How to get URL link on X (Twitter) App

One small difference is that the Chouinards are paying $17.5m in gift tax on the 2% of their shares that are going to a trust outside the (c)(4). But normally, a $3b gift would result in $1.2b in gift tax. 2/

One small difference is that the Chouinards are paying $17.5m in gift tax on the 2% of their shares that are going to a trust outside the (c)(4). But normally, a $3b gift would result in $1.2b in gift tax. 2/

https://twitter.com/crampell/status/1508492563837341696This past summer, @AZBobLord & I noted that the Biden FY 2022 Greenbook still would allow high-net-worth individuals to obtain significant gift tax savings when they pay income tax for irrevocable grantor trusts: papers.ssrn.com/sol3/papers.cf…. 2/

.@SpeakerPelosi will bring the bill to a vote via suspension, which means any member can demand a roll call. It's a put-up-or-shut-up moment for progressive Dems: When leadership wants to rush through a big 🎁 to BlackRock & the top 1%, do you have the courage to object? 2/

.@SpeakerPelosi will bring the bill to a vote via suspension, which means any member can demand a roll call. It's a put-up-or-shut-up moment for progressive Dems: When leadership wants to rush through a big 🎁 to BlackRock & the top 1%, do you have the courage to object? 2/

I can't think of any reason why Treasury would ever want to favor more energy-intensive proof-of-work validation over other validation methods (eg, proof-of-stake). This seems 180° wrong from an environmental perspective 2/

I can't think of any reason why Treasury would ever want to favor more energy-intensive proof-of-work validation over other validation methods (eg, proof-of-stake). This seems 180° wrong from an environmental perspective 2/

https://twitter.com/lawfareblog/status/1410946203320295436Q1: To paraphrase Howard Baker: What did Trump know & will Weisselberg say that Trump knew it?

Folks w/full specs on Romney plan details: Where am I going wrong? cc @dylanmatt @ScottElliotG @hamandcheese. Not clear from Romney's announcement or Niskanen Center analysis what the EITC would be for the $30k parent, so I'm eyeballing from this chart 2/

Folks w/full specs on Romney plan details: Where am I going wrong? cc @dylanmatt @ScottElliotG @hamandcheese. Not clear from Romney's announcement or Niskanen Center analysis what the EITC would be for the $30k parent, so I'm eyeballing from this chart 2/

Some thoughts sparked by the paper: Congress could, eg, pass a modern-day analogue to the First Ku Klux Klan Act, imposing a duty on federal prosecutors to bring quo warranto actions against any state or federal officeholder involved in the insurrection of Jan 6, 2021 ... 2/

Some thoughts sparked by the paper: Congress could, eg, pass a modern-day analogue to the First Ku Klux Klan Act, imposing a duty on federal prosecutors to bring quo warranto actions against any state or federal officeholder involved in the insurrection of Jan 6, 2021 ... 2/

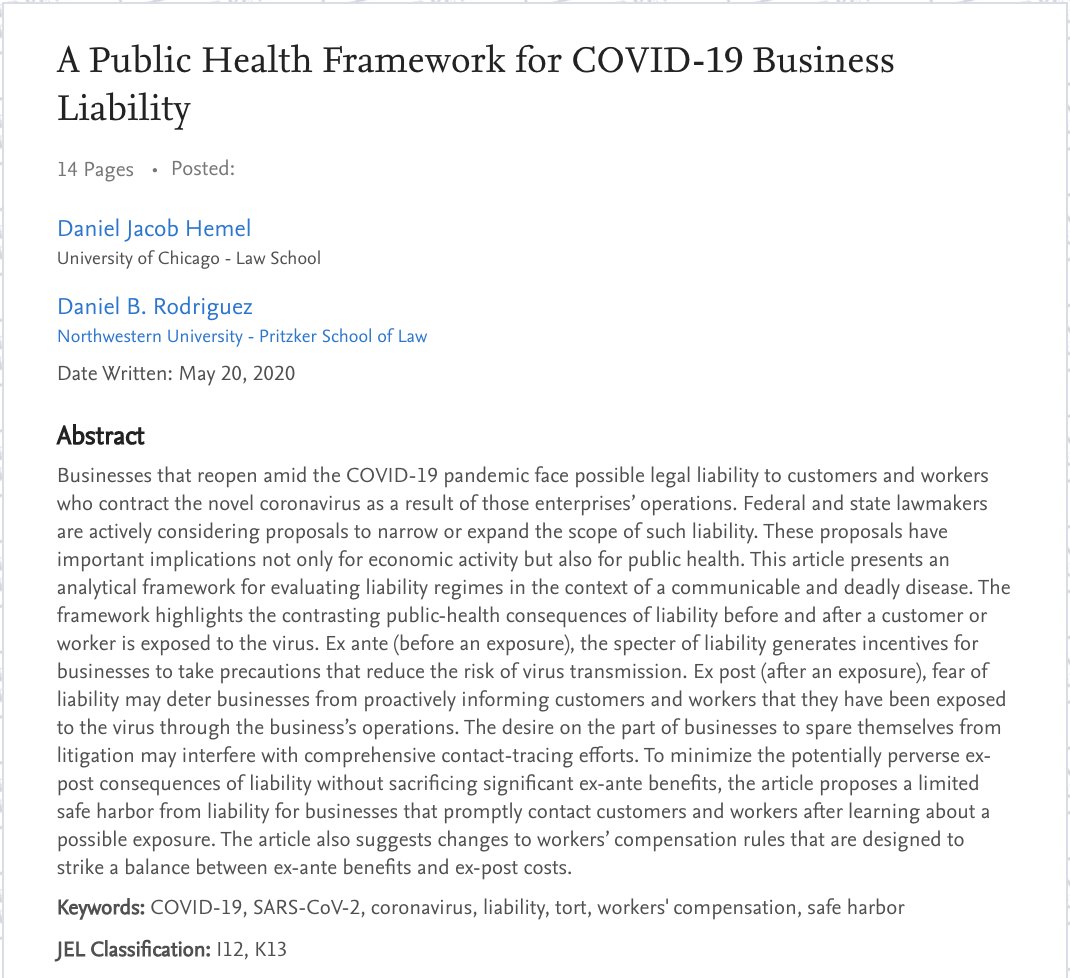

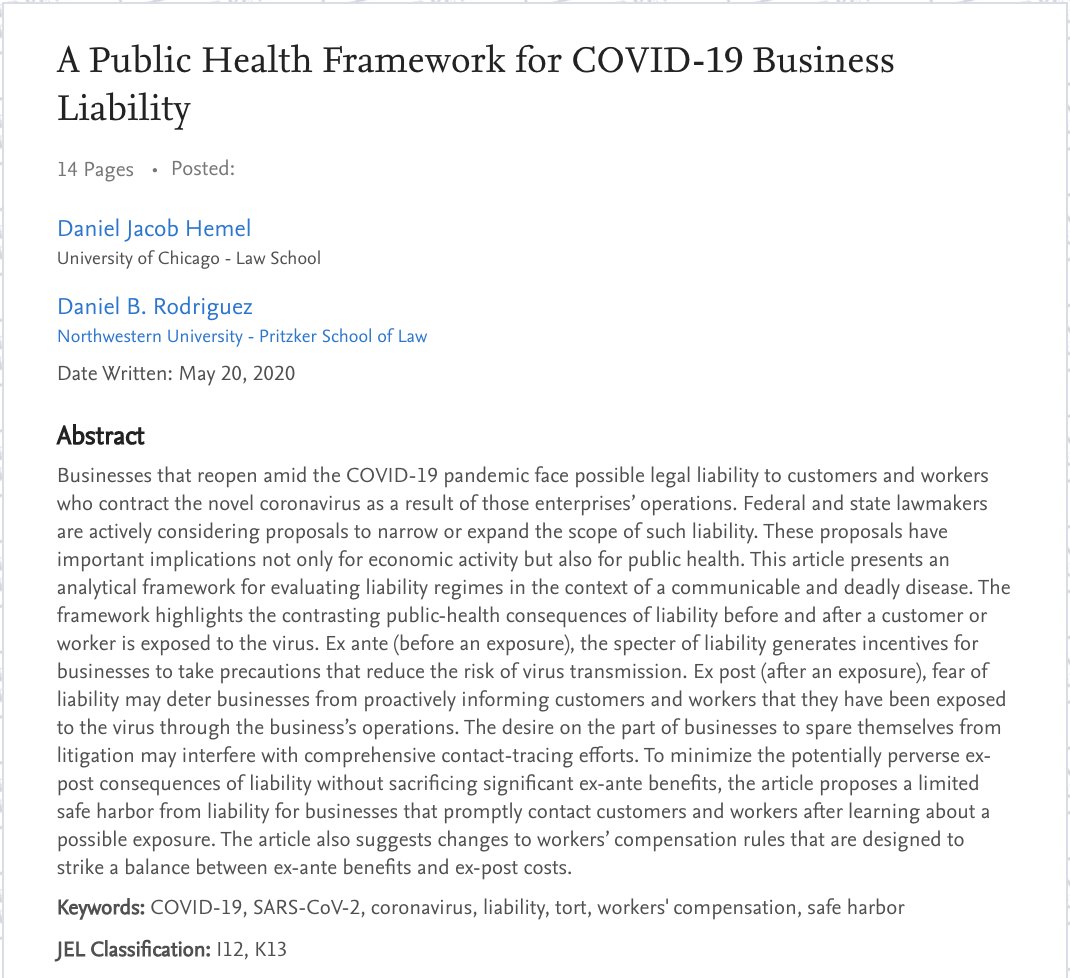

We begin w/survey of legal landscape. Tl;dr (but it's not long, so please read): These won't be easy claims for plaintiffs to win. Causation will be especially tough to prove. Workers' comp exclusivity will bar lots of employee claims. But occasional outsized awards are likely 2/

We begin w/survey of legal landscape. Tl;dr (but it's not long, so please read): These won't be easy claims for plaintiffs to win. Causation will be especially tough to prove. Workers' comp exclusivity will bar lots of employee claims. But occasional outsized awards are likely 2/

https://twitter.com/KellyO/status/1241173299360661505I noted 4 reasons why Trump’s 3/13 declaration migh not trigger sec. 7508A(d):

https://twitter.com/RichardRubinDC/status/1125515923853651973-Also hasn't applied procedure to returns filed by Trump-controlled businesses & trusts

https://twitter.com/RichardRubinDC/status/1082440235328380938The decision means IRS employees will be asked to work w/out pay to process the refunds. An employee might sue under the Administrative Procedure Act, challenging the IRS’s refund processing as “agency action … not in accordance w/law” (the “law” being the Antideficiency Act) 2/

Q ≠ *whether* fed govt will make payments but *when*. If Trump admin won’t pay, insurers can sue fed govt in Ct of Fed Claims—& will win 2/9

Q ≠ *whether* fed govt will make payments but *when*. If Trump admin won’t pay, insurers can sue fed govt in Ct of Fed Claims—& will win 2/9