecoins

Disclosure: Galaxy and/or members of Galaxy Research own Bitcoin, Ether, and Dogecoin. Many more predictions were made and not shared, and many more could be made. These predictions are not investment advice, or an offer, recommendation, or solicitation to buy or sell any securities, including Galaxy securities. These predictions represent the point-in-time views of the Galaxy Research team as of December 2024 and do not necessarily reflect the views of Galaxy or any of its affiliates. These predictions will not be updated.

Adding @ninja_five_ (JW) from @glxyresearch. Give her a follow!

• • •

Missing some Tweet in this thread? You can try to

force a refresh