All things energy @woodmackenzie. Host of @TheEnergyGang podcast. Formerly @FT, @BBCNews. Opinions my own

How to get URL link on X (Twitter) App

https://twitter.com/thomas_m_wilson/status/1602011888652632064It does feel as though we have been here before. The BBC reported back in 2013 that "during an experiment in late September, the amount of energy released through the fusion reaction exceeded the amount of energy being absorbed by the fuel". (2/x) bbc.com/news/science-e…

The book sets out how during WW1 British policymakers came to appreciate the vital strategic importance of oil, and saw Mesopotamia (Iraq) and Persia (Iran) as the places where they could secure supplies. This was the discussion in the British cabinet in the summer of 1918. (2/x)

The book sets out how during WW1 British policymakers came to appreciate the vital strategic importance of oil, and saw Mesopotamia (Iraq) and Persia (Iran) as the places where they could secure supplies. This was the discussion in the British cabinet in the summer of 1918. (2/x)

https://twitter.com/SenatorRomney/status/1601279117252386816.@SenatorRomney: "We're the largest producer of fossil fuel in the world - of oil and gas - by far. We're number one. We are now going to go to a world where China dominates in the energy world. China is going to be, if you will, a one-member nation of its own OPEC..." (1/2

...while for capacity contracted for 2022-25, that proportion rises to 27%. Tech companies and retailers have been in the lead, but they are clearing a path that many other companies are now following. For more, check out the latest Energy Pulse: woodmac.com/news/opinion/u…

...while for capacity contracted for 2022-25, that proportion rises to 27%. Tech companies and retailers have been in the lead, but they are clearing a path that many other companies are now following. For more, check out the latest Energy Pulse: woodmac.com/news/opinion/u…

Includes this chart showing European oil companies' ambitions in renewables. If they achieve their goals, they will be up there with some of the big power companies in terms of wind and solar capacity

Includes this chart showing European oil companies' ambitions in renewables. If they achieve their goals, they will be up there with some of the big power companies in terms of wind and solar capacity

Yesterday Kerry was asked the very reasonable question: How do you intend to achieve the US NDC? The NDC document filed with the UNFCCC does not give much of an indication. (2/x) www4.unfccc.int/sites/ndcstagi…

Yesterday Kerry was asked the very reasonable question: How do you intend to achieve the US NDC? The NDC document filed with the UNFCCC does not give much of an indication. (2/x) www4.unfccc.int/sites/ndcstagi…

Al-Razi was an amazing man. He was the first person to write a detailed identification of smallpox and measles, and wrote the first ever book on pediatric medicine. The US National Library of Medicine has a good article on his work here: nlm.nih.gov/exhibition/isl…

Al-Razi was an amazing man. He was the first person to write a detailed identification of smallpox and measles, and wrote the first ever book on pediatric medicine. The US National Library of Medicine has a good article on his work here: nlm.nih.gov/exhibition/isl…

Sieges of Constantinople in 669 and 718 were pushed back when Byzantine ships used Greek Fire against the Arab fleets, to devastating effect

Sieges of Constantinople in 669 and 718 were pushed back when Byzantine ships used Greek Fire against the Arab fleets, to devastating effect

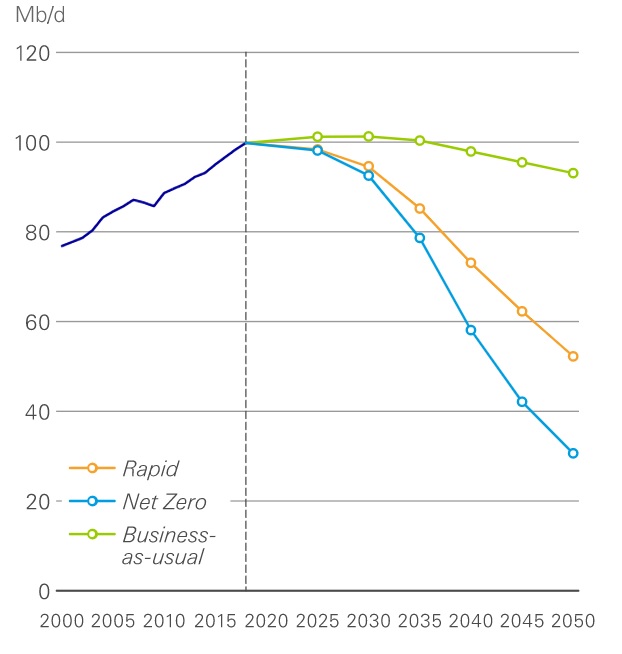

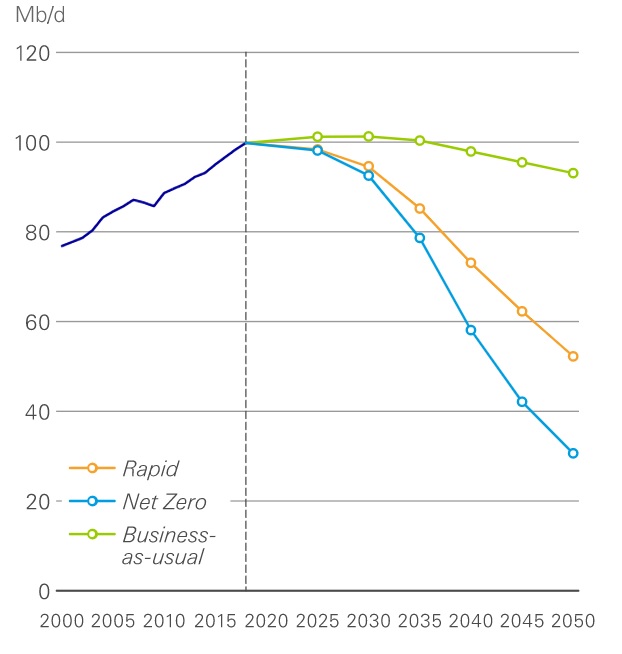

The only assets Total has identified as at risk of being stranded are its holdings in the Canadian oil sands, which have "reserves beyond 20 years and high production costs". Still, its move is sign of how what was a fringe idea not so long ago has now moved into the mainstream

The only assets Total has identified as at risk of being stranded are its holdings in the Canadian oil sands, which have "reserves beyond 20 years and high production costs". Still, its move is sign of how what was a fringe idea not so long ago has now moved into the mainstream

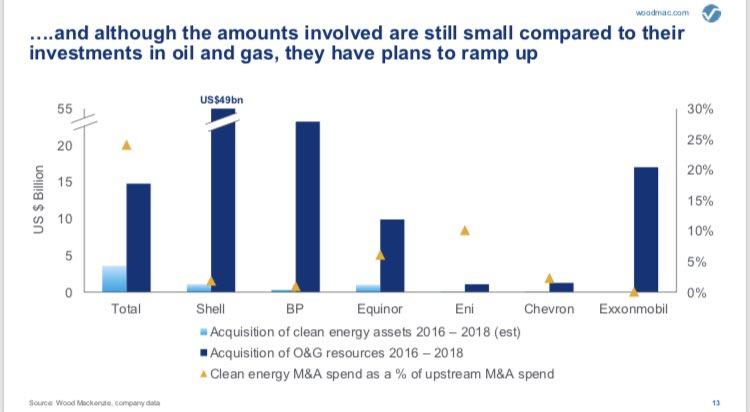

...and although the amounts they are spending are still relatively small compared to their investments in oil and gas, they are not trivial. In the past three years, Total spent 25% of its upstream M&A budget on new energies, and Eni 10%. Shell’s % was lower, but is ramping up

...and although the amounts they are spending are still relatively small compared to their investments in oil and gas, they are not trivial. In the past three years, Total spent 25% of its upstream M&A budget on new energies, and Eni 10%. Shell’s % was lower, but is ramping up

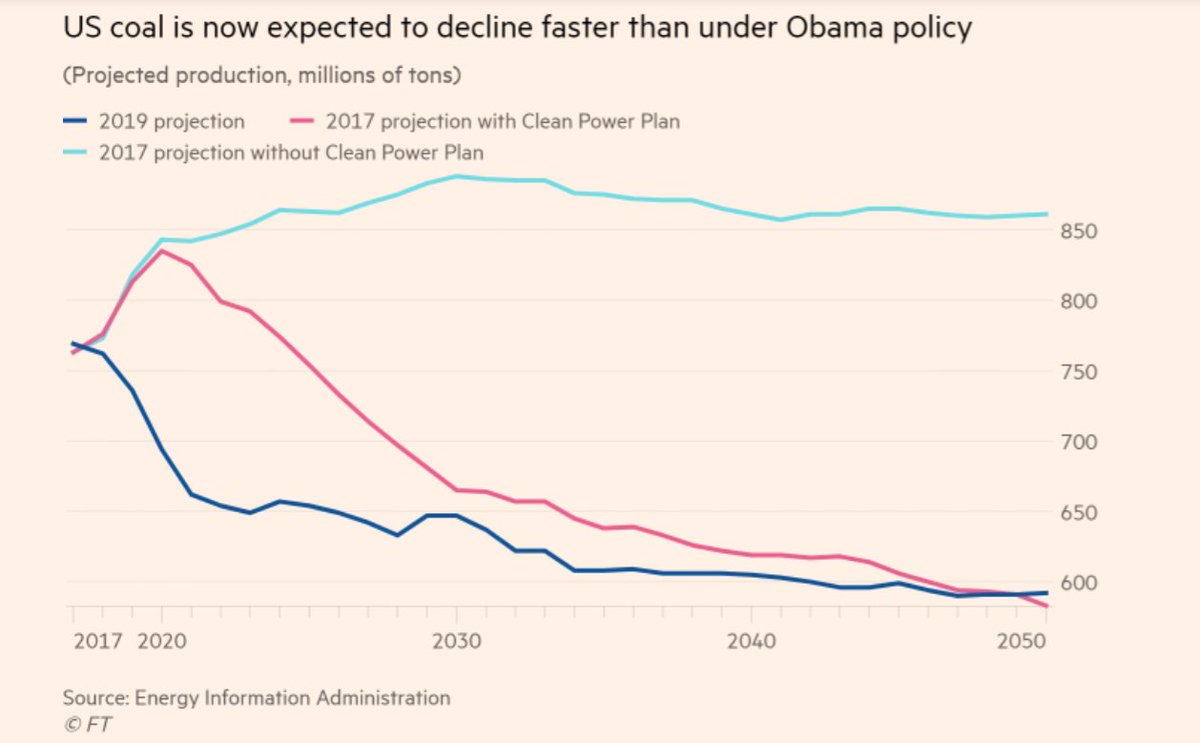

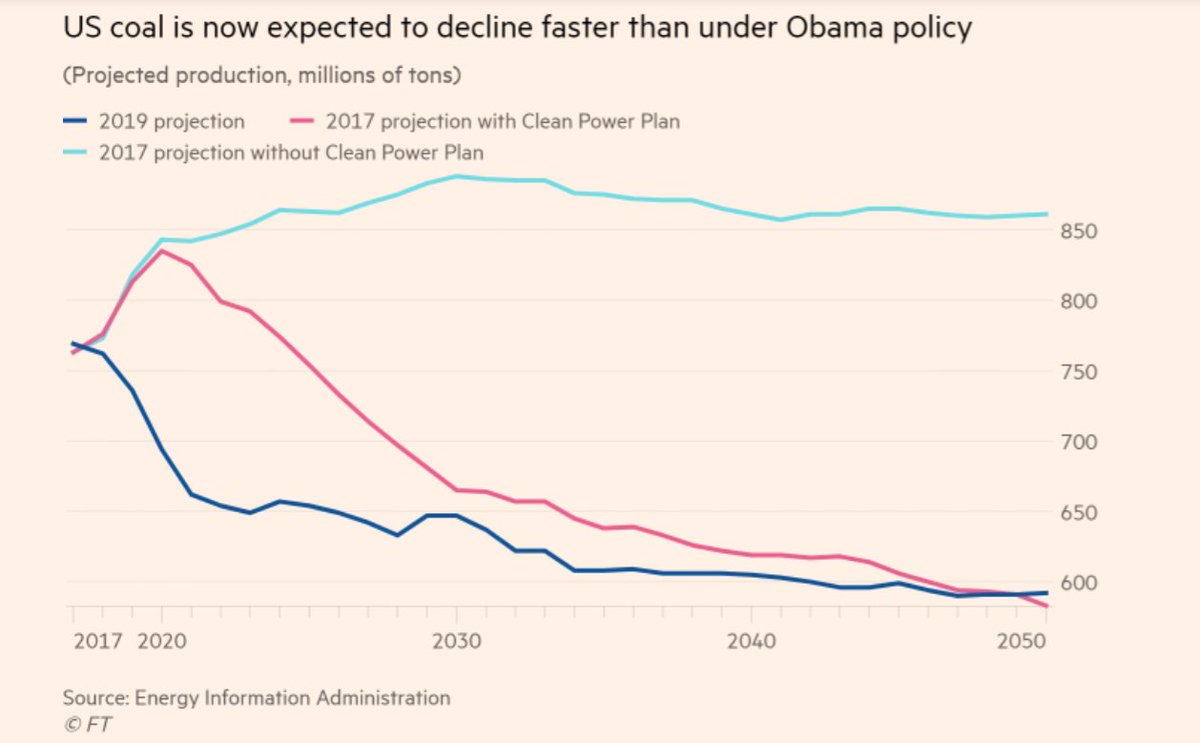

In a sign of the continuing pressure on the US coal industry, West Virginia-based Revelation Energy and its affiliate, Blackjewel filed for Chapter 11 bankruptcy protection on Monday wfpl.org/major-appalach…

In a sign of the continuing pressure on the US coal industry, West Virginia-based Revelation Energy and its affiliate, Blackjewel filed for Chapter 11 bankruptcy protection on Monday wfpl.org/major-appalach…

Take a look at this. The pale blue line is the @EIAgov projection in 2017 for US coal production if the Clean Power Plan were scrapped. The red line is the 2017 projection if it had taken effect. The dark blue is the 2019 projection, with no CPP. It's even lower than the red line

Take a look at this. The pale blue line is the @EIAgov projection in 2017 for US coal production if the Clean Power Plan were scrapped. The red line is the 2017 projection if it had taken effect. The dark blue is the 2019 projection, with no CPP. It's even lower than the red line

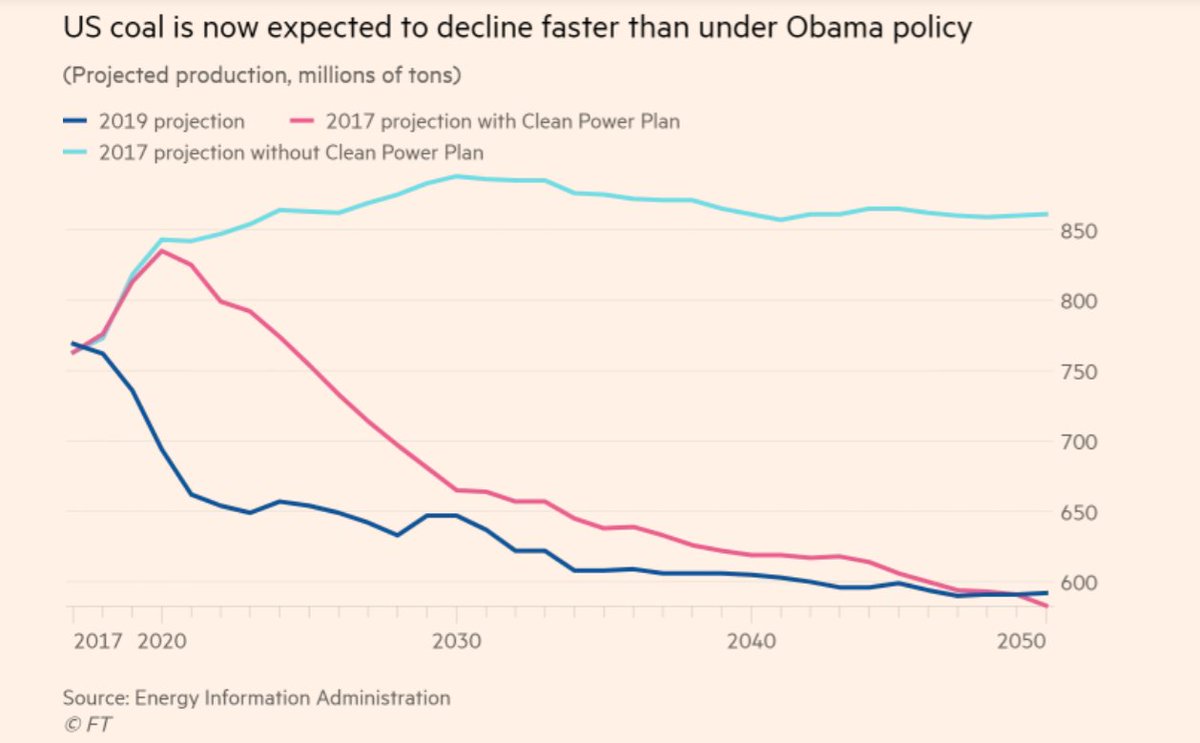

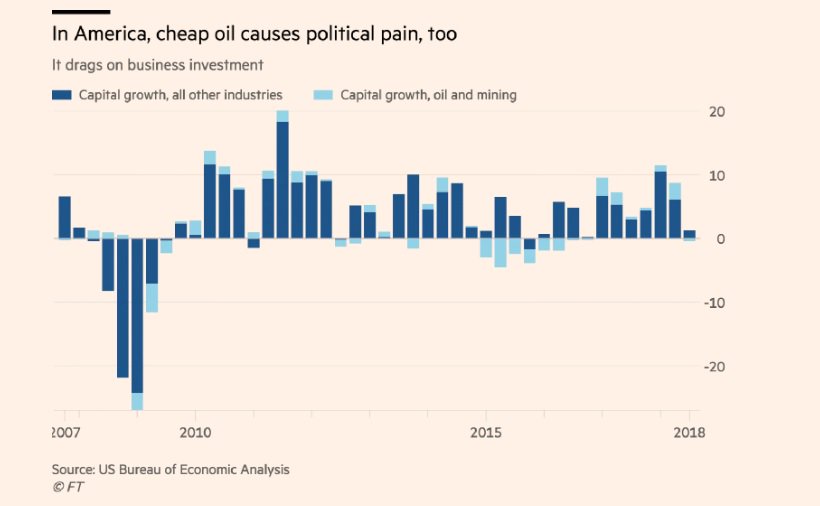

https://twitter.com/realDonaldTrump/status/10652257798255984651) I don't quite recognise the numbers: possibly a mix-up between Brent and WTI. But it is true that crude prices have fallen very sharply since the beginning of October. Brent peaked at over $85 last month, and was below $64 just now