How to get URL link on X (Twitter) App

I first shared this setup in May, suggesting the possibility that we do nothing for a few months, form this new base and then the fireworks go off.

I first shared this setup in May, suggesting the possibility that we do nothing for a few months, form this new base and then the fireworks go off.https://x.com/CalebFranzen/status/1922752424311234981

Being a bit reflective here, but I've been super "jumpy" in my trades since I started re-engaging with crypto trades in early/mid-January.

Being a bit reflective here, but I've been super "jumpy" in my trades since I started re-engaging with crypto trades in early/mid-January.

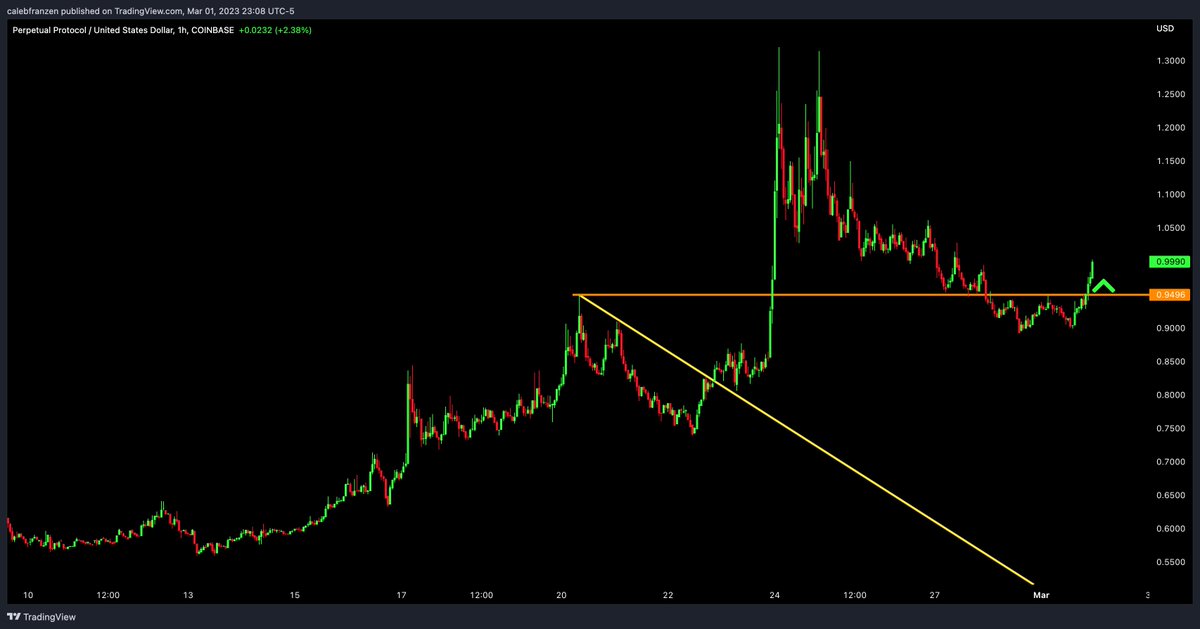

Here is the first post where I highlighted the bullish divergence:

Here is the first post where I highlighted the bullish divergence:https://twitter.com/CalebFranzen/status/1591132498402357248?s=20

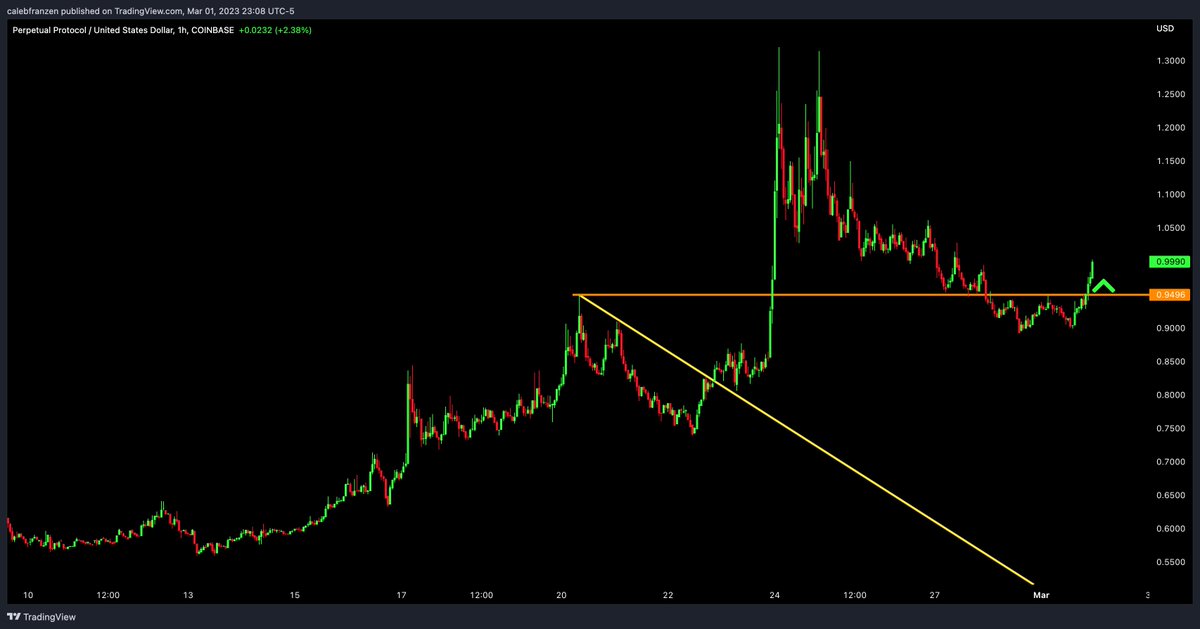

Calling shots & outlining scenarios before they even happen.

Calling shots & outlining scenarios before they even happen.https://twitter.com/CalebFranzen/status/1625535417645776896?s=20

Linear regressions are a common statistical tool, used in econometrics & finance.

Linear regressions are a common statistical tool, used in econometrics & finance.

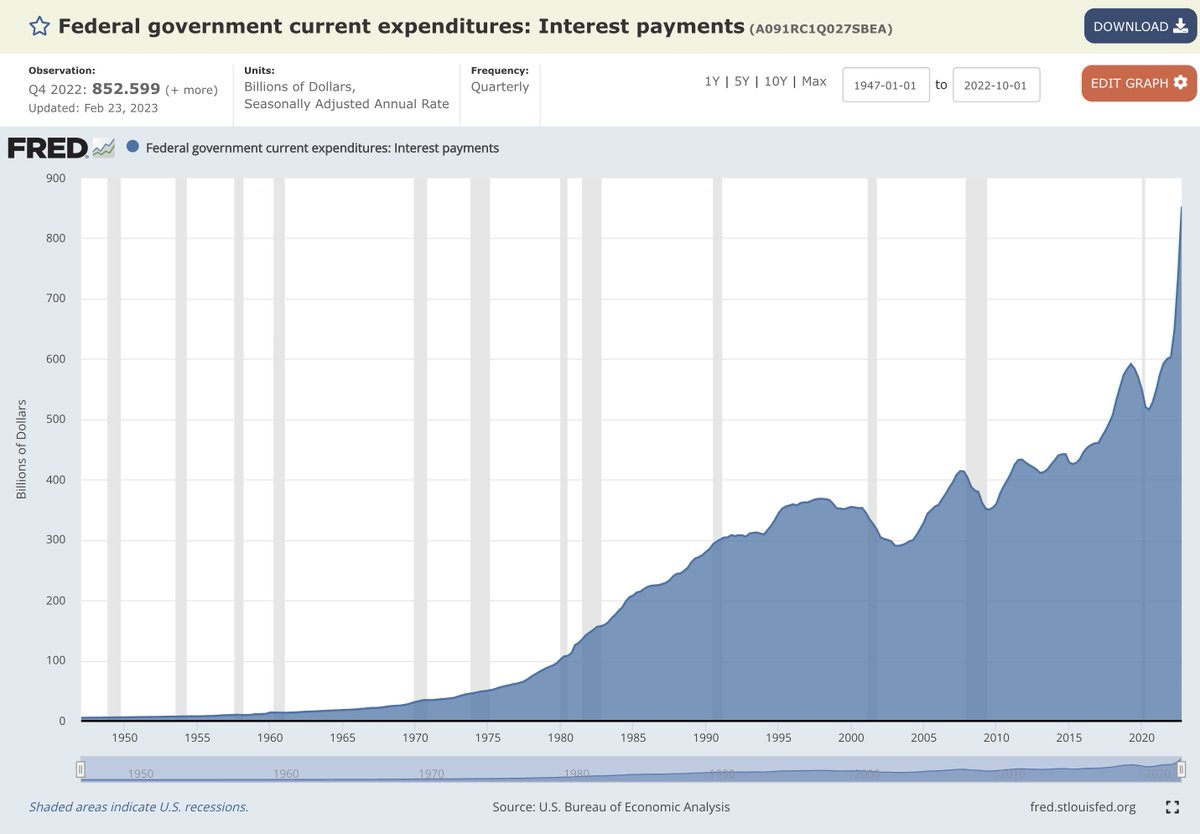

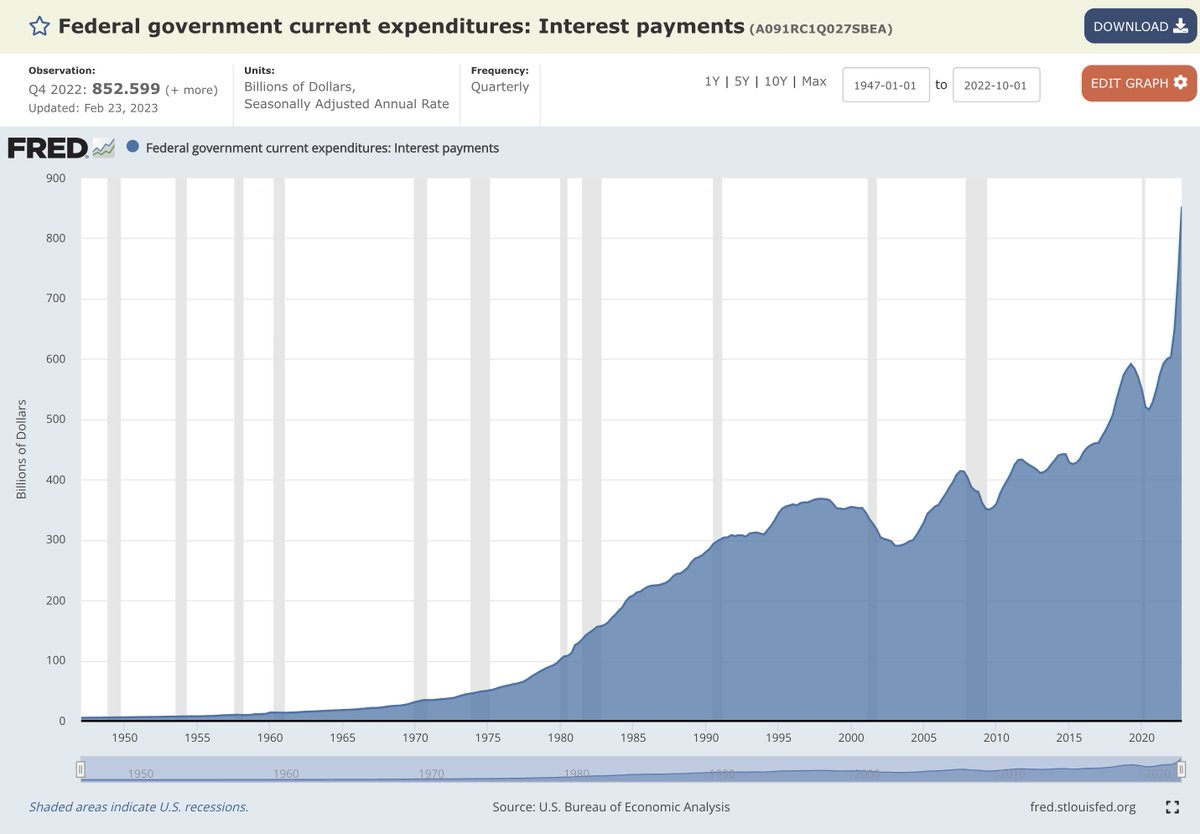

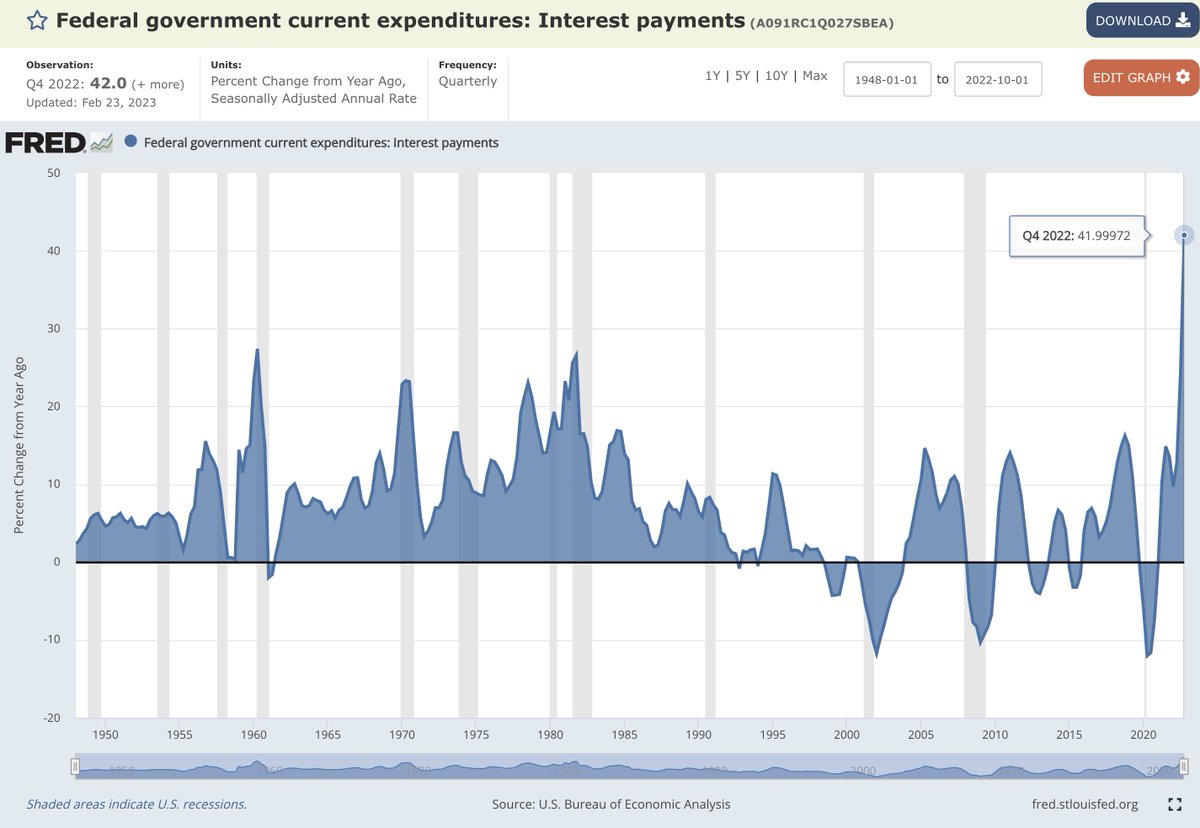

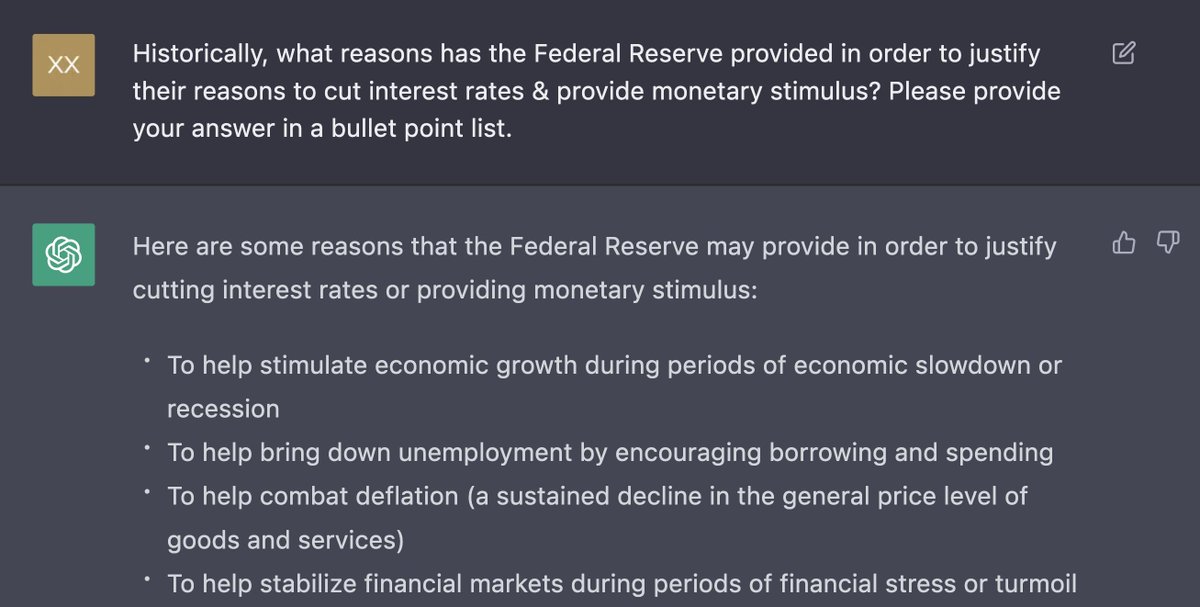

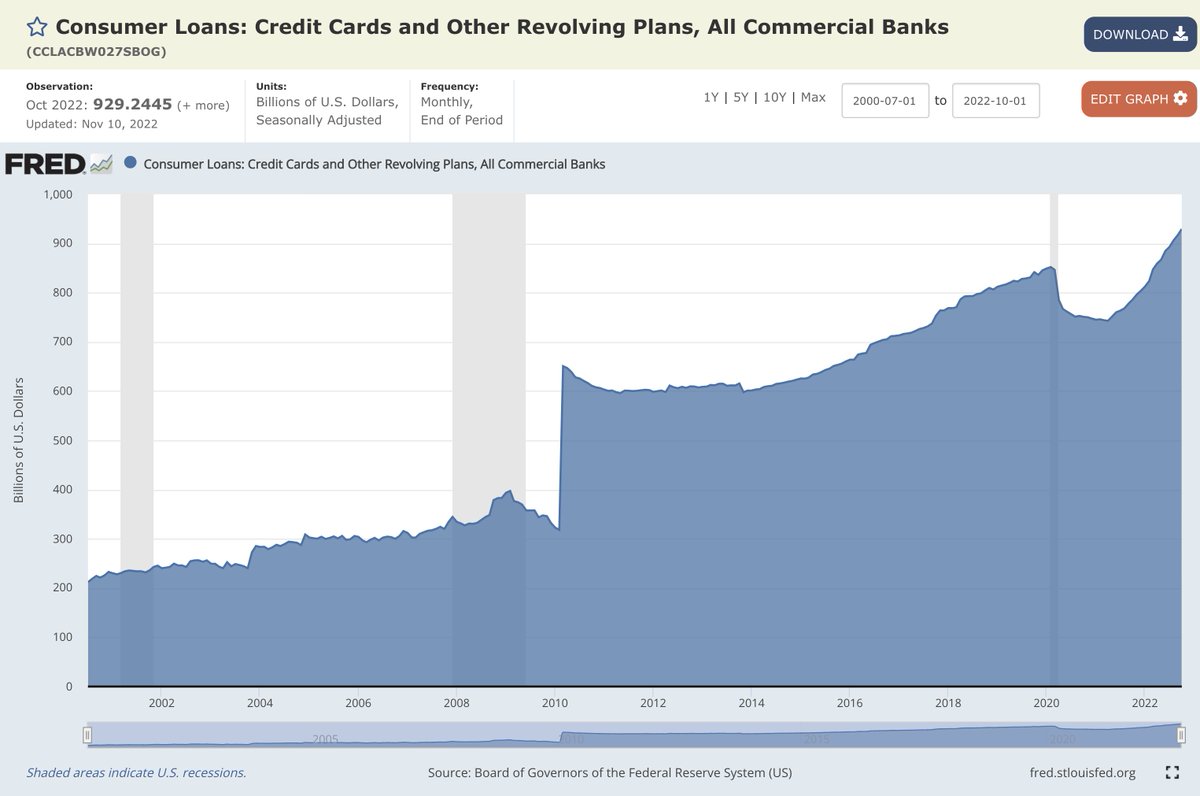

Instead of looking at the nominal value, look at the YoY rate of change! We've never seen interest expense accelerate this fast!

Instead of looking at the nominal value, look at the YoY rate of change! We've never seen interest expense accelerate this fast!

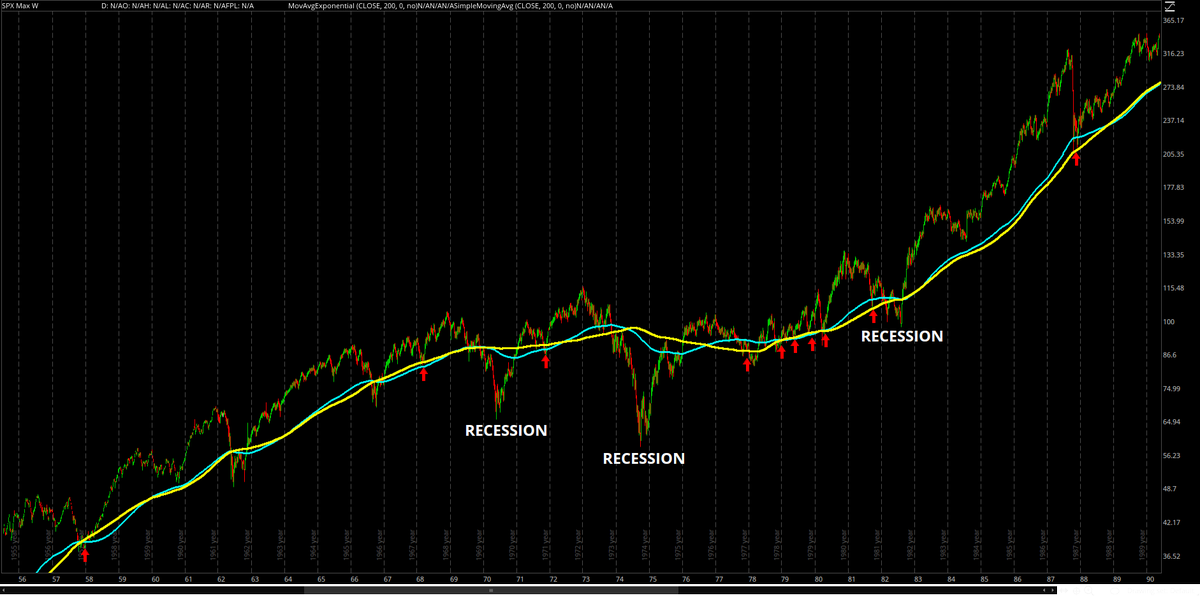

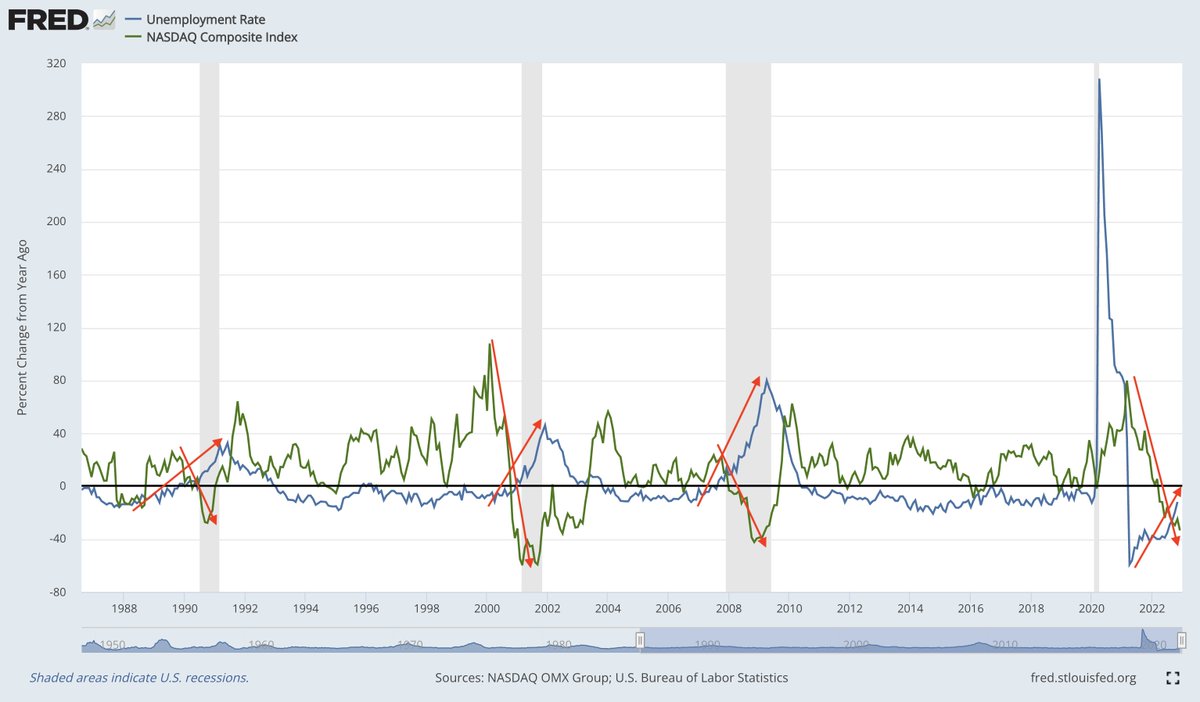

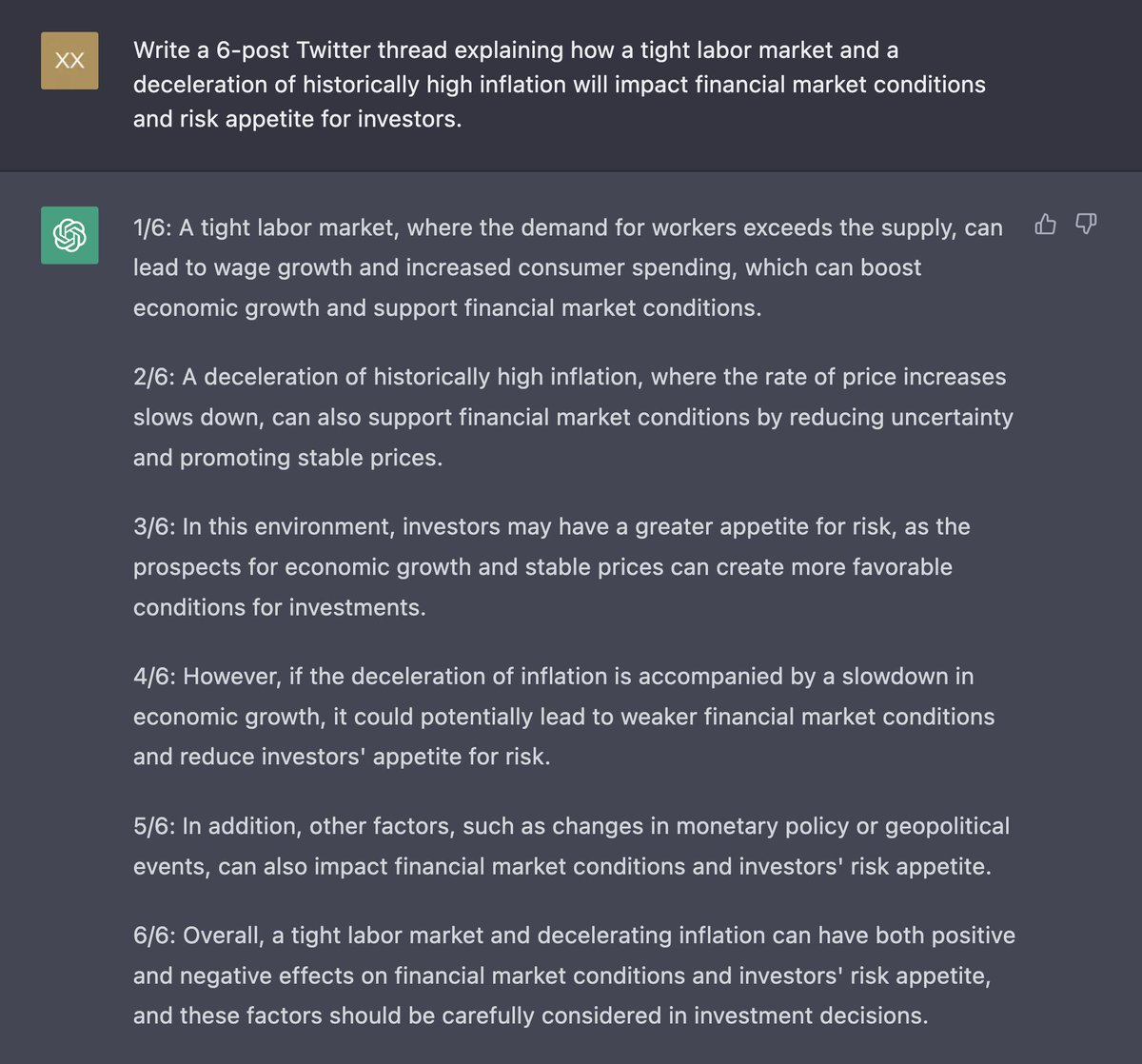

1. Economic growth was anemic in the first half of 2022, but appears to be coming back in terms of real GDP growth.

1. Economic growth was anemic in the first half of 2022, but appears to be coming back in terms of real GDP growth.

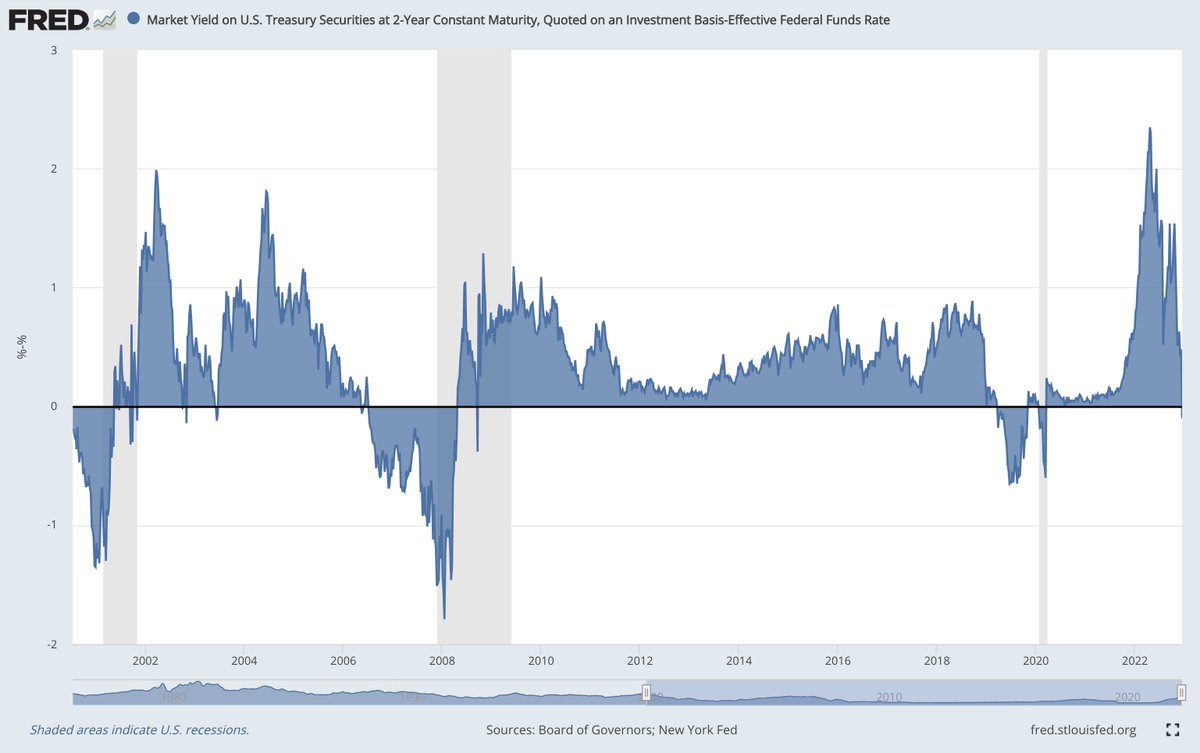

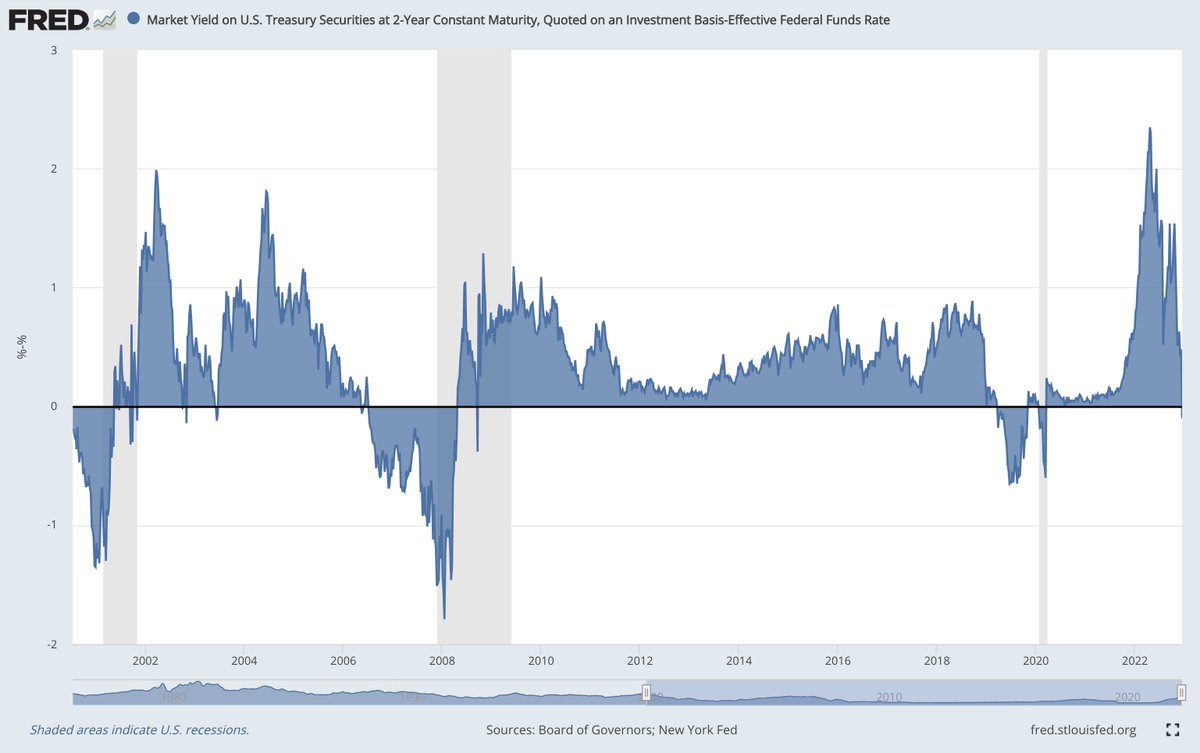

@JanWues @APompliano @fxmacroguy @f_wintersberger @Maverick_Equity @rhemrajani9 @JeffWeniger @VailshireCap @LynAldenContact @MacroAlf Conversely, the curve can invert further because of a rapidly declining 2Y Treasury yield.

@JanWues @APompliano @fxmacroguy @f_wintersberger @Maverick_Equity @rhemrajani9 @JeffWeniger @VailshireCap @LynAldenContact @MacroAlf Conversely, the curve can invert further because of a rapidly declining 2Y Treasury yield.

The market got misguided that the path of monetary policy was going to be +0.5% and then +0.25% or pause.

The market got misguided that the path of monetary policy was going to be +0.5% and then +0.25% or pause.

Meanwhile M2 growth is still expanding, but at a significantly slower rate than it was post-COVID.

Meanwhile M2 growth is still expanding, but at a significantly slower rate than it was post-COVID.

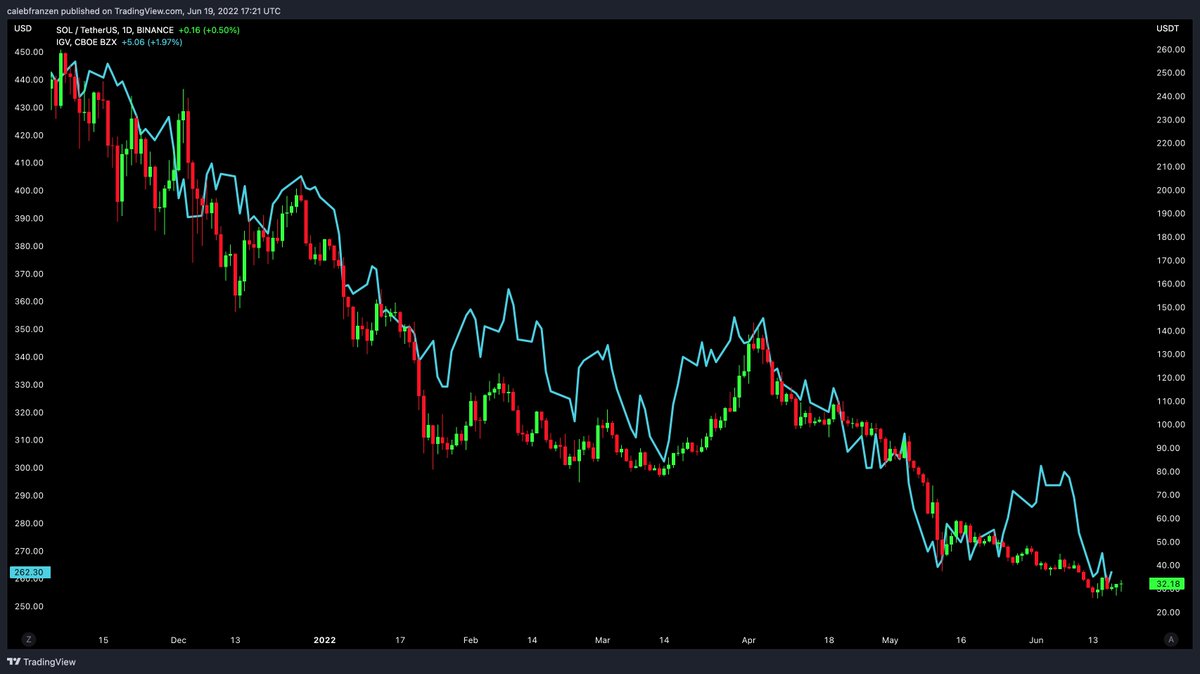

Let's analyze $SOL (candles) vs. $IGV (teal) since the peak in Nov.'21.

Let's analyze $SOL (candles) vs. $IGV (teal) since the peak in Nov.'21.