1/ #Bitcoin Stages -

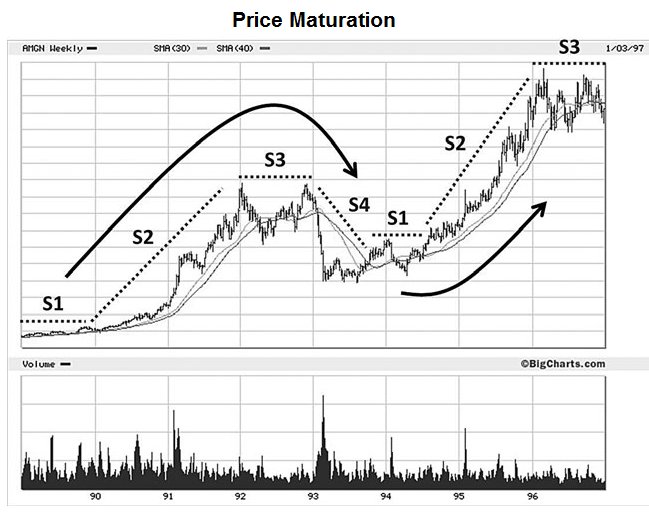

Price momentum can always be divided into 4 stages -@markminervini

-S1 accumulation range (no media/max opportunity)

-S2 directionnal trend (<<-- THIS IS WHERE YOU SHOULD TRADE)

-S3 huge volatility (media are nuts/min opportunity)

-S4 final mark down/crash

Price momentum can always be divided into 4 stages -@markminervini

-S1 accumulation range (no media/max opportunity)

-S2 directionnal trend (<<-- THIS IS WHERE YOU SHOULD TRADE)

-S3 huge volatility (media are nuts/min opportunity)

-S4 final mark down/crash

2/ I told you to look into this article, that was the key for a great trade to do:

- Leave S2 behind

- Act during S3 that's going nowhere (22nd dec -40% day was the clue for S3)

- So you had plenty of time to avoid S4 by beeing invested in it.

- Leave S2 behind

- Act during S3 that's going nowhere (22nd dec -40% day was the clue for S3)

- So you had plenty of time to avoid S4 by beeing invested in it.

https://twitter.com/Beetcoin/status/948552310694797312

3/ #Bitcoin is the key leader and barometer of $CRYPTO sector. Hate it or not. This is just rationnal and reality. As long it's not trending up (S2), $CRYPTO will mostly not trending up.

Your goal is to survive/make minimum mistakes not beeing right every move so avoid S1/S3/S4

Your goal is to survive/make minimum mistakes not beeing right every move so avoid S1/S3/S4

-You'll make 90% of your profits & best trades during S2

-Spend less time during S1/S3/S4, be liquid

-S1/S3/S4 lead to small mistakes that grow and become FATAL

-Trade less so you'll be more profitable

-Survive to experience hundred's S2 in your career

-Spend less time during S1/S3/S4, be liquid

-S1/S3/S4 lead to small mistakes that grow and become FATAL

-Trade less so you'll be more profitable

-Survive to experience hundred's S2 in your career

https://twitter.com/Beetcoin/status/935525730292785152

9/ these are obviously general guidelines, but it's primordial to do this work to know where you are on the map, what you are trading, what's the plan & how to behave accordingly.

Insight biais is easy (draw the chart after) but at least for now we're almost sure it's not S2.

Insight biais is easy (draw the chart after) but at least for now we're almost sure it's not S2.

#Bitcoin ($CRYPTO) stages 2015 - 2018: July Update

Bounced again on the $6k low, still in S1/S4.

A bullish #Chuvashov's fork is in the making. Downtred slowed down, can reverse now. But need few steps to turn very bullish. It can also be clogged in a S1 range for a while.

Bounced again on the $6k low, still in S1/S4.

A bullish #Chuvashov's fork is in the making. Downtred slowed down, can reverse now. But need few steps to turn very bullish. It can also be clogged in a S1 range for a while.

#Bitcoin ($CRYPTO) stages 2015 - 2018: August Update

Failed to break over the bullish #Chuvashov's fork (green lines).

Remains clogged, still in S1/S4.

Failed to break over the bullish #Chuvashov's fork (green lines).

Remains clogged, still in S1/S4.

#Bitcoin ($CRYPTO) stages 2015 - 2018: September Update. More of the same:

Failed to break (again) over the bullish #Chuvashov's fork (green lines).

Remains clogged, still in S1/S4.

Failed to break (again) over the bullish #Chuvashov's fork (green lines).

Remains clogged, still in S1/S4.

#Bitcoin ($CRYPTO) stages 2015 - 2018: October Update.

Spent previous month in a very low volatilty narrow range. Might expect a strong move out from there with key levels just over and below. Thrilling!

Spent previous month in a very low volatilty narrow range. Might expect a strong move out from there with key levels just over and below. Thrilling!

#Bitcoin ($CRYPTO) stages 2015 - 2018: November Update.

Not very different from October regime:

- Things get ever more squeezed.

- RSI is completly amorphous

Patience is key, use this time to improve your clear-sightedness and simplify things.

Not very different from October regime:

- Things get ever more squeezed.

- RSI is completly amorphous

Patience is key, use this time to improve your clear-sightedness and simplify things.

#Bitcoin ($CRYPTO) stages update: expected move occured and has choosen downside.

This thread 👆 telling you $crypto is not bullish long term since feb 2018 (read: no S2) 🤓

Good guy, No noise 🧐🤫

This thread 👆 telling you $crypto is not bullish long term since feb 2018 (read: no S2) 🤓

Good guy, No noise 🧐🤫

#Bitcoin ($CRYPTO) stages 2015 - 2018: December Update

During the whole year the latter stage was marked as "S1?" or "S4?"

Turns out we were still def. in S4 and you've been notified (see prior tweet -40% since then)

I repeat, the main teaching of this is that we weren't in S2

During the whole year the latter stage was marked as "S1?" or "S4?"

Turns out we were still def. in S4 and you've been notified (see prior tweet -40% since then)

I repeat, the main teaching of this is that we weren't in S2

12/ Because nobody can explain the market if they don't ever had skin in the game (mindblowing: they wouldn't be economist or have any honorific mention if it was the case ;-))

Trader & technicians, do/did, cut the TV, read, connect to them.

Trader & technicians, do/did, cut the TV, read, connect to them.

#Bitcoin ($CRYPTO) stages 2015 - 2019: February, straight to a 2 months update

During this period, we bounced on support once & failed under resistance twice (arrows). Trading slow in between, consolidating for the the move

For any trend change: need RSI to coil up 1st (yellow)

During this period, we bounced on support once & failed under resistance twice (arrows). Trading slow in between, consolidating for the the move

For any trend change: need RSI to coil up 1st (yellow)

#Bitcoin ($CRYPTO) stages 2015 - 2019: April update

Price marked a consolidation under resistance w/ multiple rejections.

For the 1st time since the crash, we witness a bullish breakout... and RSI went exactly in the spot, coiling up.

We are now closer from S1 or S2 than S4.

Price marked a consolidation under resistance w/ multiple rejections.

For the 1st time since the crash, we witness a bullish breakout... and RSI went exactly in the spot, coiling up.

We are now closer from S1 or S2 than S4.

#Bitcoin ($CRYPTO) stages 2015 - 2019: May update

We expected the end of weaknesses and... it did not disappoint.

The strength pops us out with a bullish breakout of key RSI level over >55 last seen in 2015 (pink arrows).

Q. now is: how & where this (S1) S2 will first mature?

We expected the end of weaknesses and... it did not disappoint.

The strength pops us out with a bullish breakout of key RSI level over >55 last seen in 2015 (pink arrows).

Q. now is: how & where this (S1) S2 will first mature?

#Bitcoin ($CRYPTO) stages 2015 - 2019: June update

We had a first break between 8.5k-7.5k, but it has no chill when it's a bull market.

We had a first break between 8.5k-7.5k, but it has no chill when it's a bull market.

#Bitcoin ($CRYPTO) Stages 2015 - 2019: July update

Price flashed up to ~$14K, but now below a significant barrier around ~12K support of last S3.

RSI & Price look still under bull control. But things can consolidate for few weeks/months below this resistance. Still in S2.

Price flashed up to ~$14K, but now below a significant barrier around ~12K support of last S3.

RSI & Price look still under bull control. But things can consolidate for few weeks/months below this resistance. Still in S2.

#Bitcoin ($CRYPTO) Stages 2015 - 2019: August update

in the midst of a temporary consolidation, quite random chop in it.

Patience...

in the midst of a temporary consolidation, quite random chop in it.

Patience...

#Bitcoin ($CRYPTO) Stages 2015 - 2019: September update

Still in the consolidation chopping traders left & right (you've been warned!).

The RSI now looks exhausted. I won't be surprise if it dips from there.

Question: will it be a fake move down (quick recover) or worse?

Still in the consolidation chopping traders left & right (you've been warned!).

The RSI now looks exhausted. I won't be surprise if it dips from there.

Question: will it be a fake move down (quick recover) or worse?

#Bitcoin ($CRYPTO) Stages 2015 - 2019: September important update:

Didn't take long, it dipped few hours after.

In a near future this is not S2 anymore. It's better to trade S2 assets.

Question remains: will it be a fake move down (quick recover) or worse? Price action needed.

Didn't take long, it dipped few hours after.

In a near future this is not S2 anymore. It's better to trade S2 assets.

Question remains: will it be a fake move down (quick recover) or worse? Price action needed.

#Bitcoin ($CRYPTO) Stages 2015 - 2019: October update:

Price dip is now showing some signs of maturation. Still too soon to predict next move direction.

We're sitting in opposing bullish medium & long term vs bearish short term.

Saw many people capitulating & low activity.

Price dip is now showing some signs of maturation. Still too soon to predict next move direction.

We're sitting in opposing bullish medium & long term vs bearish short term.

Saw many people capitulating & low activity.

#Bitcoin ($CRYPTO) Stages 2015 - 2019: November update:

The month has been wild! We're almost at the same level than the last update but with 2 new things to look for:

- The upside (+40% in 24H) has been stopped under S3 short term. Weakness.

- We made a new low. S2 seems far.

The month has been wild! We're almost at the same level than the last update but with 2 new things to look for:

- The upside (+40% in 24H) has been stopped under S3 short term. Weakness.

- We made a new low. S2 seems far.

#Bitcoin ($CRYPTO) Stages 2015 - 2020: February update.

Market is always tricky when things become obvious it seldom becomes easy money.

In Dec/Jan, we made a lower rectangle consolidation and didn't went lower. We broke upward continuing a slashed S2.

Now @ Pivot level. HH?

Market is always tricky when things become obvious it seldom becomes easy money.

In Dec/Jan, we made a lower rectangle consolidation and didn't went lower. We broke upward continuing a slashed S2.

Now @ Pivot level. HH?

#Bitcoin ($CRYPTO) Stages 2015 - 2020: March update

And so it didn't: Pivot level pointed last tweet hasn't been crossed. No Higher High (HH) + Virus.

Drop's been so huge, I can't imagine a long consolidation (at least) from here

Feel bad for the "ultimate hedge" sellers (lol)

And so it didn't: Pivot level pointed last tweet hasn't been crossed. No Higher High (HH) + Virus.

Drop's been so huge, I can't imagine a long consolidation (at least) from here

Feel bad for the "ultimate hedge" sellers (lol)

#Bitcoin ($CRYPTO) Stages 2015 - 2020: March update (2/2)

Looking at the RSI, we missed the opp. this february to pile another green box.

I think we're due for a new cycle below 55 (dashed line) = nothing to see until we go over. Bad news, can be LONG! (1y+)

Would you survive?

Looking at the RSI, we missed the opp. this february to pile another green box.

I think we're due for a new cycle below 55 (dashed line) = nothing to see until we go over. Bad news, can be LONG! (1y+)

Would you survive?

13/ On the left: a conceptual representation of stages in Weinstein's (1988) book.

On the right: a today technological stock

#stages

On the right: a today technological stock

#stages

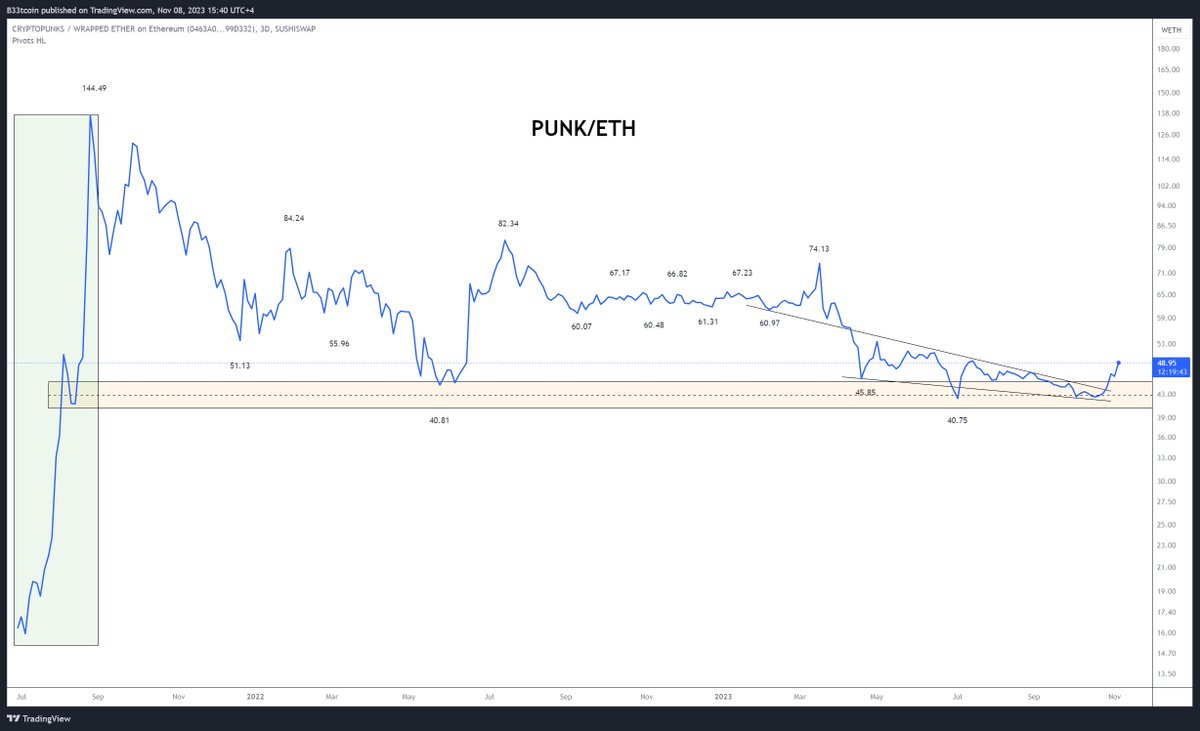

14/ On the left: a conceptual representation of stages in Weinstein's book (1988).

On the right: one of the most sophisticated cryptocurrency (in DeFi).

So what's most important ? Guessing *Value* of things or How *Price* behave ?

On the right: one of the most sophisticated cryptocurrency (in DeFi).

So what's most important ? Guessing *Value* of things or How *Price* behave ?

• • •

Missing some Tweet in this thread? You can try to

force a refresh