The House Ways and Means tax bill released today is skewed in favor of rich people, is even more costly than the original 2017 law, and fails to deliver for working-class families and small businesses.

A thread 🧵

A thread 🧵

Let’s start w/ the bill’s failure to deliver for families on the #ChildTaxCredit – 17 million kids today do not get the full $2,000 max credit b/c their families don’t earn enough – these are parents who drive delivery trucks, clean offices, care for the elderly, etc.

None of these 17 million kids from low-income families will get a dime of the Republicans’ proposed increase in the #CTC as Kris Cox explains here ⬇️

bsky.app/profile/krisyc…

bsky.app/profile/krisyc…

For all the rhetoric we will hear about small businesses on Tuesday, it’s notable that House Rs propose to do nothing but watch the health premiums of 3 million small businesses owners – and 21 million low/middle inc people overall – skyrocket:

https://x.com/sarahL202/status/1922031282487206373

While ignoring small biz health care needs & leaving millions of working-class fams behind, the bill throws a gold-plated kitchen sink of tax cuts at high-income ppl – incl expanded discounts for wealthy partnerships, tax-free millions for heirs, & new windfalls for shareholders.

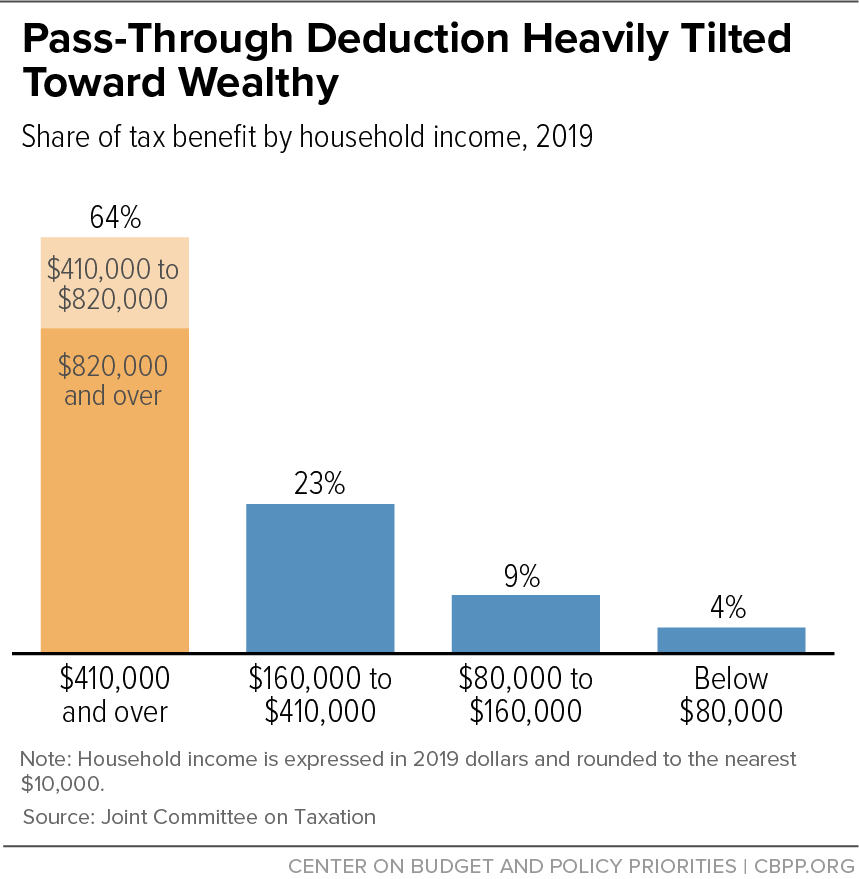

While 3 million small business owners will see their health insurance premiums skyrocket, wealthy partnerships will receive an even larger pass-through deduction – rising from 20% to a 23% deduction.

While House Rs excluded critical improvements to the #ChildTaxCredit that 169 of them voted for last year (Smith-Wyden bill), they included ALL of the add’l corporate tax cuts that were in that same bill, plus permanent lower tax rates on corporations’ foreign income.

These new corporate tax cuts come on top of the already permanent corp tax cuts – which delivered an eye-popping 83% of benefits to the households with incomes in the top 1%.

And while Republicans left out 17 million children in low-income families from their Child Tax Credit proposal, they increased to $30 million per couple the amount that can be bequeathed tax-free to trust fund kids.

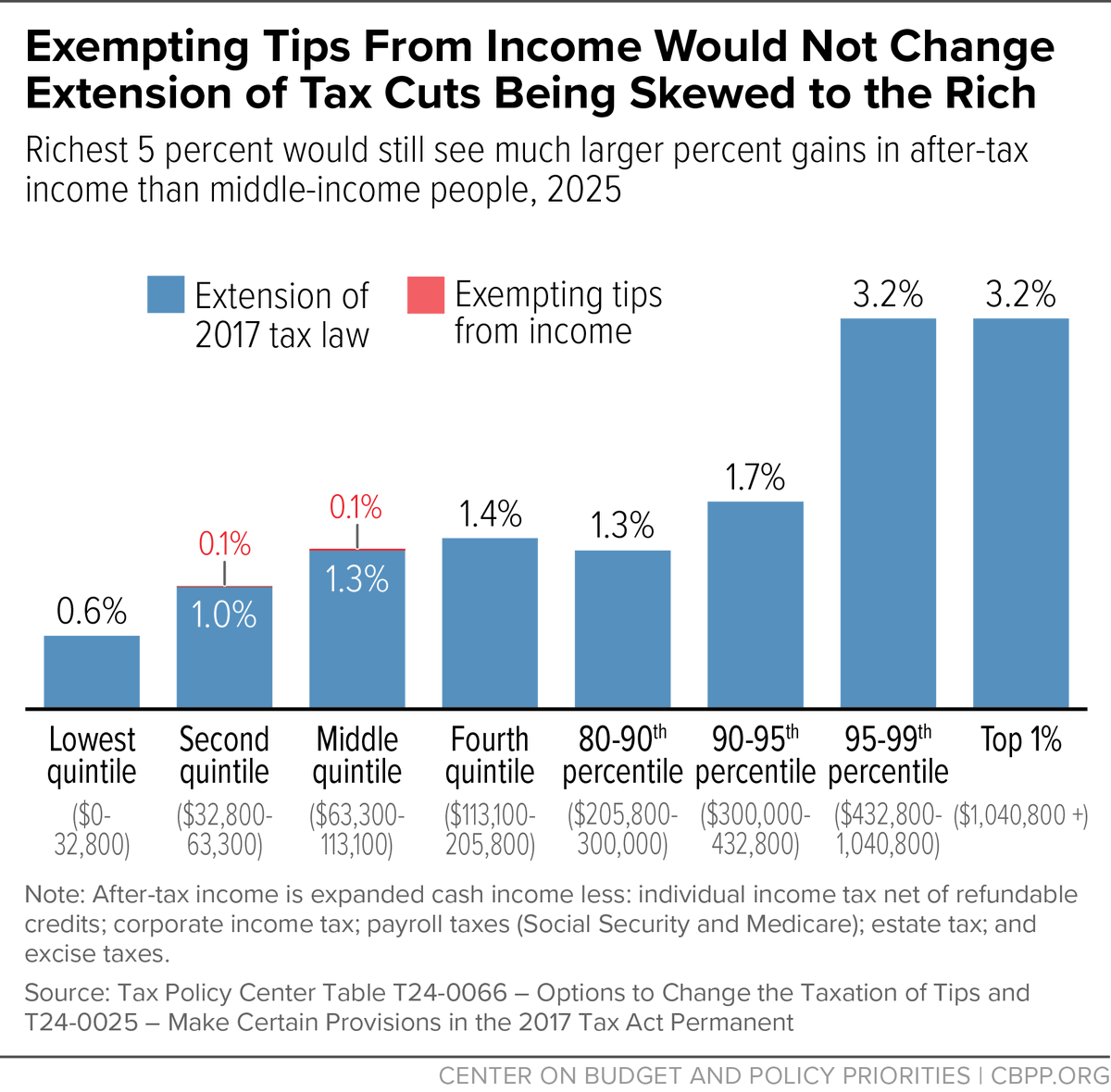

And none of the much-touted new tax exemptions change the picture.

No tax on tips barely registers b/c it affects a tiny share of workers. (Chart is from an older bill but same story here.) And deductions for overtime & seniors add to the cost but don’t fundamentally change the story either (& leave out lower income filers).

And for all of the feigned concern about budget deficits, the House bill likely costs hundreds of billions more than a full extension of the already bloated 2017 tax law. (More to come when JCT scores are released.) The ultimate cost would be much higher without budget gimmicks.

Meanwhile, the Ways and Means bill does nothing about the elephant that is going to be in their hearing room on Tuesday: the Trump tariffs --- which would erase much of the small working-class gains from their skewed tax bill while risking recession.

The tax cuts will be partly offset by taking away/cutting food assistance, health coverage, income assistance, & college aid, making it harder for people to afford their basic needs and limiting opportunity.

This is an upside-down plan that walks away from campaign promises to serve those at the margins of the economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh