#1 Energy Research Service on Seeking Alpha: https://t.co/Nns2a1CnGk

4 subscribers

How to get URL link on X (Twitter) App

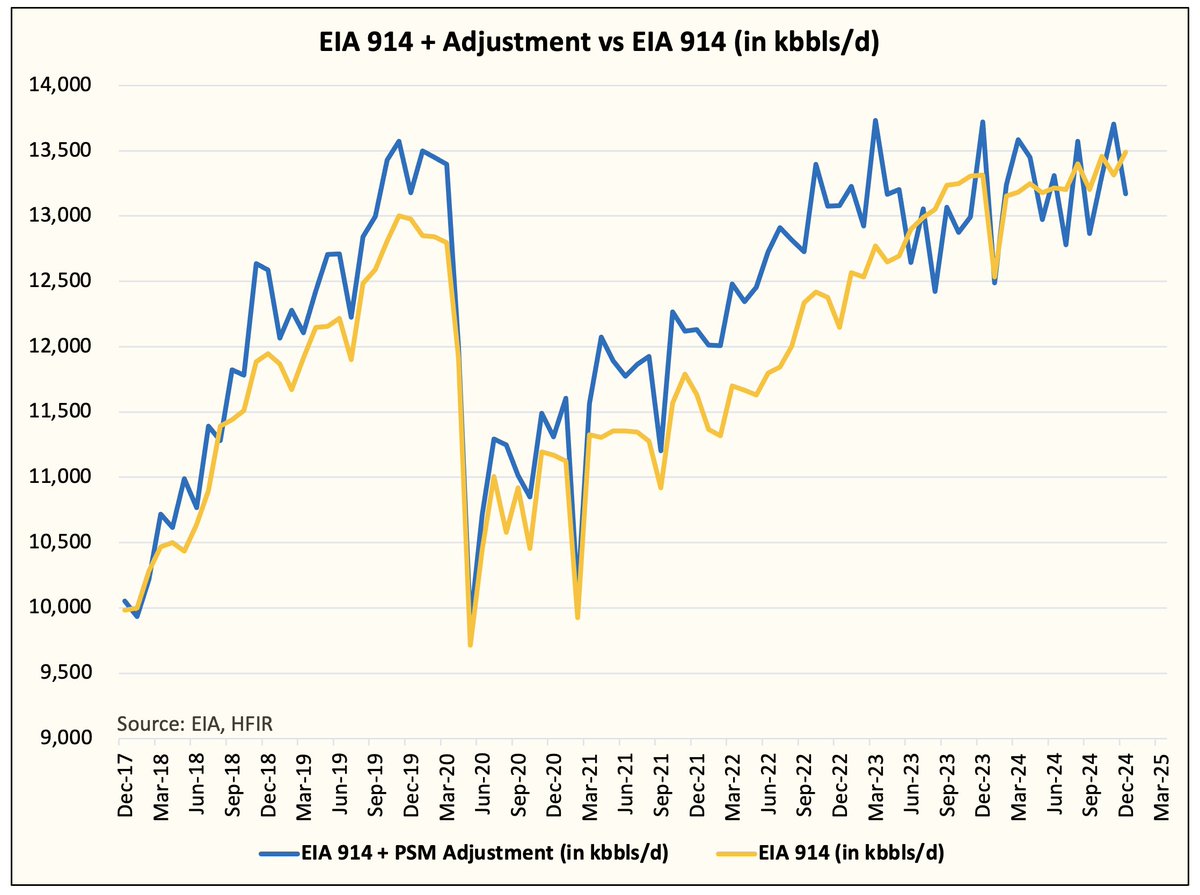

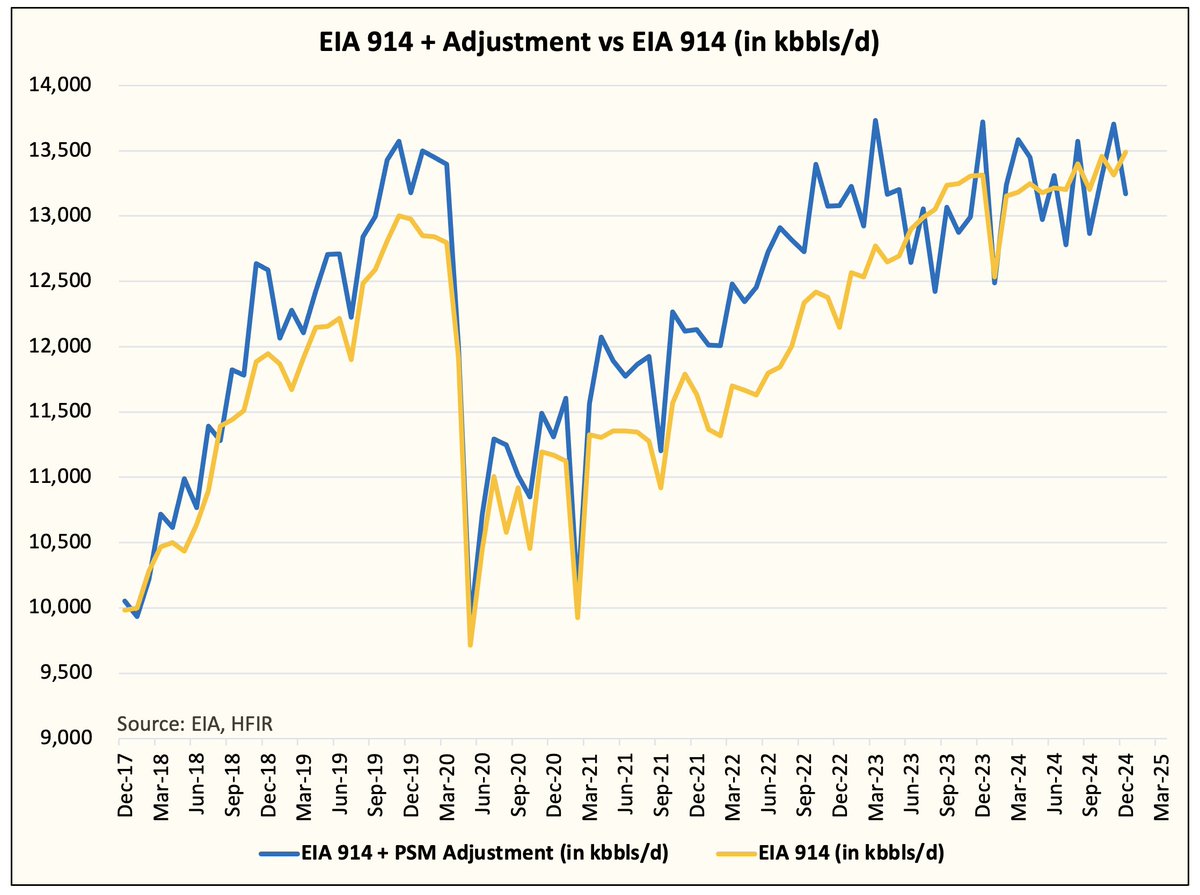

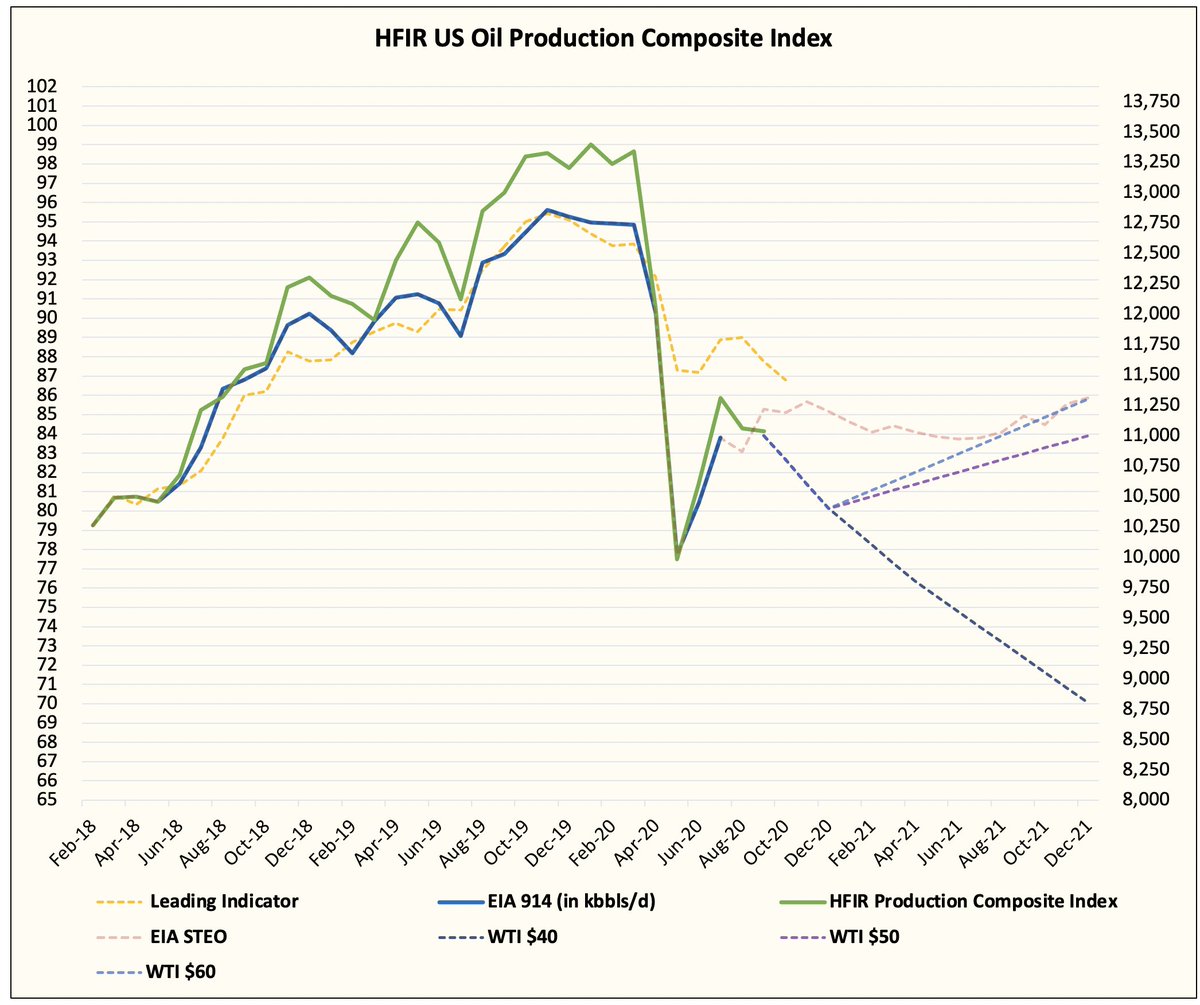

The adjustment serves as a balancing factor for the equation.

The adjustment serves as a balancing factor for the equation.

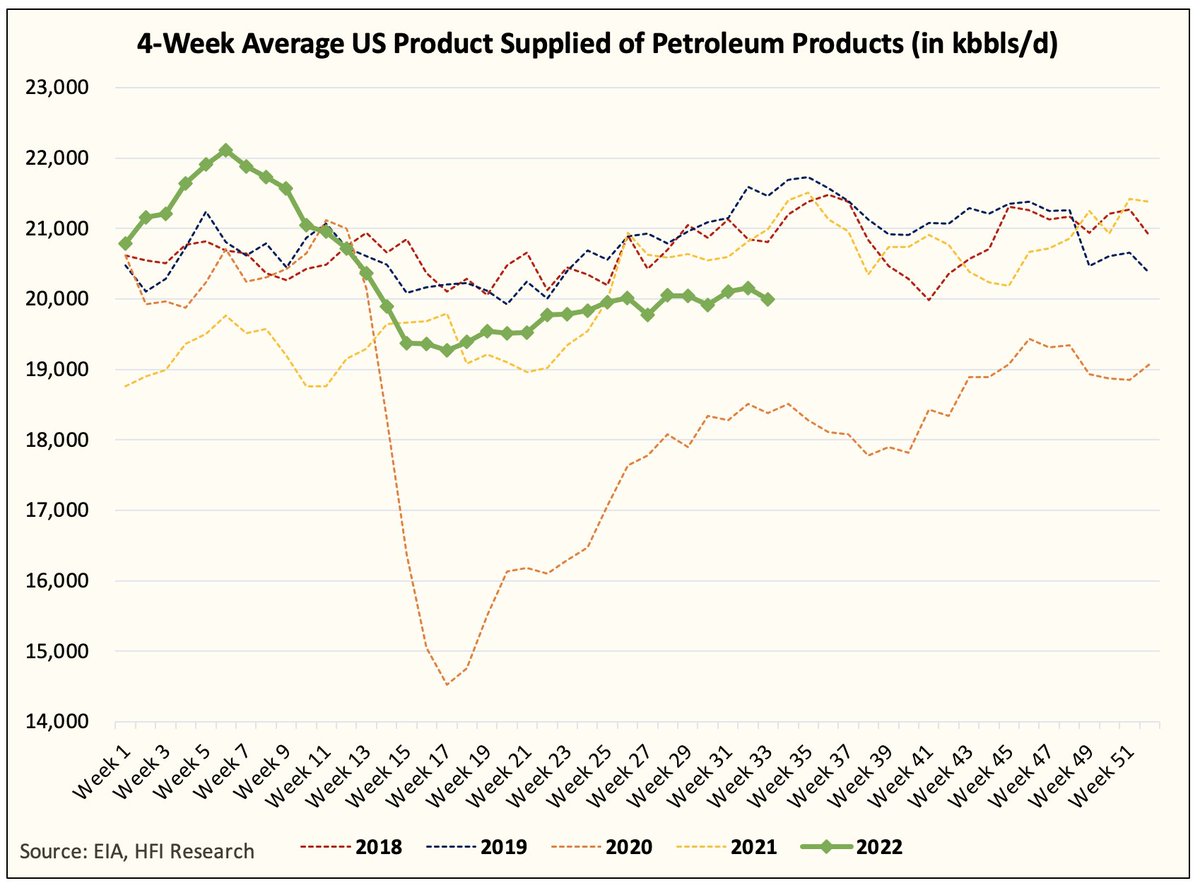

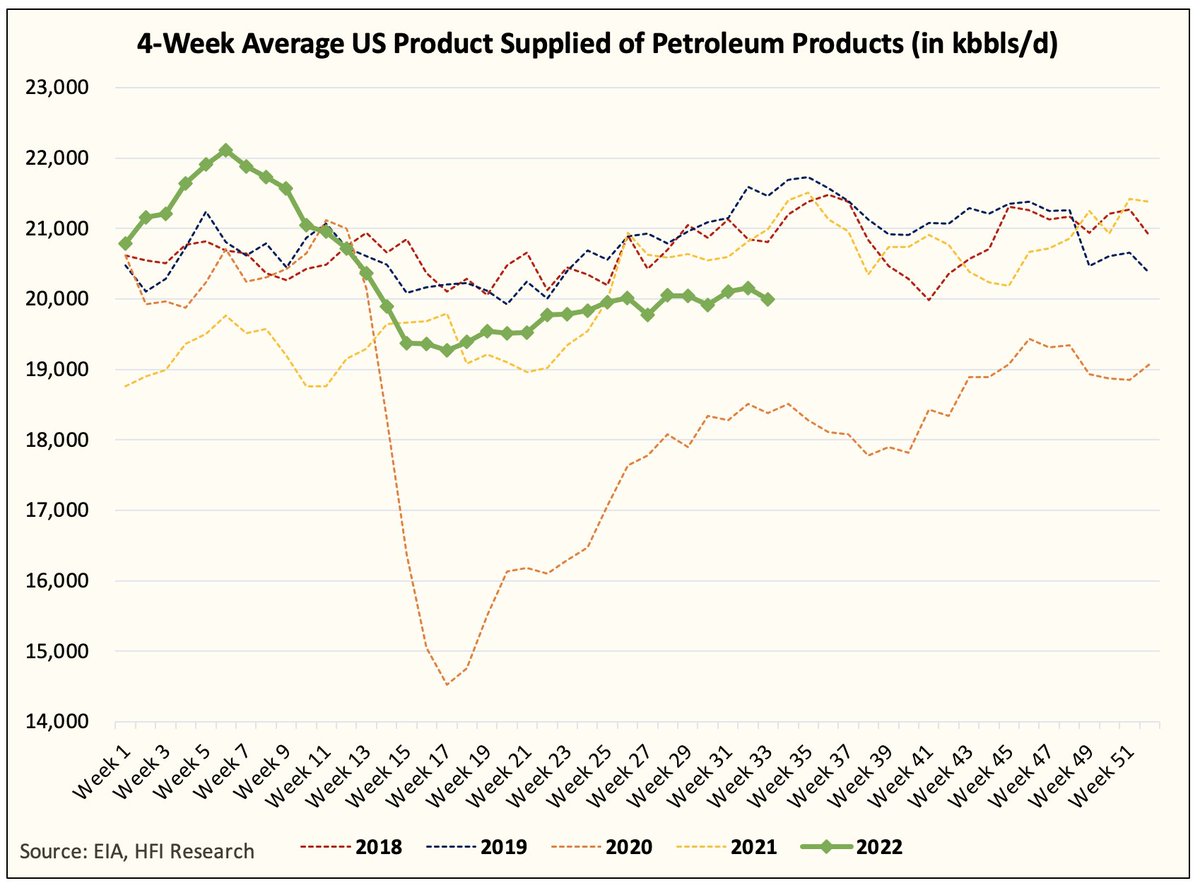

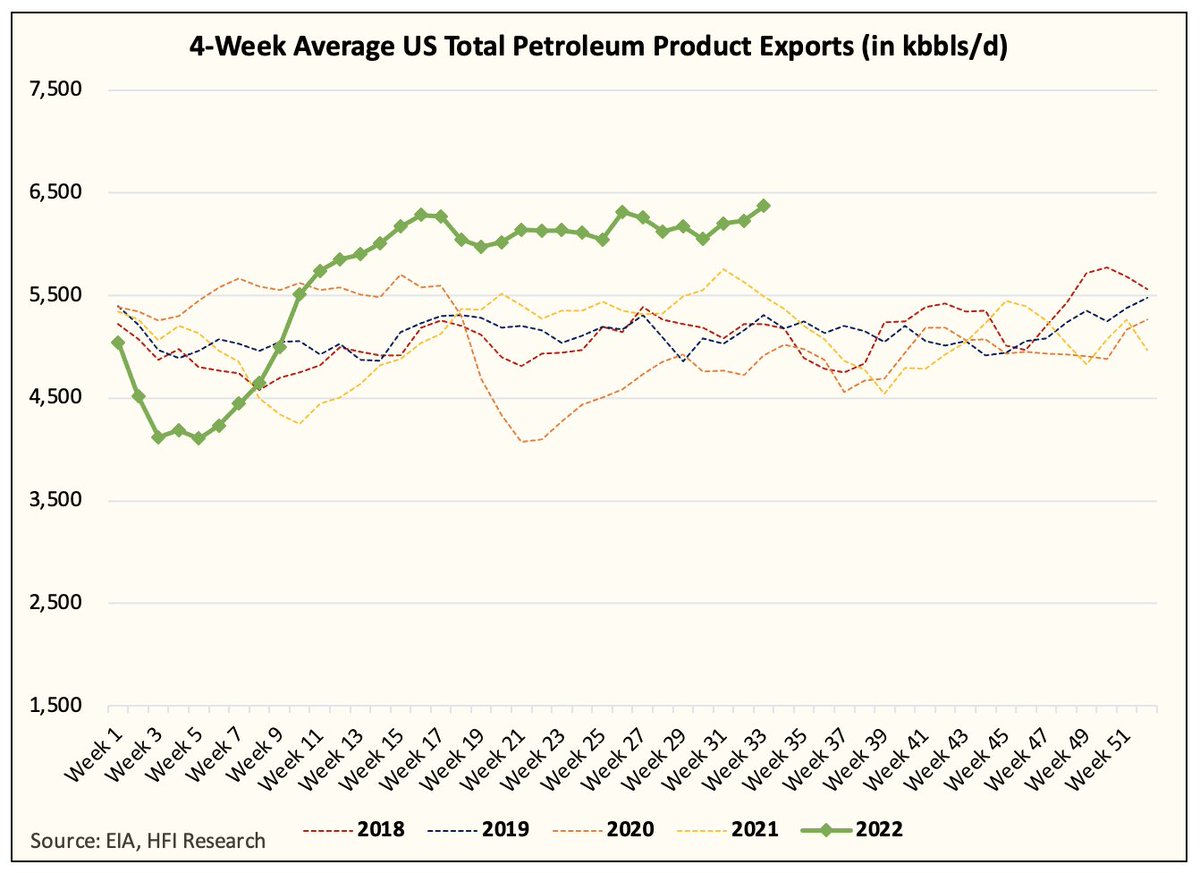

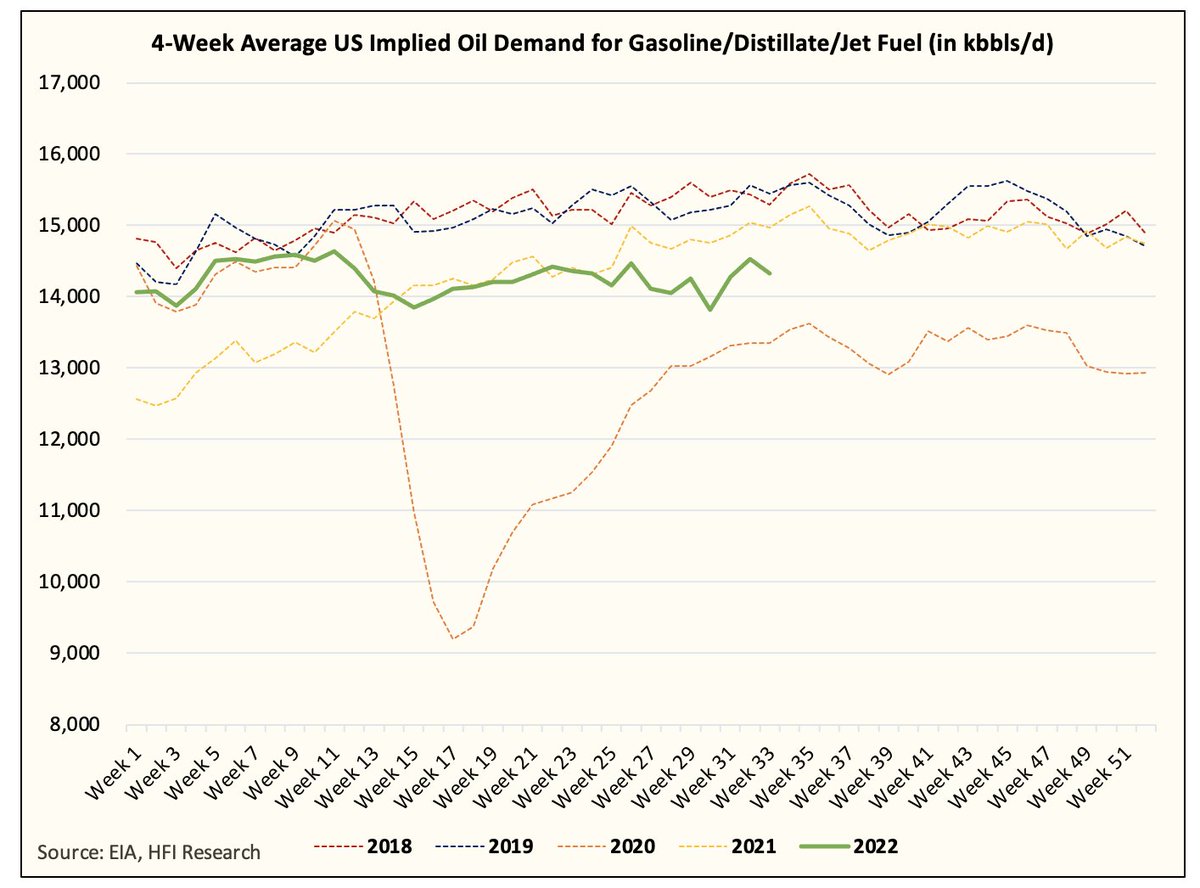

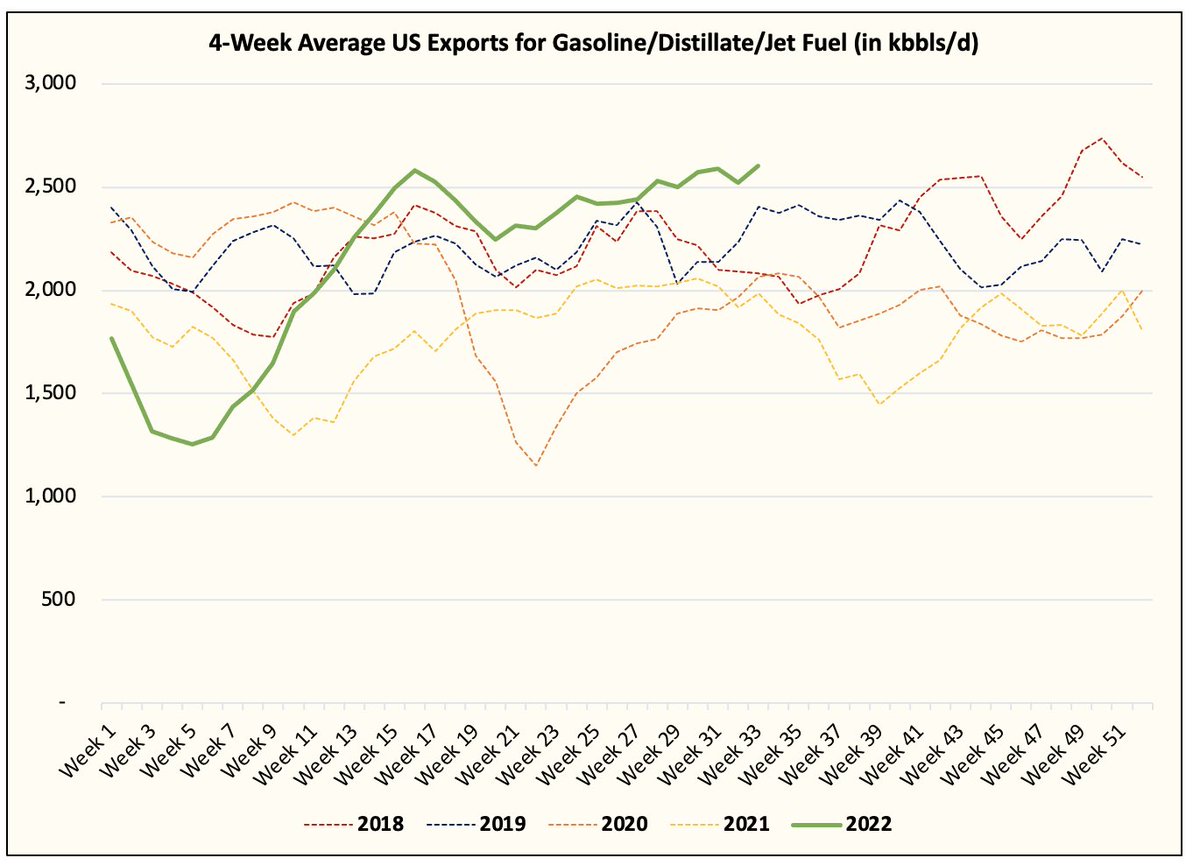

Demand is slightly lower y-o-y, but the issue here is that if product exports are overstated, then it inherently lowers the "implied" demand domestically. That's the reason why when EIA understates exports, implied demand jumps and vice versa.

Demand is slightly lower y-o-y, but the issue here is that if product exports are overstated, then it inherently lowers the "implied" demand domestically. That's the reason why when EIA understates exports, implied demand jumps and vice versa.

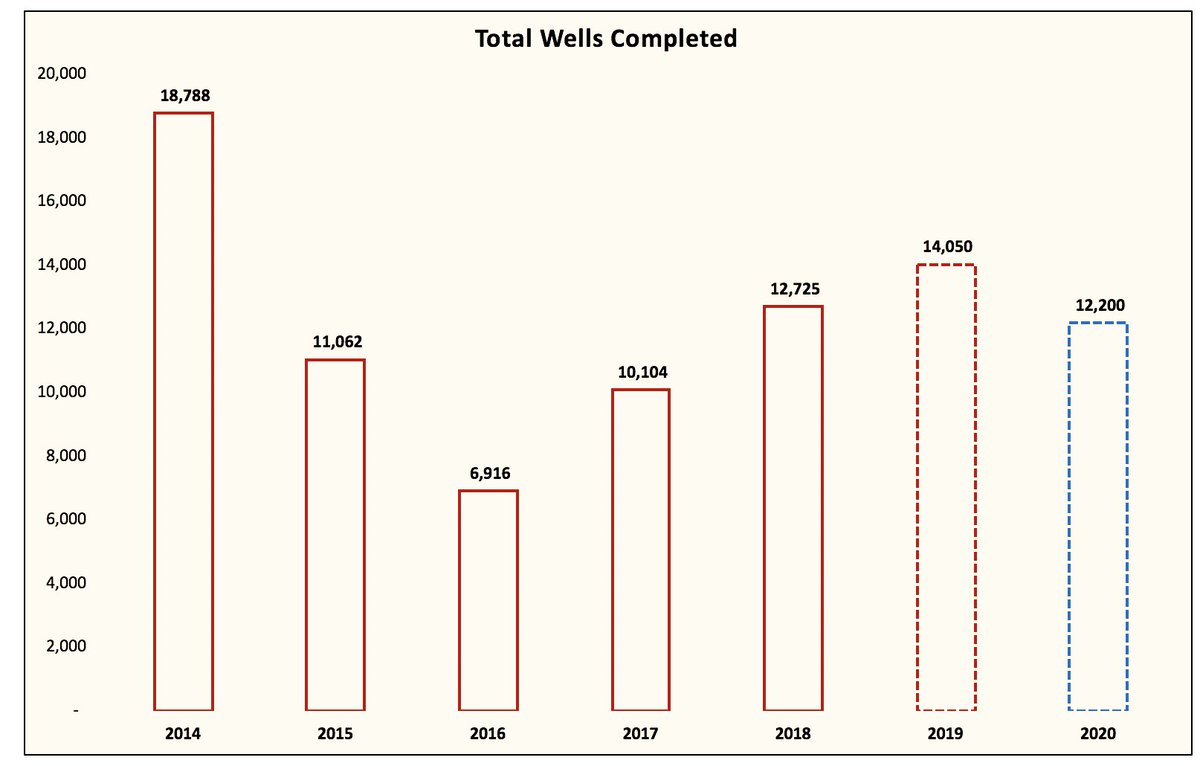

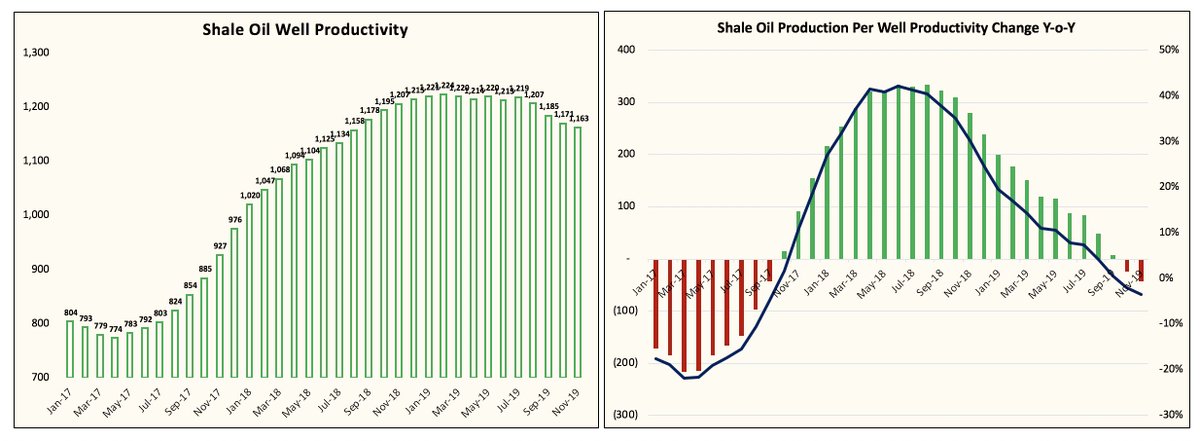

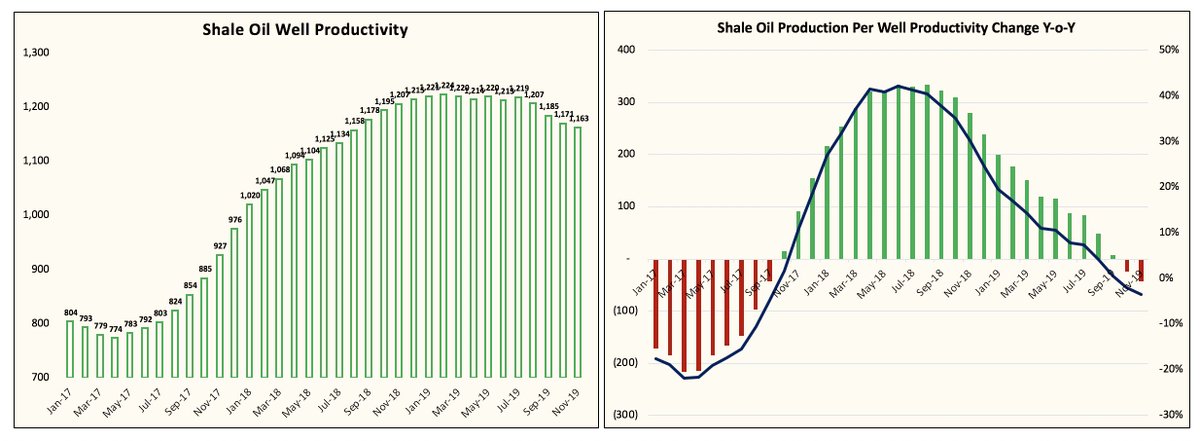

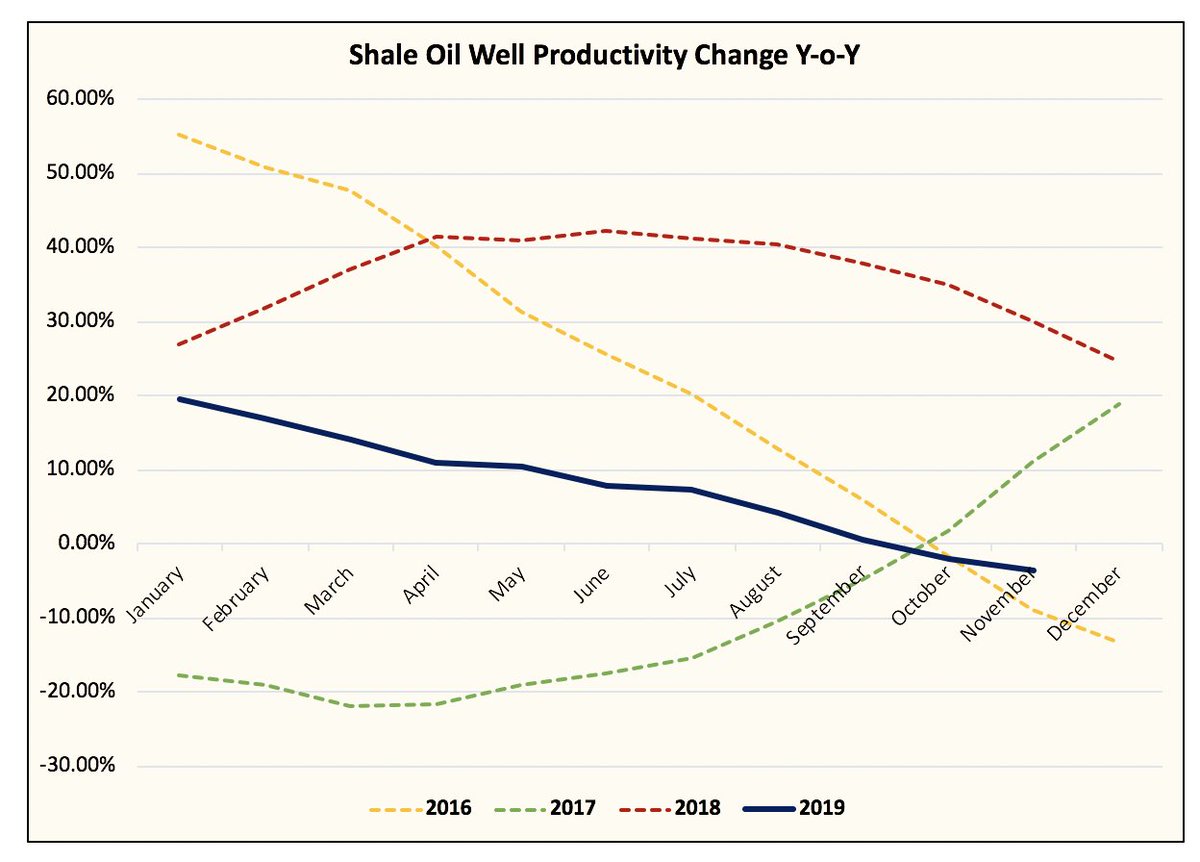

Estimated 2020 using ~12.2k well completions.

Estimated 2020 using ~12.2k well completions.