Fintech enthusiast @twifintech

Founder @thestablecon

General Partner @thefintechfund

The dogs bark but the caravan moves on

How to get URL link on X (Twitter) App

The number of #fintech deals has been sharply ticking upwards:

The number of #fintech deals has been sharply ticking upwards:

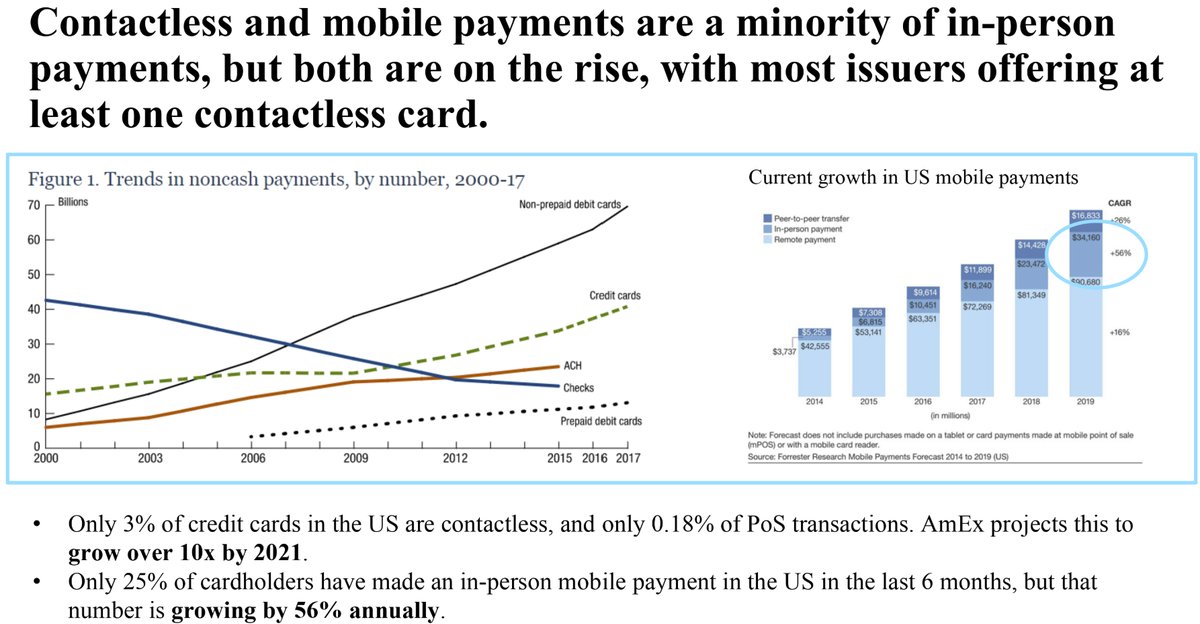

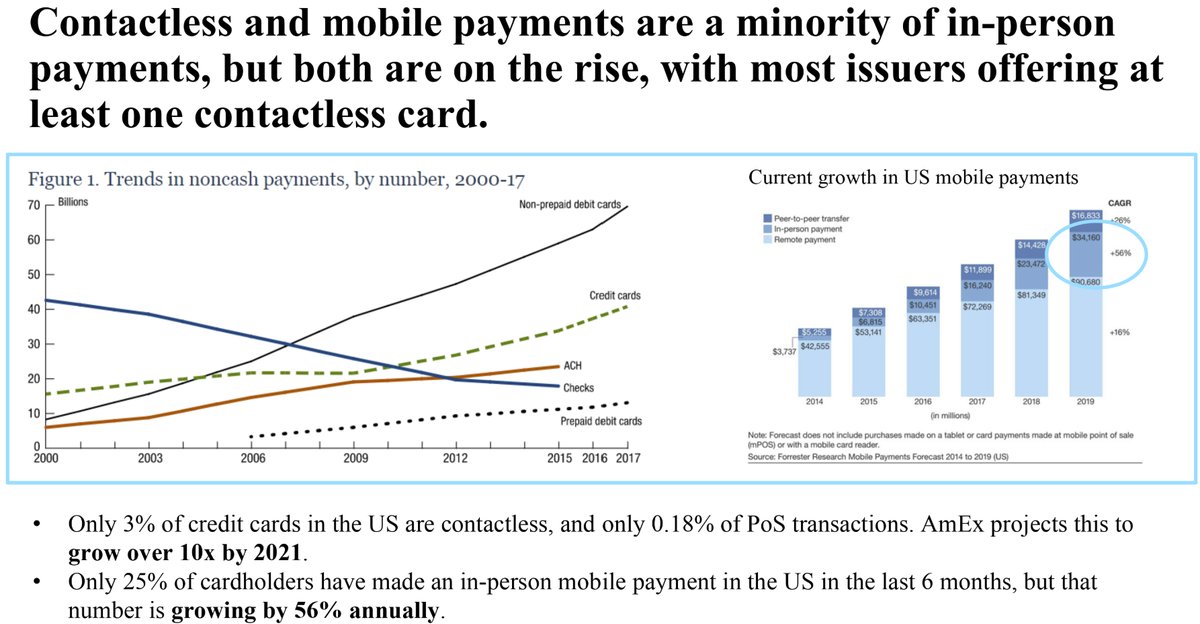

https://twitter.com/noyesclt/status/1289227091217715200Mobile and QR payments took off in other countries (eg. Alipay/WeChat Pay in China), but they lagged significantly in the US for years.