Non-profit, non-partisan research & advocacy for fair taxation / OSBL, non-partisan, recherche et plaidoyer pour équité fiscale

How to get URL link on X (Twitter) App

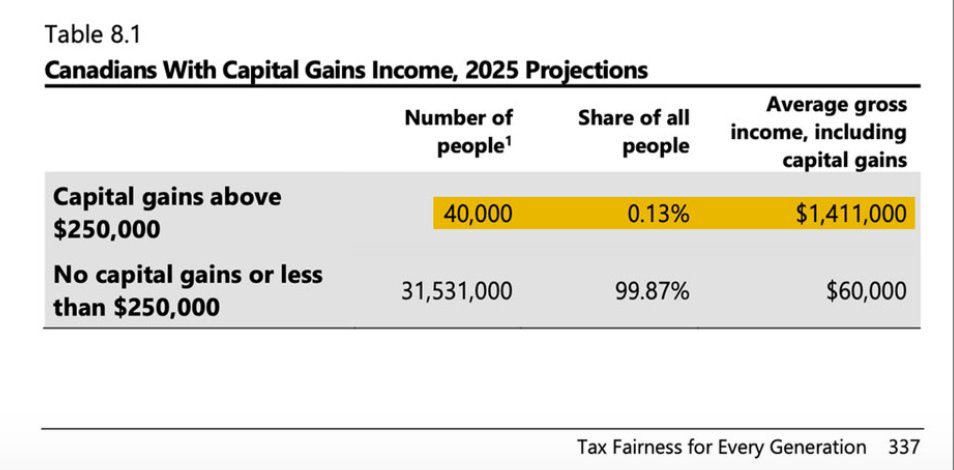

The capital gains inclusion rate will move from 50% to 66% for annual amounts over $250,000. Even better: capital gains inclusion rates for corporations also go from 1/2 to 2/3, with no minimum threshold. #Budget24 #CanPoli

The capital gains inclusion rate will move from 50% to 66% for annual amounts over $250,000. Even better: capital gains inclusion rates for corporations also go from 1/2 to 2/3, with no minimum threshold. #Budget24 #CanPoli