How to get URL link on X (Twitter) App

https://twitter.com/dberenzon/status/1749962249182027784

2) I guess the story started off with @richardchen39 @hosseeb @ttunguz etc. driving the airdrop model seems to be broken narrative using UNI airdrop as the case study, good analysis by @jphackworth42 tho, love the work. However, the angles are completely wrong in connecting the analysis to conclusion.

2) I guess the story started off with @richardchen39 @hosseeb @ttunguz etc. driving the airdrop model seems to be broken narrative using UNI airdrop as the case study, good analysis by @jphackworth42 tho, love the work. However, the angles are completely wrong in connecting the analysis to conclusion.

2) A bunch of common buyers bought the NFTs at around the 4-5 ETH range when @gabrielleydon announced an airdrop for @DigiDaigaku holders.

2) A bunch of common buyers bought the NFTs at around the 4-5 ETH range when @gabrielleydon announced an airdrop for @DigiDaigaku holders. https://twitter.com/gabrielleydon/status/1562812713054896128?s=20&t=TZGGgg-jci831j8PQD-SEQ

https://twitter.com/alexgedevani/status/1549728443901923328

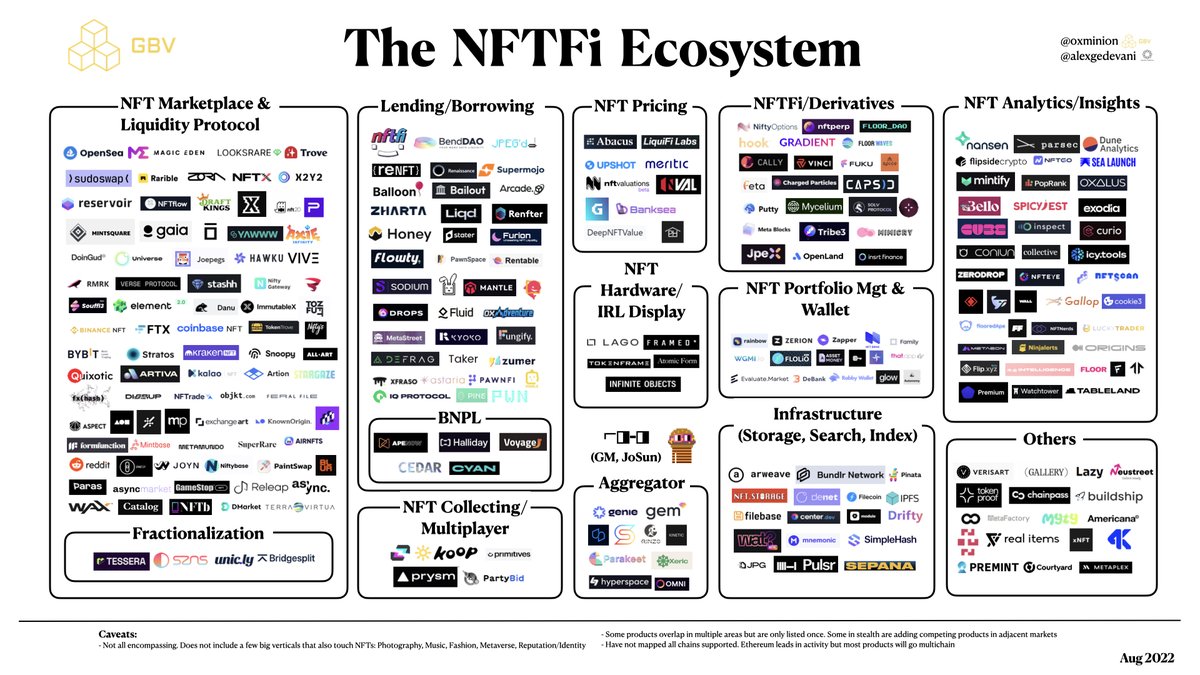

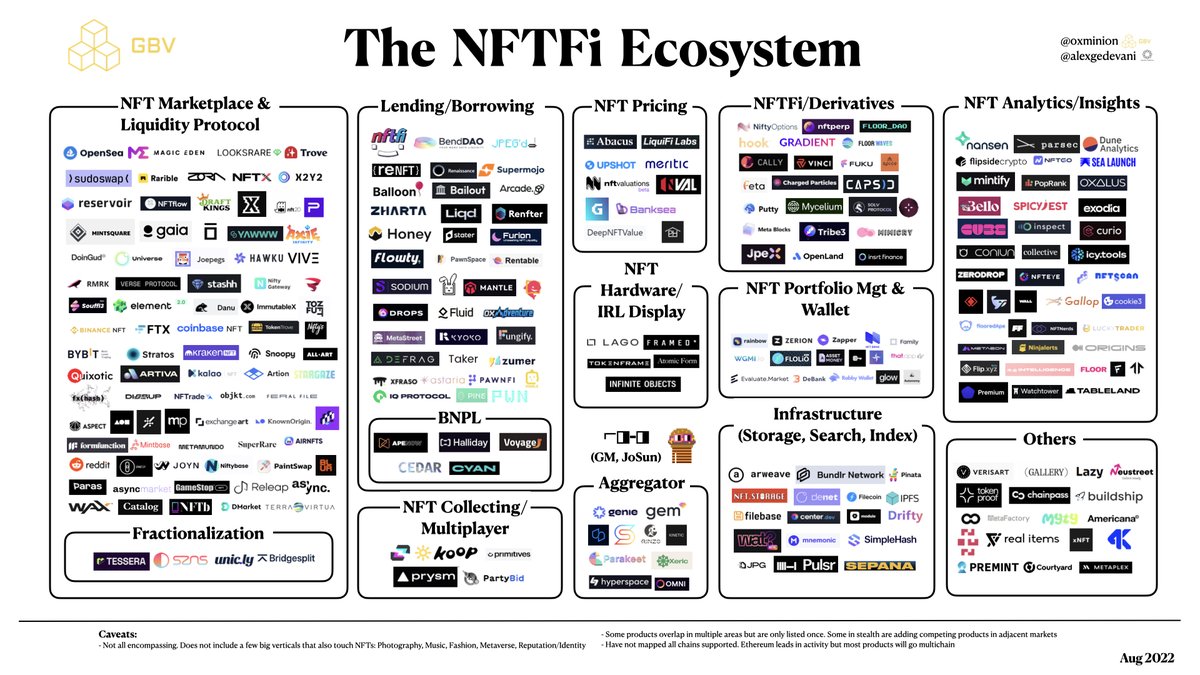

2) First of all, some numbers. Within the sample size, the #NFT marketplace & liquidity protocol accounts for 26% of the pool (incl. fractionalization). Seconded by NFT Analytics & Insights ~ 14.5%, followed by NFT lending/borrowing ~14% (incl. BNPL), NFTFi/derivatives ~ 7.1%.

2) First of all, some numbers. Within the sample size, the #NFT marketplace & liquidity protocol accounts for 26% of the pool (incl. fractionalization). Seconded by NFT Analytics & Insights ~ 14.5%, followed by NFT lending/borrowing ~14% (incl. BNPL), NFTFi/derivatives ~ 7.1%.

https://twitter.com/cobie/status/1538666240696254471?s=20&t=K3CMxfDsJf5GycZz7OkbyQ

https://twitter.com/0xminion/status/13641993544630026242) Show me the Liquidity: Evaluating NFT Financialization Methods by @nichanank @1kxnetwork

https://twitter.com/ethglobal/status/1518234859323408384?s=21&t=VB2oiJKBDnGzJWg-gNUqkg

https://twitter.com/0xminion/status/1485532784169033735?s=21&t=FVd6aWzvKVMwHEmVV_XSZw2) The discussion started with @celiawan2 on why there is no on-chain derivatives protocol such as options protocol building on top of @Uniswap V3 structure since its range order payoffs are regular options like payoff with a bit of twist.

https://twitter.com/0xperp/status/14853574270546329612) It's a bias to say DeFi on-chain derivatives should be big based on the fact that equity markets options/futures volume trade at certain multiple to spot volume. Why? Bcs we have a very different user base on-chain! Equity market=mainly institutions, on-chain=individuals

https://twitter.com/0xminion/status/14606097409421025302) @DarleyGo_io The community choice award. It's the first mythical based NFT horse racing game utilizing NFTs on @solana The team is well experienced in the traditional horse racing industry.

2) #gm is a culture shift, bonding crypto people irl. We love to say gm irl now.

2) #gm is a culture shift, bonding crypto people irl. We love to say gm irl now.https://twitter.com/0xminion/status/1458979504777400321?s=20

https://twitter.com/ashwathbk/status/1417827146374864898?s=202) There are so many misunderstanding elements for primary& secondary investment/trading. Newbies are often jealous about how primary market participants getting 100x ROI with many of them still at their book value which is a useless metrics to chase.