How to get URL link on X (Twitter) App

Why Use Stochastic RSI?

Why Use Stochastic RSI?

Introduction:

Introduction:

•What are optimistic rollups?

•What are optimistic rollups?

Now you may ask what is Omnichain interoperability protocol?

Now you may ask what is Omnichain interoperability protocol?

$SPX

$SPX

By understanding the fundamentals of a project, we can make informed decisions on whether to invest in a particular project or not.

By understanding the fundamentals of a project, we can make informed decisions on whether to invest in a particular project or not.

Satoshi Nakamoto released the "Bitcoin: A Peer-to-Peer Electronic Cash System" whitepaper in 2008. It describes how a decentralized digital currency system, which enables safe, direct transactions without the need for a centralized authority, is designed and operates.

Satoshi Nakamoto released the "Bitcoin: A Peer-to-Peer Electronic Cash System" whitepaper in 2008. It describes how a decentralized digital currency system, which enables safe, direct transactions without the need for a centralized authority, is designed and operates.

•At an early age, Livermore worked as a "board boy" at a Boston brokerage company to start his career as a stock trader.

•At an early age, Livermore worked as a "board boy" at a Boston brokerage company to start his career as a stock trader.

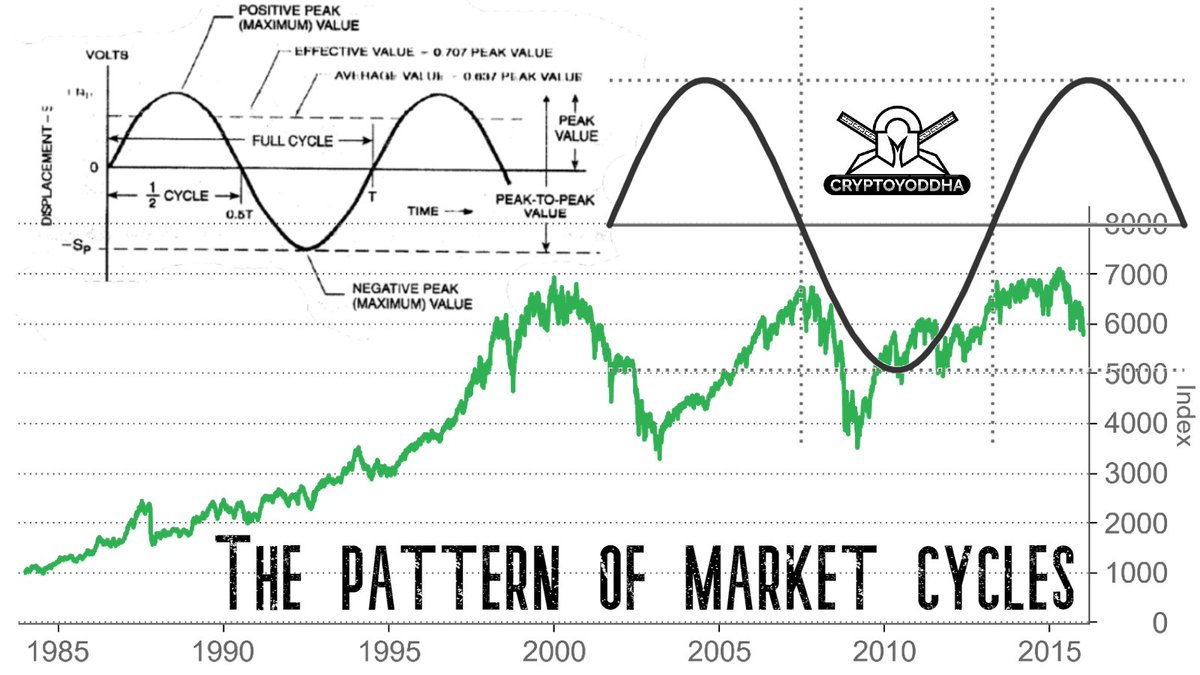

The pattern of market cycles

The pattern of market cycles

Andrew's Pitchfork is used to determine a potential trading range for an asset's price when it is in an uptrend or downtrend, and also to forecast when an asset is going to reverse its direction.

Andrew's Pitchfork is used to determine a potential trading range for an asset's price when it is in an uptrend or downtrend, and also to forecast when an asset is going to reverse its direction.

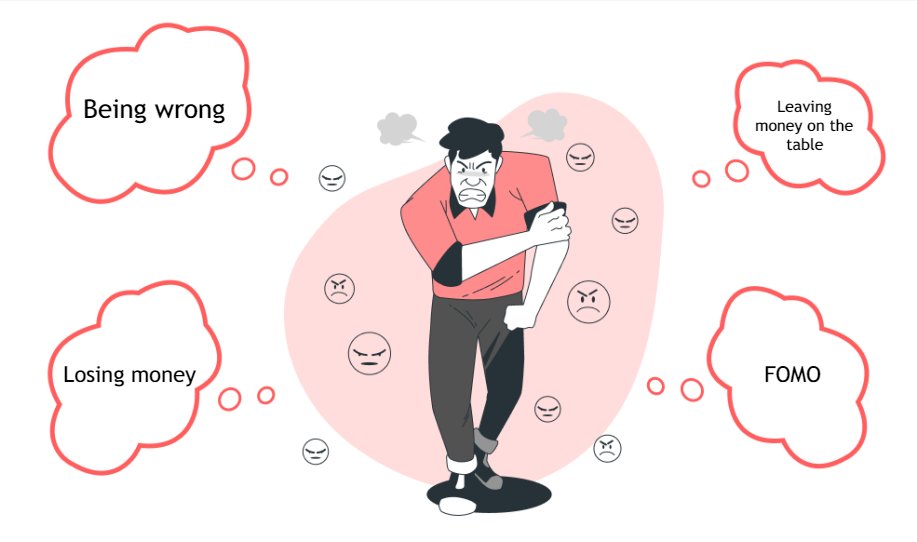

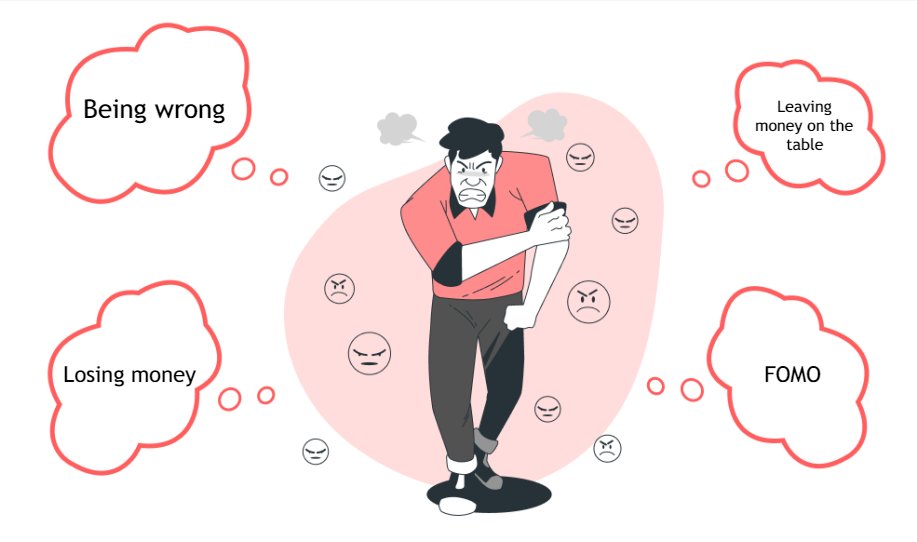

Q? For every trade that you are going to take, you will have 2 decisions associated with it:

Q? For every trade that you are going to take, you will have 2 decisions associated with it:

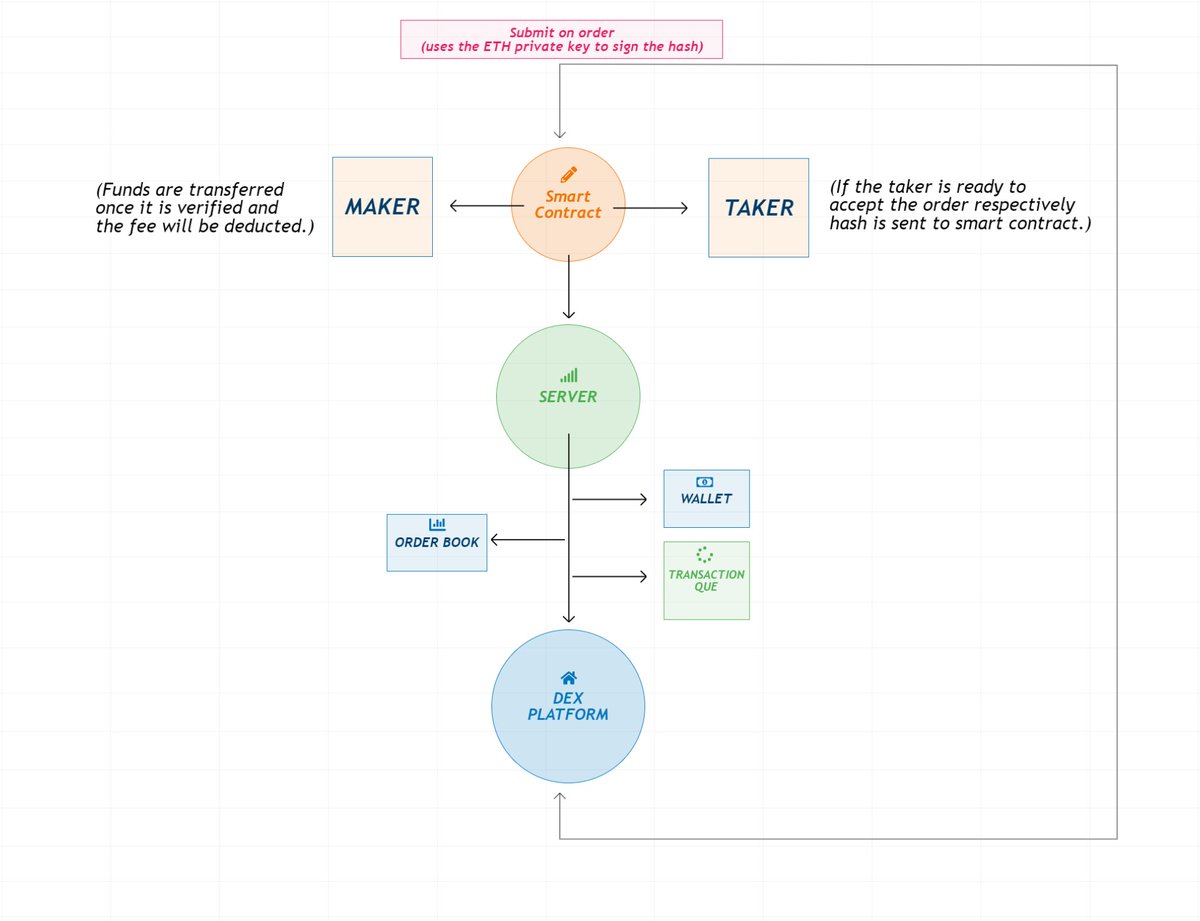

Understanding and working of a DEX:

Understanding and working of a DEX:

Here in this example below we had a proper downtrend and after price broke the structure to upside presenting the best buying opportunity.

Here in this example below we had a proper downtrend and after price broke the structure to upside presenting the best buying opportunity.