How to get URL link on X (Twitter) App

https://twitter.com/CryptoKaleo/status/1947667148186296368

The broader market has seen various 2020/2021 growth stocks that bottomed out with similar charts run it back to their highs over the course of the year so far.

The broader market has seen various 2020/2021 growth stocks that bottomed out with similar charts run it back to their highs over the course of the year so far.

FWIW - I’m going into this with the full expectation these could end up being worth zero.

FWIW - I’m going into this with the full expectation these could end up being worth zero.

$DOGE is at nearly the exact same USD price it was when it started to giga-send in the Spring of 2021, price action before the breakout looks eerily similar too.

$DOGE is at nearly the exact same USD price it was when it started to giga-send in the Spring of 2021, price action before the breakout looks eerily similar too.

https://twitter.com/CryptoKaleo/status/1631028996463816704

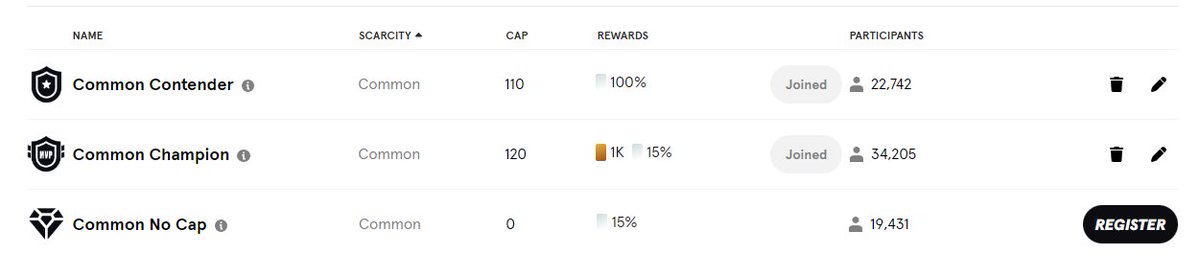

And yes you can trade Bitcoin, shitcoins, whatever your heart desires

And yes you can trade Bitcoin, shitcoins, whatever your heart desires

https://twitter.com/BtbJesse/status/1620238238194728960

Another short story

Another short storyhttps://twitter.com/BtbJesse/status/1566273467506376704?s=20&t=0sddufOdS8cdXwMF_2WhZw

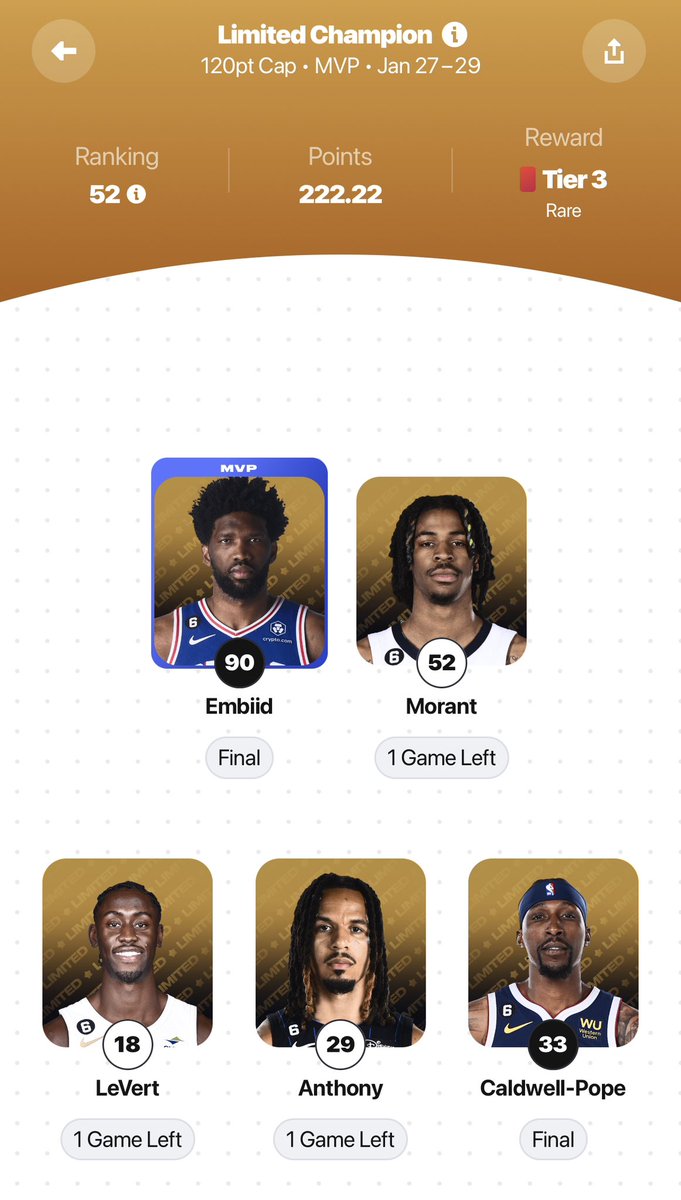

Alright 52 after the game ended gotta save it before it’s gone 🫡

Alright 52 after the game ended gotta save it before it’s gone 🫡

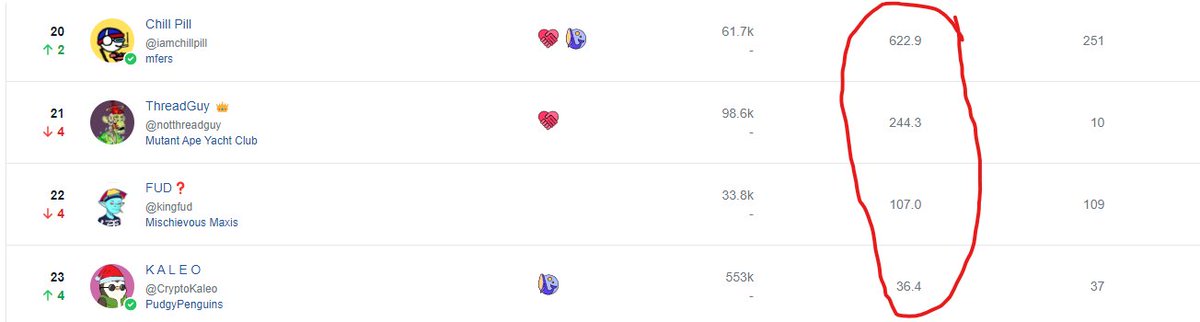

@notthreadguy HOW ARE THESE TWEETS PER DAY NUMBERS REAL???

@notthreadguy HOW ARE THESE TWEETS PER DAY NUMBERS REAL???

https://twitter.com/CryptoKaleo/status/1598812761538134016?s=20&t=xRT_dzNFNE5-KhNiLwoIEA

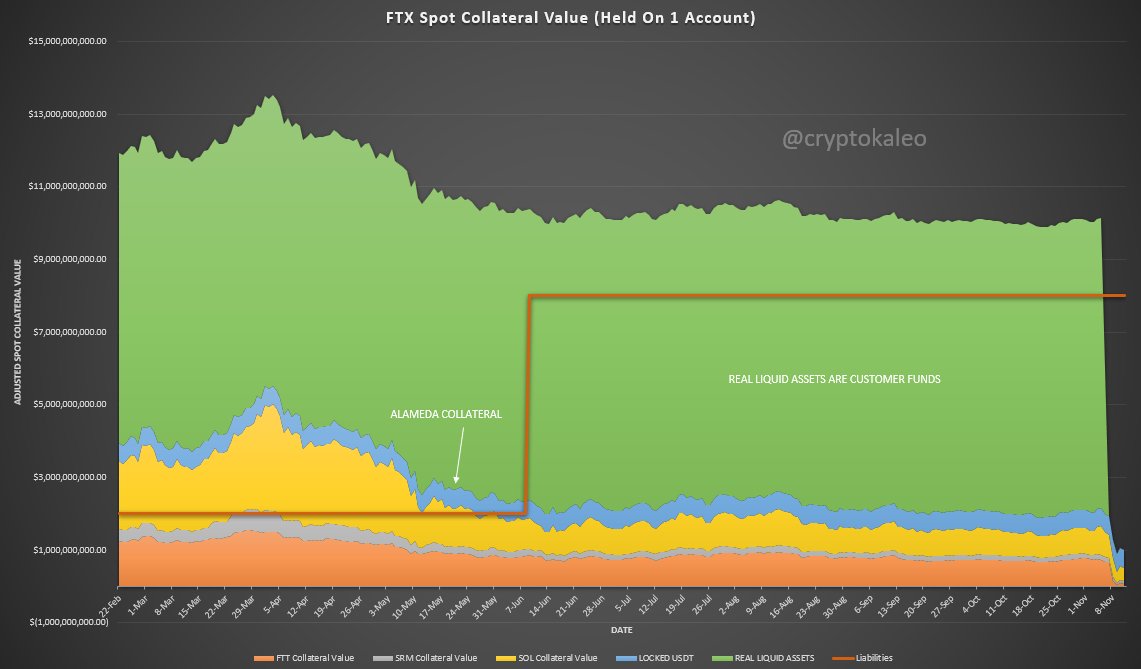

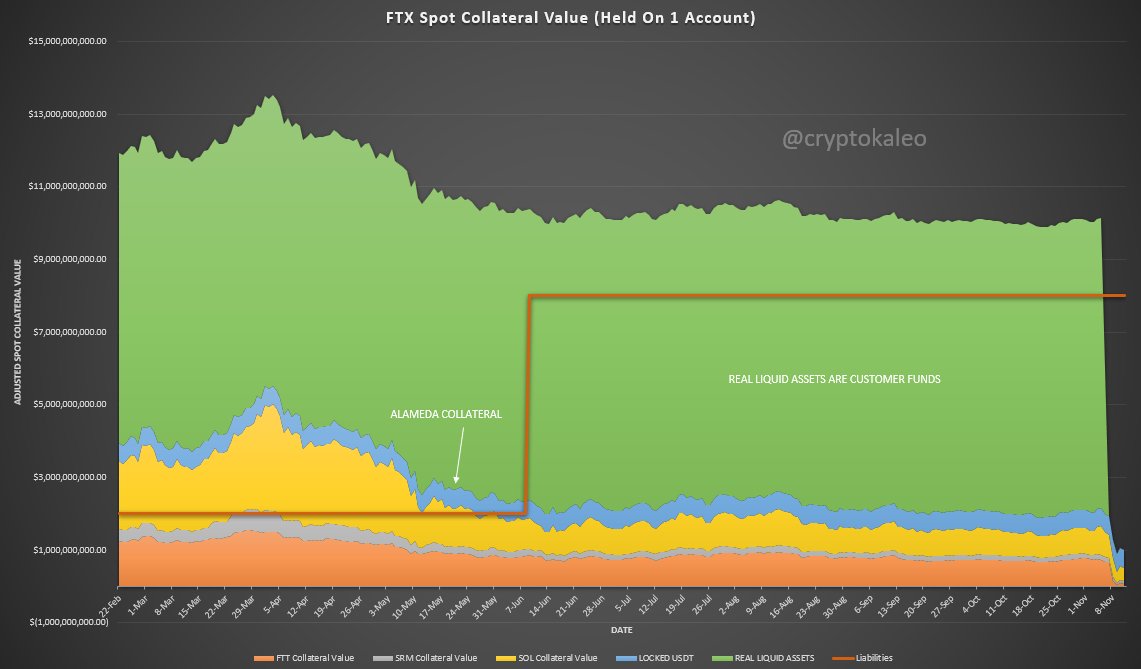

This assumes the "liabilities" outlined by SBF's email has some semblance of truth, and that Alameda accounted for the majority of FTX's liabilities.

This assumes the "liabilities" outlined by SBF's email has some semblance of truth, and that Alameda accounted for the majority of FTX's liabilities.

Zero beginners to trading should ever attempt Futures Day Trading to begin with, but to put out a guide w/ a “here’s how YOU can do a 100X if you’re a beginner!” is insane.

Zero beginners to trading should ever attempt Futures Day Trading to begin with, but to put out a guide w/ a “here’s how YOU can do a 100X if you’re a beginner!” is insane.

#Bitcoin / $BTC

#Bitcoin / $BTC