People lined up around the block to buy gold, right outside Australia’s central bank.

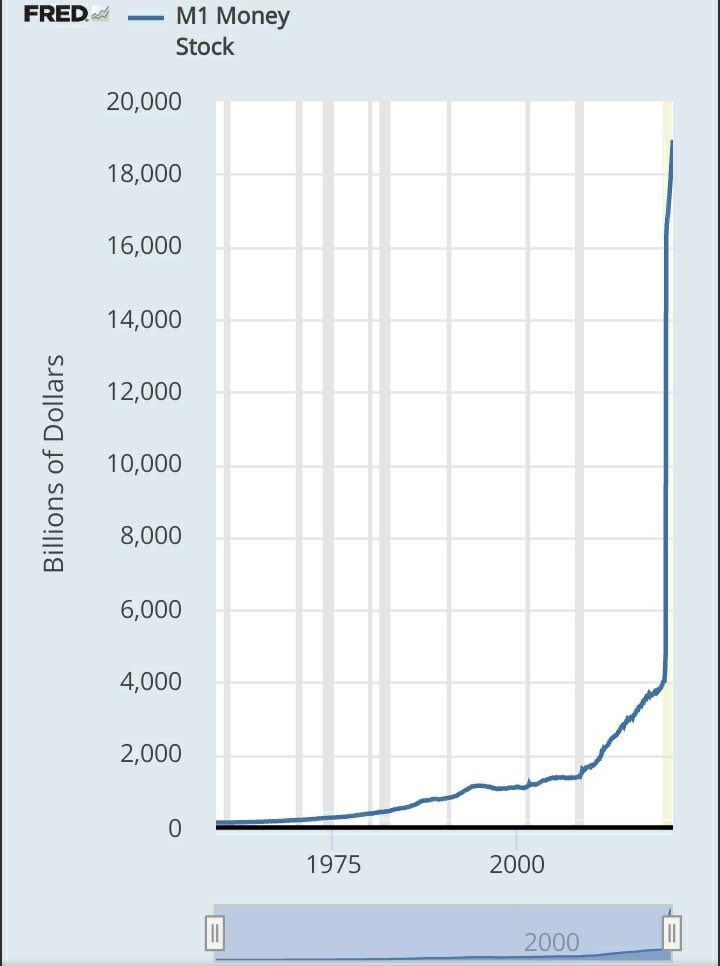

Yesterday in Sydney, dozens waited at Martin Place to buy physical gold, literally steps from the Reserve Bank of Australia, as inflation, low interest rates, and cost-of-living pressures erode trust in paper currency.

Gold is up ~50% this year, hitting a record $4,059/oz, as Australians pile in to protect their savings from debasement.

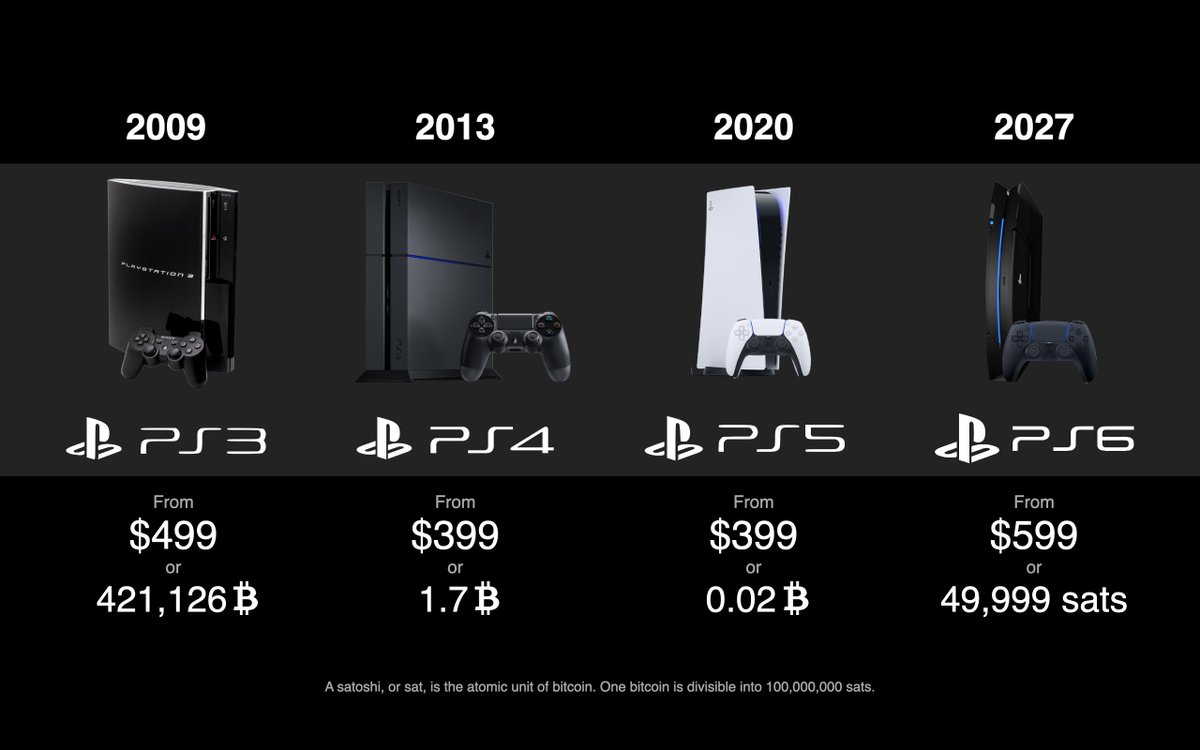

Gold was for the 20th century.

Bitcoin is for the 21st.

It’s scarce, self-custodial, portable, and immune to dilution... the first truly global, programmable form of sound money humanity has ever had.

Yesterday in Sydney, dozens waited at Martin Place to buy physical gold, literally steps from the Reserve Bank of Australia, as inflation, low interest rates, and cost-of-living pressures erode trust in paper currency.

Gold is up ~50% this year, hitting a record $4,059/oz, as Australians pile in to protect their savings from debasement.

Gold was for the 20th century.

Bitcoin is for the 21st.

It’s scarce, self-custodial, portable, and immune to dilution... the first truly global, programmable form of sound money humanity has ever had.

Read more: thenightly.com.au/australia/lunc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh