Representing charities on tax since 1982. CTG is dedicated to improving the tax position of charities and campaigns on the key issues affecting the sector!

How to get URL link on X (Twitter) App

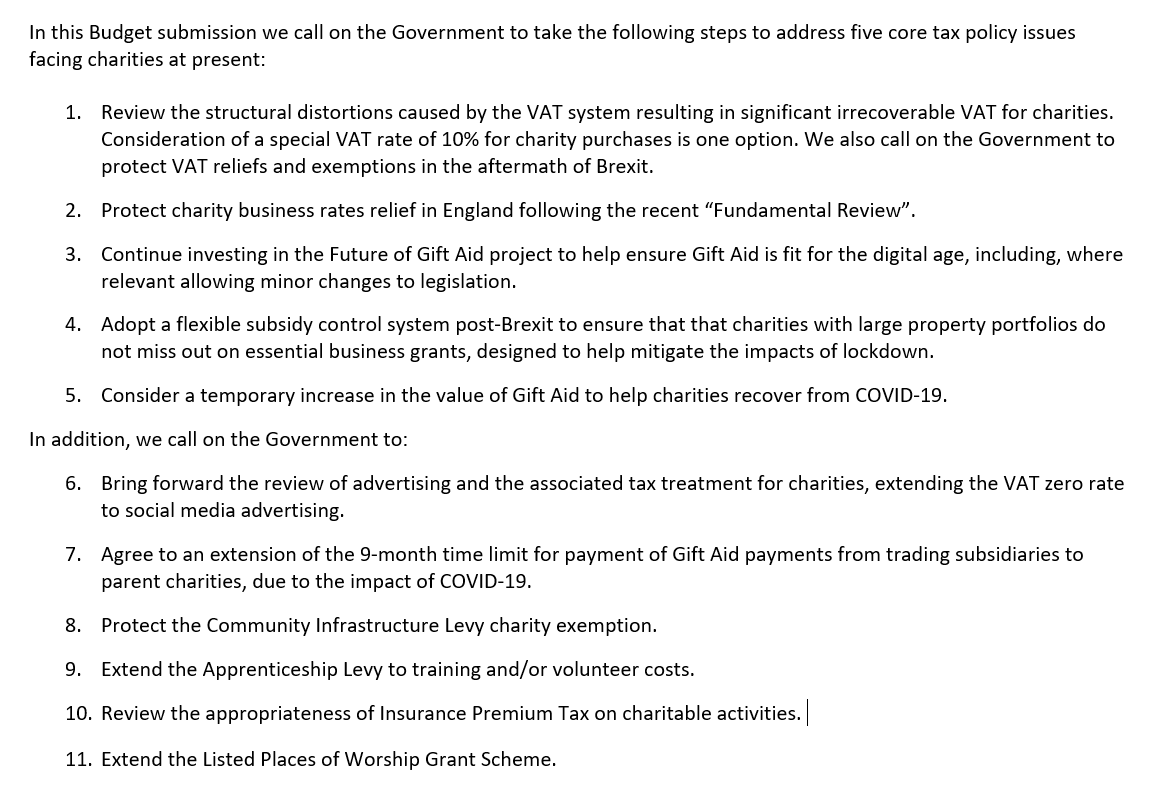

Existing charity tax reliefs should be protected & tax compliance and administration simplified. Protecting existing business rates & VAT reliefs is crucial as is future-proofing tax systems and legislation #charitytax #budget2021 2/

Existing charity tax reliefs should be protected & tax compliance and administration simplified. Protecting existing business rates & VAT reliefs is crucial as is future-proofing tax systems and legislation #charitytax #budget2021 2/

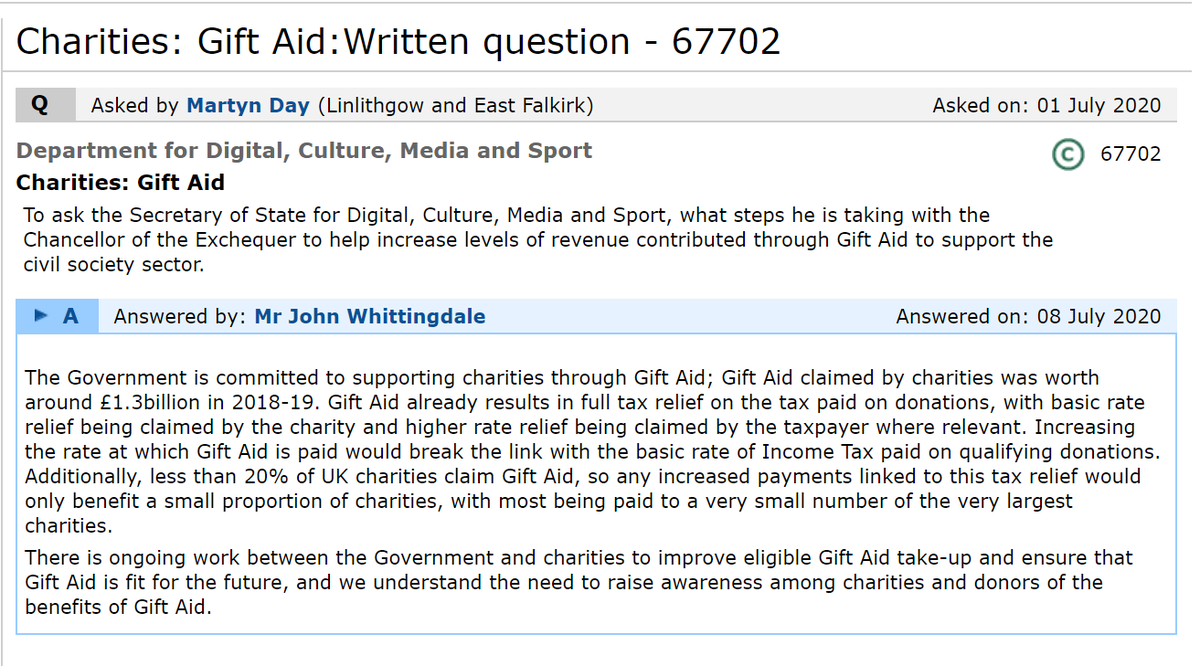

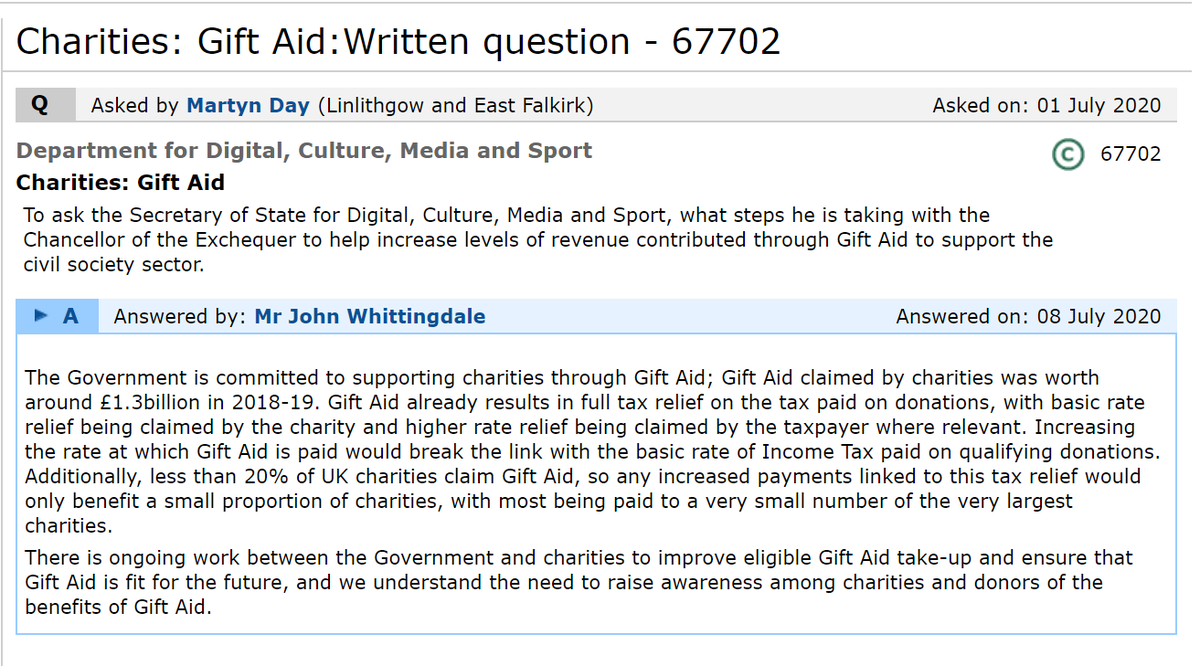

The Minister noted that <20% of charities would benefit from #GiftAidrelief. 73,050 charities claimed #GiftAid in 2018/19 approx 40% of UK charities representing a major part of the sector workforce & beneficiaries. The proposal has widespread support 2/ assets.publishing.service.gov.uk/government/upl…

The Minister noted that <20% of charities would benefit from #GiftAidrelief. 73,050 charities claimed #GiftAid in 2018/19 approx 40% of UK charities representing a major part of the sector workforce & beneficiaries. The proposal has widespread support 2/ assets.publishing.service.gov.uk/government/upl…