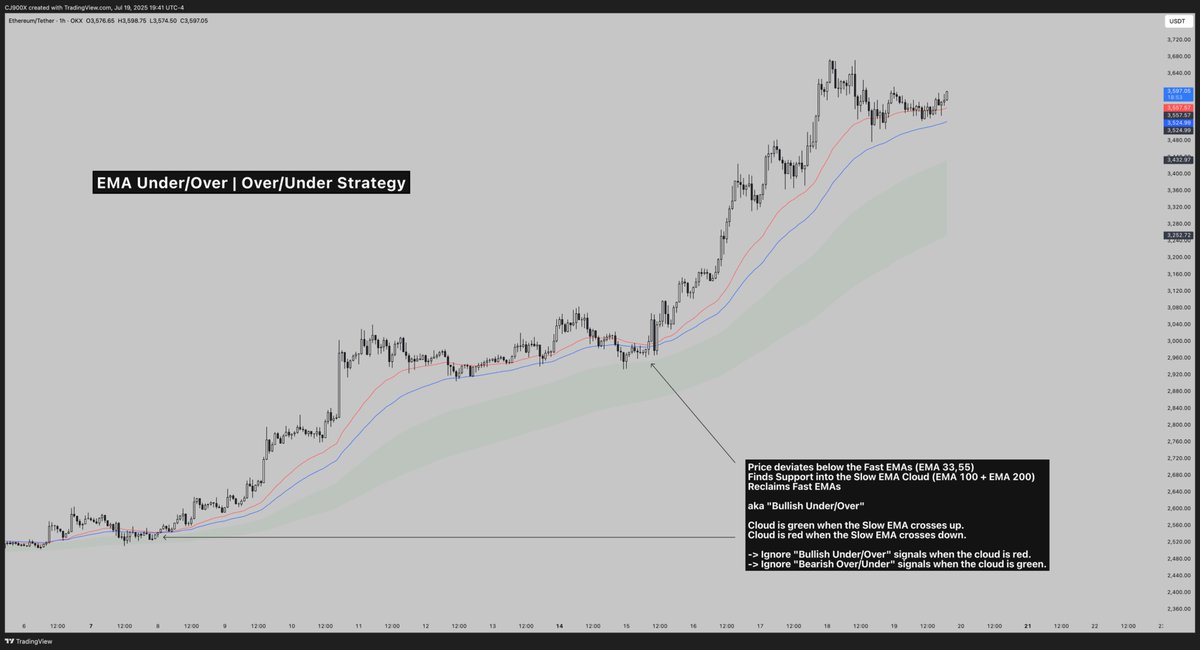

I am a price action maxi at heart, but it's difficult to beat a simple EMA strategy when price is trending.

This is my go-to EMA strategy, which can be used on any timeframe.

Enjoy

Fast EMAs: 33,55

Slow EMAs: 100,200 (cloud)

This is my go-to EMA strategy, which can be used on any timeframe.

Enjoy

Fast EMAs: 33,55

Slow EMAs: 100,200 (cloud)

Just switched to the 1 minute timeframe to see if there was a setup, to prove that this can work on any timeframe and here you go.

Keep in mind this isn't magic, long signals work best when the HTF is bullish.

Additionally, when price starts to range, EMA strategies aren't great as they chop around from bullish to bearish.

But hopefully you get the idea with the examples. The example below would have captured 3-4R.

GL

Keep in mind this isn't magic, long signals work best when the HTF is bullish.

Additionally, when price starts to range, EMA strategies aren't great as they chop around from bullish to bearish.

But hopefully you get the idea with the examples. The example below would have captured 3-4R.

GL

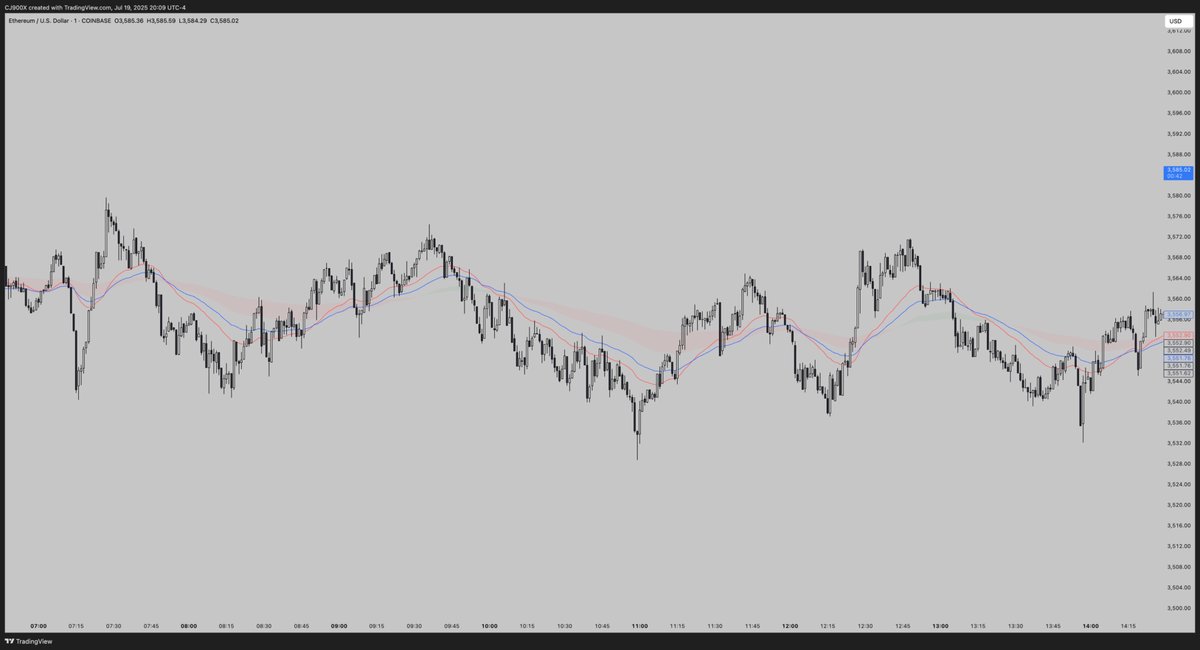

Example of when NOT to use it - price is ranging and the EMA cloud is switching from bearish to bullish frequently.

Just don't force anything. Wait until the setup looks too good not to take, in line with your higher timeframe bias.

Just don't force anything. Wait until the setup looks too good not to take, in line with your higher timeframe bias.

• • •

Missing some Tweet in this thread? You can try to

force a refresh