Data-led insights on all things markets, investing, life. Articles here https://t.co/a15Y3s2chw Head of Strategic Research Unit @Schroders. Not investment advice

How to get URL link on X (Twitter) App

2️⃣/8 IG spreads cheaper than HY

2️⃣/8 IG spreads cheaper than HY

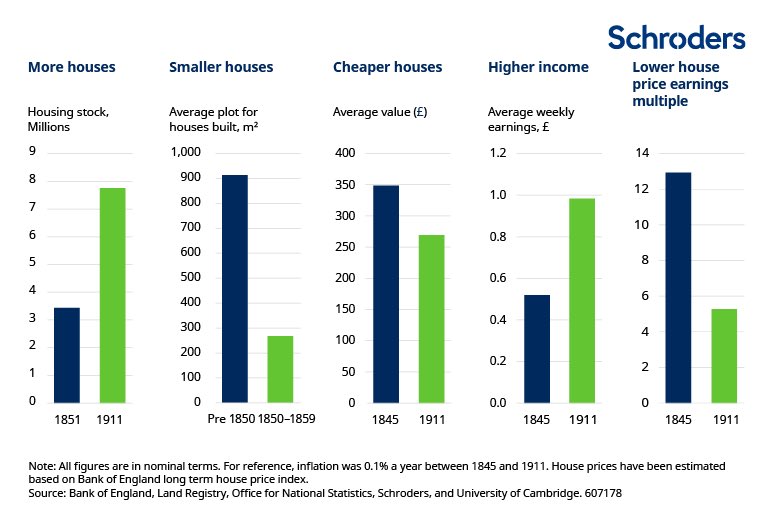

2/9 Last time UK houses were so expensive vs earnings was the year 1876

2/9 Last time UK houses were so expensive vs earnings was the year 1876

https://twitter.com/DuncanLamont2/status/15859374568679874562/9

2/6

2/6