CIO of ReSolve Asset Management. Tweets and/or views do not represent ReSolve’s investment positioning.

5 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/rjparkerjr09/status/1455950889123041286Large institutions are forced to invest in only the most scalable risk premia: public and private equity, term, credit, and RE. Their only real advantage is potential *access* to better deals. At the limit they converge on the mkt portfolio, with limited capacity for active risk.

2/ Passive commodity investment represents about $300 billion in assets under management. Most of these assets track popular commodity indices like GSCI, Refinitiv/CRB (CRB), Bloomberg (BCOM), and Deutsche Bank Optimal Yield (DBOY).

2/ Passive commodity investment represents about $300 billion in assets under management. Most of these assets track popular commodity indices like GSCI, Refinitiv/CRB (CRB), Bloomberg (BCOM), and Deutsche Bank Optimal Yield (DBOY).

https://twitter.com/GestaltU/status/1341773479578914823Professor @zhanglu_osu very graciously makes dozens of factor strategy return series available for download on his website, global-q.org/testingportfol….

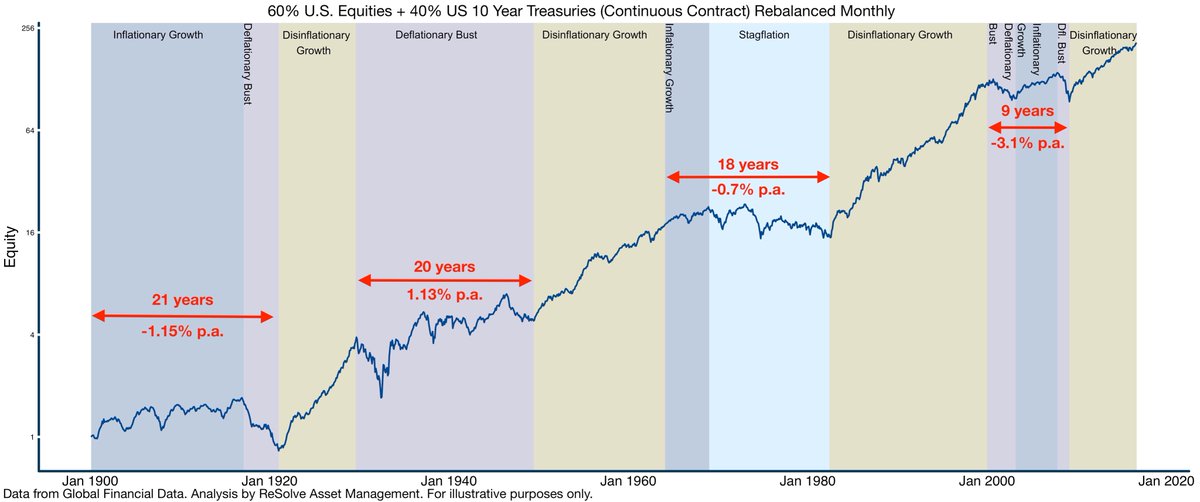

1/ In the current low return environment, a diversified risk parity portfolio with a 2-3 percent rebalancing premium may be an attractive alternative to global 60/40, with the added benefit of owning a diverse set of markets that benefit from a wider range of economic outcomes.

1/ In the current low return environment, a diversified risk parity portfolio with a 2-3 percent rebalancing premium may be an attractive alternative to global 60/40, with the added benefit of owning a diverse set of markets that benefit from a wider range of economic outcomes.

1. Risk Parity (RP) portfolios are designed to achieve reliable investment performance given any trajectory of future growth and inflation shocks. This is in contrast to typical “balanced” stock & bond portfolios like 60/40 which only thrive in periods of disinflationary growth.

1. Risk Parity (RP) portfolios are designed to achieve reliable investment performance given any trajectory of future growth and inflation shocks. This is in contrast to typical “balanced” stock & bond portfolios like 60/40 which only thrive in periods of disinflationary growth.

https://twitter.com/JohnHawver/status/12156215507429171202. While prices are set at the margin, CTA trading (esp. ex-BW) still represents a single-digit proportion of total trading.

2/ Our objectives were twofold:

2/ Our objectives were twofold:

Comparing the performance of Min Vol products vs lowest cost cap-weighted products we see that Min Vol ETFs have dominated lower cost cap-weighted ETFs in compound returns, risk-adjusted returns, drawdowns, and alpha to respective benchmarks since inception in late 2011.

Comparing the performance of Min Vol products vs lowest cost cap-weighted products we see that Min Vol ETFs have dominated lower cost cap-weighted ETFs in compound returns, risk-adjusted returns, drawdowns, and alpha to respective benchmarks since inception in late 2011.

1/We’re 3 articles into a series on portfolio optimization and I’ve been challenged to distill the core themes and make it relevant for practitioners.

1/We’re 3 articles into a series on portfolio optimization and I’ve been challenged to distill the core themes and make it relevant for practitioners.https://twitter.com/GestaltU/status/1026440264913707008