Smallcase: https://t.co/rtMQMaLAe9 For detailed disclaimers, disclosures and other registration details: https://t.co/rJSLEC7PHF

17 subscribers

How to get URL link on X (Twitter) App

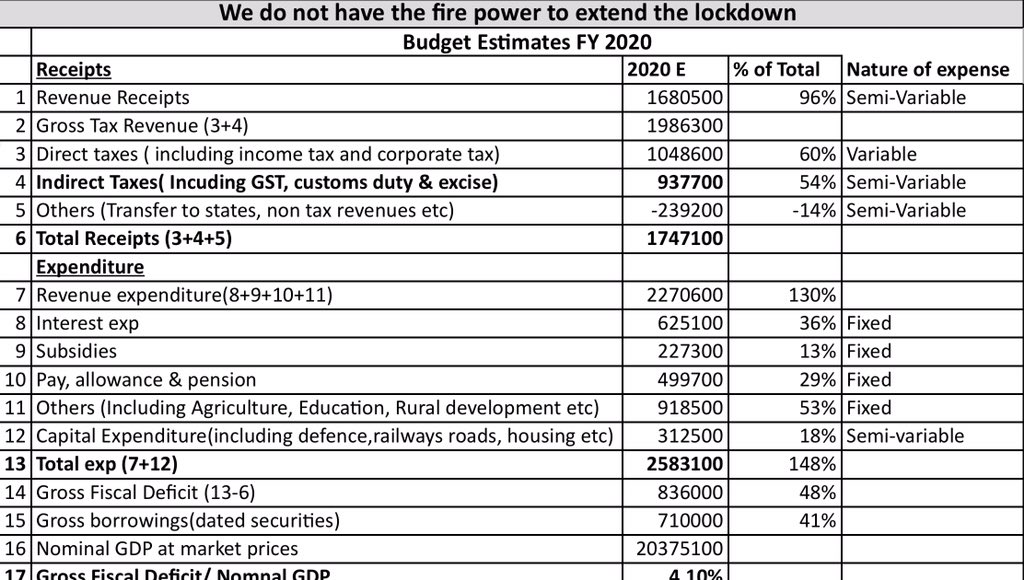

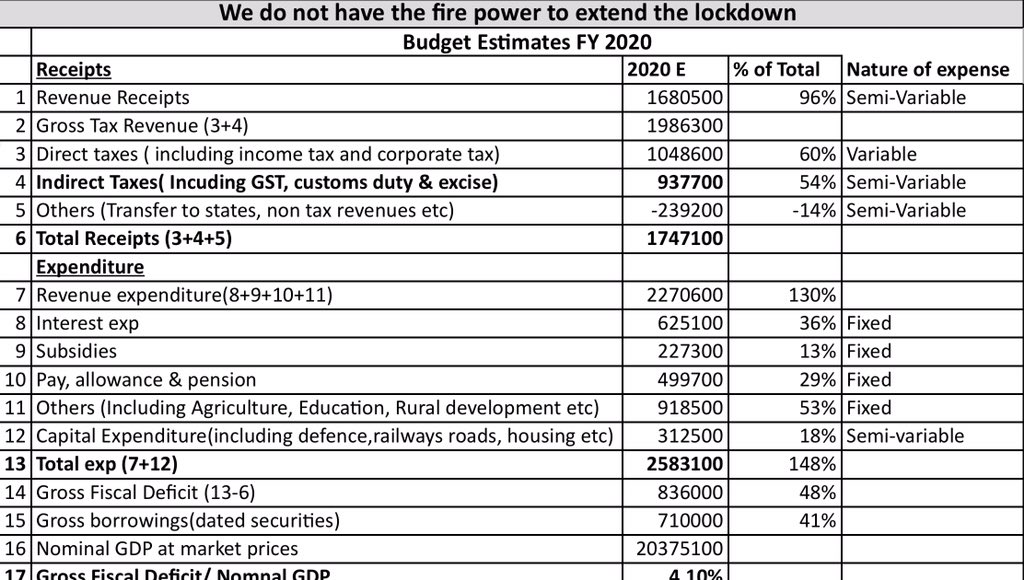

A severely undesirable and predictable outcome is a steep drop in tax collections and an increase in welfare expenditure. Quite possible but equally detrimental.

A severely undesirable and predictable outcome is a steep drop in tax collections and an increase in welfare expenditure. Quite possible but equally detrimental. https://twitter.com/nigel__dsouza/status/12455792080566476823) Someone who’s lost 40% will be happy because someone else is down 41%. Someone who couldn’t anything will be pleased just because his neighbour is down 40% on. 50x. That’s still 30x from the bottom. The public finds great satisfaction in seeing everyone else lose.

https://twitter.com/gouse7558/status/1213658366225960960The first 10 lakhs needs a lot of self control. You have to stop spending to reach here. The next 15 lakhs needs skill. You have to grow what you’ve saved. From 25 lakh to 50 lakhs it’s self control. You have to stop thinking of buying a home, car, Holiday, TV etc.

https://twitter.com/aceaps/status/1188322992725446657Strangely, the public jumps in when valuations start to becomes cheap and that’s the time the professionals log out ! Ask yourself, how many bought Infosys, Wipro, HUL, L&T, Unitech, BHEL, Bharti, Pantaloon, Page, Gruh, Sun Pharma, Eicher when they were expensive?

https://twitter.com/rishibagree/status/11676729908778352652) As we privatise we will get foreign capital on negative interest rates. Why wouldn’t anyone raising capital at negative rates buy out a stable NHPC, Coal India? By running inefficient PSUs the Govt has already privatised the sector so why not the companies?