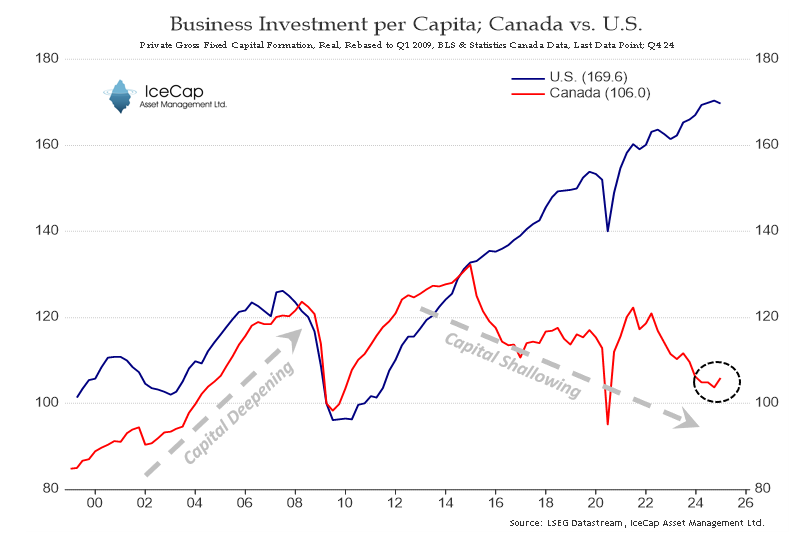

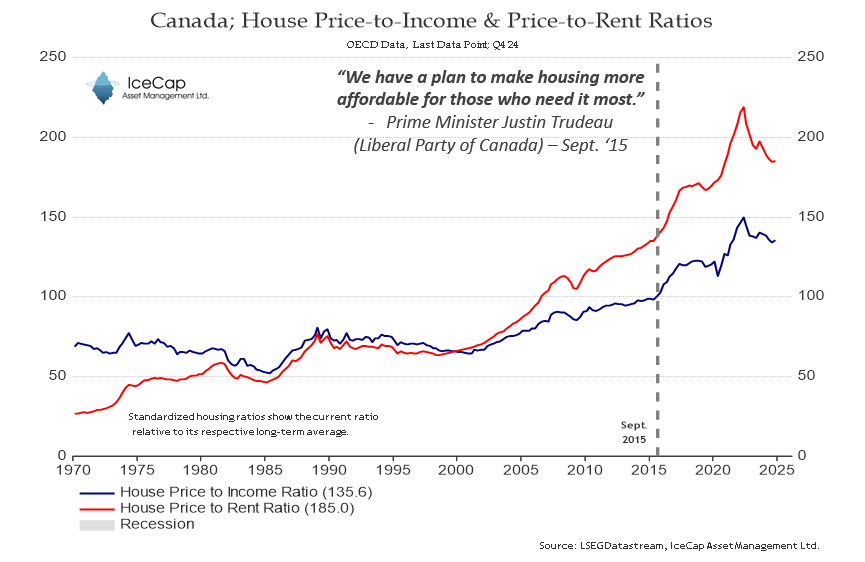

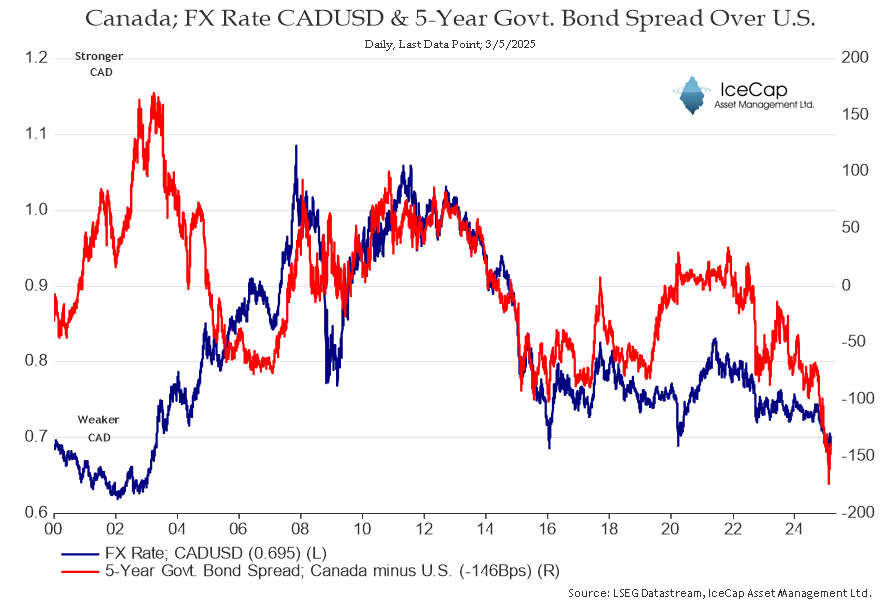

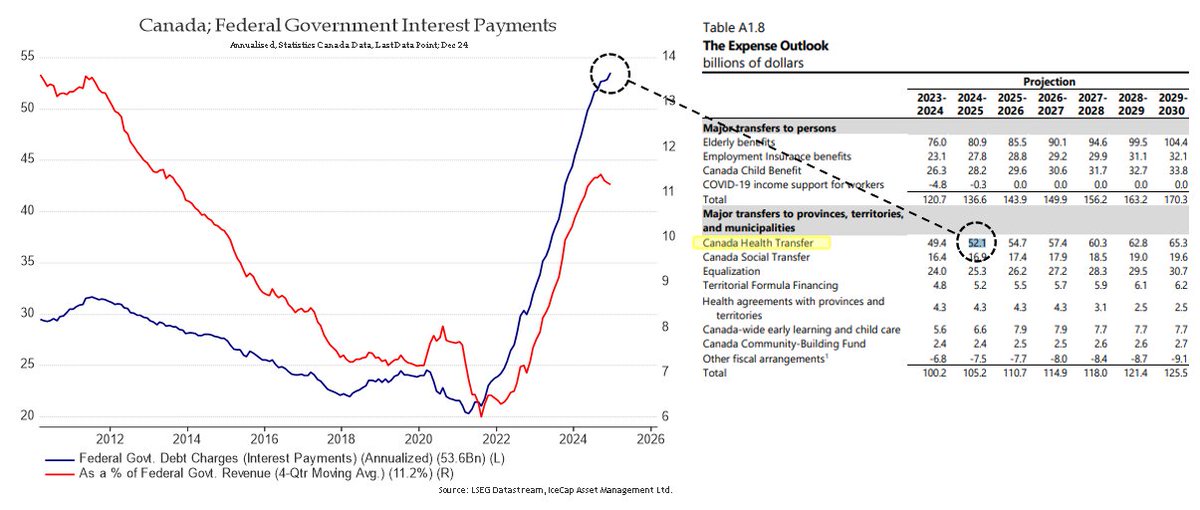

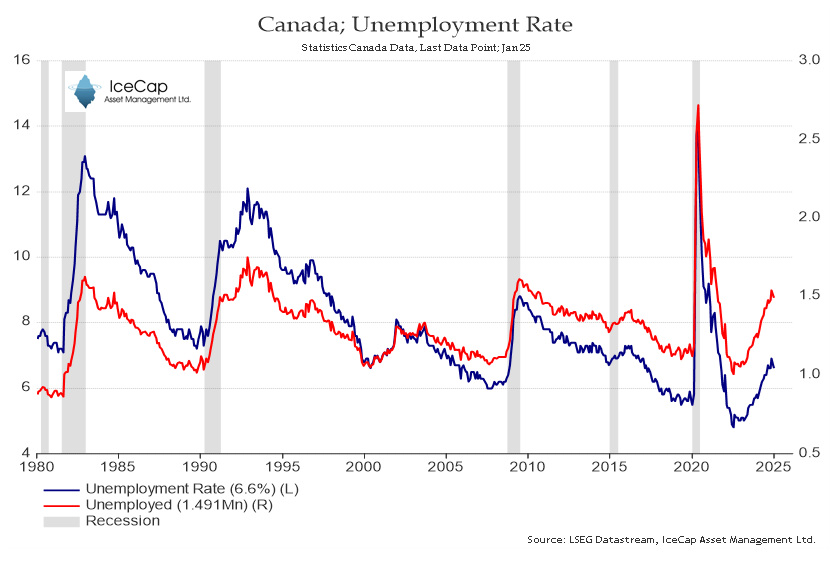

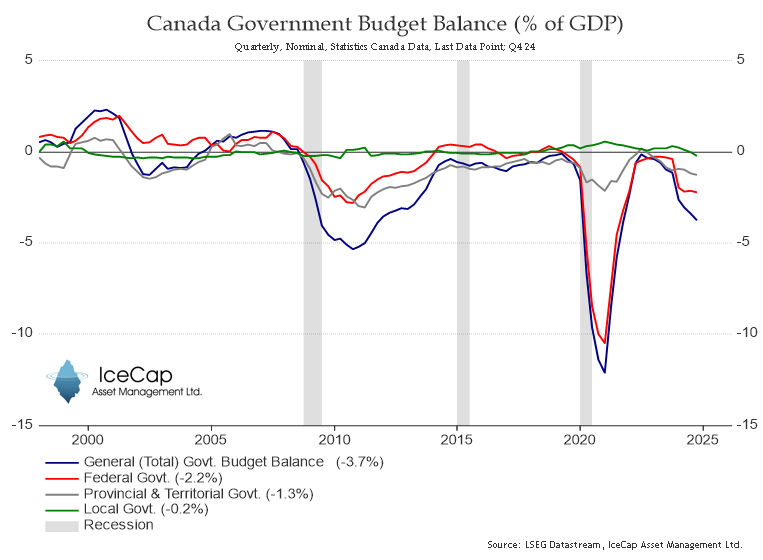

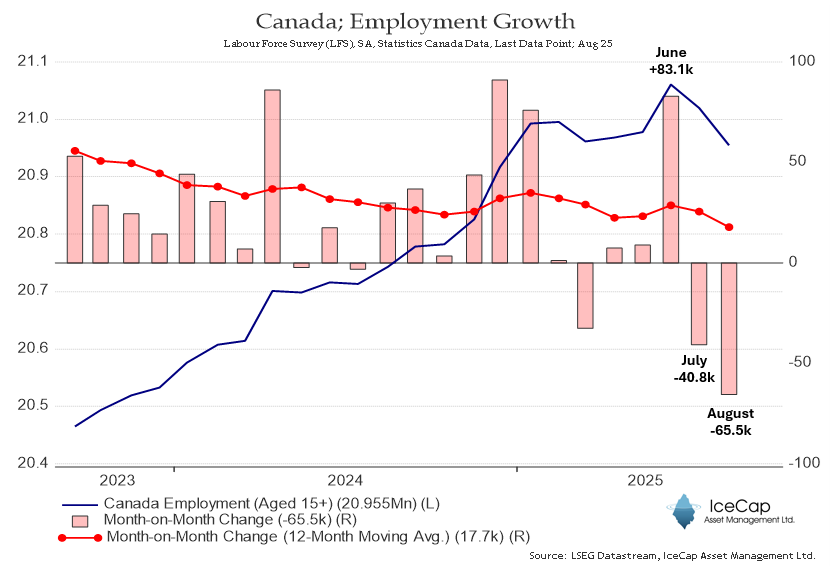

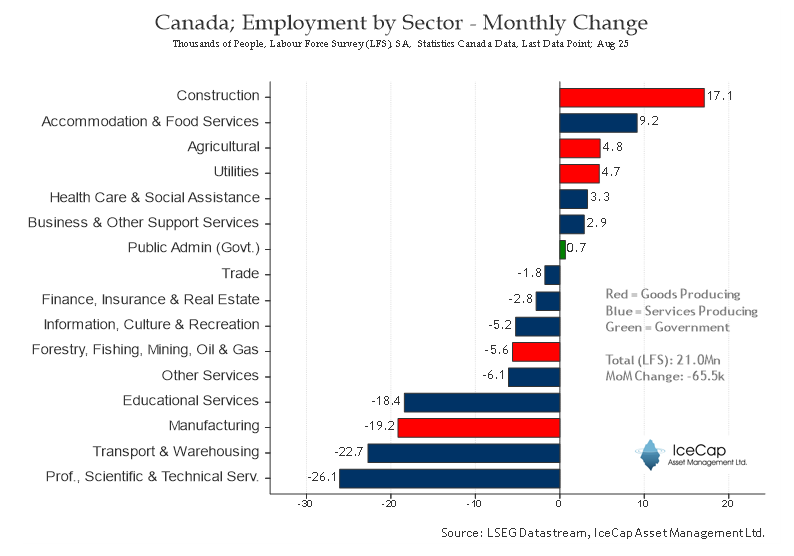

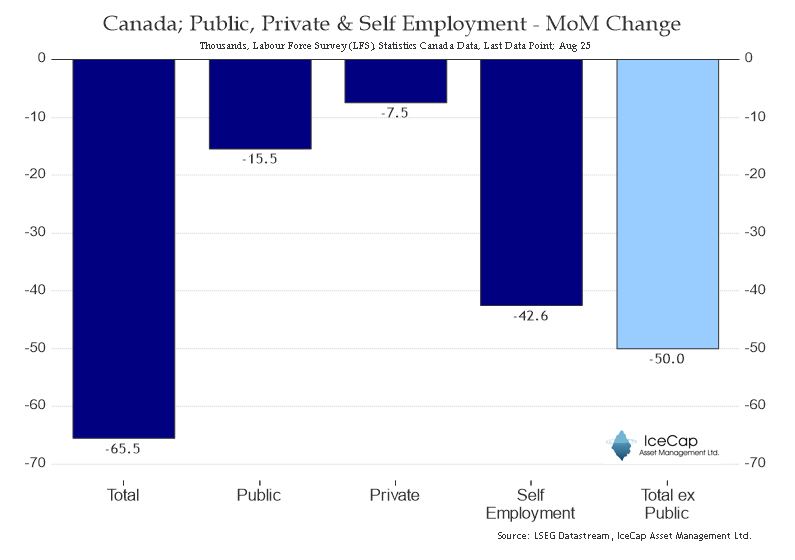

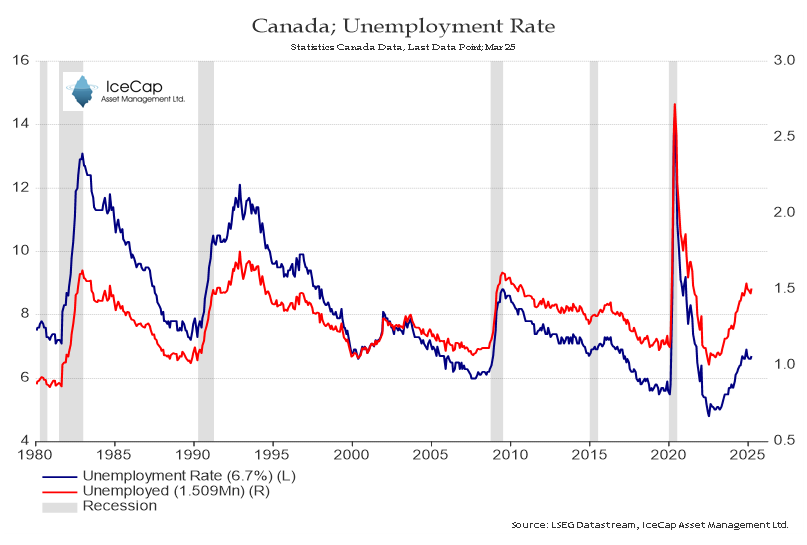

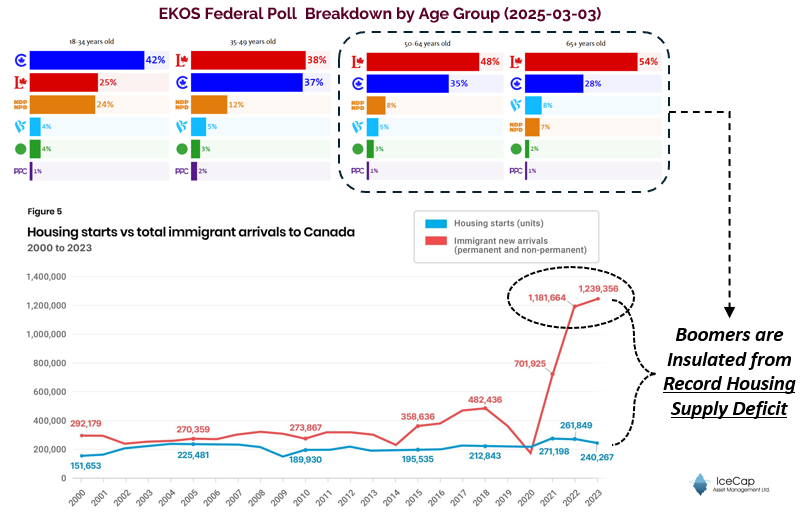

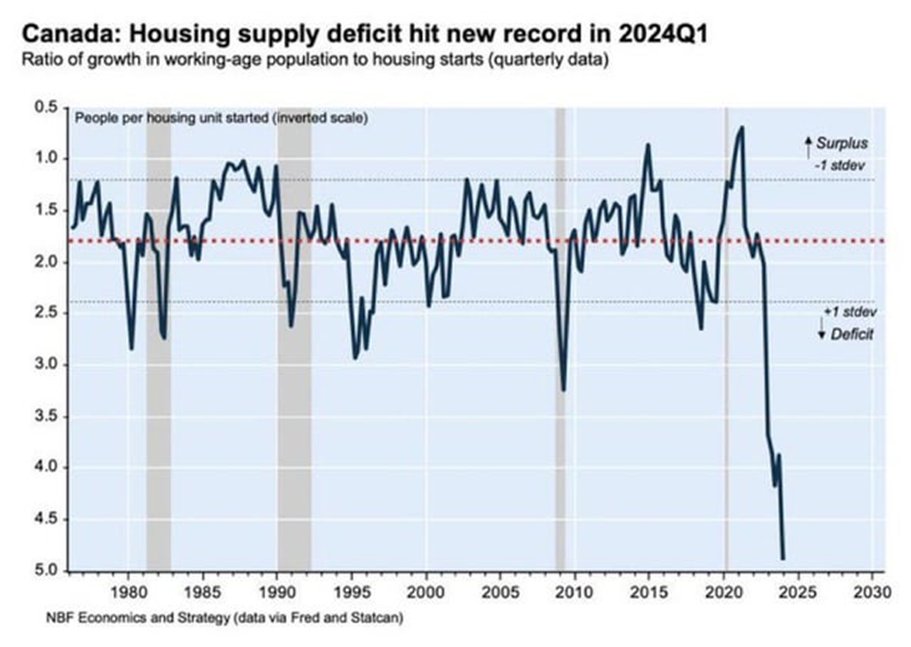

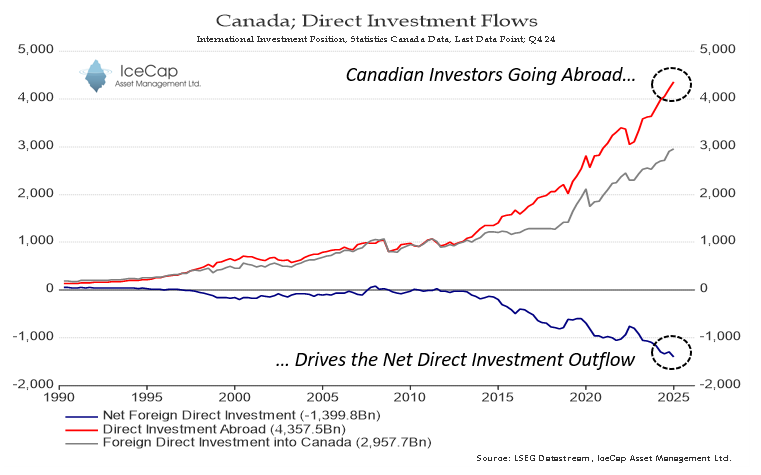

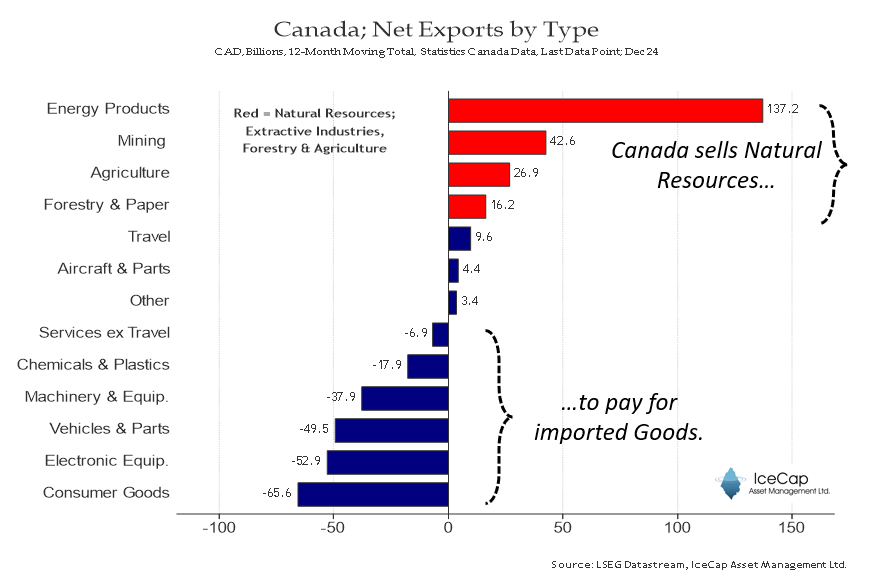

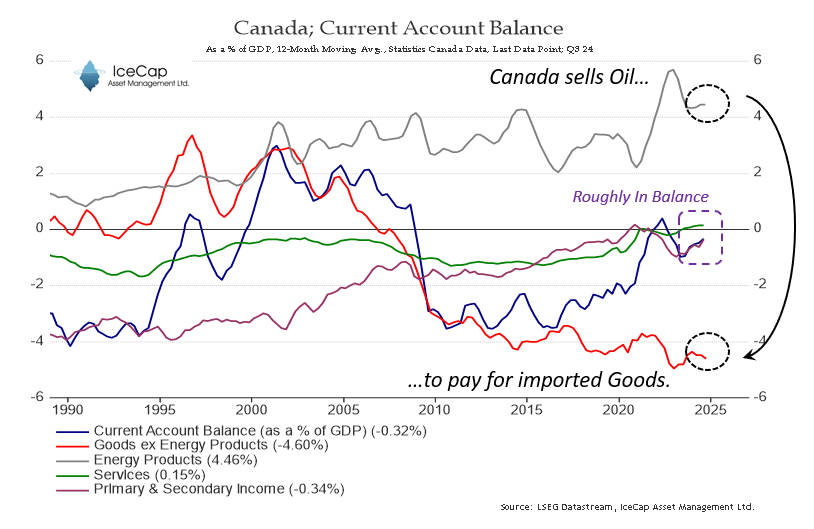

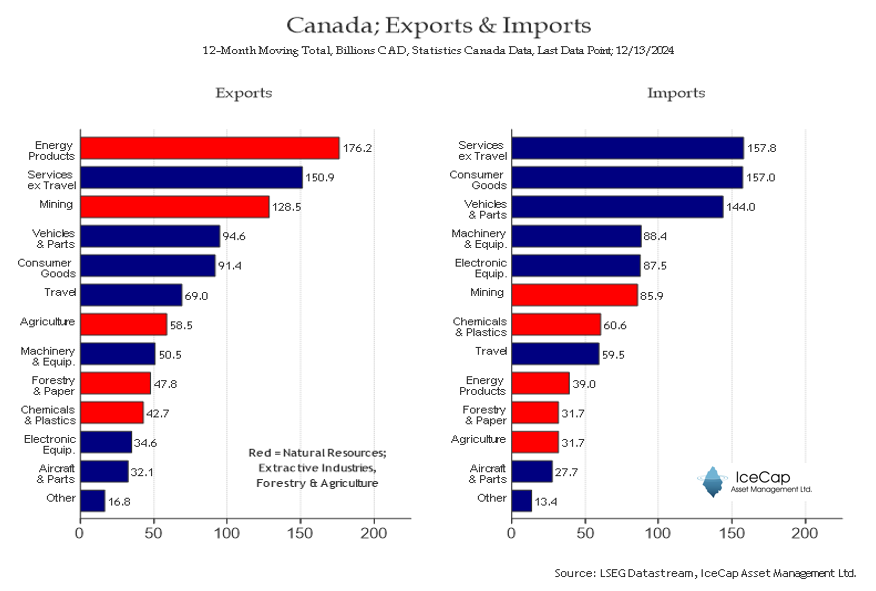

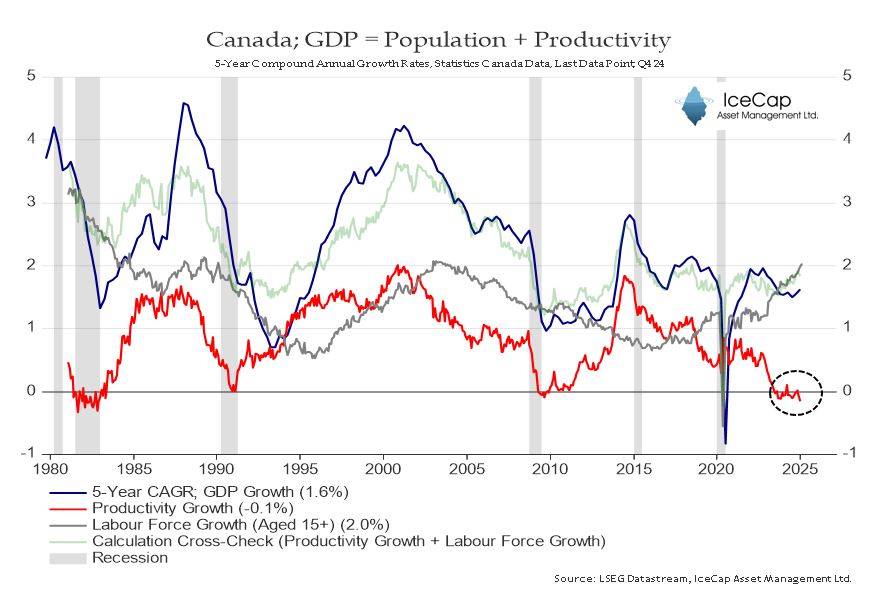

Timing is everything, and this Tariff War is precisely what the Federal Government needed to distract Canadians from their abysmal economic record. From Capital Flight, Falling Investment, and my personal favourite, a collapse in Productivity Growth. The data speaks for itself.⬇️

• • •

Missing some Tweet in this thread? You can try to

force a refresh