Canada's December Trade Data was released this morning.

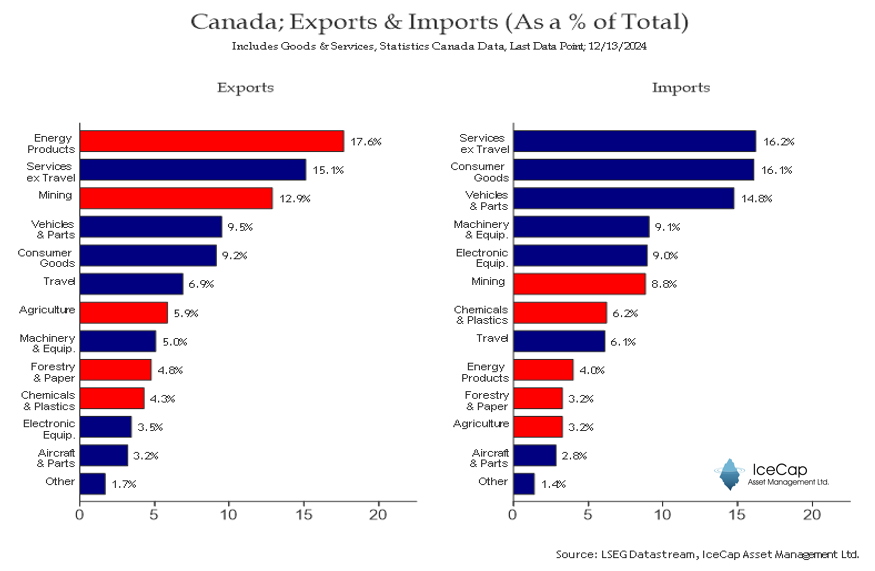

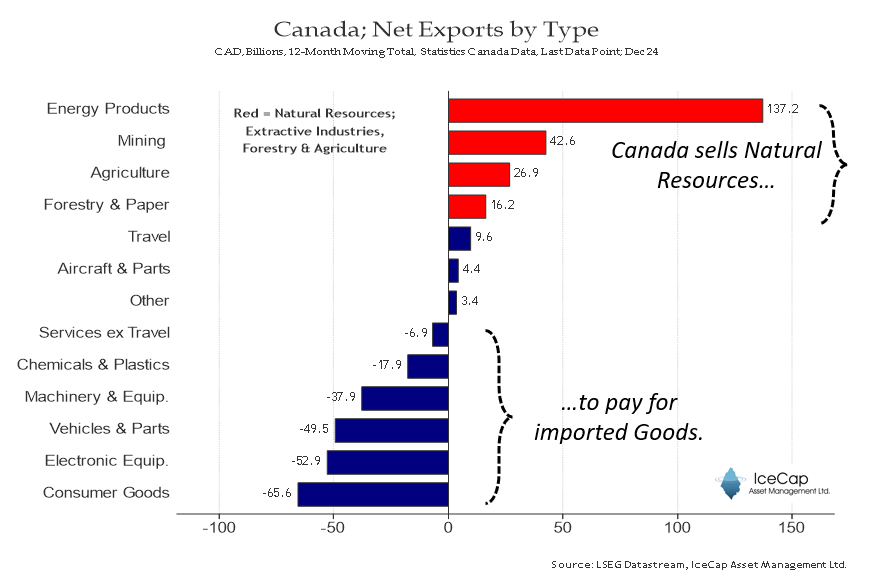

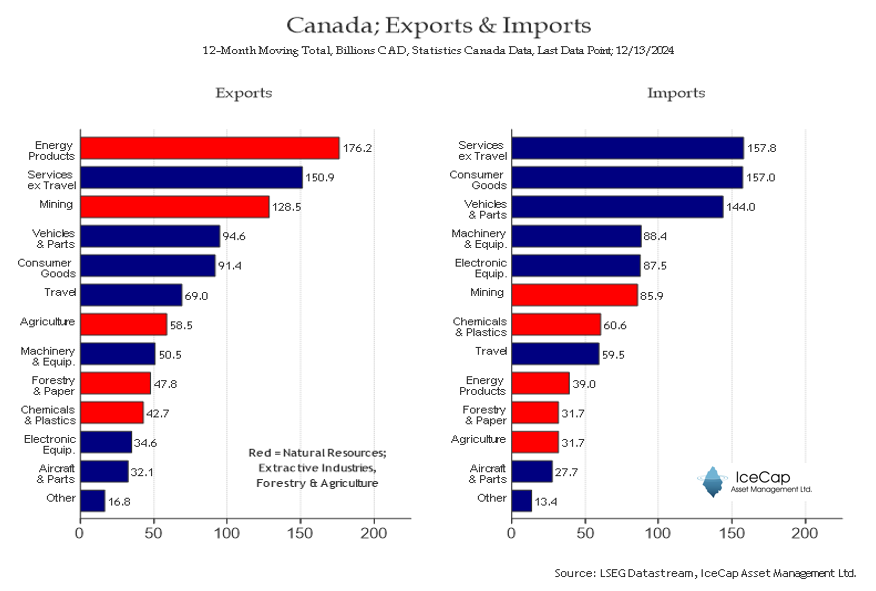

Conclusion: Canada sells Natural Resources (i.e. Crude Oil, Minerals, & Agricultural Products) to pay for Imported Goods. A thread...🧵 www150.statcan.gc.ca/n1/daily-quoti…

Conclusion: Canada sells Natural Resources (i.e. Crude Oil, Minerals, & Agricultural Products) to pay for Imported Goods. A thread...🧵 www150.statcan.gc.ca/n1/daily-quoti…

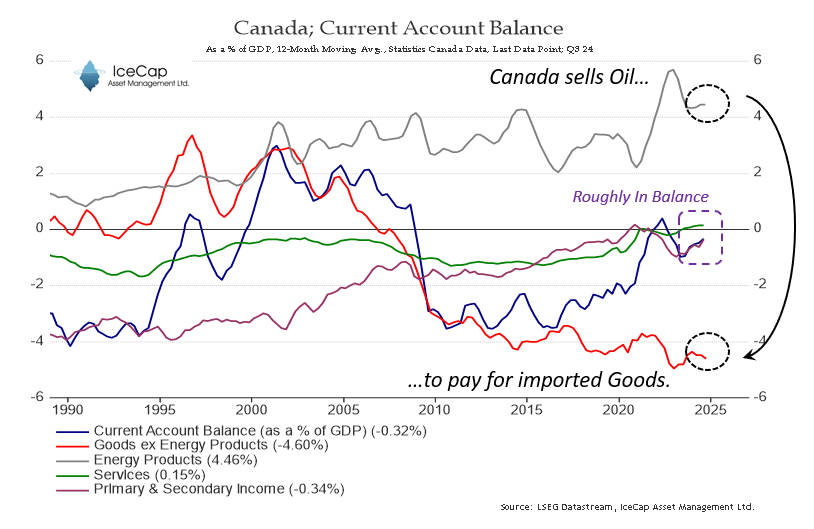

The importance of Energy Exports is particularly clear when one considers the current account balance.

Without the massive, sustained positive contribution, our Current Account Balance would be deeply negative, requiring a painful readjustment, such as a lower exchange rate or fewer imports (consumption).

Without the massive, sustained positive contribution, our Current Account Balance would be deeply negative, requiring a painful readjustment, such as a lower exchange rate or fewer imports (consumption).

Of course, it is more complicated than that. Canada exports billions of dollars worth of other Goods and Services, and we Import plenty of Natural Resources.

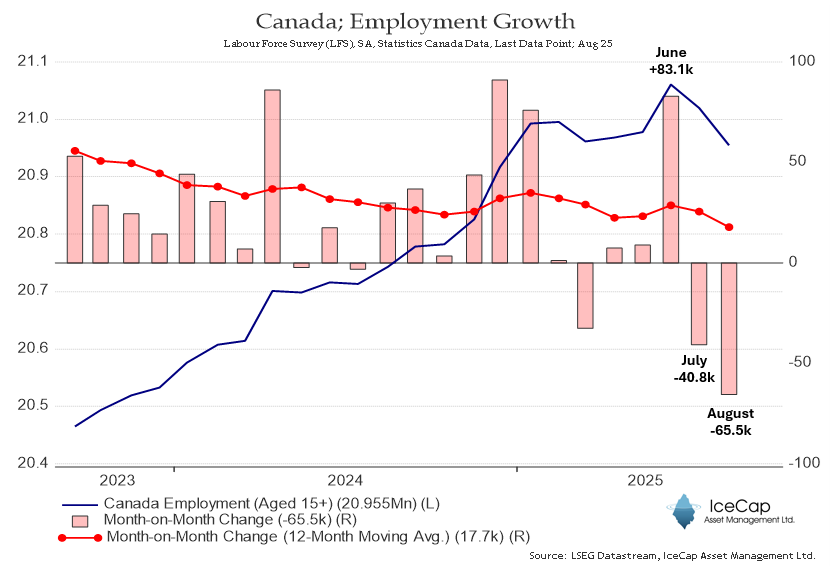

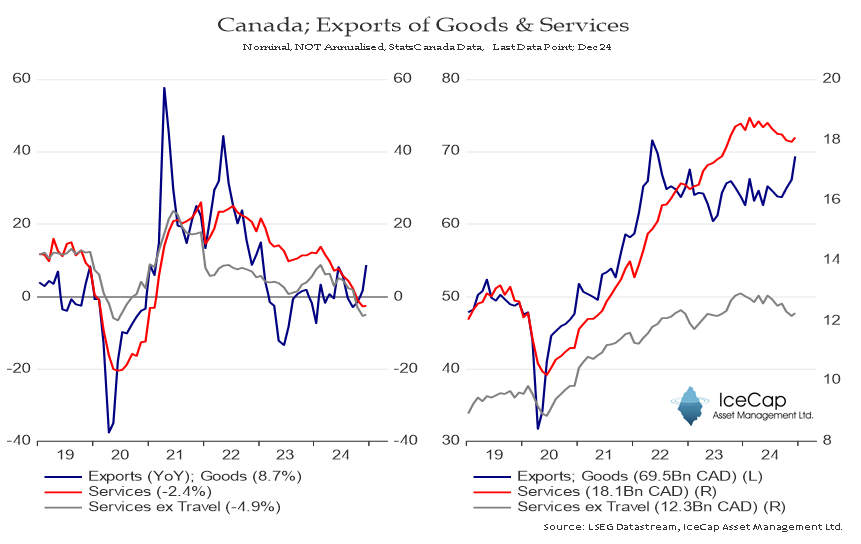

The growth of Goods Exports has rebounded after bottoming in 23/24. Services are still under pressure.

Note that price changes will affect these figures.

Note that price changes will affect these figures.

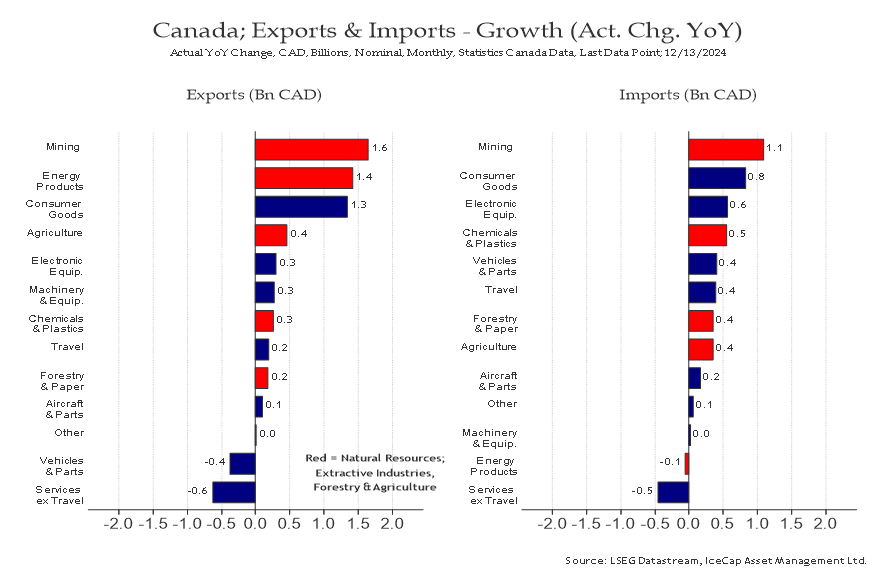

One can derive where the pop in Goods Exports and Imports comes from with the following YoY Billions bar chart. And you can see the decline in Services YoY.

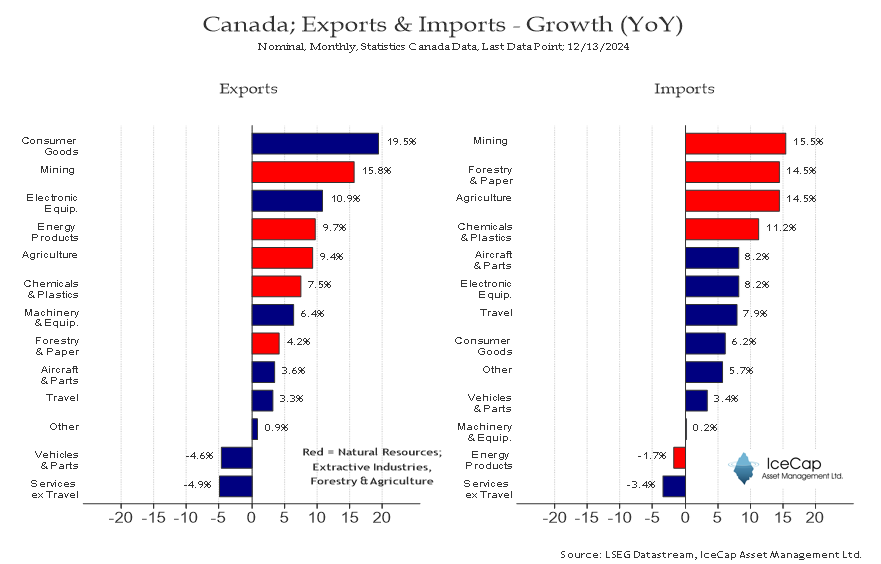

Again, year-over-year percentage changes also paint a picture. Exports of Consumer Goods showed the biggest year-over-year improvement. This also shows the significance of Natural Resource Imports.

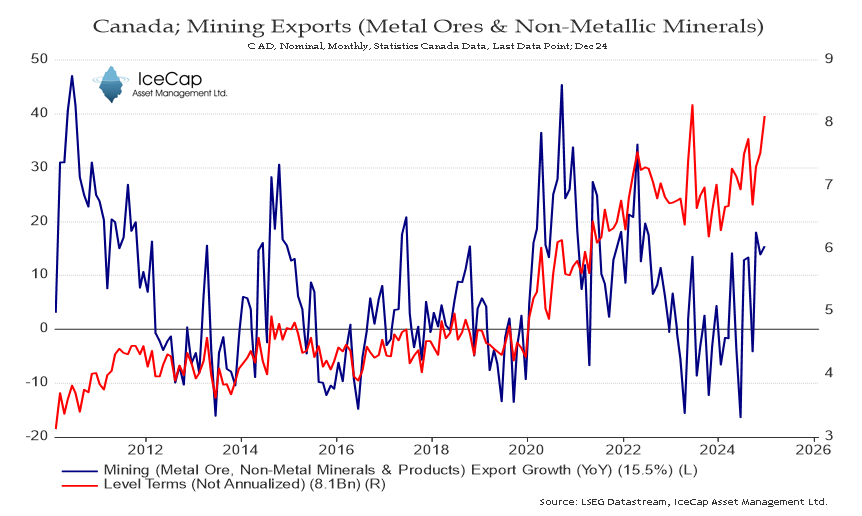

Finally, some of you might be curious about the nature of each individual series. As you can see, they fluctuate wildly on a monthly basis; this is due to volume, price, seasonality, and a bunch of other factors that impact export (or import) value.

end/

end/

• • •

Missing some Tweet in this thread? You can try to

force a refresh