How to get URL link on X (Twitter) App

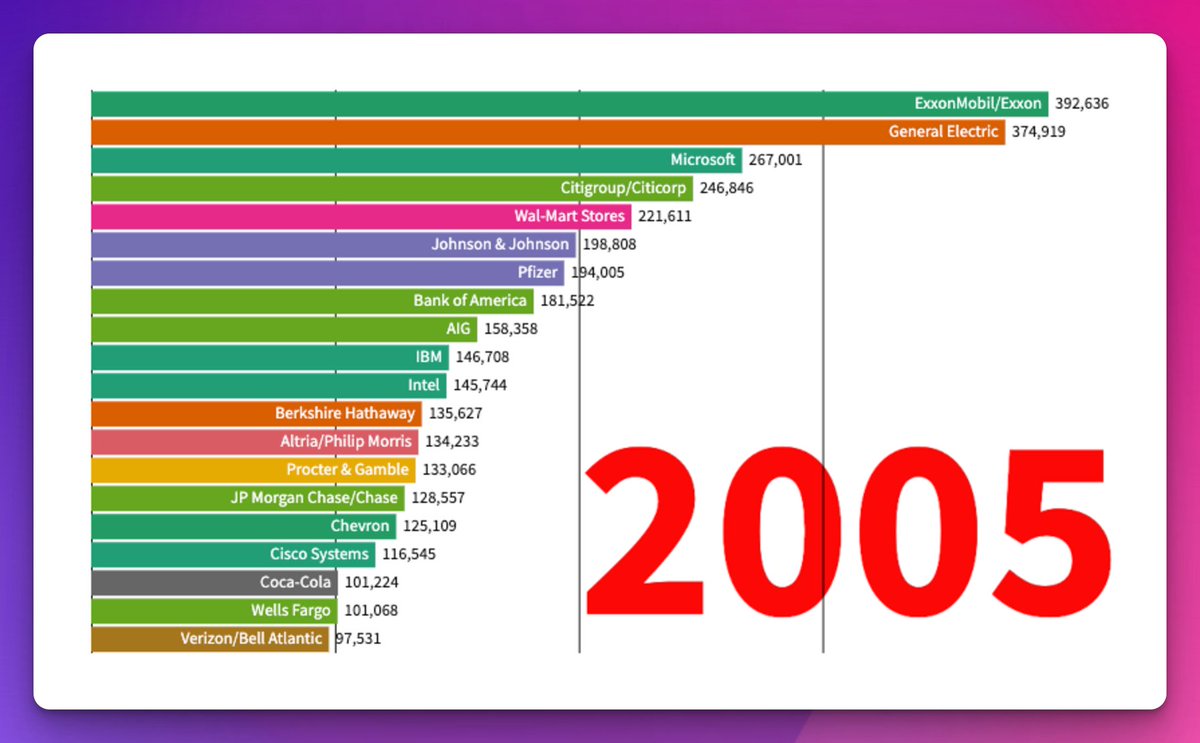

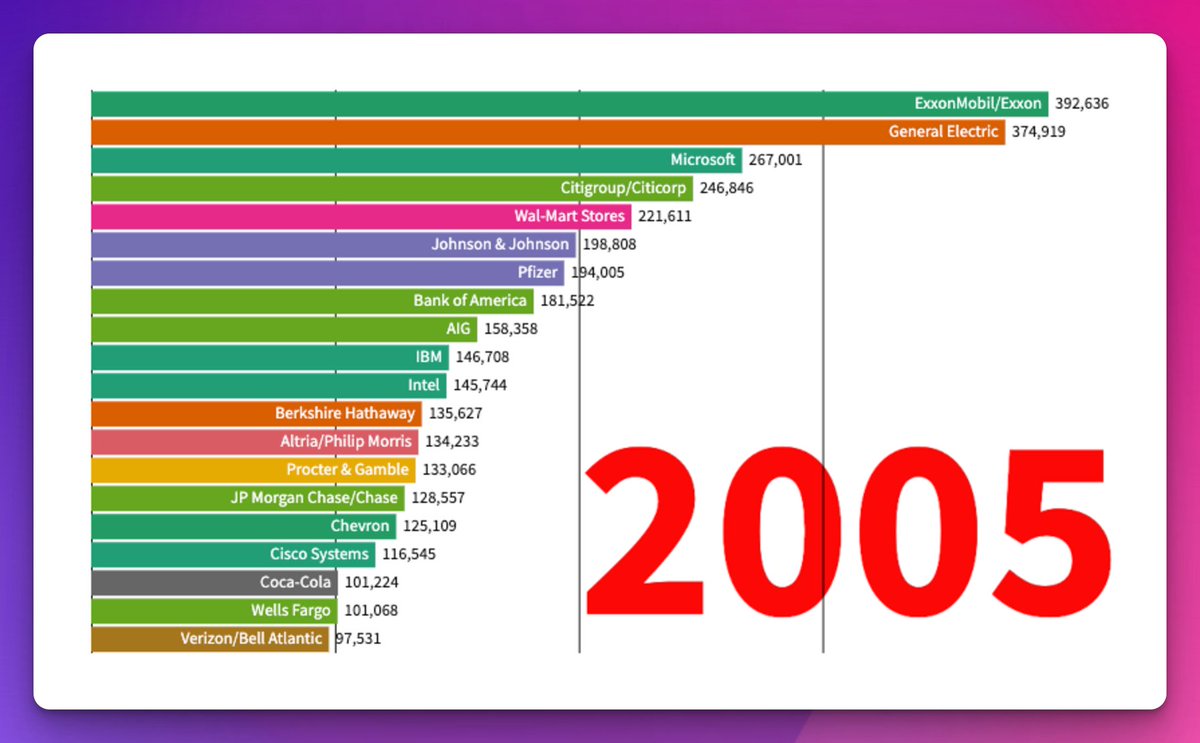

Here are the top 20 today. Small interesting note is the companies remain in both lists are Microsoft, Exxon, Walmart, Berkshire and JP Morgan.

Here are the top 20 today. Small interesting note is the companies remain in both lists are Microsoft, Exxon, Walmart, Berkshire and JP Morgan.

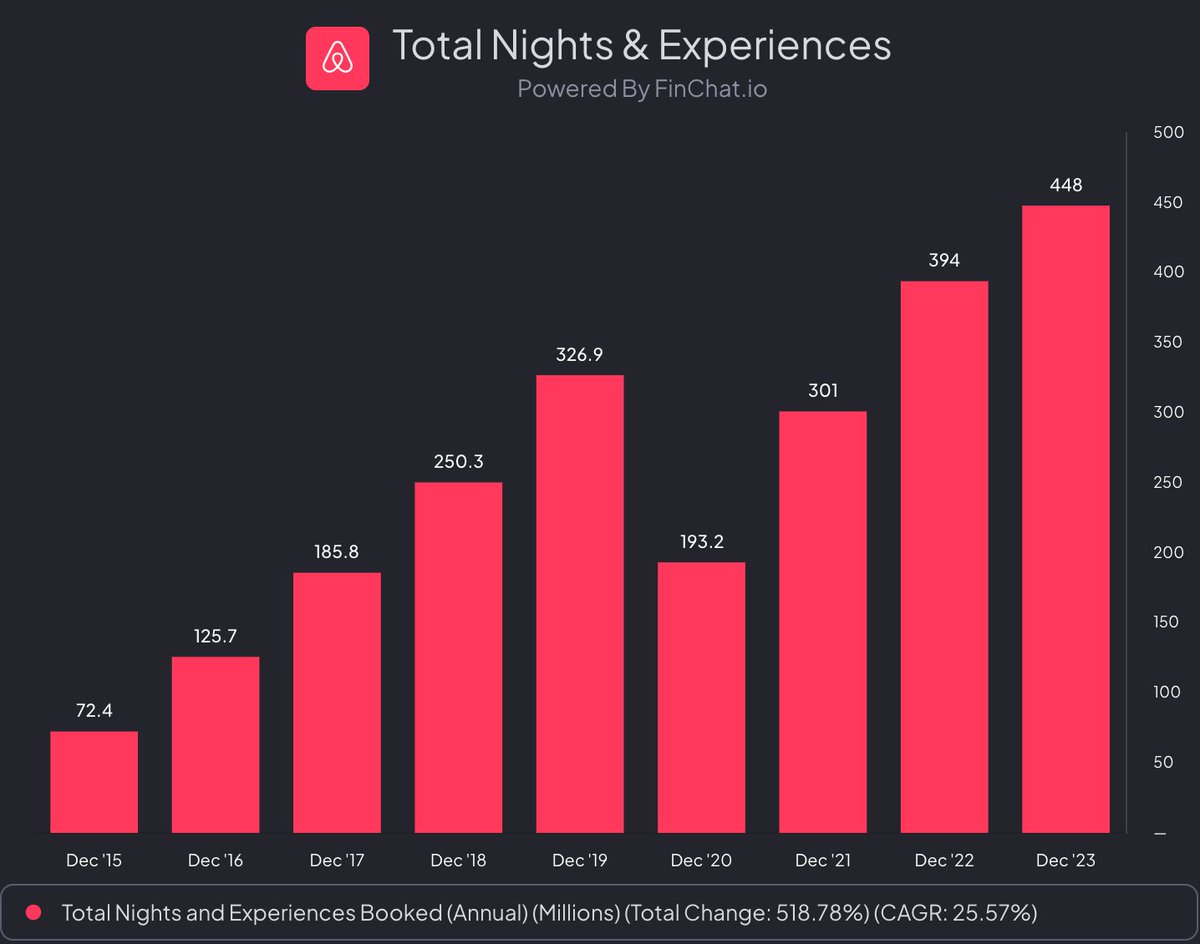

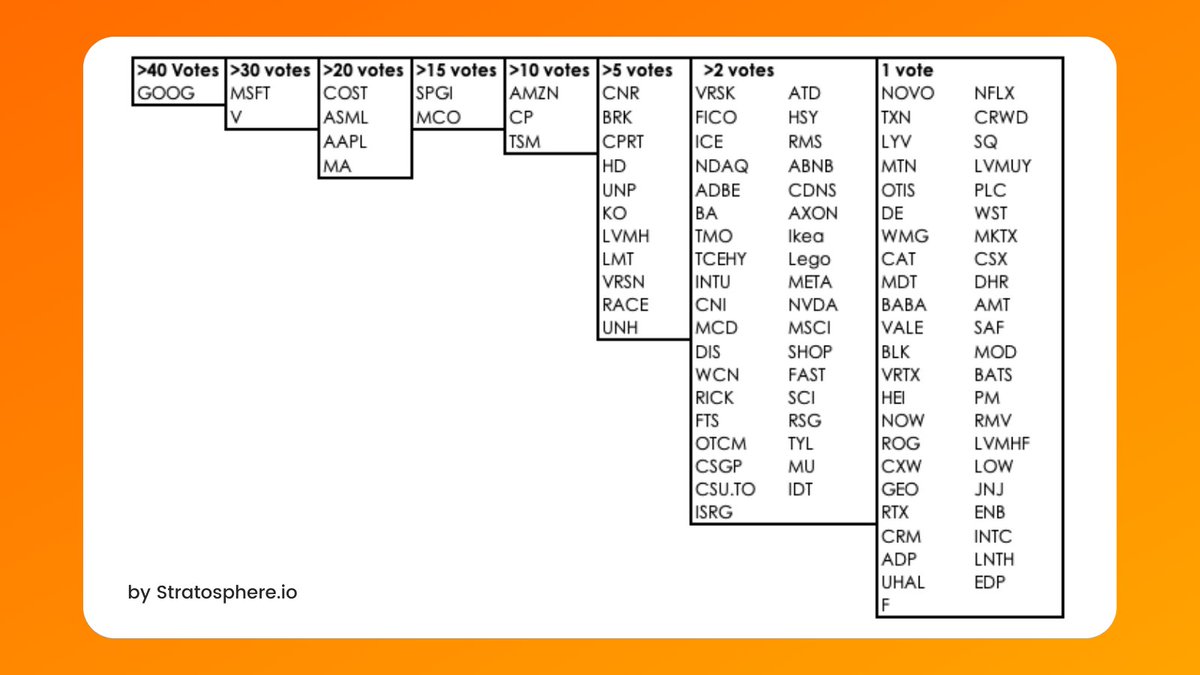

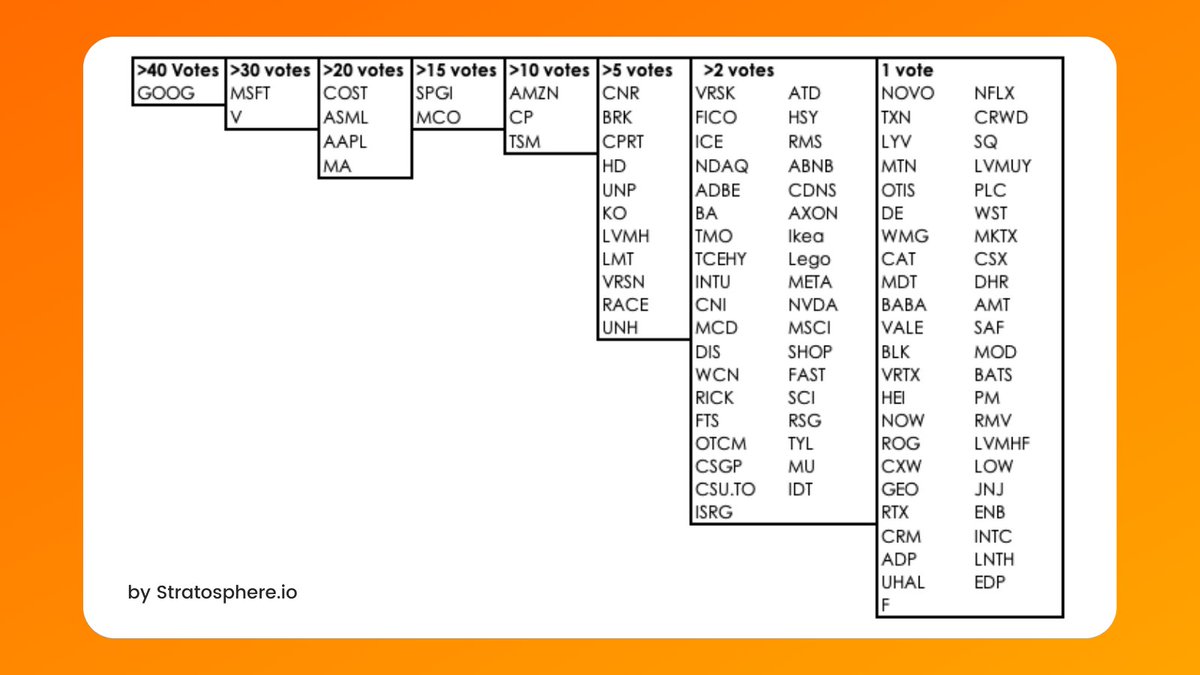

The businesses that received more than 10 votes.

The businesses that received more than 10 votes.

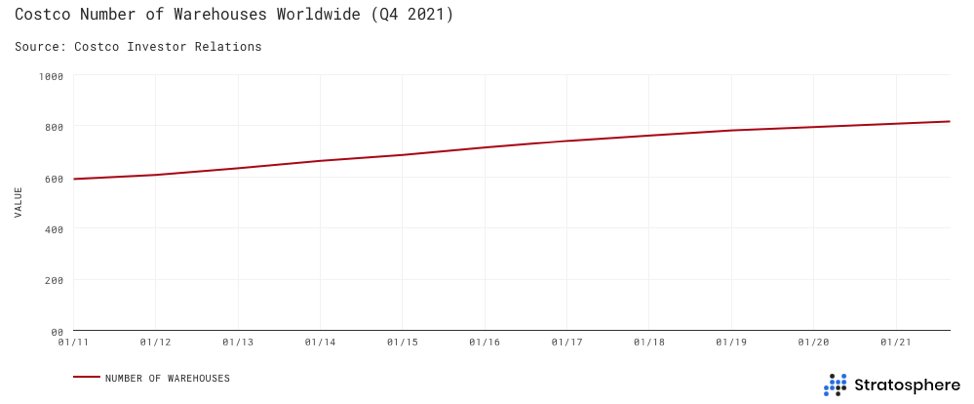

Today, Costco is just over 800 warehouses (stores) with over 80% of locations in North America.

Today, Costco is just over 800 warehouses (stores) with over 80% of locations in North America.