Some charts that caught my eye from Bain's global private equity 2025 report

🧵

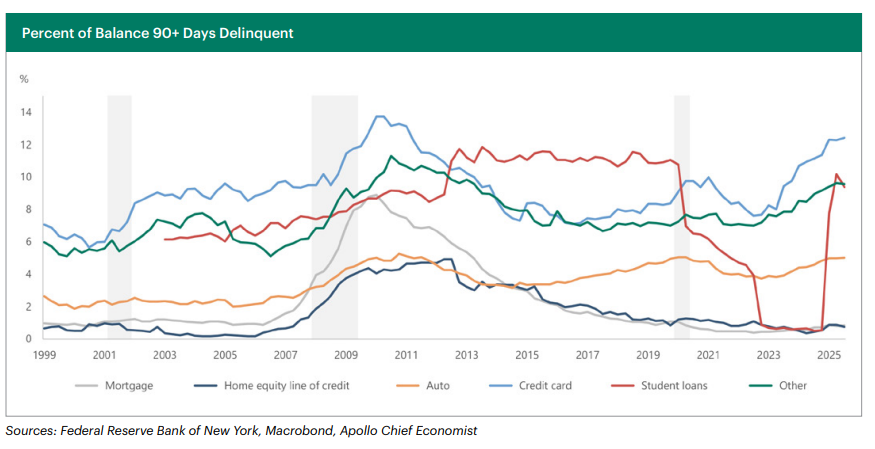

1/ Global buyout exits increased +34% y/y in 2024 but fundraising for buyout funds dropped -23% y/y

🧵

1/ Global buyout exits increased +34% y/y in 2024 but fundraising for buyout funds dropped -23% y/y

2/ AUM for private equity increased at a 14% CAGR through 2015 to 2023, but remained flat through 2Q24

3/ Follow-on funds are becoming harder to raise for bottom quartile firms. Even top quartile funds having some challenges, but still able to raise effectively

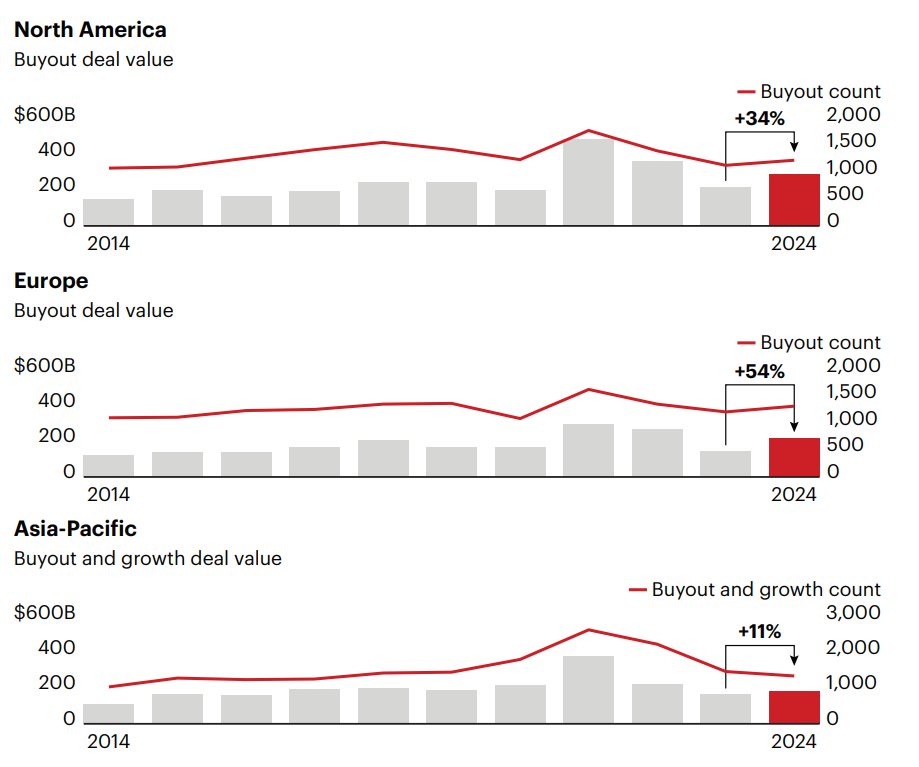

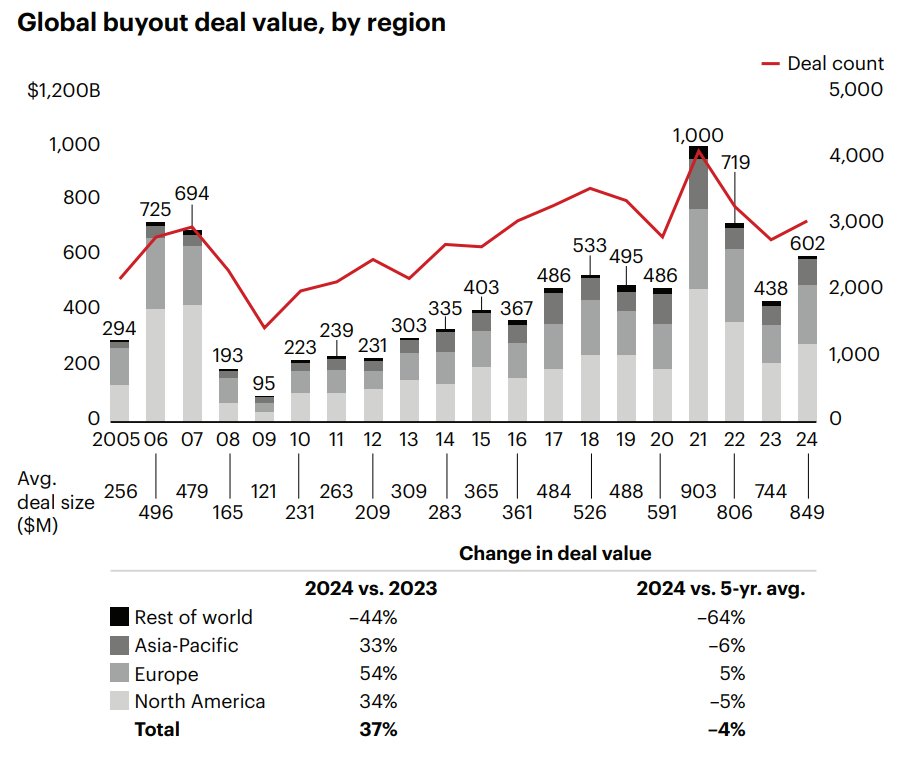

4/ Deal value recovered in 2024 vs 2023, but remains muted vs 5 year average.

Europe, in particular, showed the most strength with 54% y/y increase and +5% vs 5 year average

Europe, in particular, showed the most strength with 54% y/y increase and +5% vs 5 year average

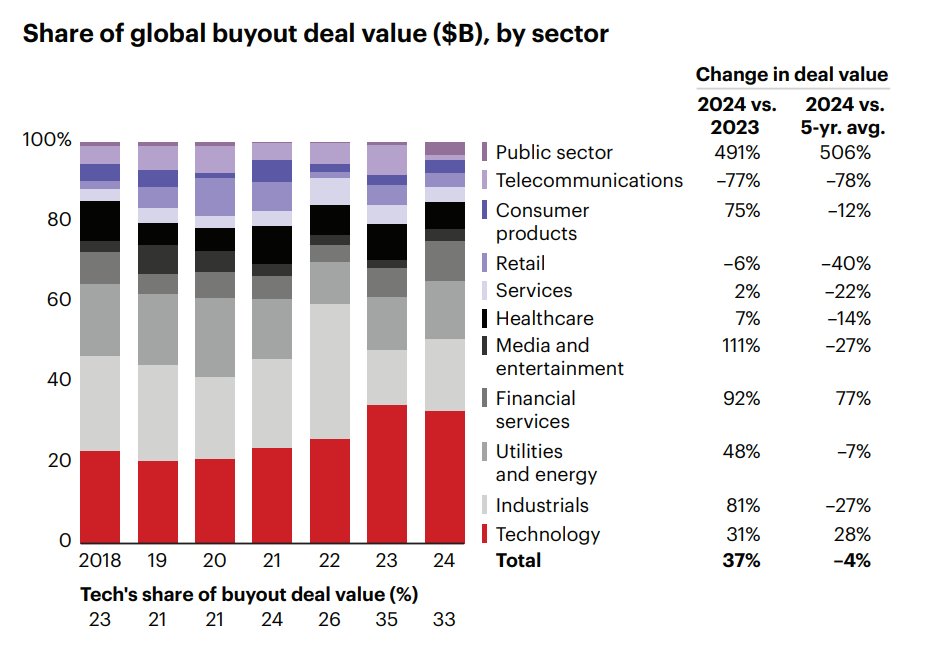

8/ Buyout deal value by sector

Most sectors rebounded in 2024 but still remain below 5 year averages

Telecom, media, retail, and industrials still well below 5 year average

Technology 28% above 5 year average

Most sectors rebounded in 2024 but still remain below 5 year averages

Telecom, media, retail, and industrials still well below 5 year average

Technology 28% above 5 year average

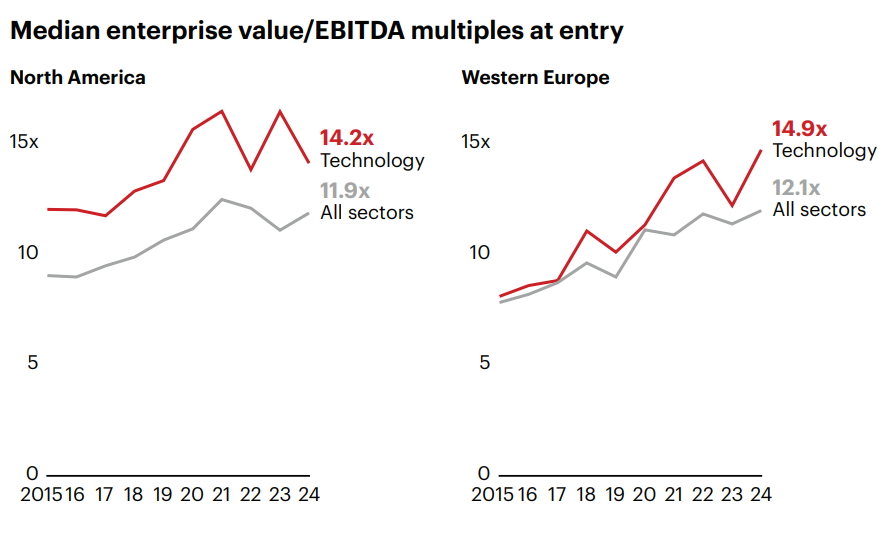

10/ Median TEV multiples pretty consistent across North America and Europe, and both at or near all time highs

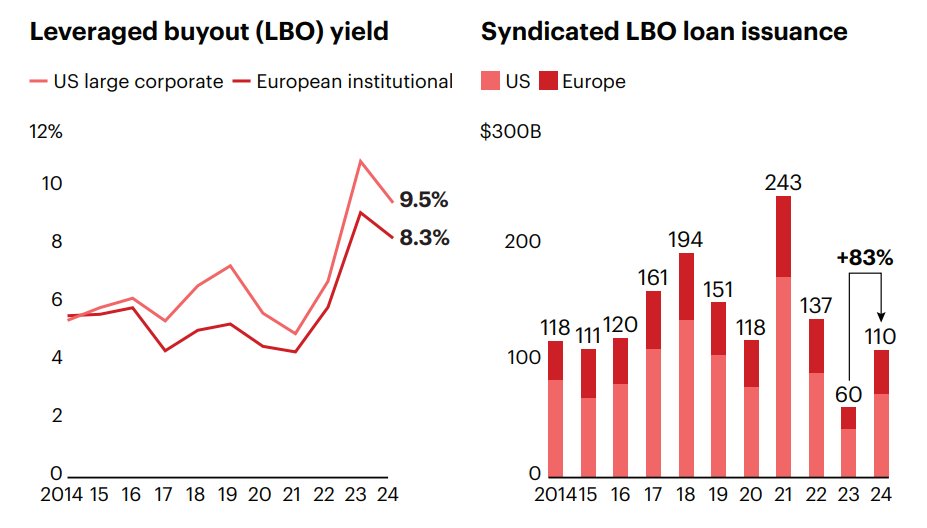

11/ Syndicated debt for LBOs saw a +83% y/y increase in 2024

LBO debt yield is higher at U.S. large corporates

LBO debt yield is higher at U.S. large corporates

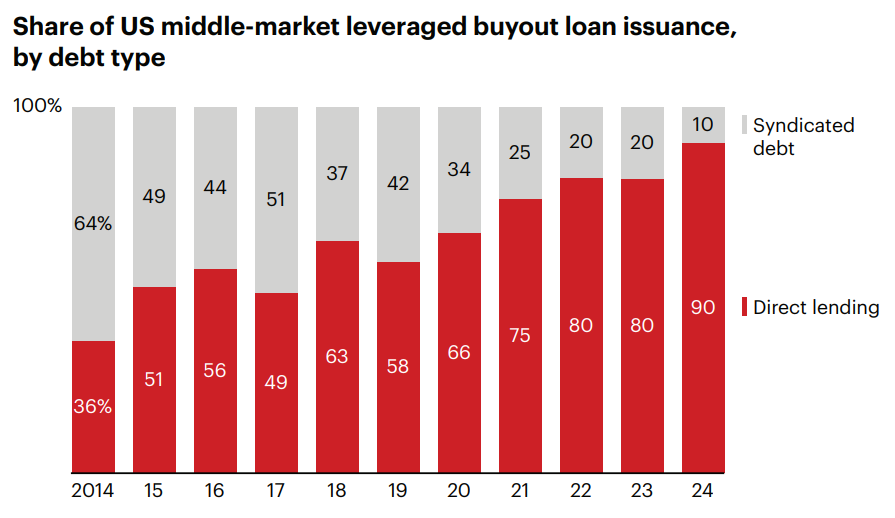

12/ Private credit continuing to eat market share from syndicated markets, especially in middle market LBOs

13/ Sponsor to sponsor deal the only exit channel above 5 year average

IPOs -46% and strategic sale -27% vs 5 year average

IPOs -46% and strategic sale -27% vs 5 year average

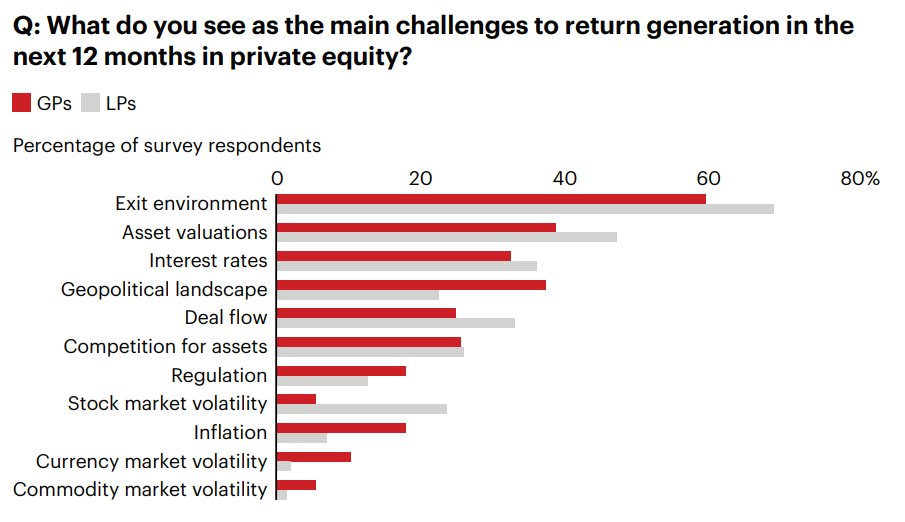

14/ LPs and GPs both agree that exit environment is the biggest challenge to return generation for next 12 months

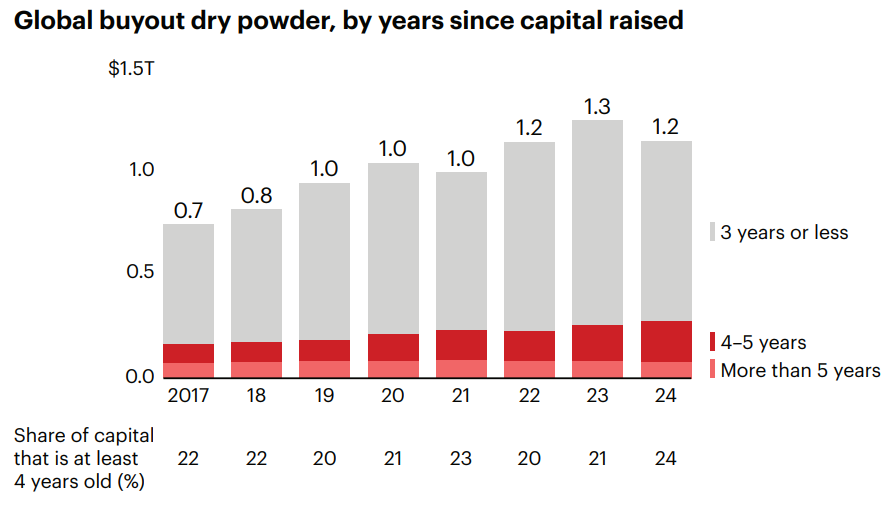

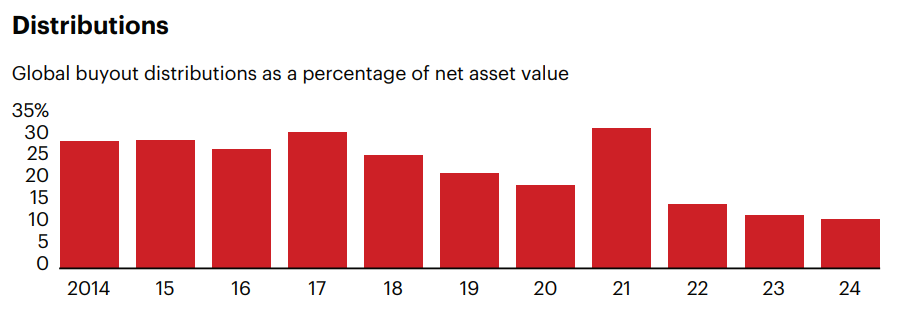

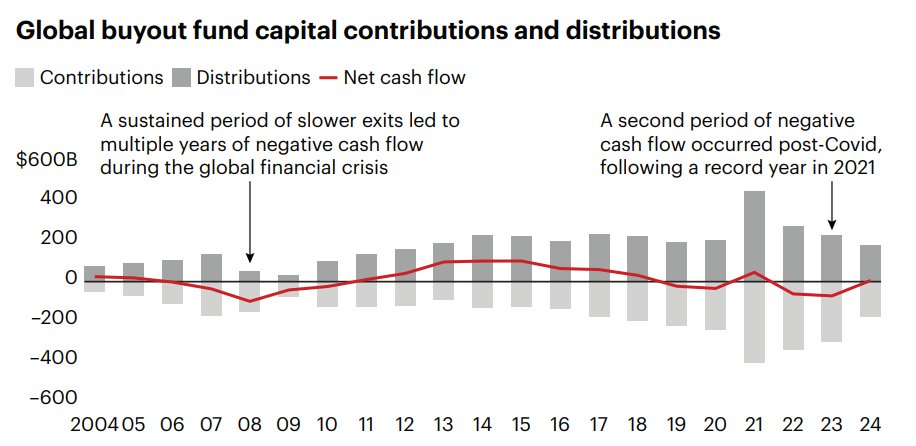

16/ Buyout net cash flow was negative through '22-23 after a record year in 2021

2024 closer to breakeven. Net cash flow highest during 2012 to 2017, which was roughly the middle of the ZIRP era

2024 closer to breakeven. Net cash flow highest during 2012 to 2017, which was roughly the middle of the ZIRP era

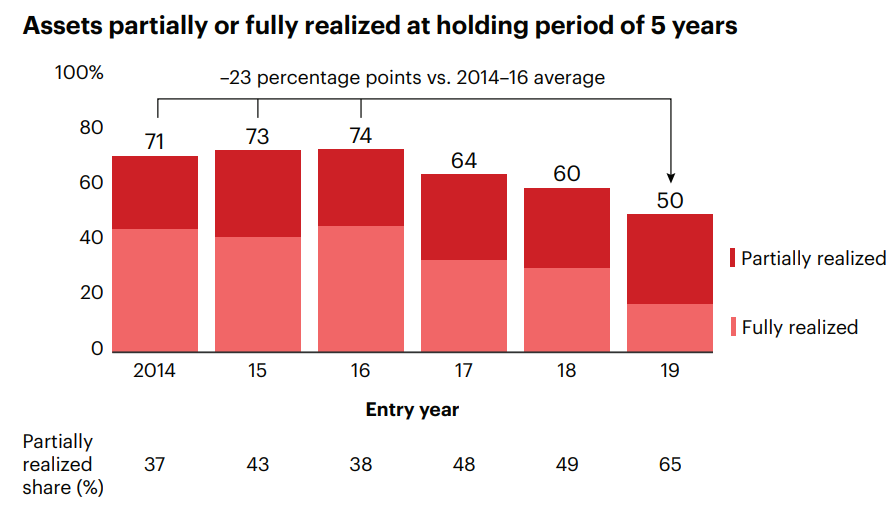

17/ Partially realized share of assets is highest it has been

This only looks at assets with a holding period of 5 years

Partial realization likely means dividend distribution, minority equity sales, asset divestitures etc. vs full sale

This only looks at assets with a holding period of 5 years

Partial realization likely means dividend distribution, minority equity sales, asset divestitures etc. vs full sale

19/ Secondaries and direct lending are the only two strategies where capital raised is higher vs 5 year average

Venture capital -57% vs 5 year average

Growth equity -35% vs 5 year average

Buyout PE -11% vs 5 year average

Real estate -46% vs 5 year average

Venture capital -57% vs 5 year average

Growth equity -35% vs 5 year average

Buyout PE -11% vs 5 year average

Real estate -46% vs 5 year average

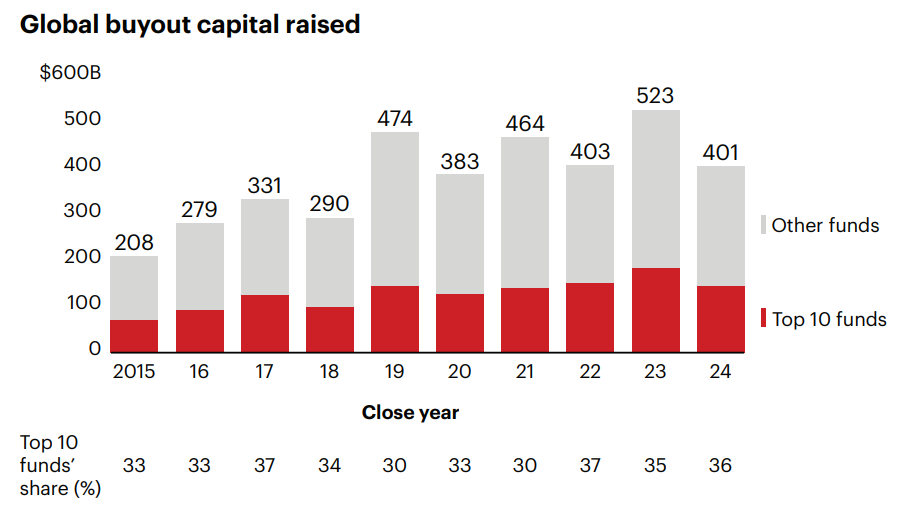

22/ Top 10 funds made up 36% of capital raised in the buyout space, consistent with historical data but starting to trend higher

23/ US buyout IRR starting to converge closer to public markets

European buyout still comfortably outpacing the MSCI Europe index

European buyout still comfortably outpacing the MSCI Europe index

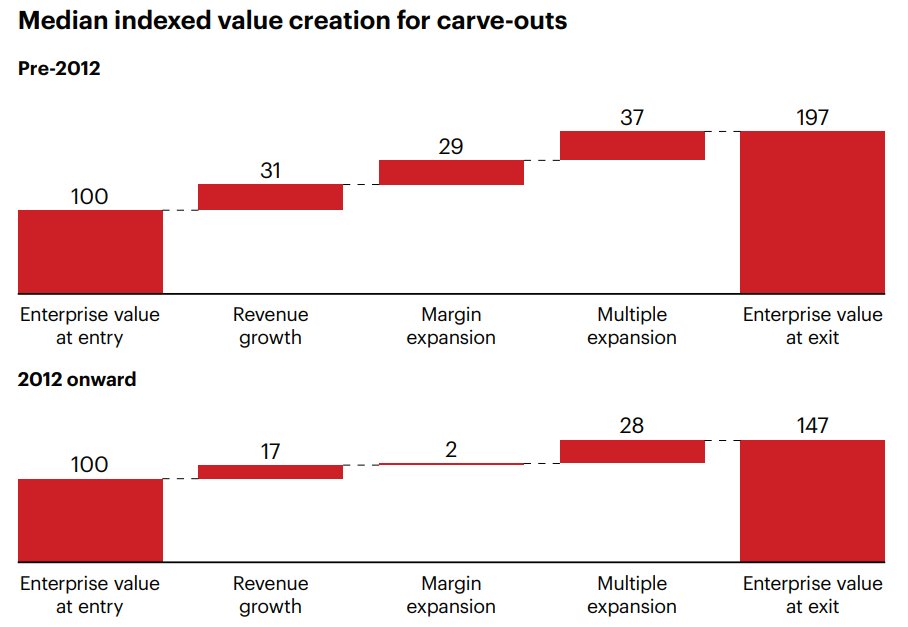

25/ Value creation estimate for private equity carve-out deals for pre-2012 deals vs post-2012 deals

Less overall value generated today with value from margin expansion having compressed the most for post-2012 deals

Less overall value generated today with value from margin expansion having compressed the most for post-2012 deals

• • •

Missing some Tweet in this thread? You can try to

force a refresh