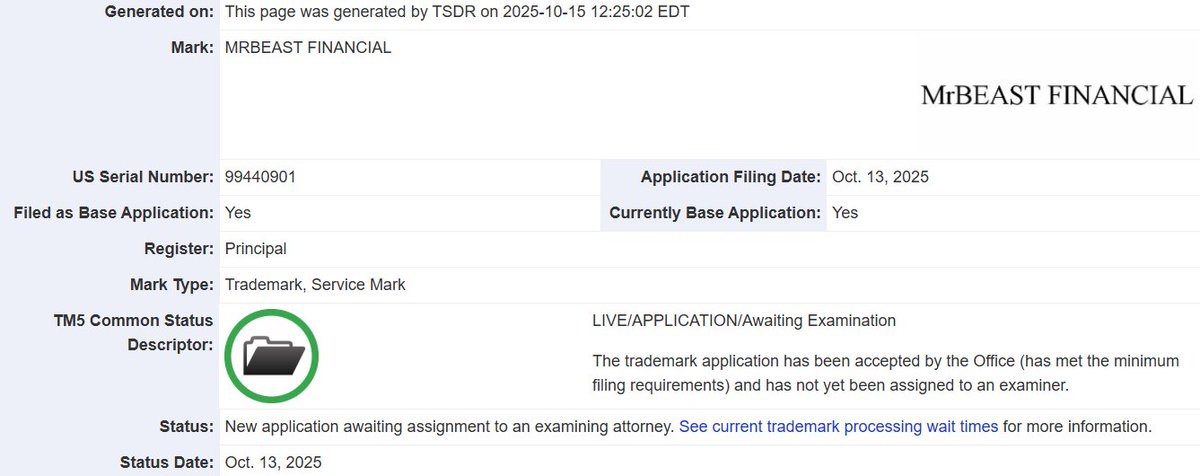

BREAKING: @MrBeast has filed a trademark to launch his own bank.

The org will be called MrBeast Financial.

The filing was submitted on an intent-to-use basis, which under trademark law means there are genuine plans to bring this to life.

The org will be called MrBeast Financial.

The filing was submitted on an intent-to-use basis, which under trademark law means there are genuine plans to bring this to life.

• • •

Missing some Tweet in this thread? You can try to

force a refresh