CA, MBA | 14 years into Practise (& thriving) |Sharing insights on GST & IT |Music addict | Movie buff | Sports Enthusiast | Just released new book- ITRR 4th Ed

3 subscribers

How to get URL link on X (Twitter) App

I still can't digest what this one tweet has achieved. It still making me smile . Last 5 days were just SO AWSOME. The unprecedented response and love it has got , is like dream . Infact, Beyond dream. I had no idea that it would become popular

I still can't digest what this one tweet has achieved. It still making me smile . Last 5 days were just SO AWSOME. The unprecedented response and love it has got , is like dream . Infact, Beyond dream. I had no idea that it would become popular

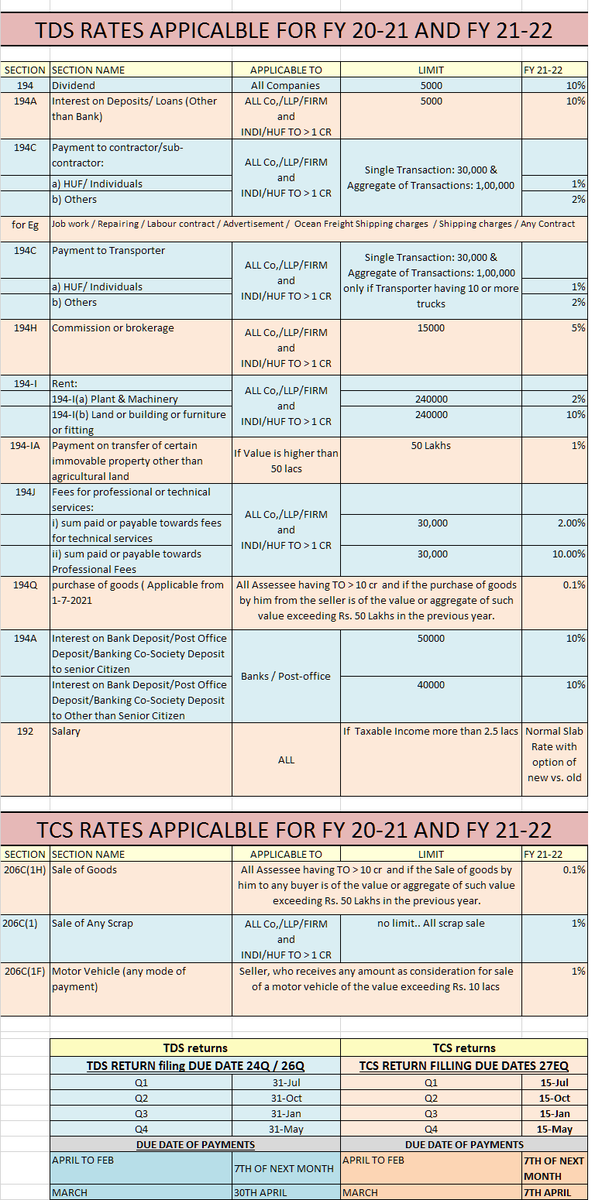

I have been writing & updating this for so long.

I have been writing & updating this for so long.