1/n Takeaways from the letters of Marathon Asset Management (UK based, > $50B AUM, value-driven)

Found these insights particularly valuable.

Found these insights particularly valuable.

High profitability

a) loosens capital discipline in an industry

b) often leads to overconfidence among CEOs

Investors & CEOs end up making highly error-prone /demand/ projections

2/n

a) loosens capital discipline in an industry

b) often leads to overconfidence among CEOs

Investors & CEOs end up making highly error-prone /demand/ projections

2/n

The Capital cycle turns Down as excess capacity becomes apparent & past demand forecasts are shown to have been overly optimistic.

➡️ Reduction in Investment & Contraction in industry supply paves the way for a return of profits.

3/n

➡️ Reduction in Investment & Contraction in industry supply paves the way for a return of profits.

3/n

A Key insight of the Capital cycle investment approach : Asset growth matters.

When analyzing prospects of value/growth stocks, imp to consider Asset Growth, at both Company & Sector level.

Avoid investing in industries where Assets are increasing rapidly.

4/n

When analyzing prospects of value/growth stocks, imp to consider Asset Growth, at both Company & Sector level.

Avoid investing in industries where Assets are increasing rapidly.

4/n

On Overconfidence & Competition Neglect -

Over-investment is Not a solitary activity; It comes about because Several players in an industry have been Increasing capacity at the Same time (not good)

5/n

Over-investment is Not a solitary activity; It comes about because Several players in an industry have been Increasing capacity at the Same time (not good)

5/n

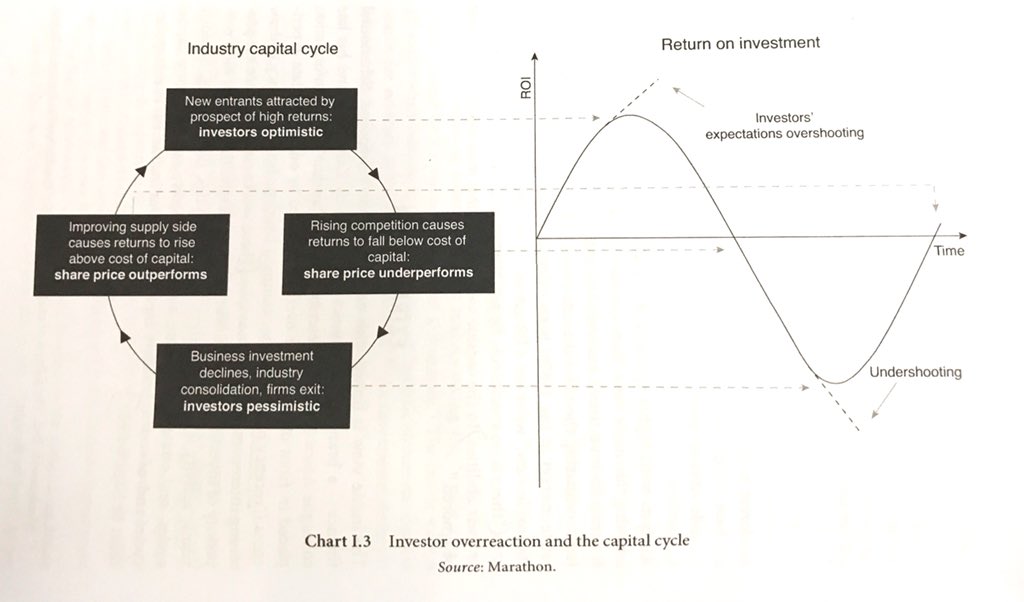

Investor Reaction & the Industry Capital cycle - a visual representation that says a lot about cycles - and what we should (always) be on the lookout for.

6/n

6/n

On the dangers of Extrapolation, the tendency to Keep making Linear forecasts despite All economic activity being essentially Cyclical.

7/n

7/n

Focus on the Supply side

1. Supply prospects are Far less uncertain than Demand, and are relatively easier to forecast.

2. Increases in an industry's aggregate supply are often well flagged.

8/n - from Marathon Asset Mgmt

1. Supply prospects are Far less uncertain than Demand, and are relatively easier to forecast.

2. Increases in an industry's aggregate supply are often well flagged.

8/n - from Marathon Asset Mgmt

How Marathon looks to invest in the two phases of an industry's capital cycle; growth vs value

10/n - from their book, "Capital Returns"

10/n - from their book, "Capital Returns"

Primary driver of healthy corporate profitability is a favorable Supply side - Not high rates of demand growth;

In fact, strong growth in demand is often the direct cause of value destruction.

11/n - from Marathon Asset Mgmt

In fact, strong growth in demand is often the direct cause of value destruction.

11/n - from Marathon Asset Mgmt

Consider investing in sectors where capital was being withdrawn ; both profits and valuations should rise after capital has exited a sector.

12/n - from Marathon Asset Mgmt

12/n - from Marathon Asset Mgmt

Warning on the post-2009 Central Bank policies for equity holders. Systemic risks have risen, no true price discovery etc..

13/n - from Marathon Asset Mgmt (probably written early 2016)

13/n - from Marathon Asset Mgmt (probably written early 2016)

On Pricing power - stemming from either

1) a concentrated marker structure OR

2) something intrinsic to the product or service itself

14/n - from Marathon asset management

1) a concentrated marker structure OR

2) something intrinsic to the product or service itself

14/n - from Marathon asset management

• • •

Missing some Tweet in this thread? You can try to

force a refresh