$13M per #Bitcoin in 20 years.

That's what Michael @Saylor expects.

THREAD breaking down what he sees & how he got to this number...

That's what Michael @Saylor expects.

THREAD breaking down what he sees & how he got to this number...

Saylor's analysis allows for a bearish scenario of "only" $3M per BTC...

But also a BULLISH scenario of as much as $49M per BTC in just 20 years.

How did he get these numbers?...

But also a BULLISH scenario of as much as $49M per BTC in just 20 years.

How did he get these numbers?...

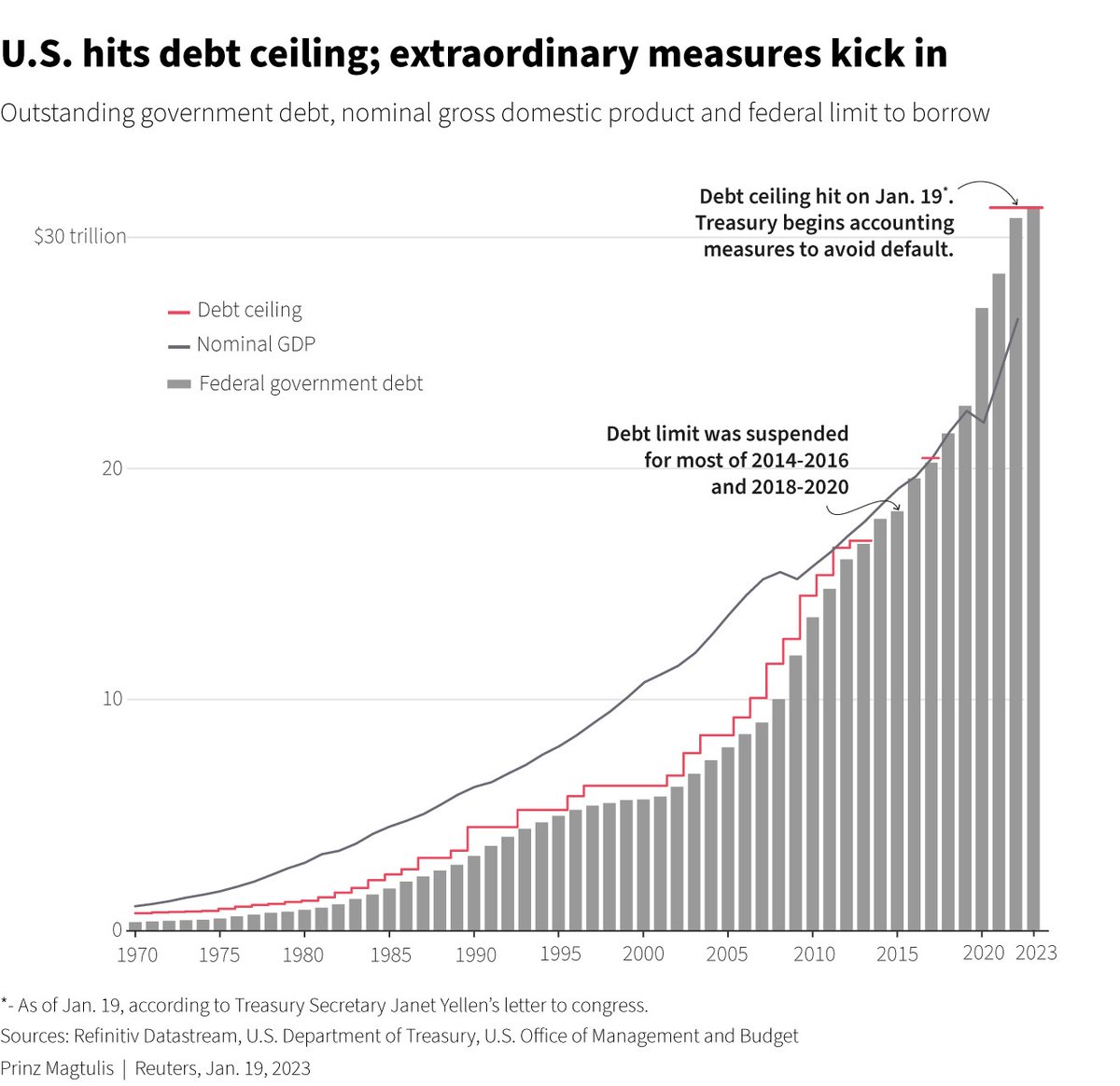

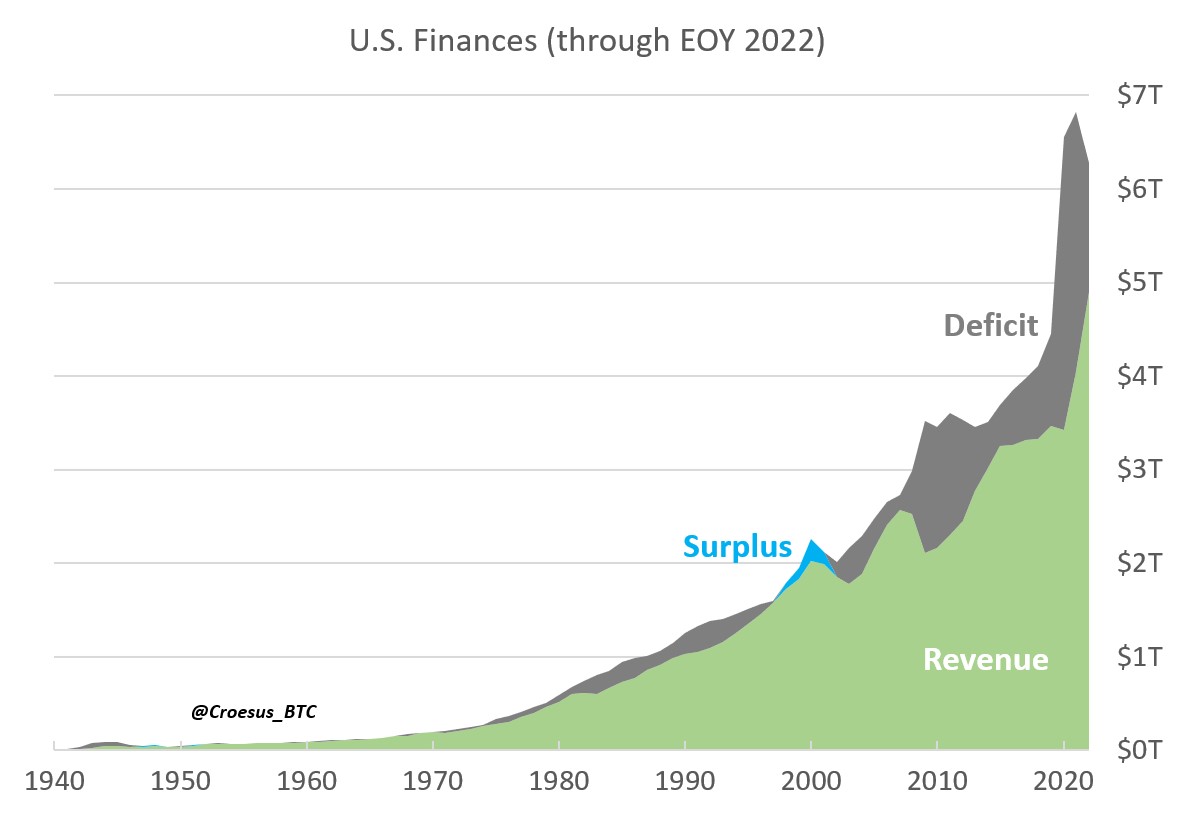

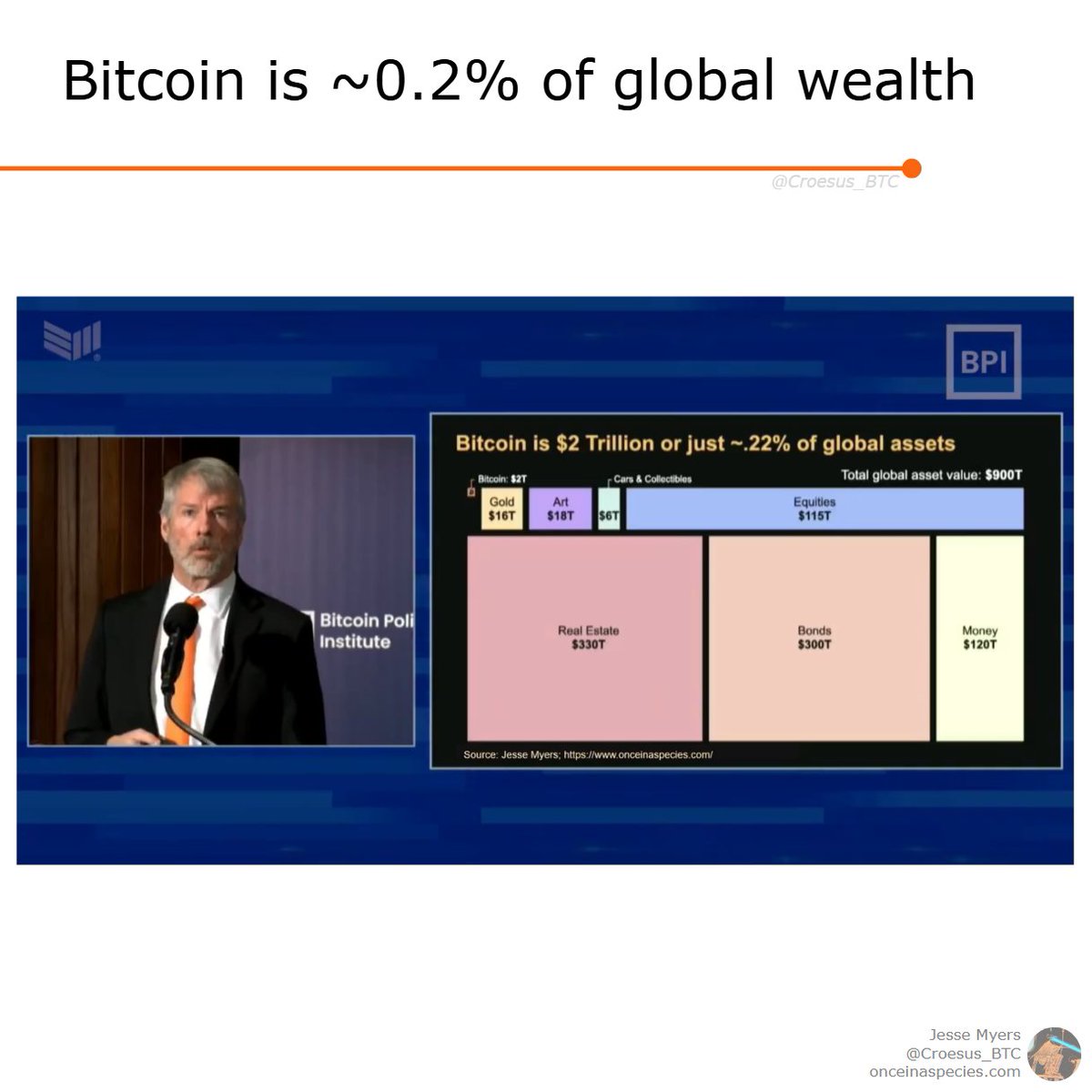

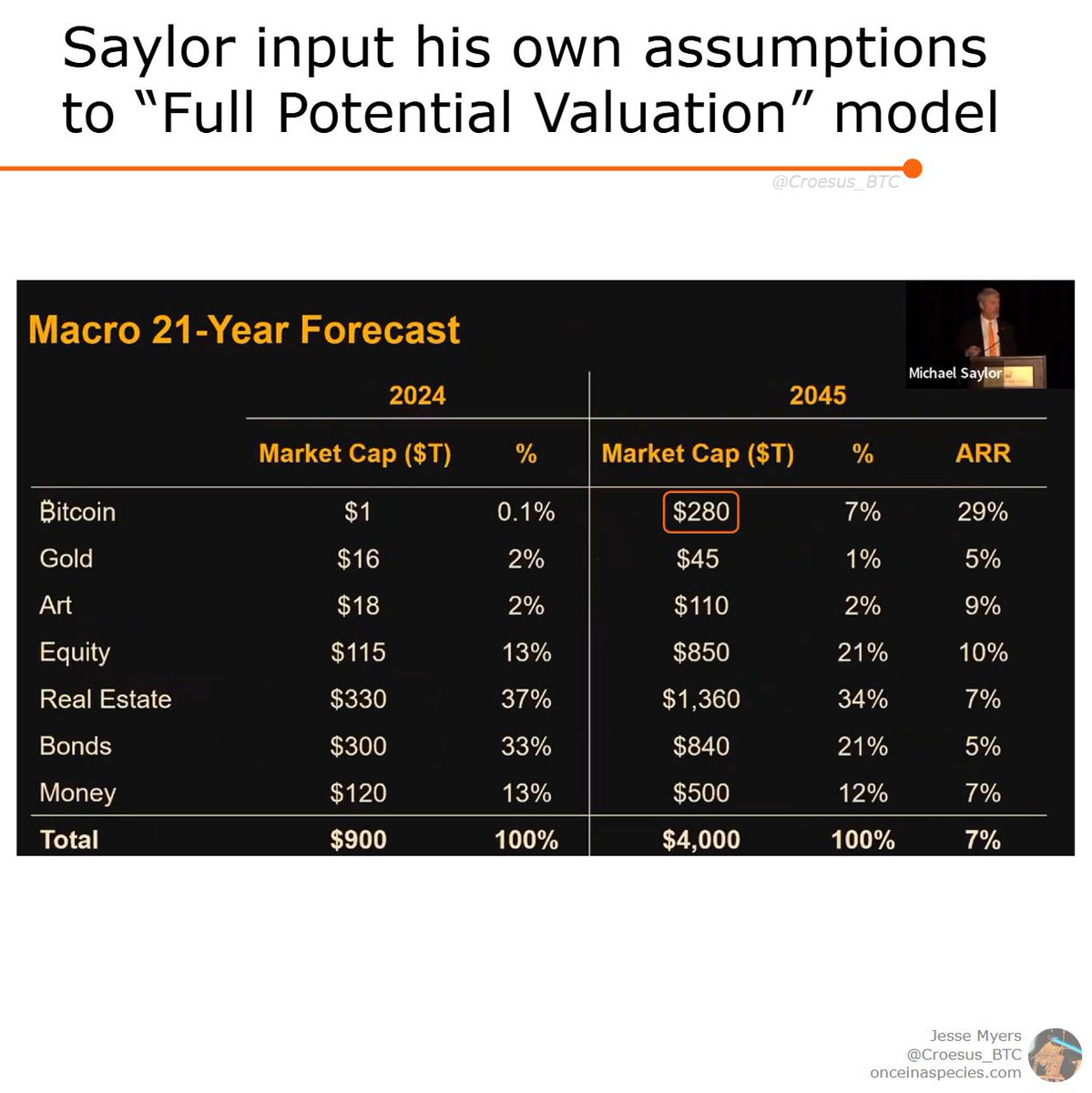

As a starting point, Saylor leveraged my analysis (@Croesus_BTC). This gave him:

- $900T of value in the world

- rationale that all $900T is within scope as SoV

- "Full Potential Valuation" framework for forecasting #Bitcoin value

(Can find original article at link in my bio)

- $900T of value in the world

- rationale that all $900T is within scope as SoV

- "Full Potential Valuation" framework for forecasting #Bitcoin value

(Can find original article at link in my bio)

With this starting point, Saylor then needed to determine:

- how much capital will #Bitcoin absorb from other asset buckets

- how quickly that will happen

- what else changes along the way

- how much capital will #Bitcoin absorb from other asset buckets

- how quickly that will happen

- what else changes along the way

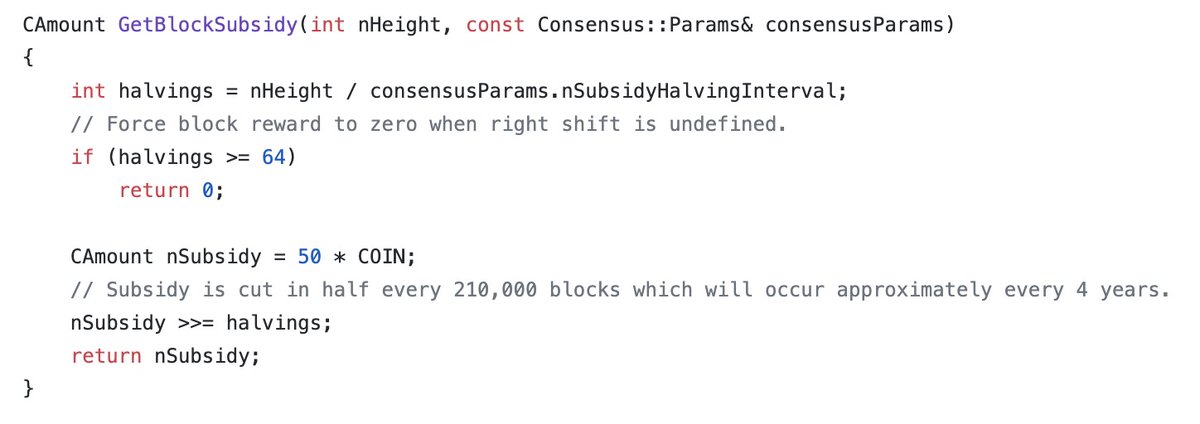

These assumptions and the associated math resulted in Saylor's conclusion:

#Bitcoin will grow to $280T, or $13M/BTC in just 20 years

#Bitcoin will grow to $280T, or $13M/BTC in just 20 years

What would that mean for the world?

#Bitcoin grows from 0.2% to 7% of assets, equating to 35x growth relative to everything else

"Everything pretty much stays the same, except for... Those who embrace #Bitcoin get richer and powerful; those that don't embrace Bitcoin get weaker and poorer." -Michael Saylor

#Bitcoin grows from 0.2% to 7% of assets, equating to 35x growth relative to everything else

"Everything pretty much stays the same, except for... Those who embrace #Bitcoin get richer and powerful; those that don't embrace Bitcoin get weaker and poorer." -Michael Saylor

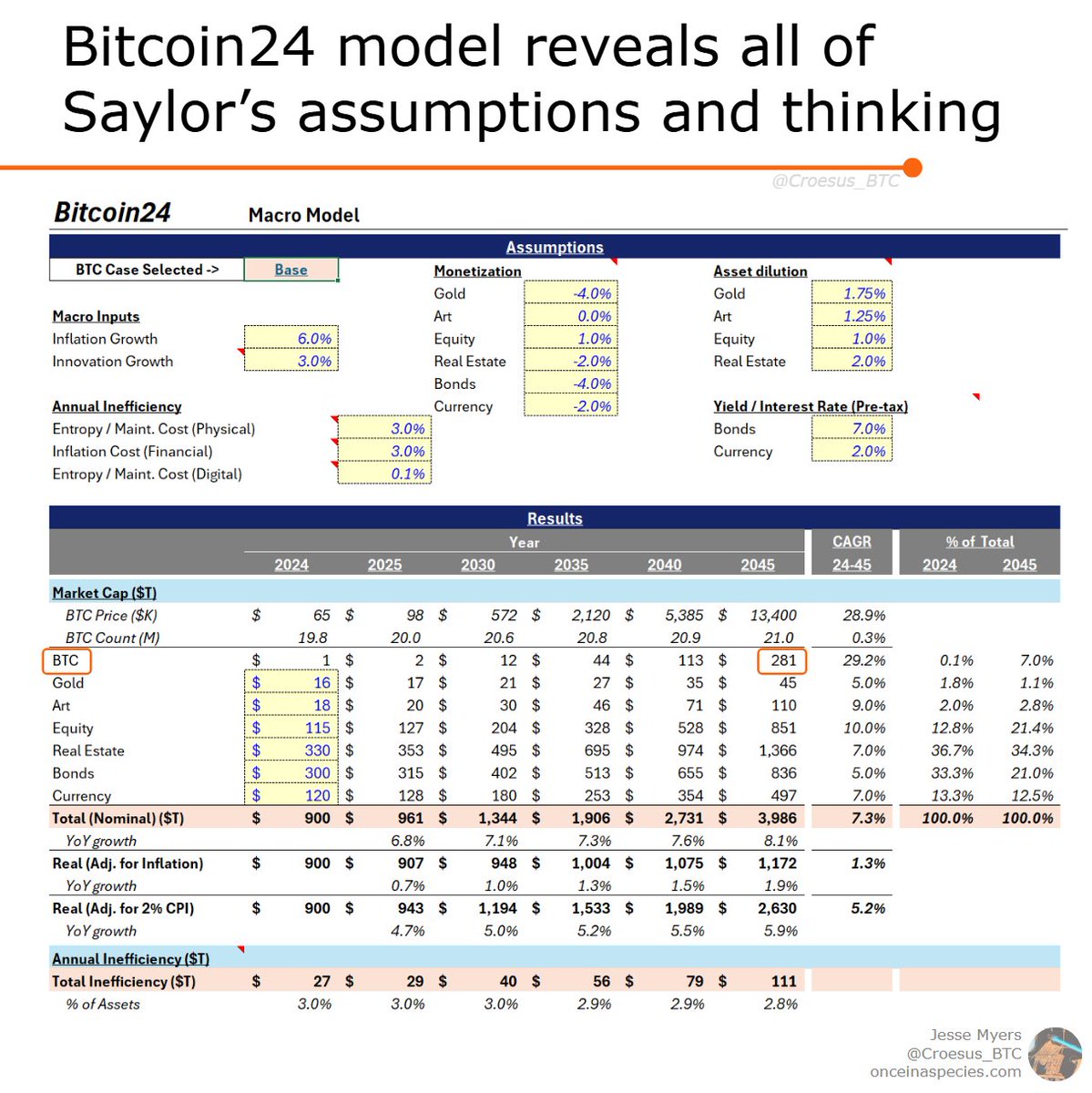

The Bitcoin24 model reveals all of Saylor's assumptions and thinking.

I'll be taking a deep dive into all that Excel analysis in my next slide thread.

To make sure you don't miss it, hit 'Follow'

I'll be taking a deep dive into all that Excel analysis in my next slide thread.

To make sure you don't miss it, hit 'Follow'

$13M per #Bitcoin in 20 years.

If this does happen, it's the biggest story in the history of finance. Fortunes will be made by some; most will regret not paying attention sooner.

Here's an overview of this story, and a preview of the analysis coming next...

If this does happen, it's the biggest story in the history of finance. Fortunes will be made by some; most will regret not paying attention sooner.

Here's an overview of this story, and a preview of the analysis coming next...

• • •

Missing some Tweet in this thread? You can try to

force a refresh