Private Investor in Resource sector. Tweet about Energy transition and investments.

3 subscribers

How to get URL link on X (Twitter) App

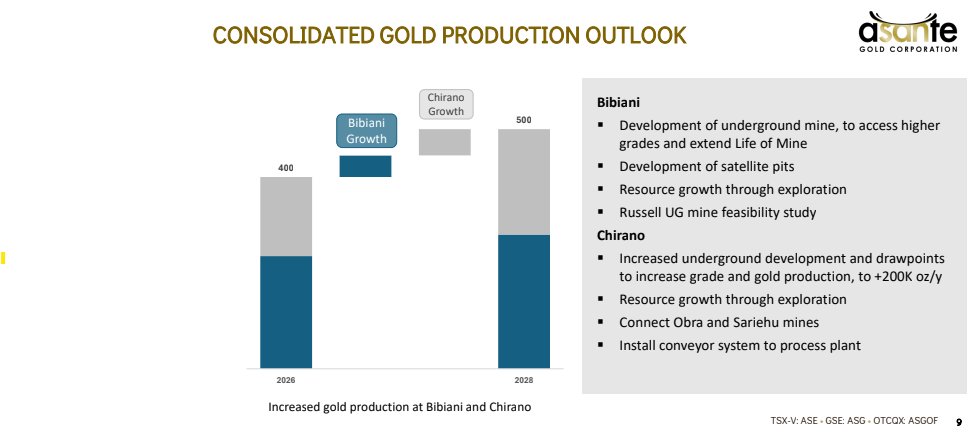

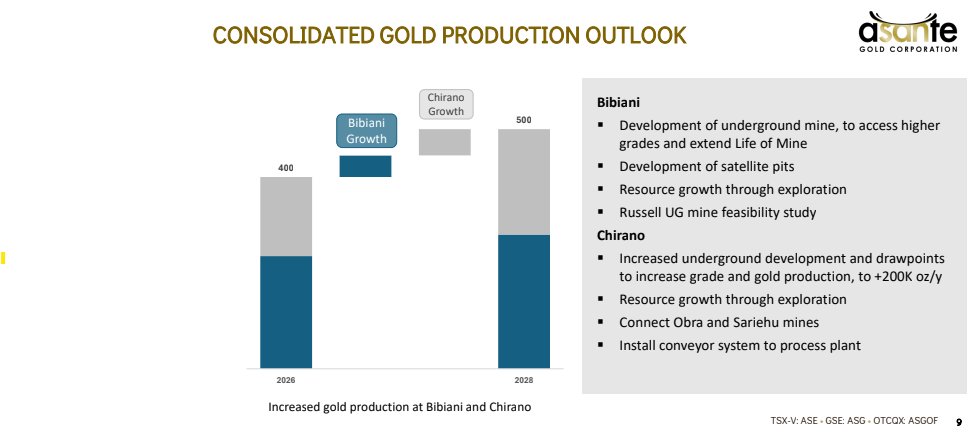

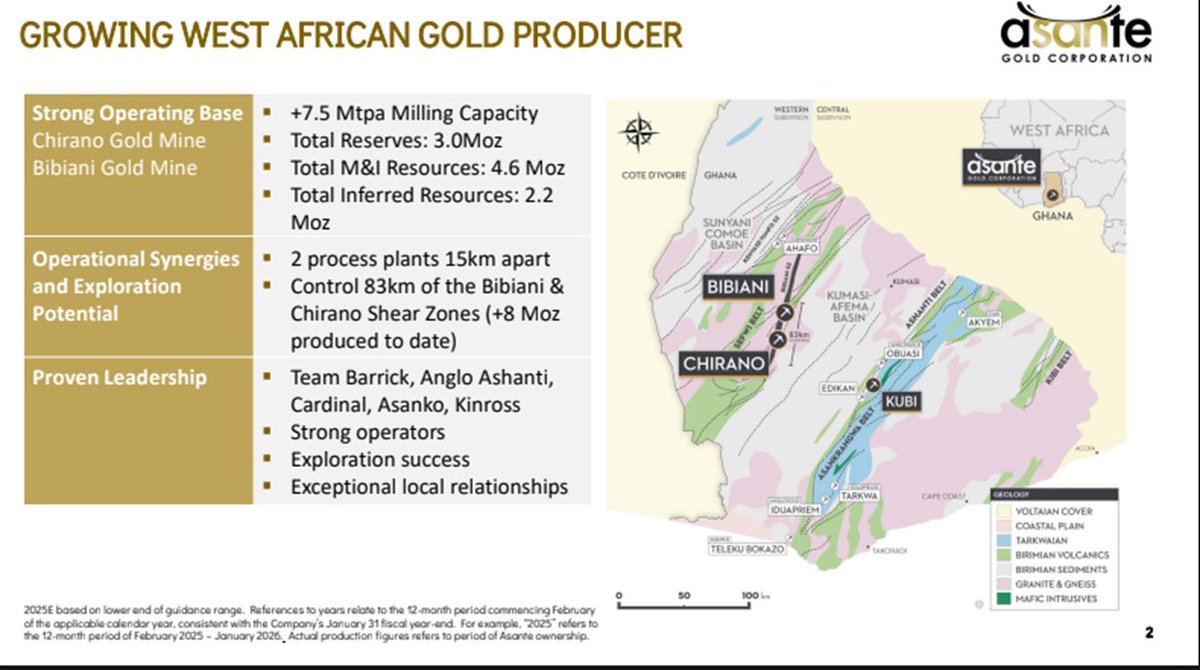

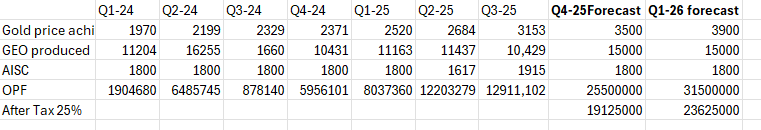

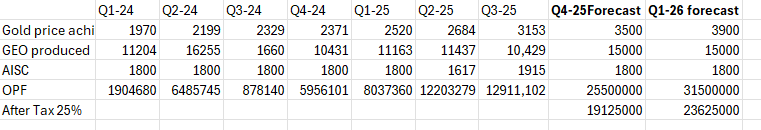

2025 Asante suffered from high costs due to a lot of waste mining and delays. Share price was under pressure from need to bring in capital, delays and additional PP at low price. Ghana will also likely increase royalties by 5%. This caused share price to lag the gold price. 2/x

2025 Asante suffered from high costs due to a lot of waste mining and delays. Share price was under pressure from need to bring in capital, delays and additional PP at low price. Ghana will also likely increase royalties by 5%. This caused share price to lag the gold price. 2/x

Minem reaches agreements on station 5 with indigenous organizations in Loreto. Important step to get ONP back online, that can enable Petrotal to produce 20-25k bopd and receive the true-up payments. #PTAL $TAL.V andina.pe/agencia/notici…

Minem reaches agreements on station 5 with indigenous organizations in Loreto. Important step to get ONP back online, that can enable Petrotal to produce 20-25k bopd and receive the true-up payments. #PTAL $TAL.V andina.pe/agencia/notici…

Here is an overview of the transaction. $VLE acquire Thai oil asset from bankrupt KrisEnergy for $3.1m initial payment. The Wassana oilfield is expected to produce 3000 bopd after reactivation, field was shut-in during 2020 oil-crash. After reactivation 9m$ quarterly CF expected.

Here is an overview of the transaction. $VLE acquire Thai oil asset from bankrupt KrisEnergy for $3.1m initial payment. The Wassana oilfield is expected to produce 3000 bopd after reactivation, field was shut-in during 2020 oil-crash. After reactivation 9m$ quarterly CF expected.

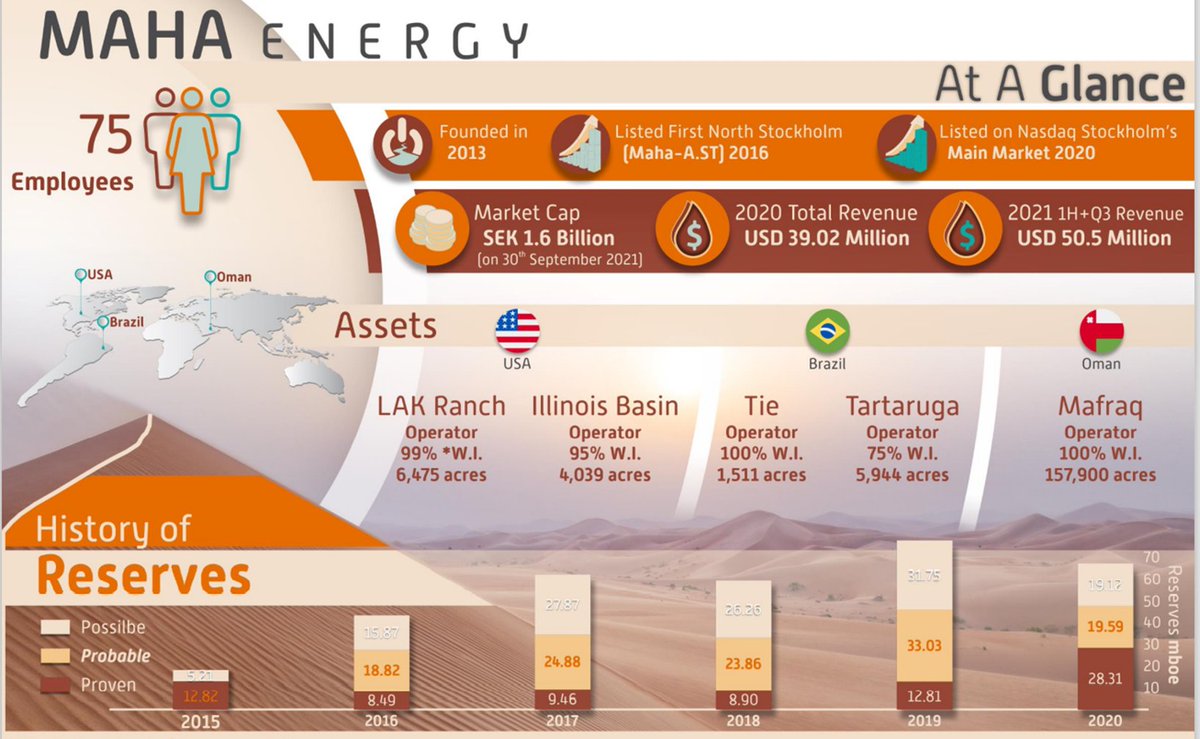

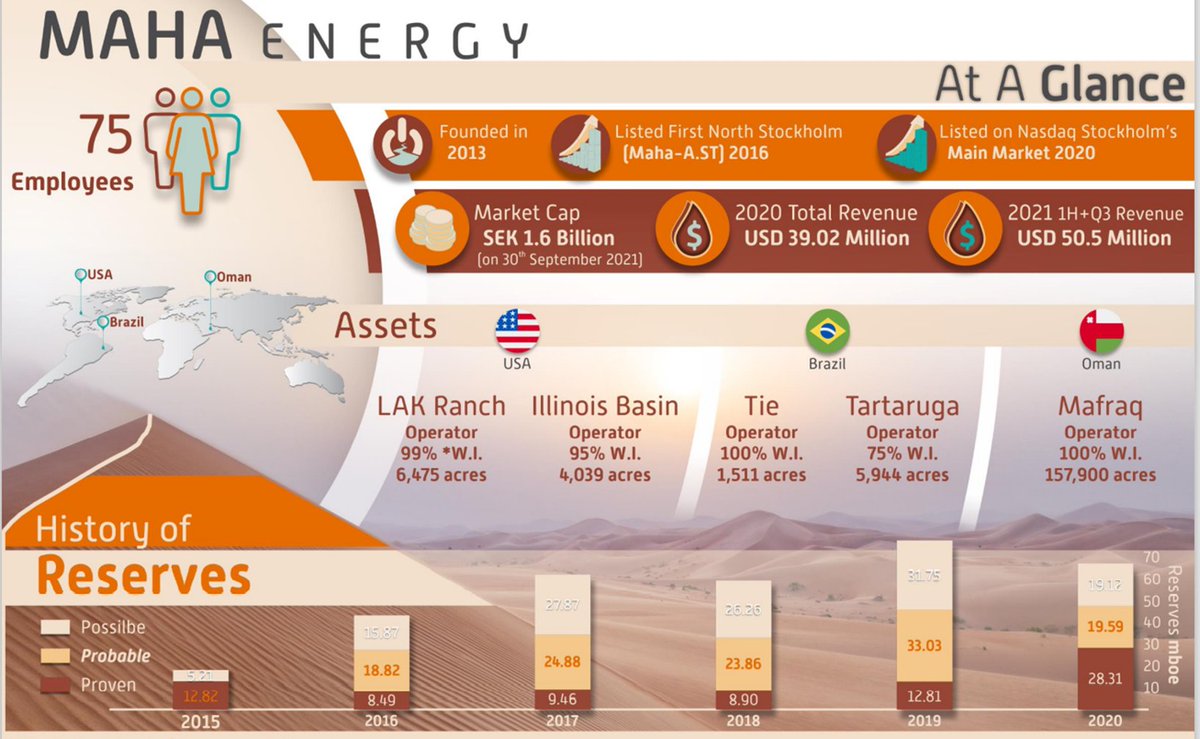

The stronger production from TIE and high oil price will in my view get MaHa 2022 results to outperform previous years results by 200-300% and trade EV/EBITDA<2. Oman field will also enable future growth and MaHa could reach 10k bopd in 2023/2024. (2/4)

The stronger production from TIE and high oil price will in my view get MaHa 2022 results to outperform previous years results by 200-300% and trade EV/EBITDA<2. Oman field will also enable future growth and MaHa could reach 10k bopd in 2023/2024. (2/4)