Official Account of the Income Tax Department, Government of India

3 subscribers

How to get URL link on X (Twitter) App

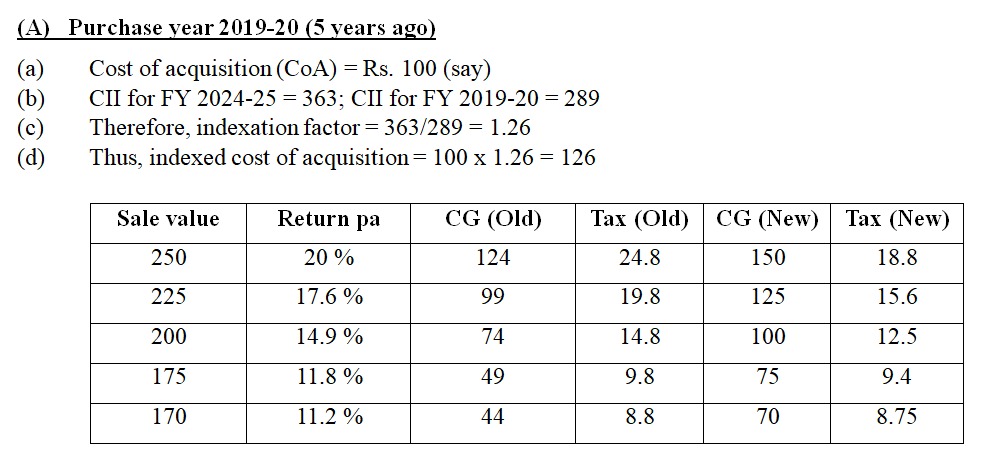

"Let’s Learn Tax"

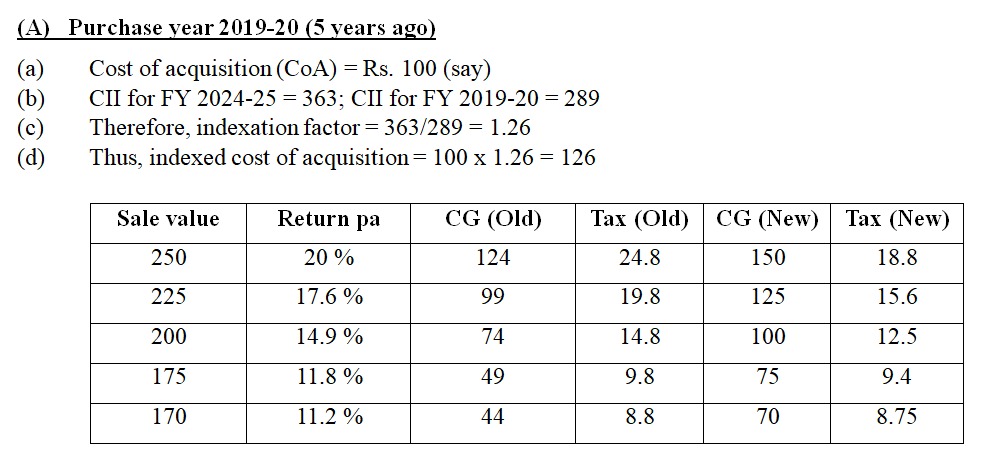

"Let’s Learn Tax"

The due date for furnishing of ITRs for the taxpayers who are required to furnish report in respect of international/specified domestic transactions has been extended to 31st January, 2021 (2/5)

The due date for furnishing of ITRs for the taxpayers who are required to furnish report in respect of international/specified domestic transactions has been extended to 31st January, 2021 (2/5)