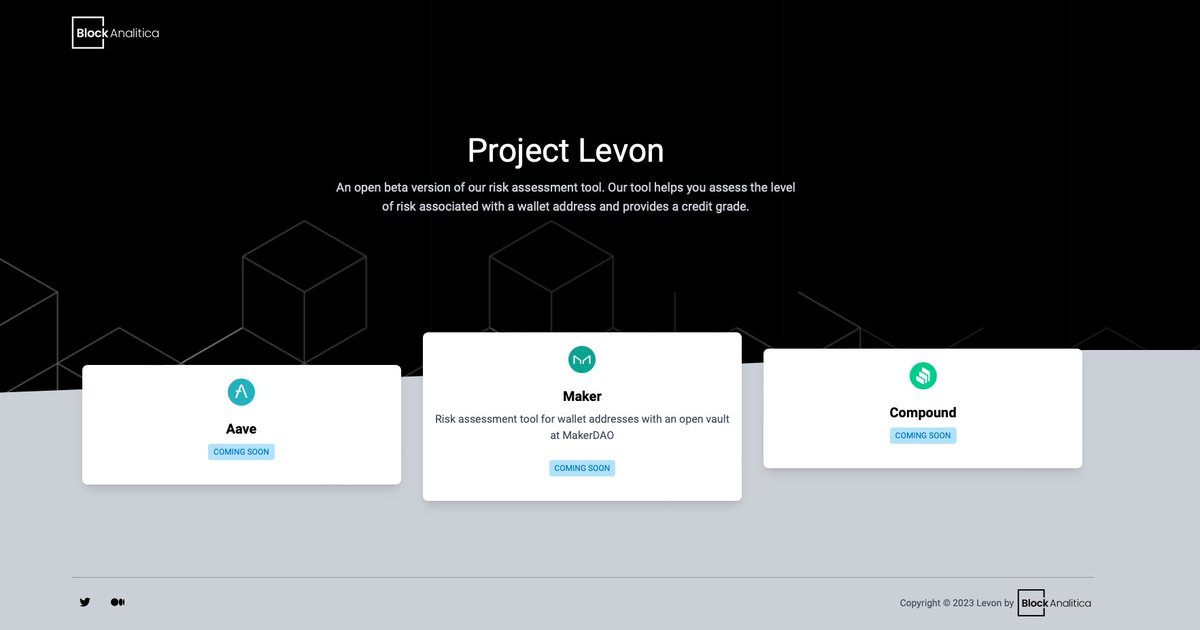

The risk team behind the USDS (DAI) stablecoin.

DeFi risk curation and management services since 2019.

How to get URL link on X (Twitter) App

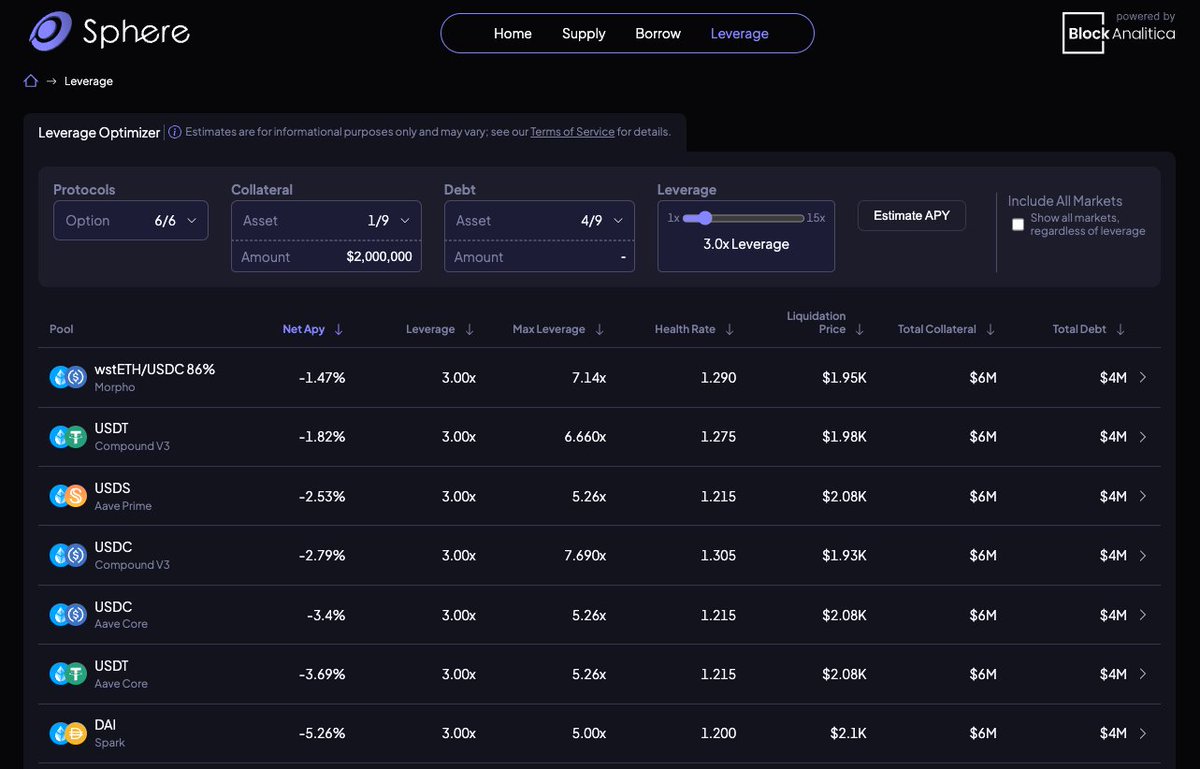

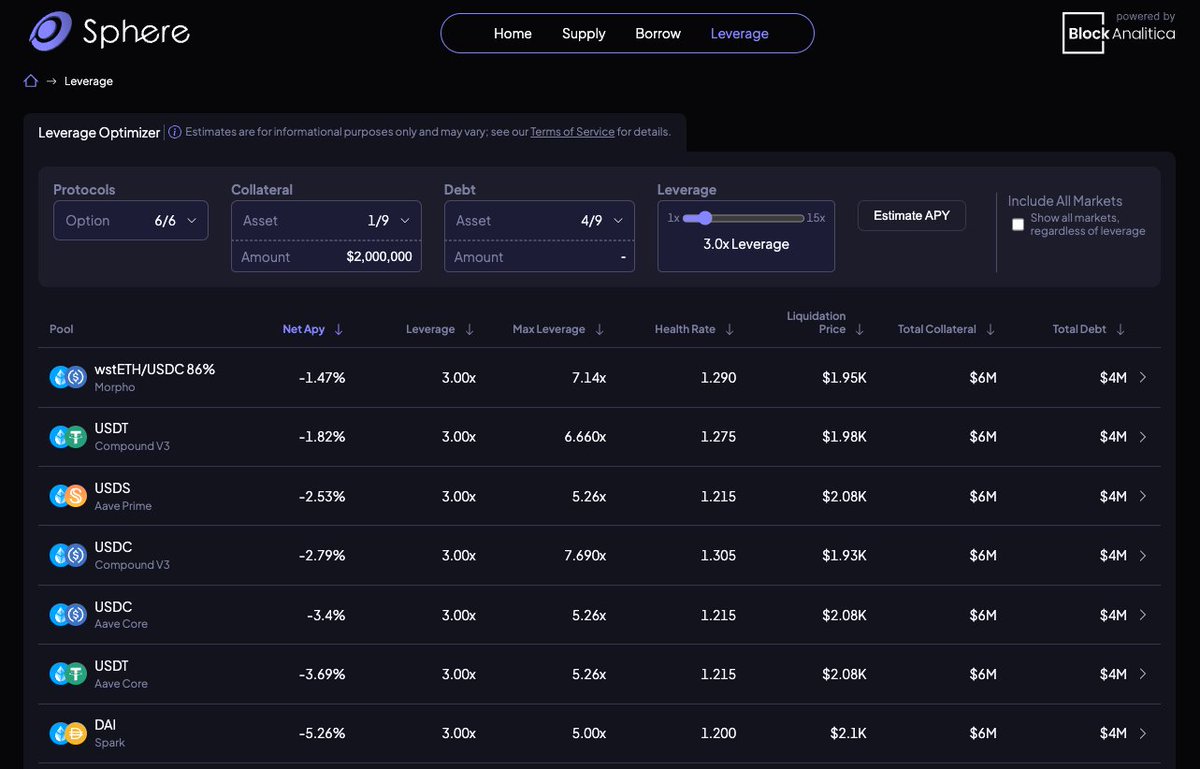

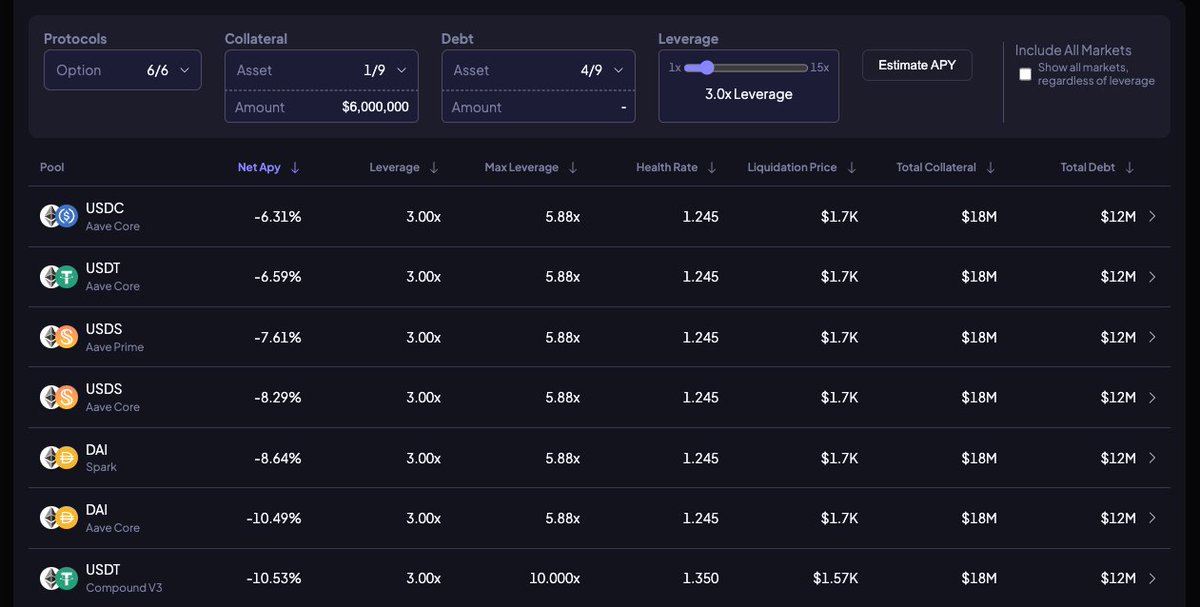

Find the lowest Net APY for a desired pair and *leverage*.

Find the lowest Net APY for a desired pair and *leverage*.

https://twitter.com/ajnafi/status/17802221241431245792/10

https://twitter.com/ethbelgrade/status/16583928184052367362/8

2/7

2/7