1) We are short AppLovin $APP, an AdTech platform for mobile games. Having peaked at $173 billion in market cap, we believe AppLovin could go down as the single largest stock promotion unraveling since at least the GFC. Our full report is now available on our website, culperresearch.com

2) $APP shares are up ~25x in the past 2 years on $APP's promotion of supposed breakthrough AI tech, "AXON 2.0." $APP describes AXON 2.0 as a "black box" and investors seem content with this. We believe it's a smokescreen, and $APP's true secret sauce is far more nefarious.

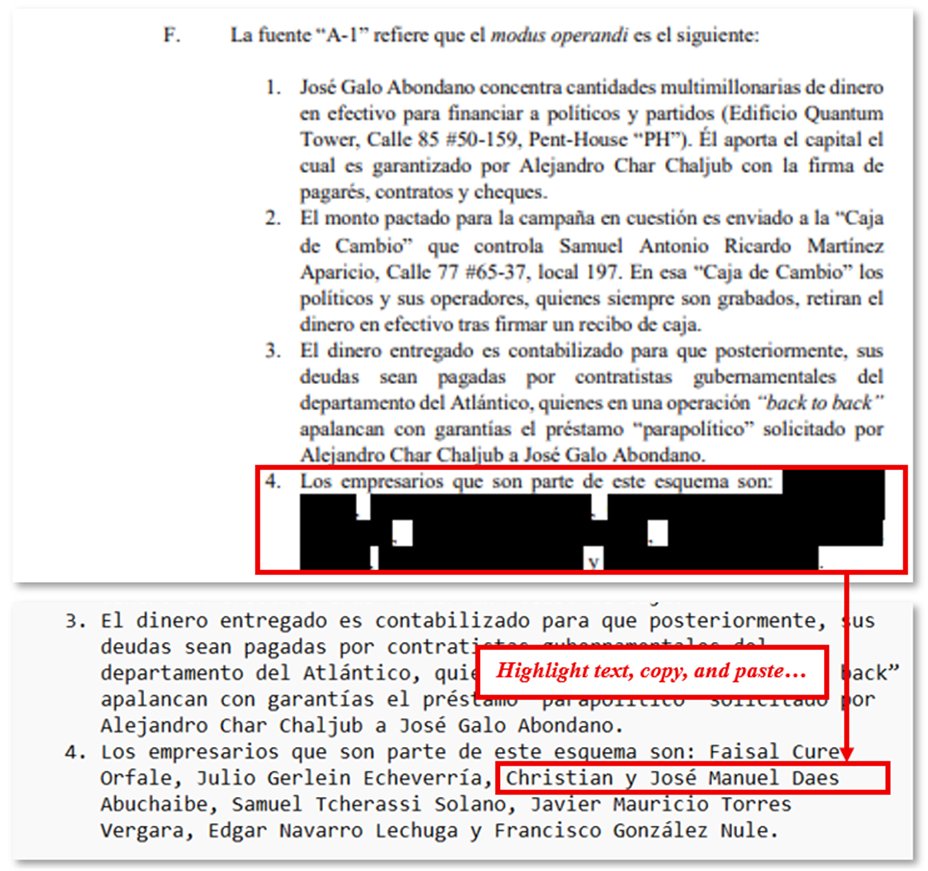

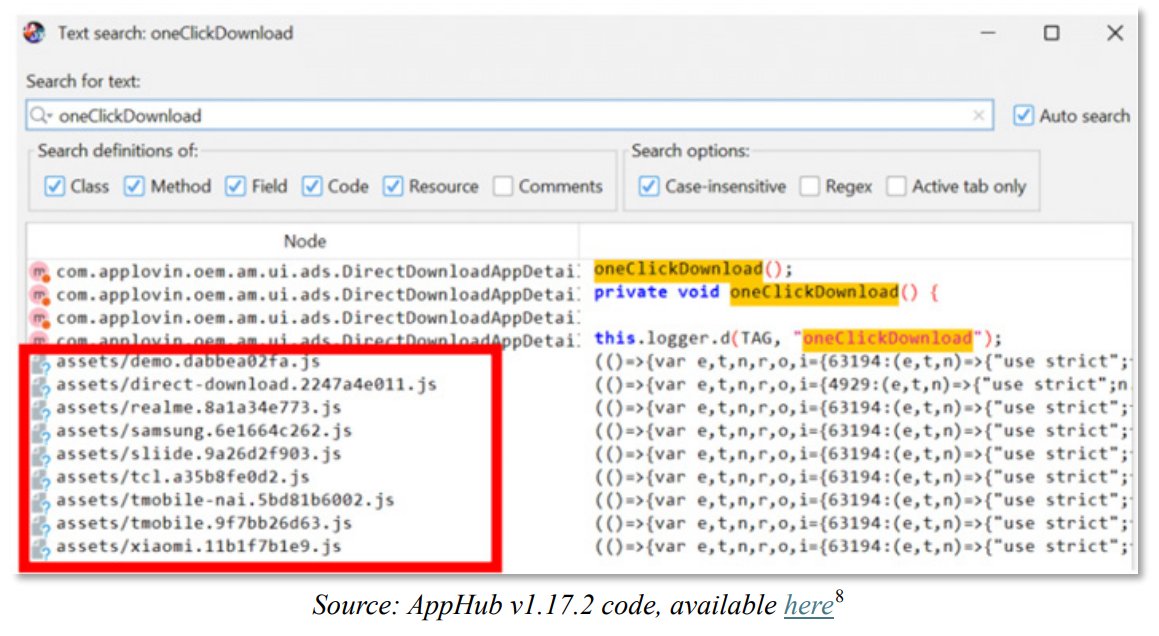

3) In its mobile gaming business, we believe $APP has systematically deployed, then exploited incredibly dangerous app permissions that enable in-app ads themselves to force-feed silent, backdoor app installations directly onto users' phones, with just a single click.

4) Given $APP's notorious UX gimmicks i.e., multiple "X" outs and fake countdowns, many clicks are inadvertent. Yet they potentially instantly trigger downloads anyway. $APP's entire business centers on app installs: this is AdTech's version of "rolling the truck down the hill."

5) Our report documents the full step-by-step process by which $APP has smuggled these "direct download" permissions into not only its own games, but thousands of highly popular games including Subway Surfers, 8 Ball Pool, Wordscapes, and Angry Birds.

6) We consulted renowned ad fraud researcher Dr. Ben Edelman to ensure our correct understanding of the abilities and functioning. He confirmed, adding that $APP also integrated the ability to "flip the switch" based on e.g., users IP address, location, activity - at its whim.

7) We believe these installations happen at unprecedented scale. $APP's own employees brag publicly of their ability to initiate "direct downloads for instant access to games from ads" and refer to "the ad product for Direct Download" as "the company’s top revenue driver.”

8a) We provide a case study: "Animal Restaurant" (10M+ downloads) -- (a) users complain the app is automatically downloading other games, namely "Bricks n Balls" which is/was owned by $APP's own studio (b) Bricks n Balls reviews then allege that it too downloads without consent.

8b) 3P download data for Bricks n Balls shows two highly irregular download spikes in Android, in May and Sept 2023, in Brazil and India respectively. This was just as $APP signed two new OEM partners - a precondition to the illicit download behavior - in those exact regions.

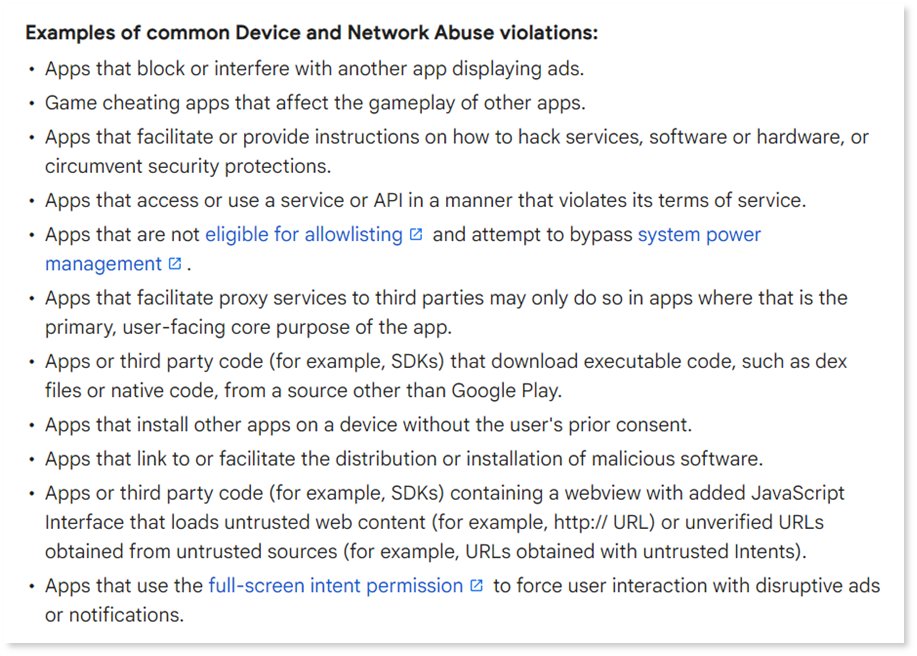

9) We believe $APP risks Google Play fallout, as this process works via $APPs app-level SDKs, which contain "binding" permissions that effectively replicate permissions that the Play store has already banned elsewhere, for obvious security reasons.

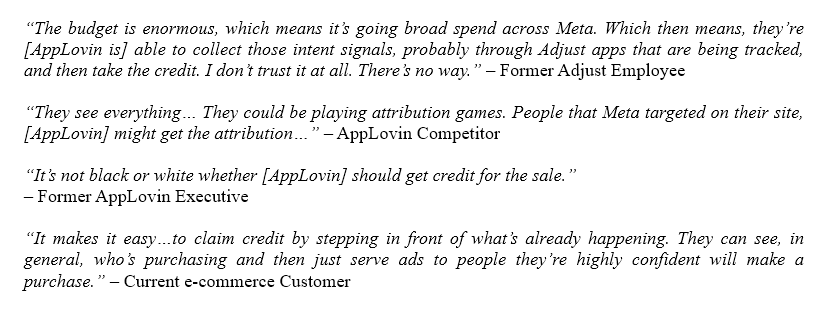

10) $APP now looks to parlay its mobile gaming promotion into e-commerce, but here too we believe the Company's push is smoke and mirrors - it's been rigged from the start as $APP will only take on customers who spend $600K/mo on Meta. There's an obvious reason for this...

11) $APP might argue this is only to ensure customer quality, but numerous experts suggested to us that the true purpose is to ensure that $APP can see Meta's existing data through MAX, then "copy Meta's homework" via last-click insertion or otherwise to take the credit.

12) Further compounding this issue is $APP's pushing advertisers to use its attribution platform, Adjust. $APP's not only copying Meta's homework, but then reporting an "A+" back to advertisers. We think $META blowback risk is obvious.

13) $APP investors now consider CEO Adam Forough an "AdTech God." We had a different G-word in mind... In the early 2000s, Foroughi worked at Gator Corp/Claria, one of the OG spyware distributors. Foroughi refers to them as mentors.

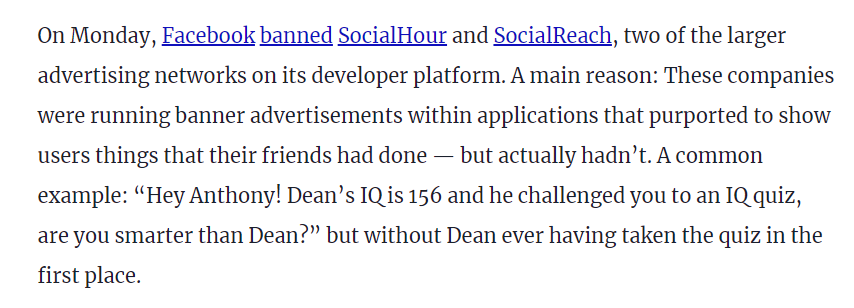

14) $APP CEO Foroughi also created Social Hour in 2008 and was its CEO from August 2008 to July 2010. Social Hour was banned from Facebook in 2009 for "misleading/scam-like advertisements."

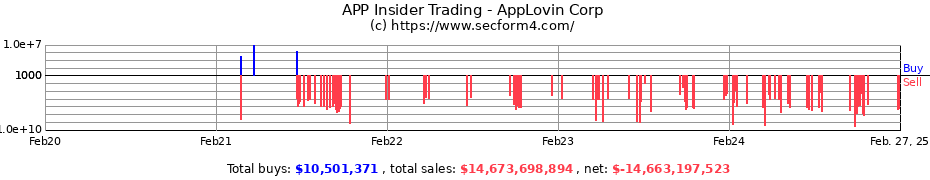

15/15) At $APP, Foroughi stacked the deck with former colleauges from Social Hour and Lifestreet. They can't sell stock fast enough. Former majority holder KKR sold its remaining stock in November, and insiders have sold $2B in the LTM. We're short and think shares head lower.

• • •

Missing some Tweet in this thread? You can try to

force a refresh