Chasing Pips | Multi-Funded | Daily value

4 subscribers

How to get URL link on X (Twitter) App

Here, you can see inducement of early shorts, then a run into 1Hr OB- running stops on 5min in bearish order flow.

Here, you can see inducement of early shorts, then a run into 1Hr OB- running stops on 5min in bearish order flow.

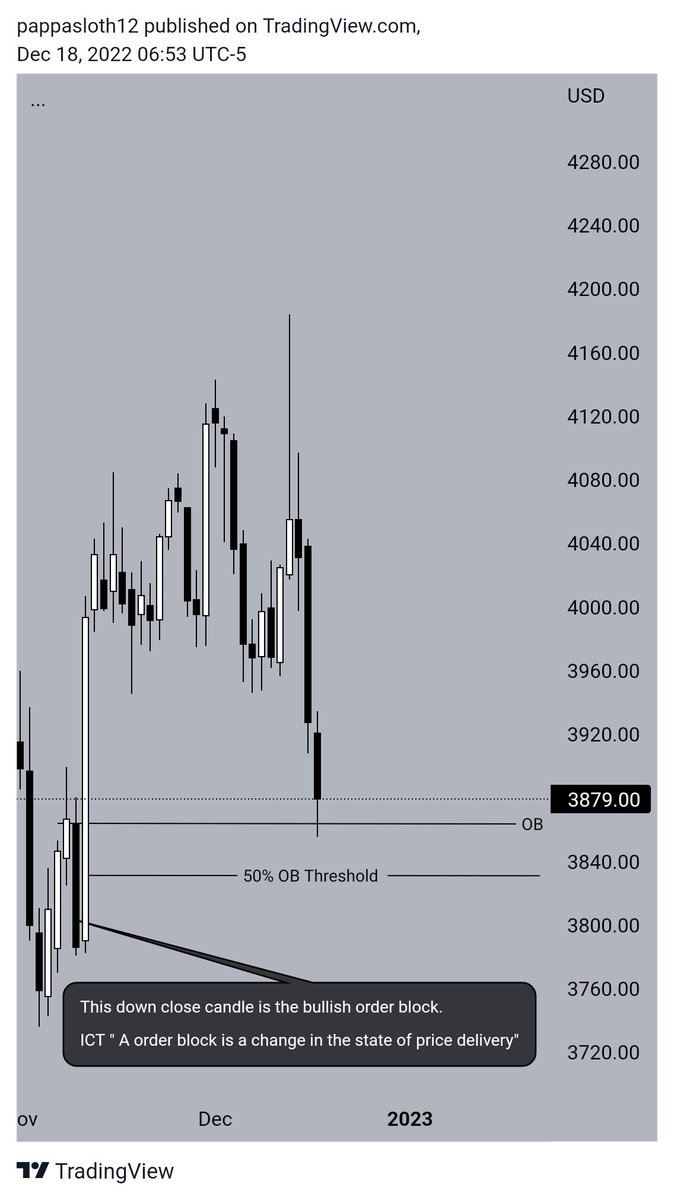

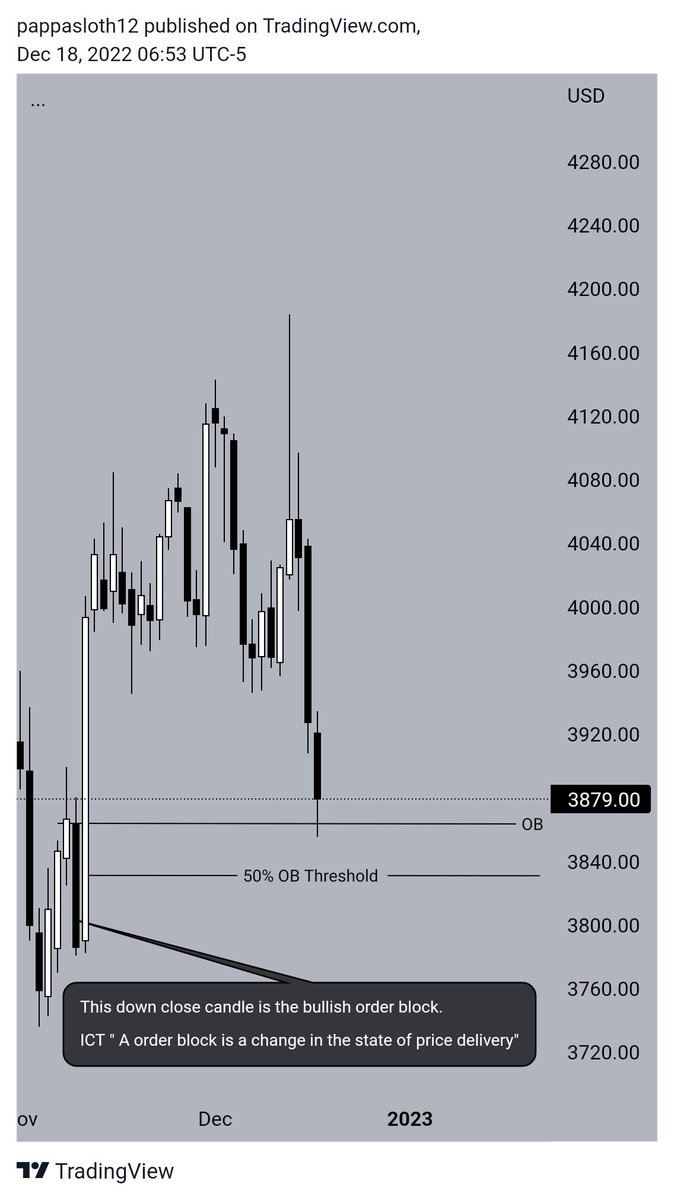

Order block.

Order block.

4H $ES

4H $ES

BASICS & OPENING RANGE.

BASICS & OPENING RANGE.

$ES 20-DAY LOOK BACK.

$ES 20-DAY LOOK BACK.