Vice President of Federal Tax Policy at the Center on Budget and Policy Priorities.

How to get URL link on X (Twitter) App

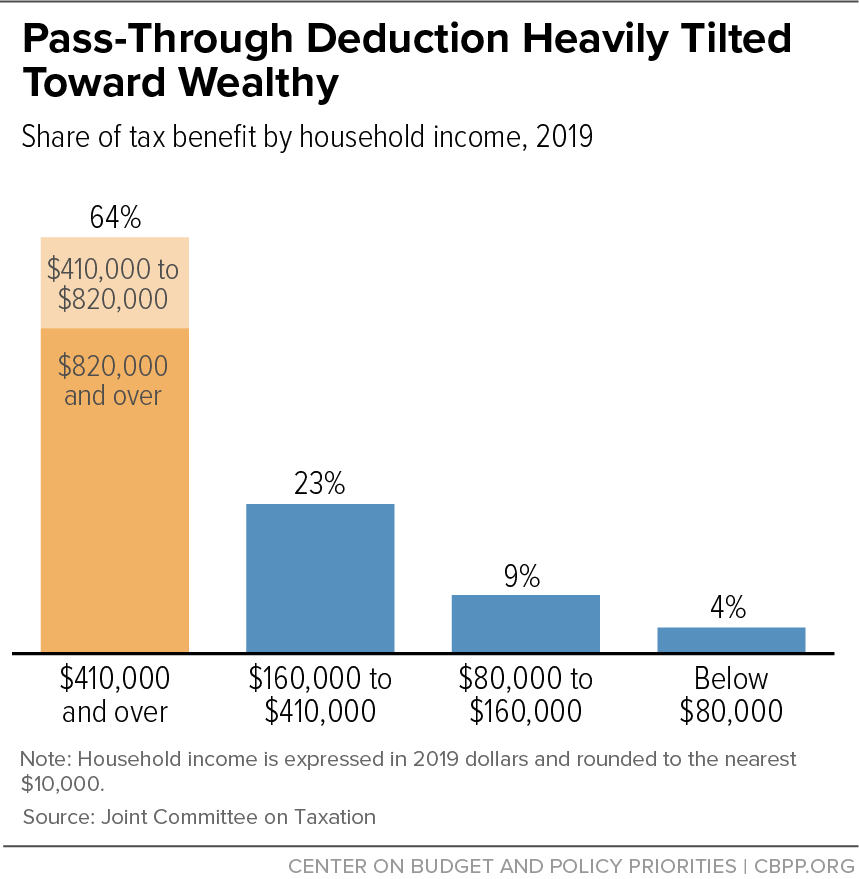

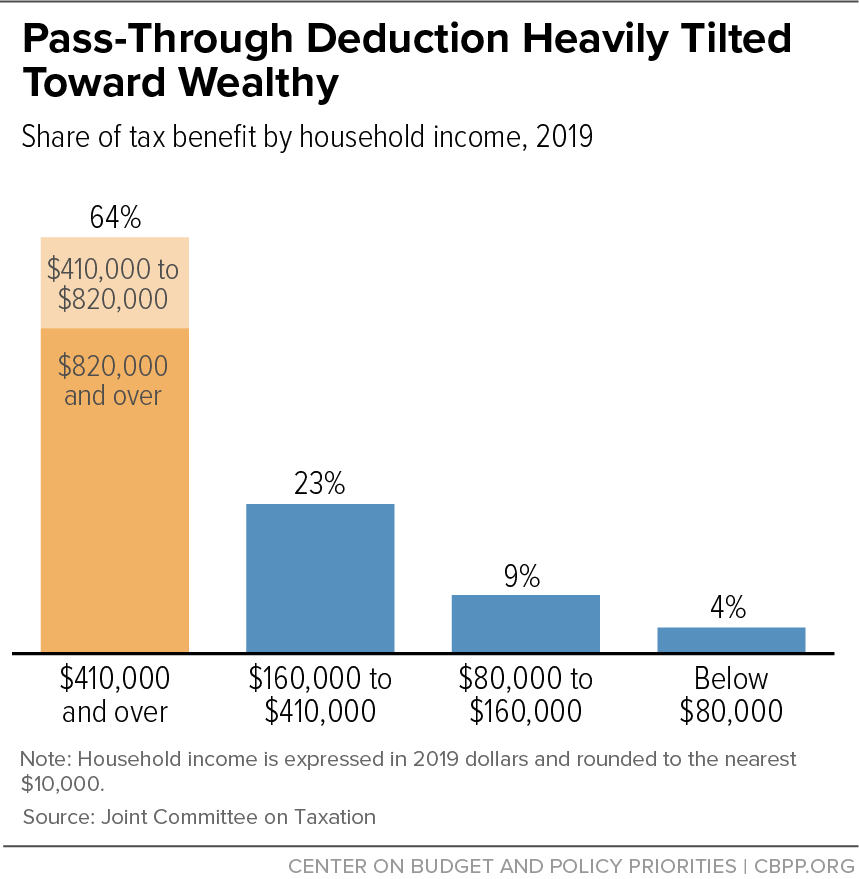

One easy course correction Republicans should take: don’t take healthcare and help buying groceries away from families or make college more expensive for the people you’re supposed to be helping. Press delete on the left side of this chart.

One easy course correction Republicans should take: don’t take healthcare and help buying groceries away from families or make college more expensive for the people you’re supposed to be helping. Press delete on the left side of this chart.