How to get URL link on X (Twitter) App

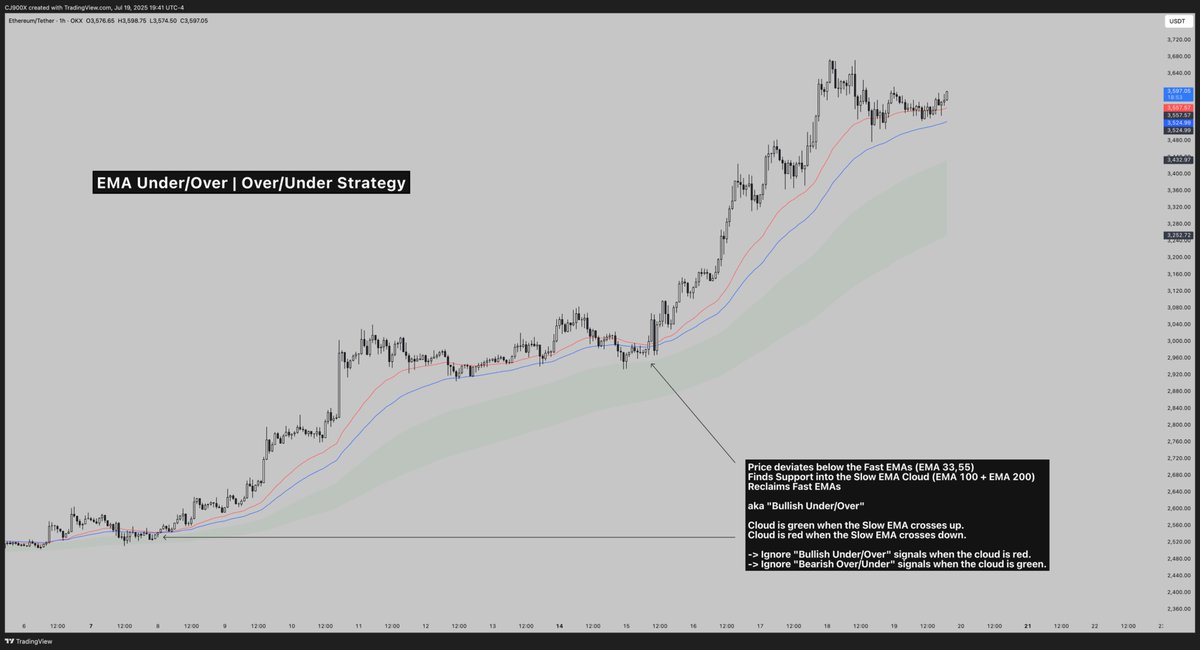

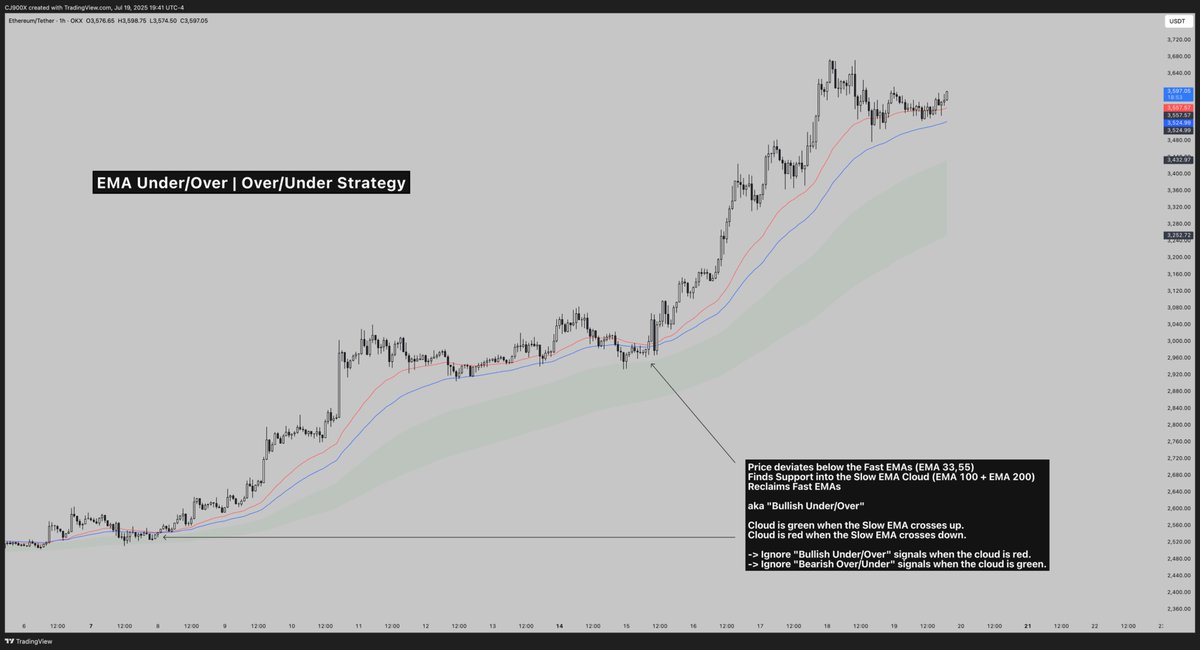

Indicator:

Indicator:

Looking for this ideally from earlier

Looking for this ideally from earlier

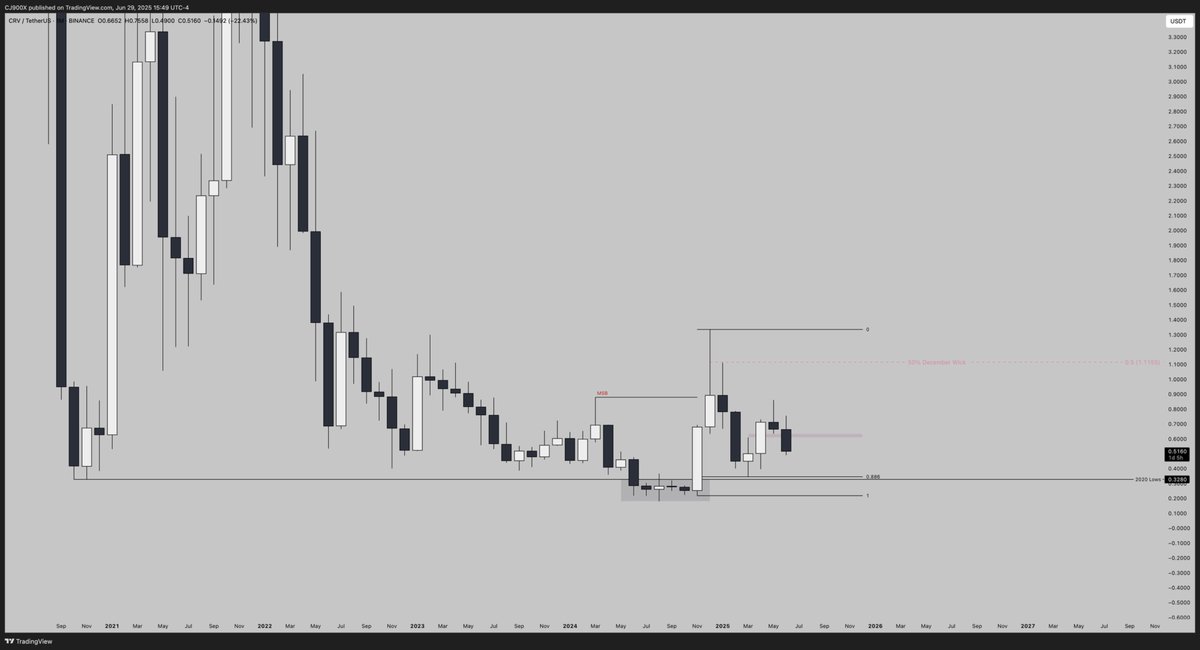

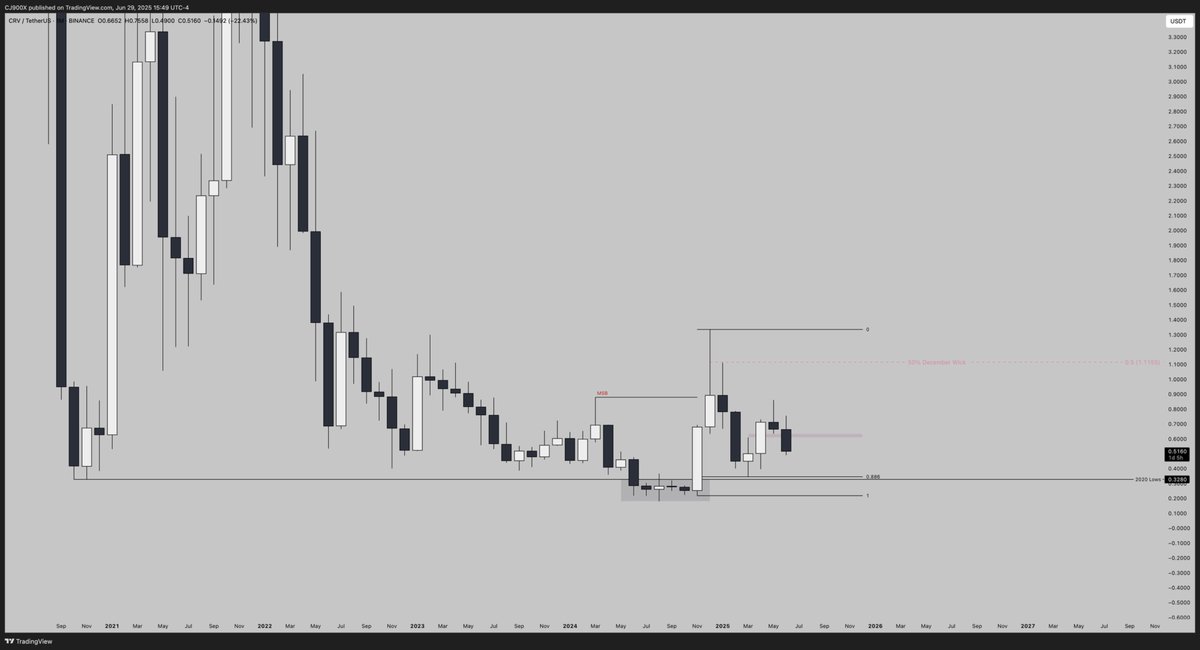

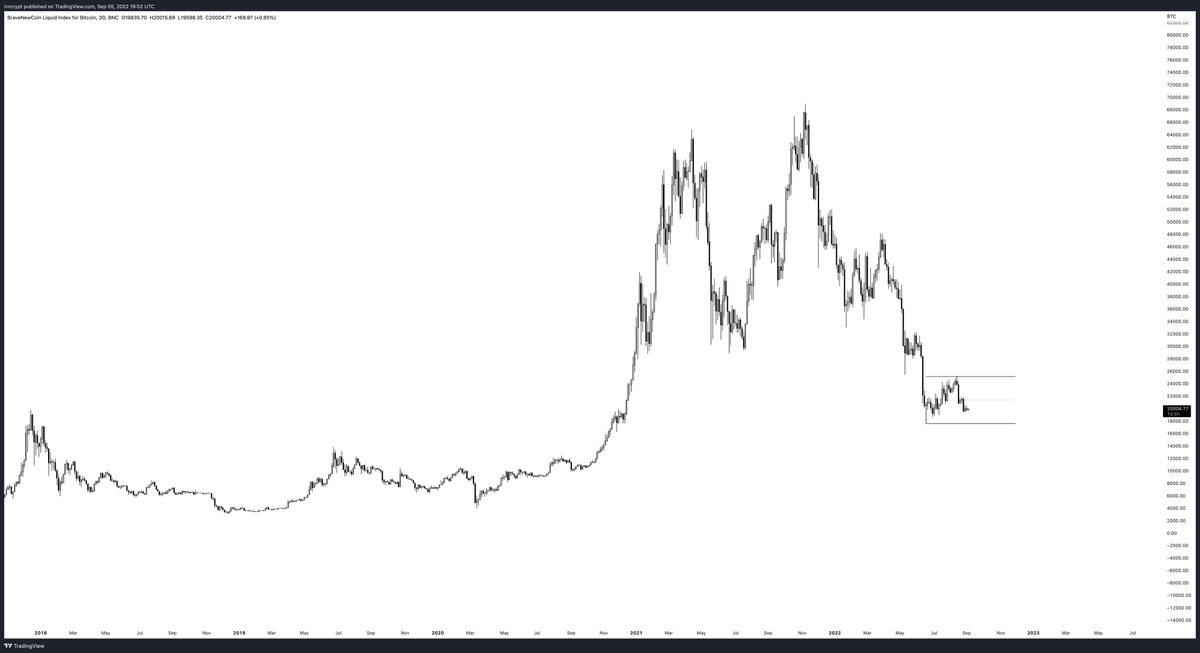

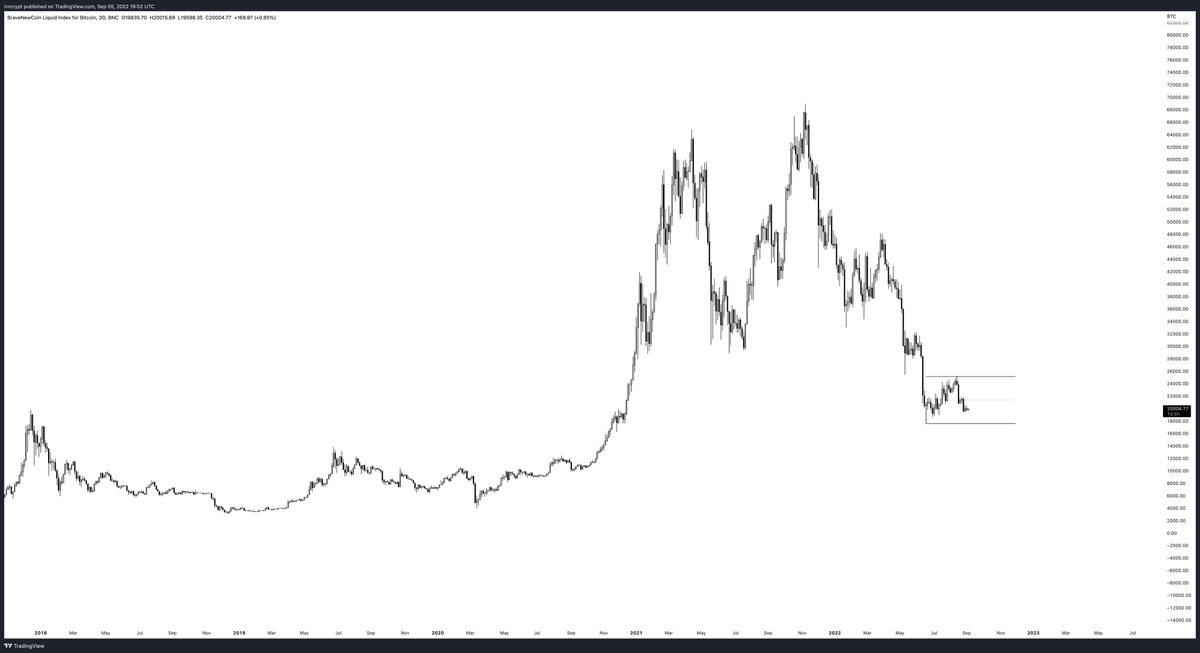

Monthly - Range

Monthly - Range

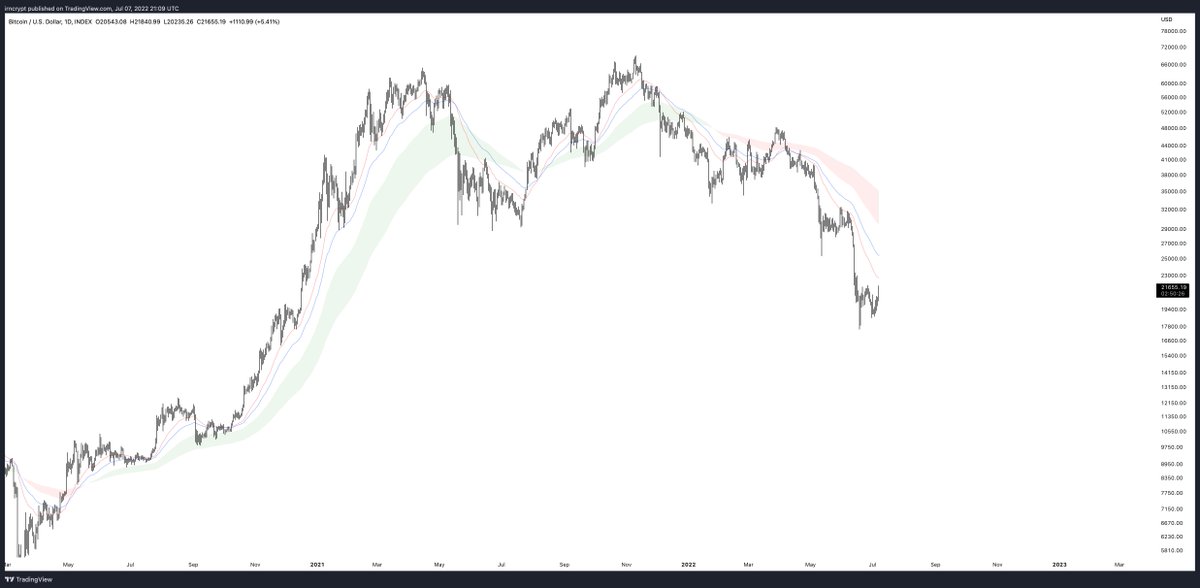

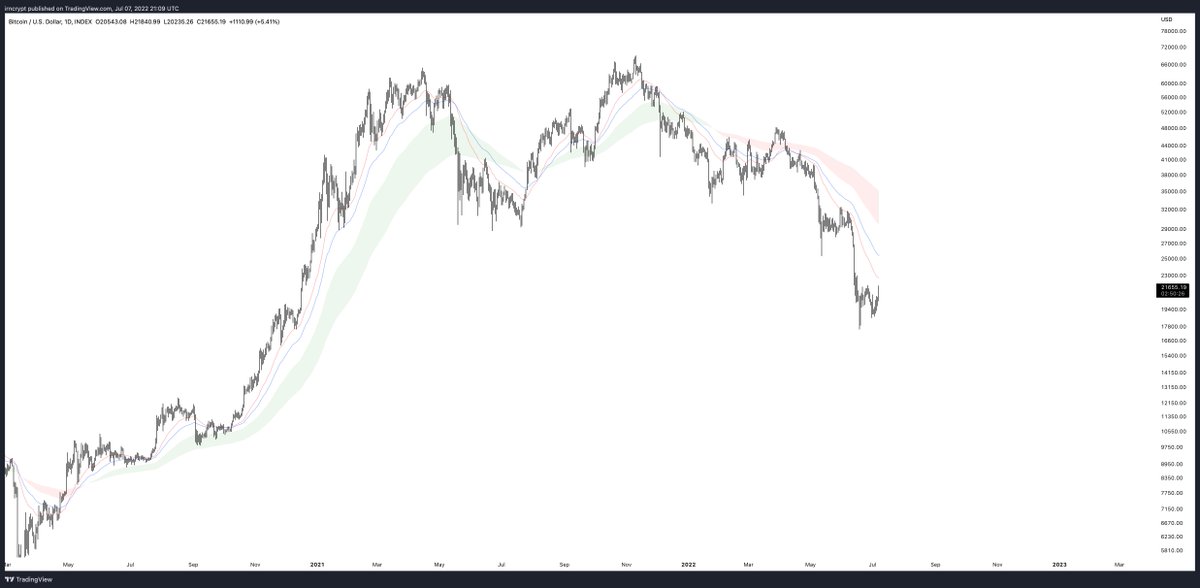

$BTC - LTF

$BTC - LTF

Breakout Attempt #1

Breakout Attempt #1

Diagonal looks ripe for a squeeze tbh

Diagonal looks ripe for a squeeze tbh

Hmm. Also v possible we run the highs first looking at these wicks.

Hmm. Also v possible we run the highs first looking at these wicks.

Reclaim the next S/R level and the weekly moving averages - then we're talking. Otherwise, you need to consider the possibility of lower prices.

Reclaim the next S/R level and the weekly moving averages - then we're talking. Otherwise, you need to consider the possibility of lower prices.

As it stands today, the EMA cloud is red and we haven't even touched the fastest moving average yet ...

As it stands today, the EMA cloud is red and we haven't even touched the fastest moving average yet ...

No position here. Haven't got a setup on the lower timeframe. While the levels are holding (Weekly, Monthly S/R Flip) this local consolidation on the lower timeframe looks a little shitty.

No position here. Haven't got a setup on the lower timeframe. While the levels are holding (Weekly, Monthly S/R Flip) this local consolidation on the lower timeframe looks a little shitty.

This would be quite something

This would be quite something