Writing on Tax Protection and Scaling Wealth ┃Strategies for Incomes $250k and Up ┃20 year financial advisor and fiduciary

3 subscribers

How to get URL link on X (Twitter) App

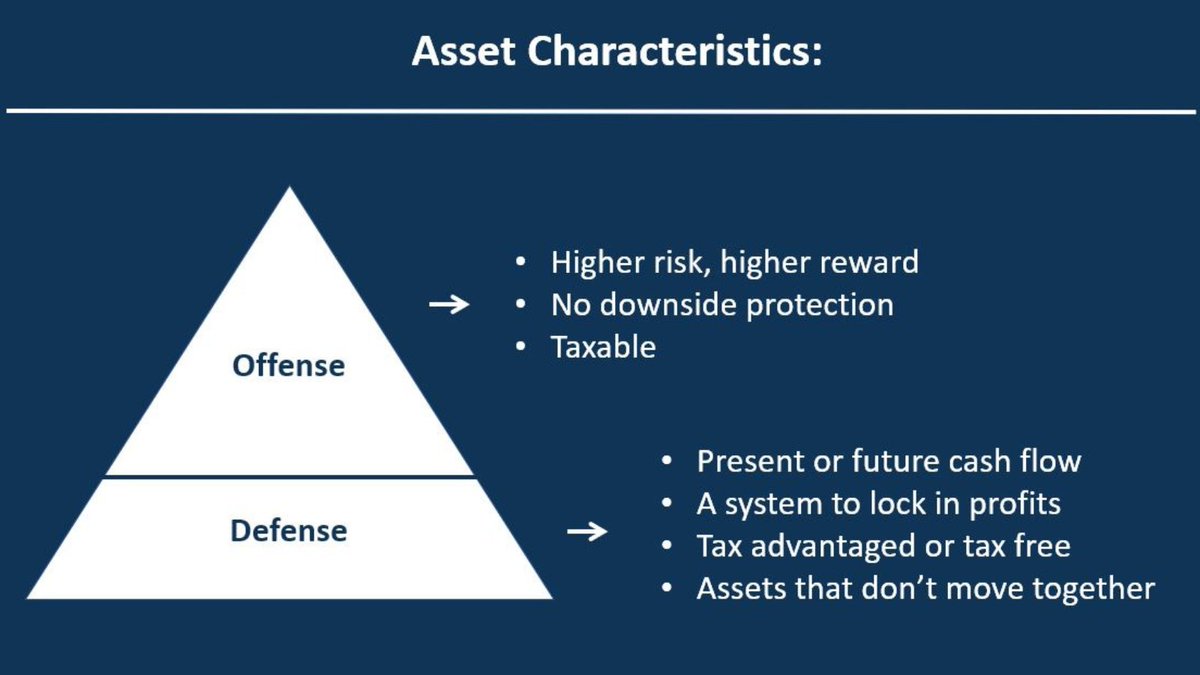

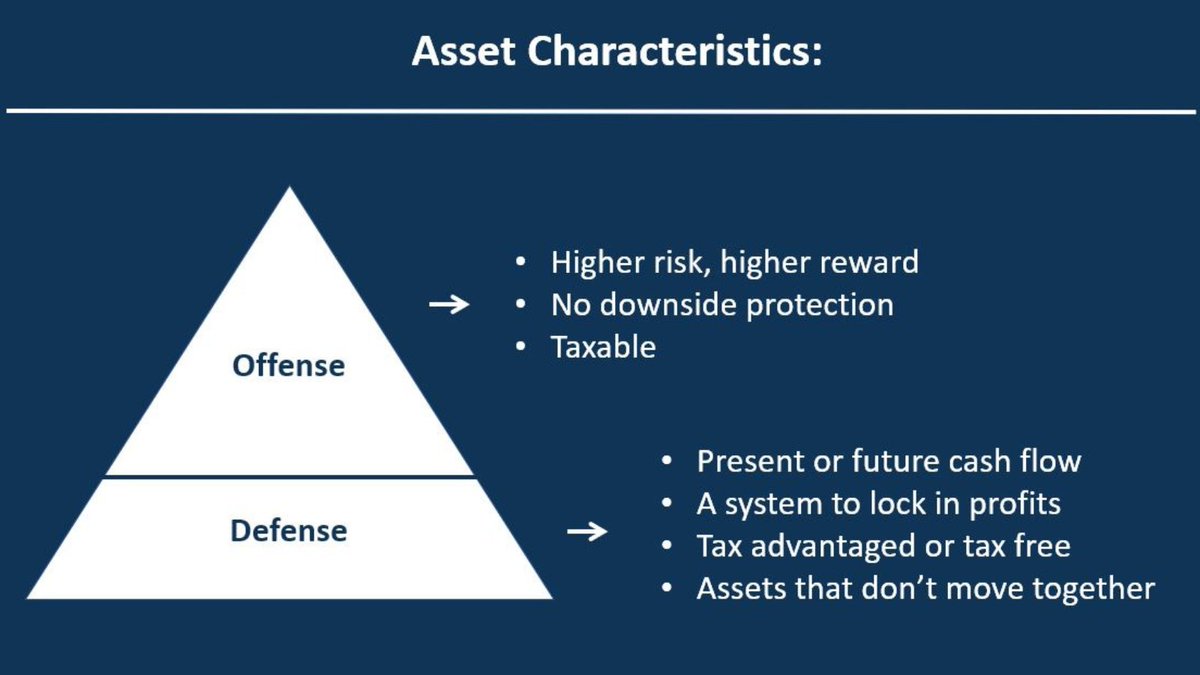

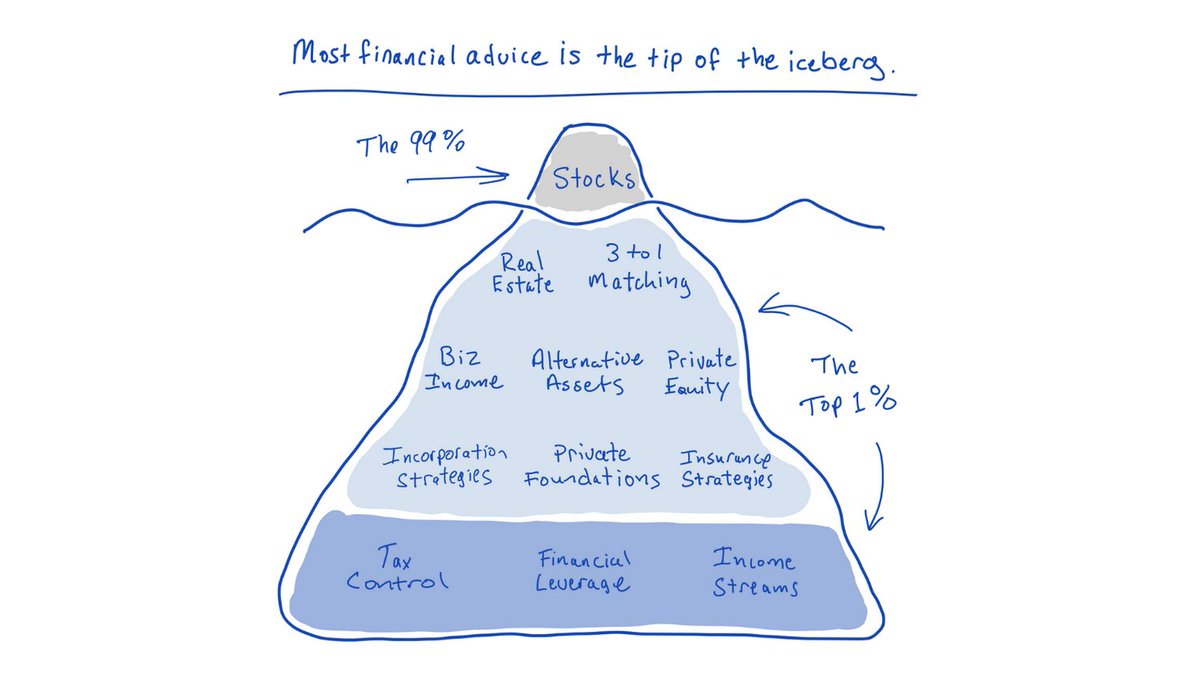

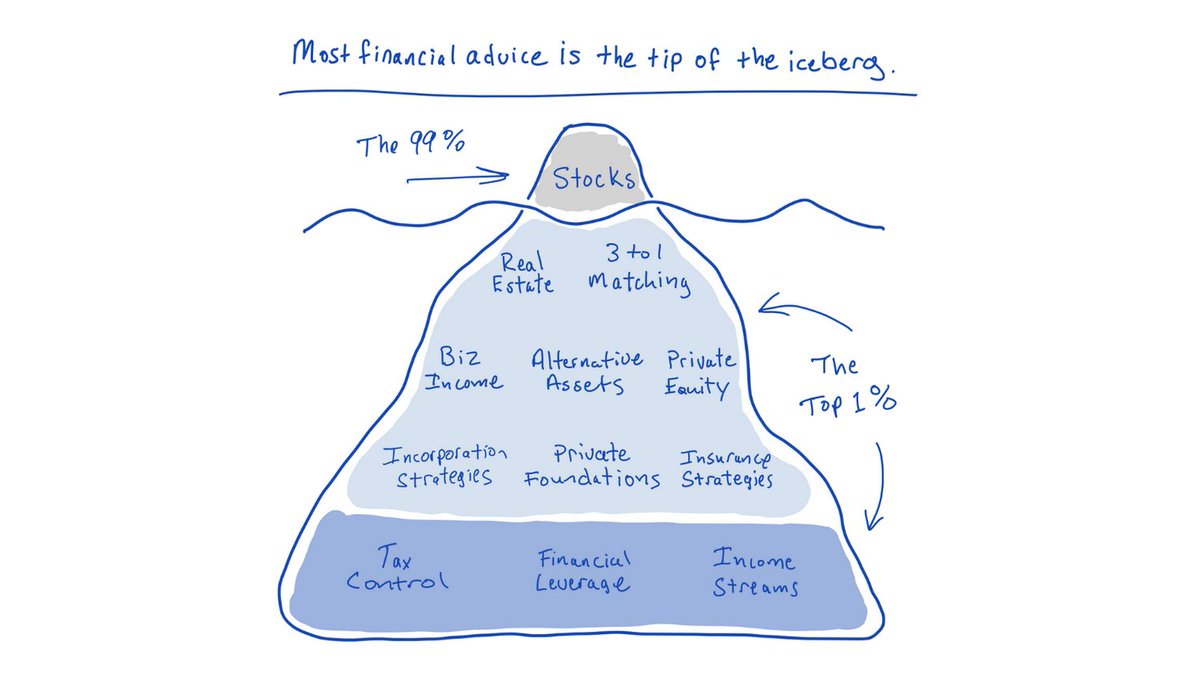

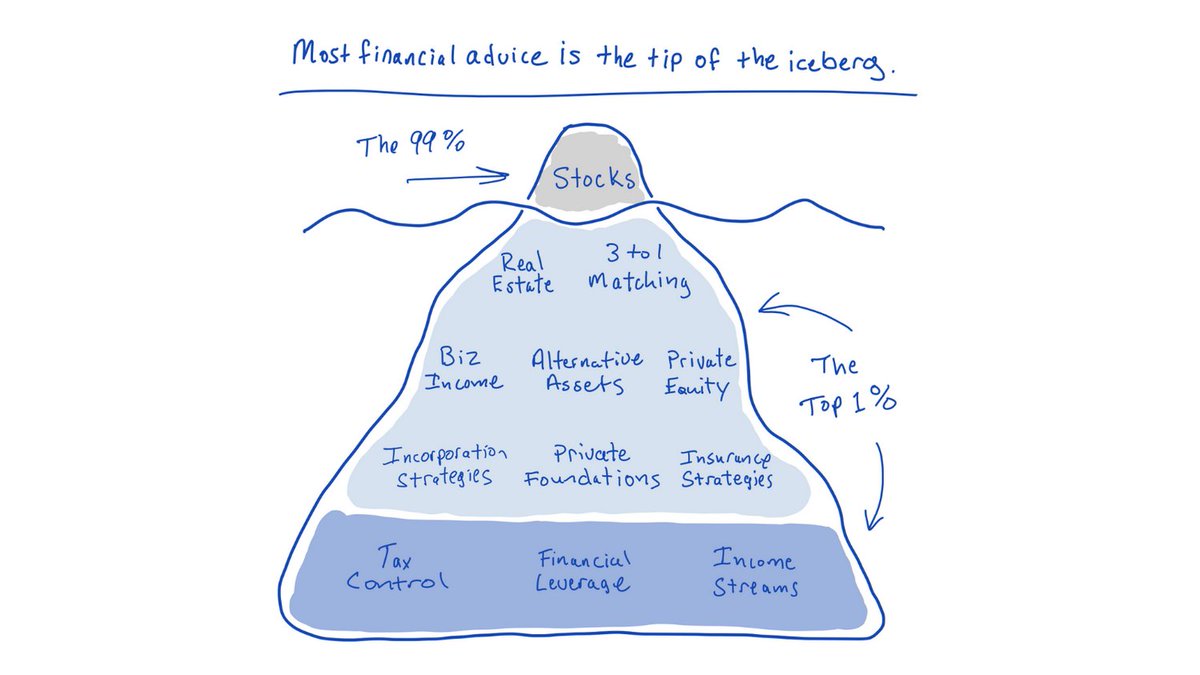

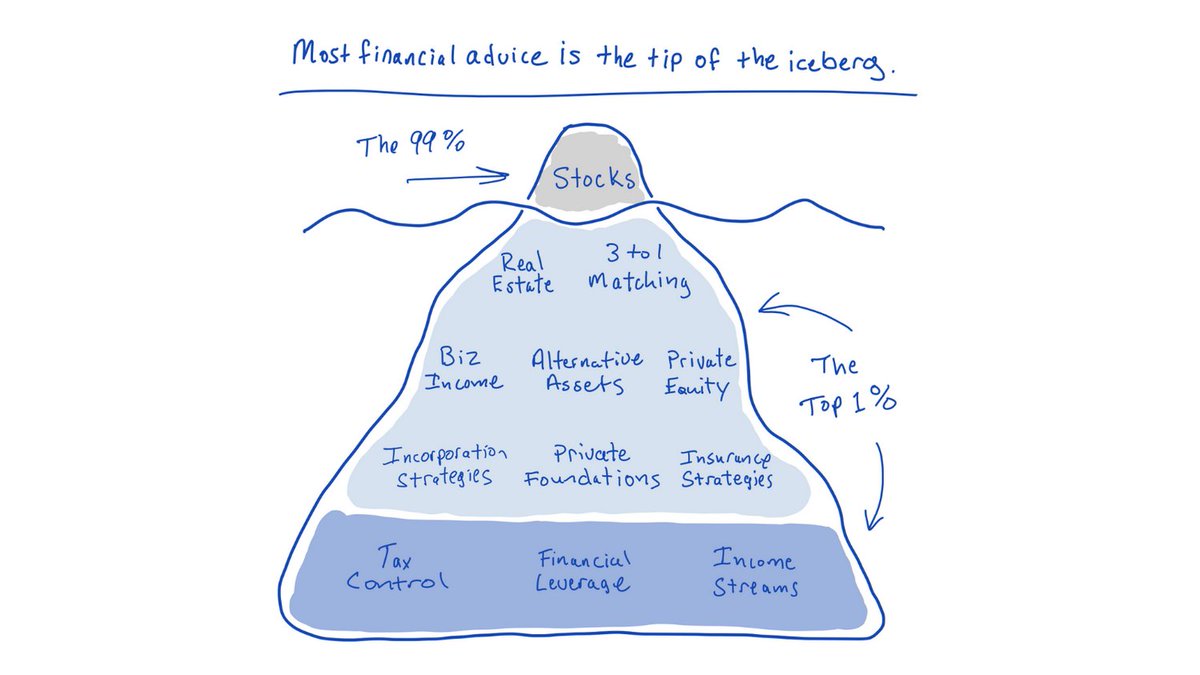

It’s not always about what gives you the best return at every given moment.

It’s not always about what gives you the best return at every given moment.

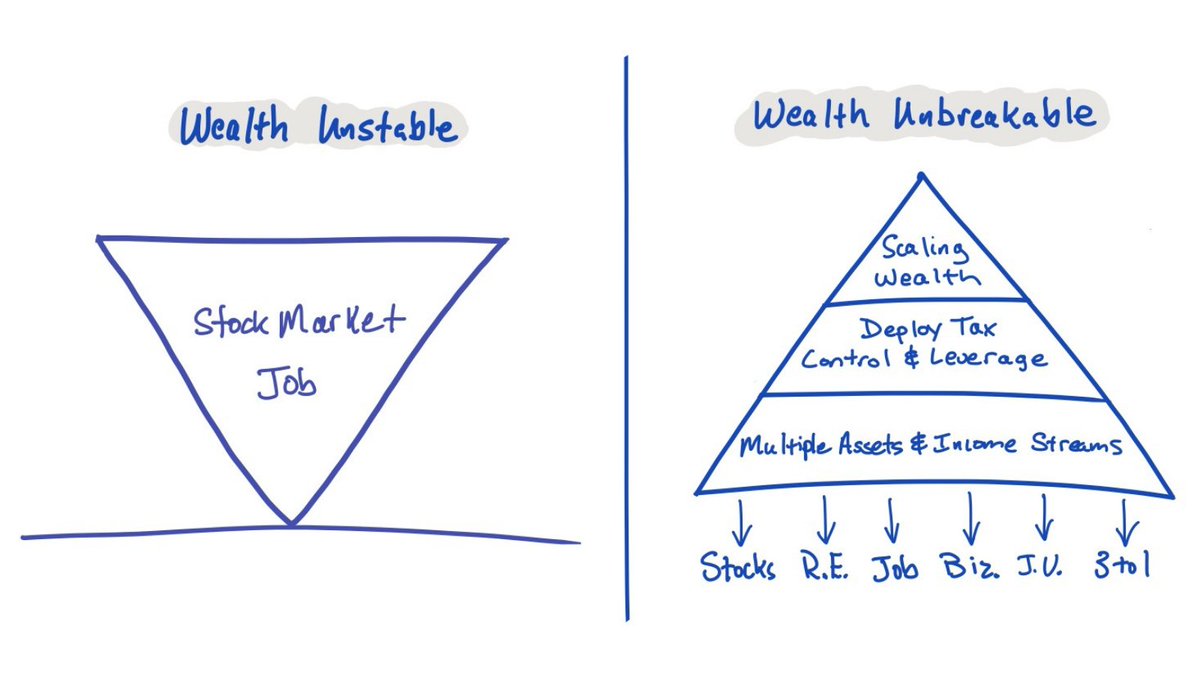

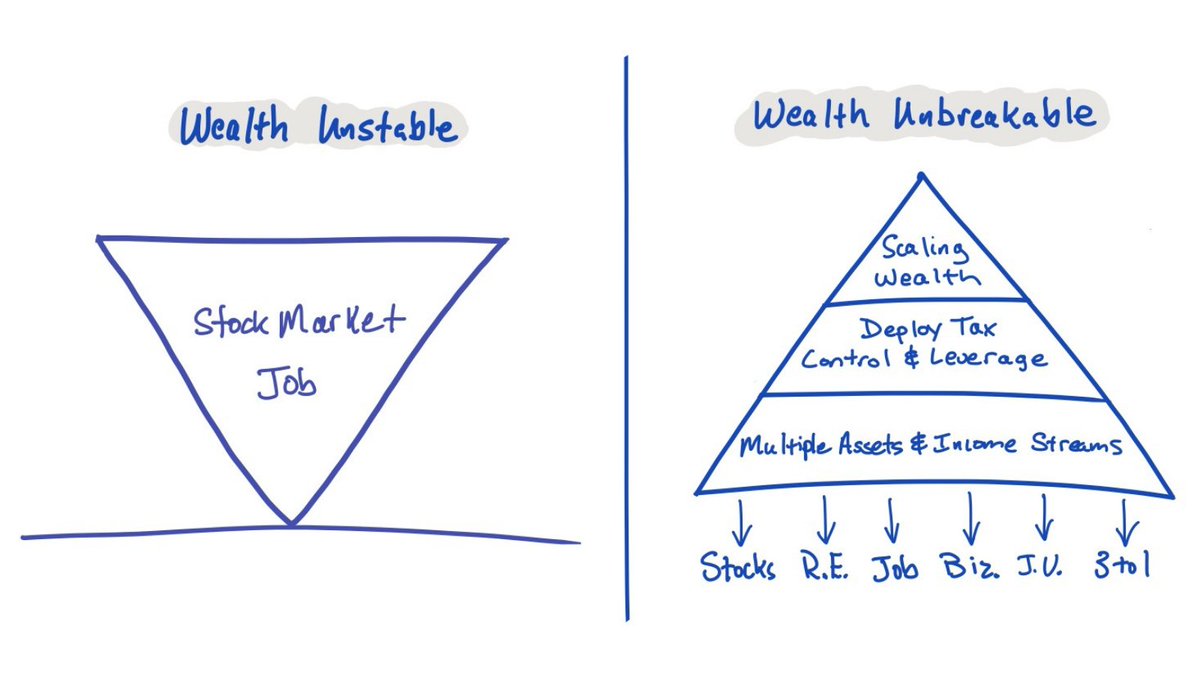

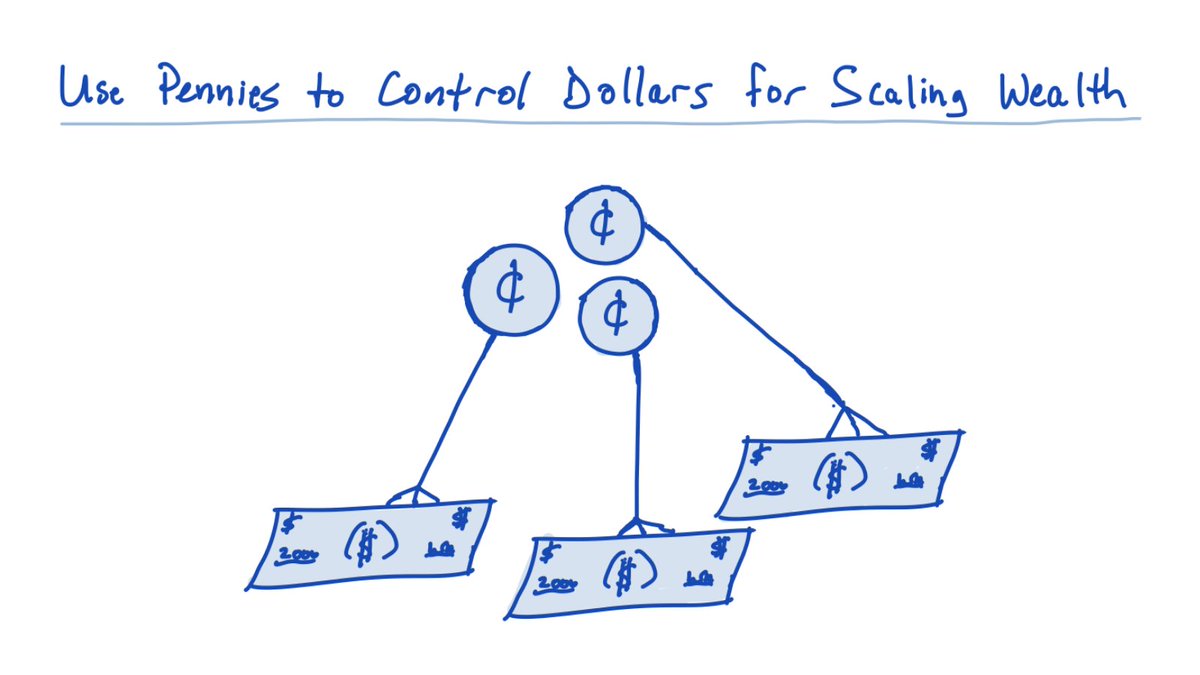

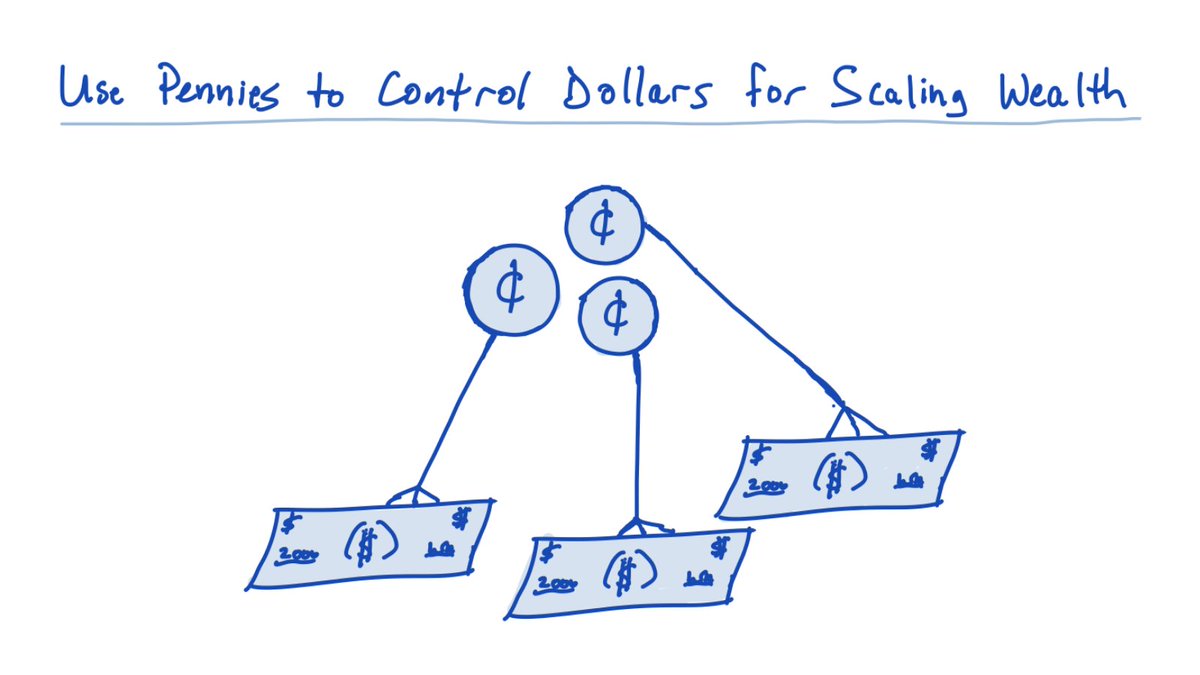

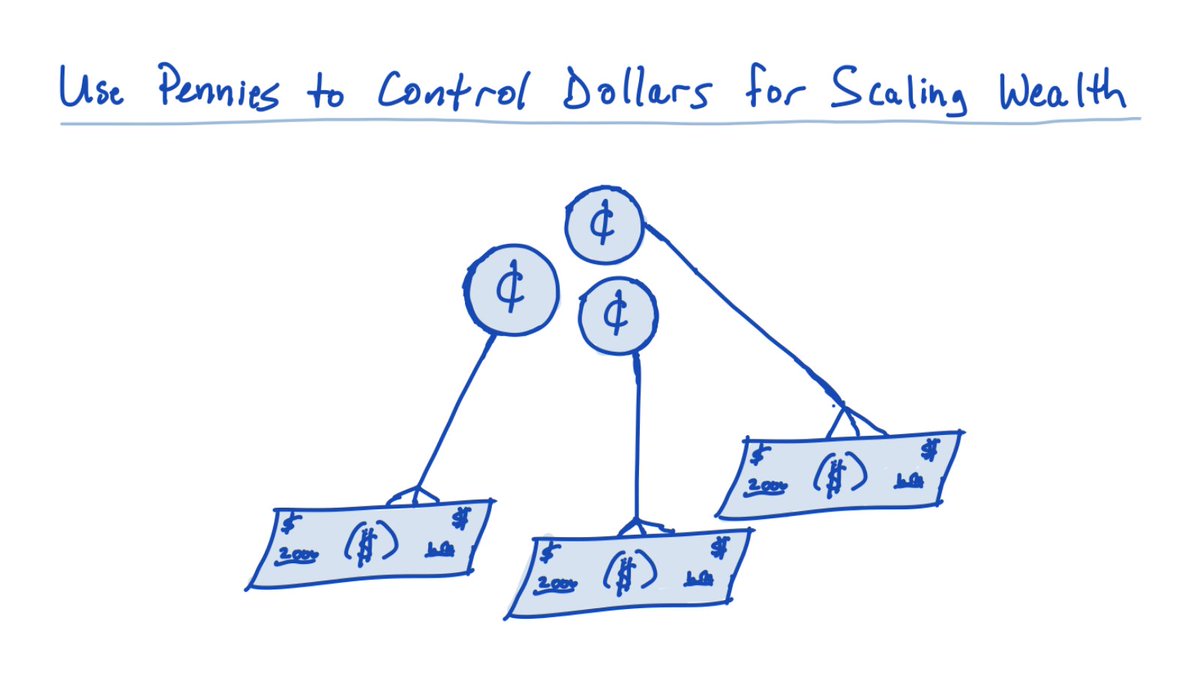

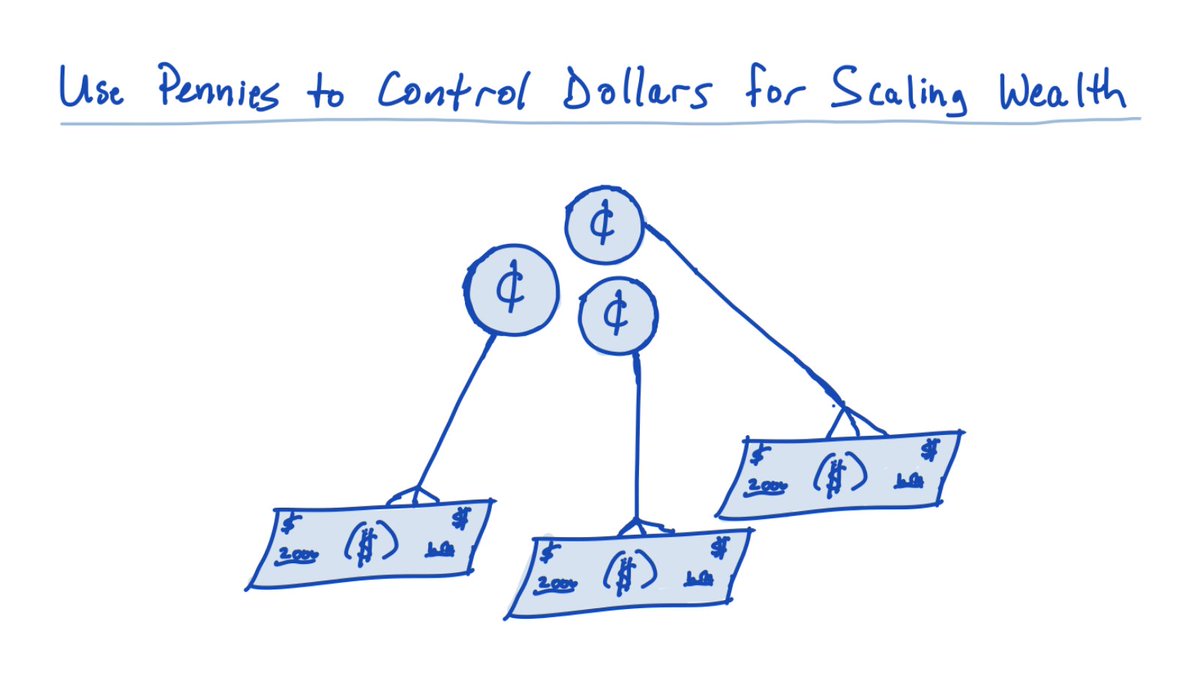

1. Use business, joint ventures and partnerships for exponential wealth. Your odds of a 10x + return are highest here. Build strong relationships and you will never run out of opportunities. You bring skills, expertise, relationships, etc. 🠗

1. Use business, joint ventures and partnerships for exponential wealth. Your odds of a 10x + return are highest here. Build strong relationships and you will never run out of opportunities. You bring skills, expertise, relationships, etc. 🠗

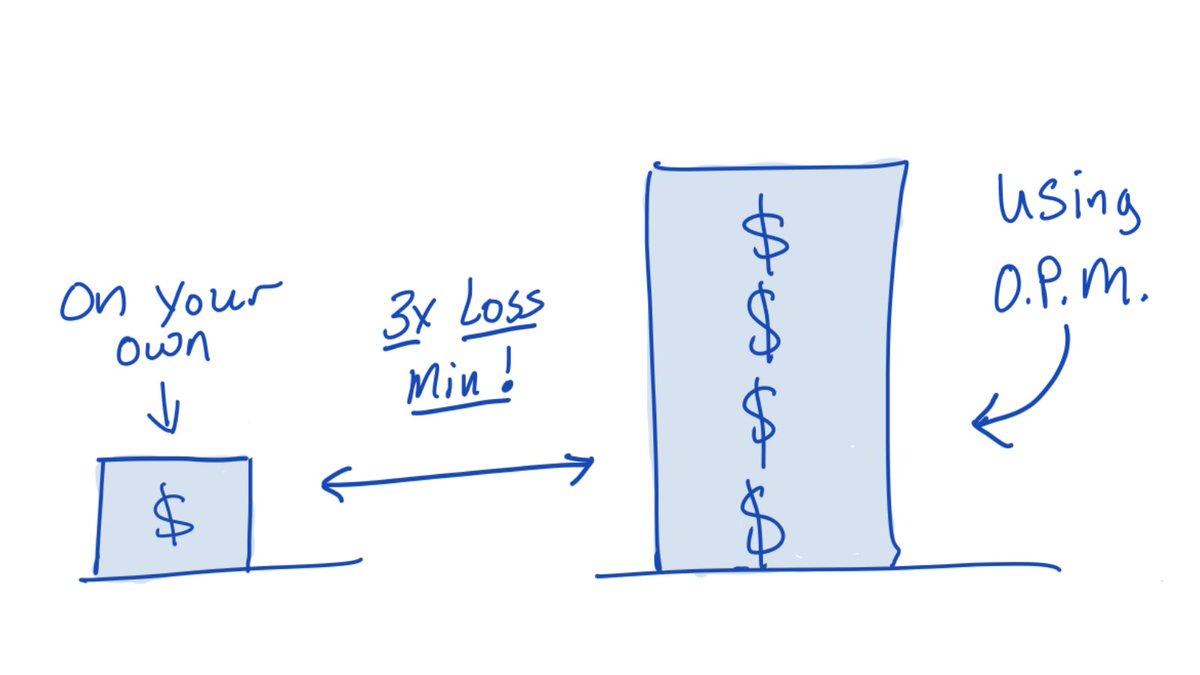

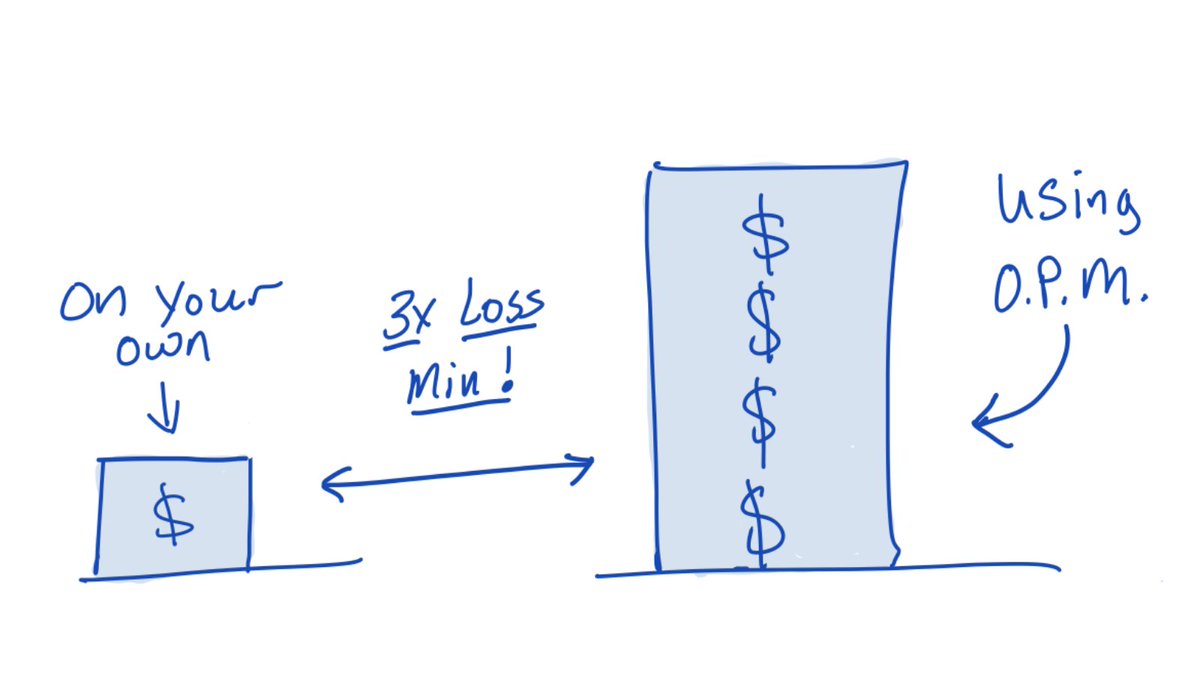

For probably 90% of Americans debt is the enemy. For those in the top 5%, trying to get the top 1% it is an essential wealth building tool.

For probably 90% of Americans debt is the enemy. For those in the top 5%, trying to get the top 1% it is an essential wealth building tool.

Now, look, I love the market.

Now, look, I love the market.

Now, look, I love the market.

Now, look, I love the market.

For probably 90% of Americans debt is the enemy. For those in the top 5%, trying to get the top 1% it is an essential wealth building tool.

For probably 90% of Americans debt is the enemy. For those in the top 5%, trying to get the top 1% it is an essential wealth building tool.

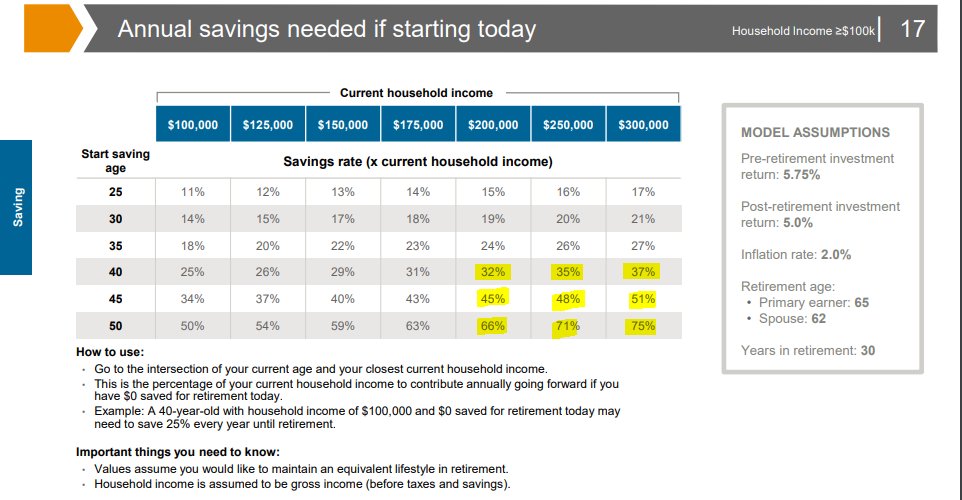

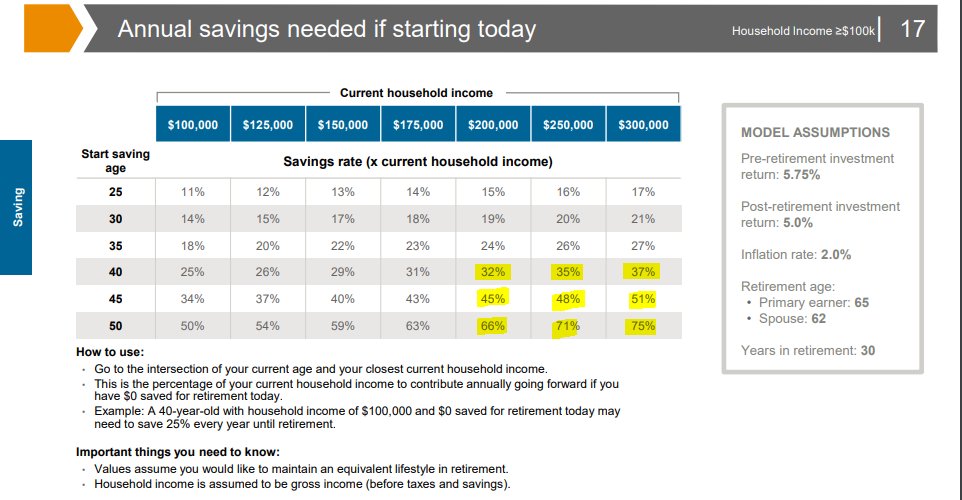

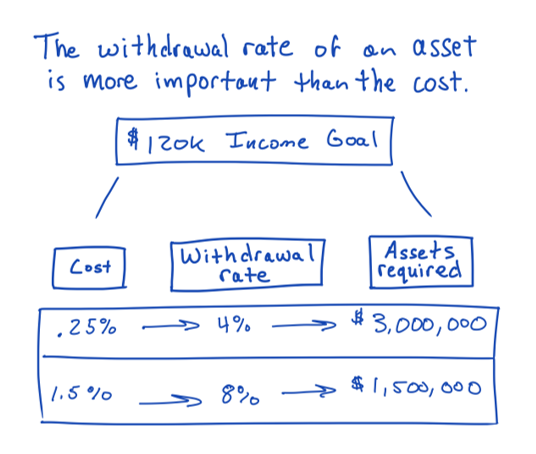

JP Morgan data uses a 4% withdrawal rate from a stock portfolio.

JP Morgan data uses a 4% withdrawal rate from a stock portfolio.

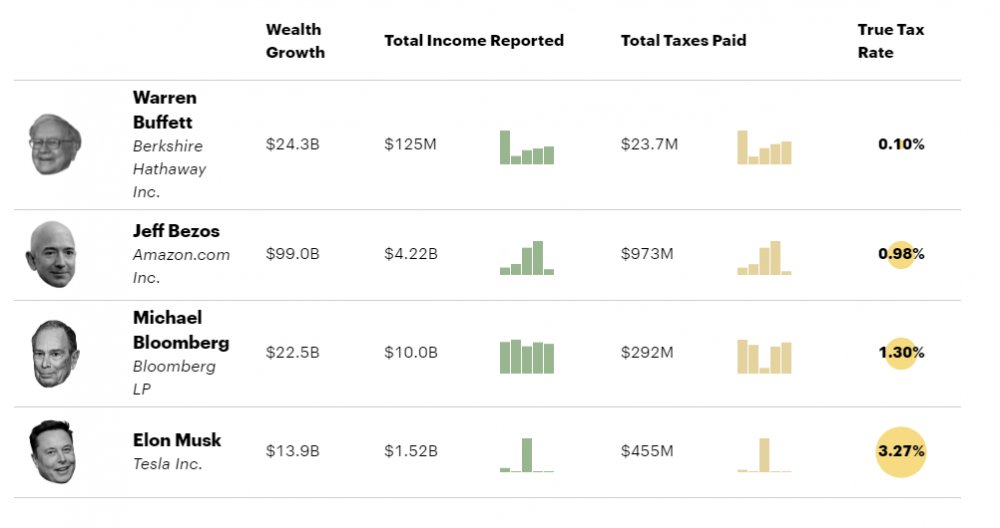

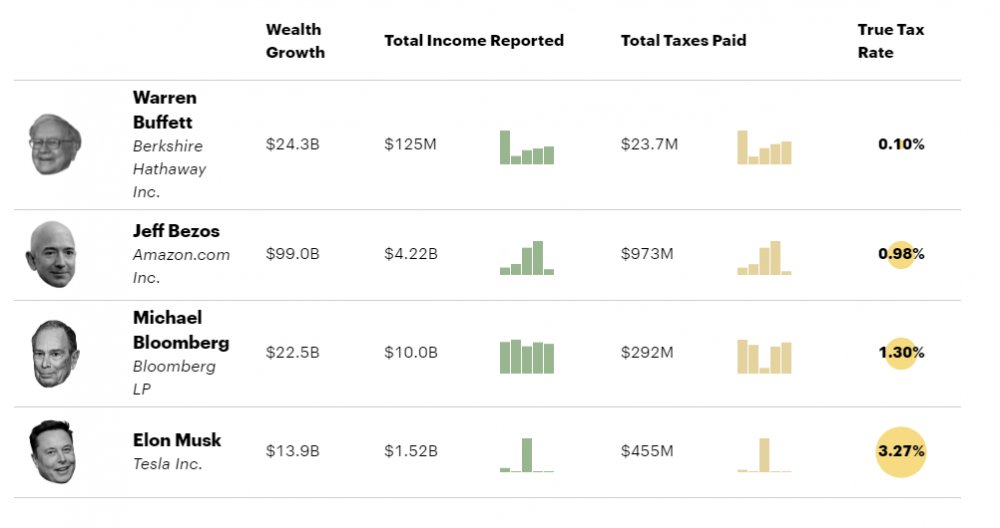

A bank loans them $10 million using the stock as collateral. Live off the loans.

A bank loans them $10 million using the stock as collateral. Live off the loans.

1. For C-Corps and Non Profits: Loan based split dollar compensation.

1. For C-Corps and Non Profits: Loan based split dollar compensation.https://twitter.com/DenverNowicz/status/1393567554266820611?s=20