Investing & sharing insights on B2B tech. 10yrs as ex. Citadel, Millennium, Tiger cub.

Founder & PM of Spear Alpha ETF $SPRX. Disclosure: https://t.co/g80M93SeiW

5 subscribers

How to get URL link on X (Twitter) App

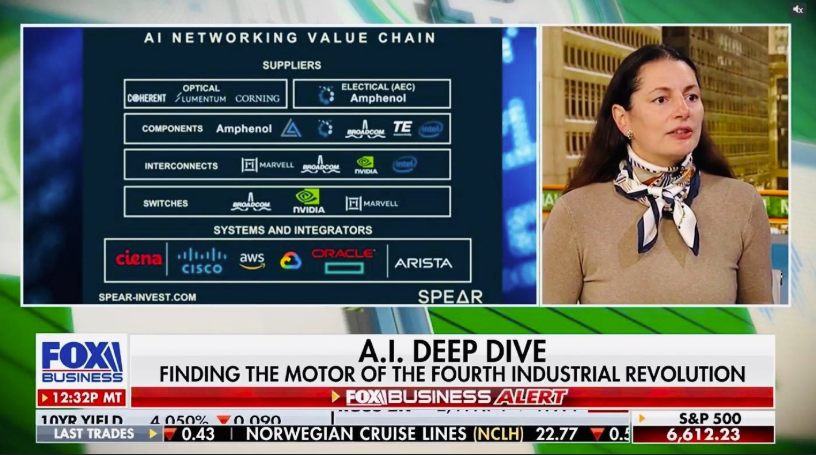

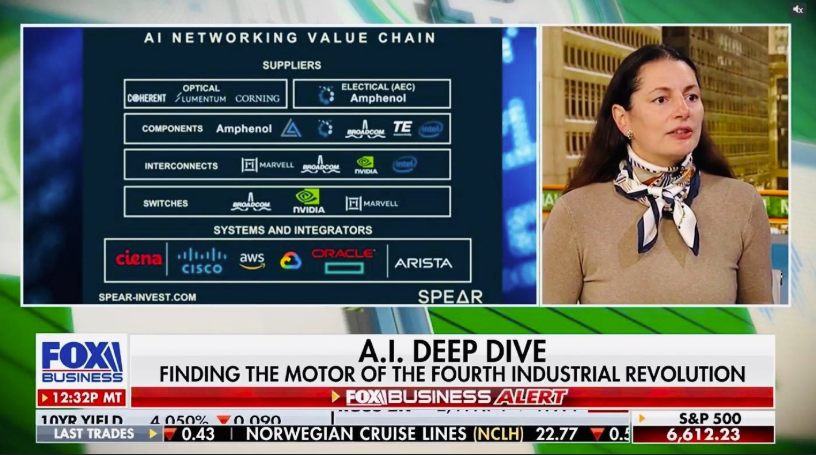

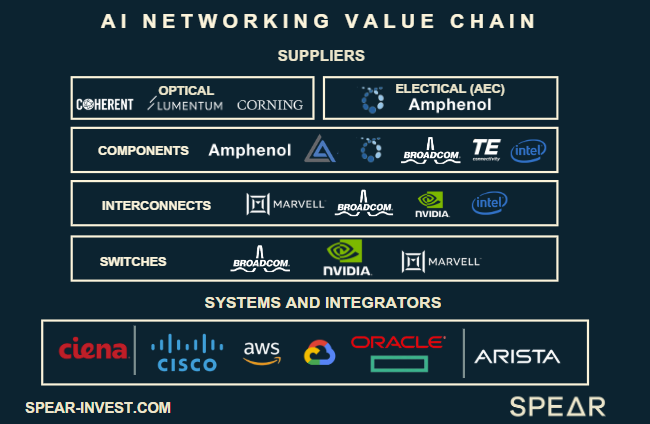

Every time a new accelerator gains traction e.g., $GOOGL TPUs, $AMD MI 400, $AMZN Trainium, it's a massive positive for the Networking value chain.

Every time a new accelerator gains traction e.g., $GOOGL TPUs, $AMD MI 400, $AMZN Trainium, it's a massive positive for the Networking value chain.

3Q'24 was a brutal quarter with macro headwinds (e.g., carry trade unwind, election uncertainty, and interest rate concerns) dominating the headlines.

3Q'24 was a brutal quarter with macro headwinds (e.g., carry trade unwind, election uncertainty, and interest rate concerns) dominating the headlines.

1. We attended several events over the past month, gathering edgy data points re: Blackwell and the value chain:

1. We attended several events over the past month, gathering edgy data points re: Blackwell and the value chain:

Earlier this month @Nvidia added a new slide to their investor deck.

Earlier this month @Nvidia added a new slide to their investor deck.

The fundamental pillar of the $MU thesis is that HBM (high bandwidth memory) takes up the available capacity of DRAM (traditional memory).

The fundamental pillar of the $MU thesis is that HBM (high bandwidth memory) takes up the available capacity of DRAM (traditional memory).

1. Hopper - while many were expecting "an air pocket" in demand for the H100, earnings calls are pointing to shortages:

1. Hopper - while many were expecting "an air pocket" in demand for the H100, earnings calls are pointing to shortages:

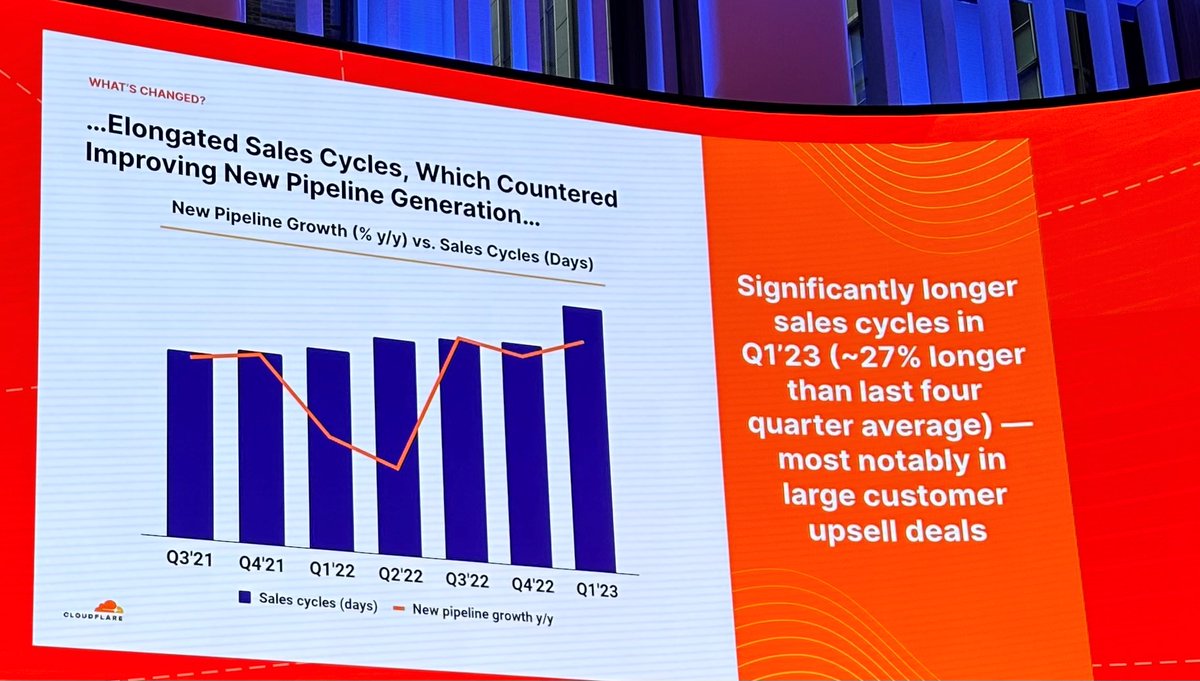

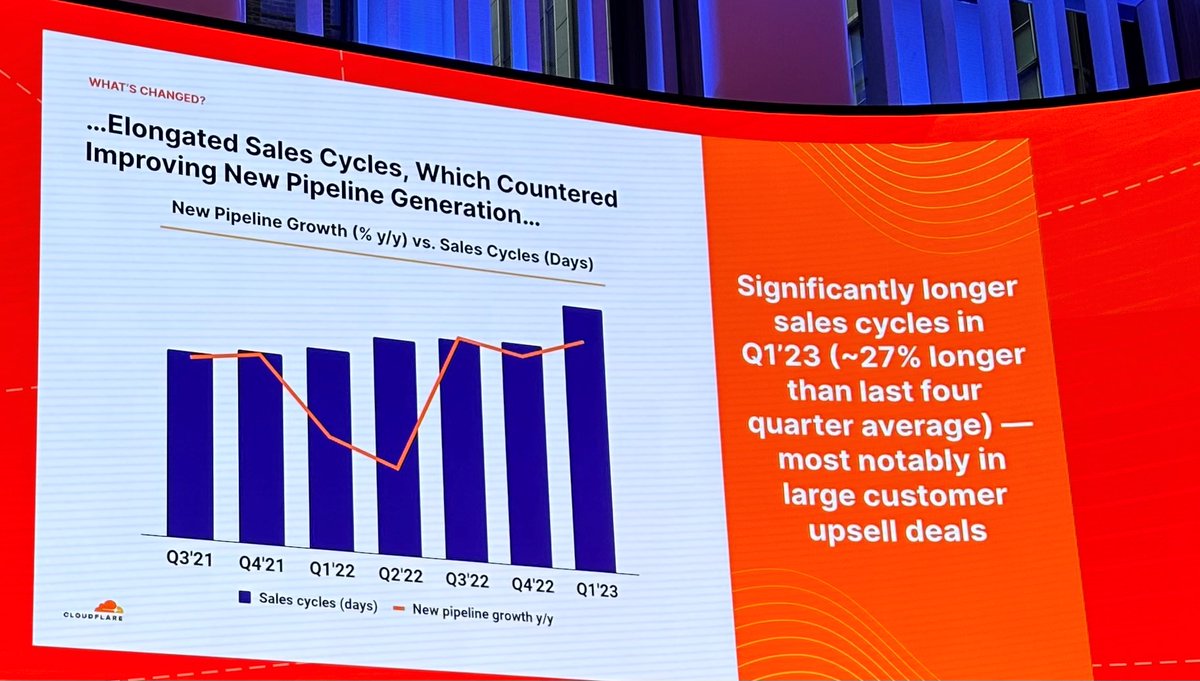

The main point from their conference is that the environment has not worsened.

The main point from their conference is that the environment has not worsened.

SPRX was up 88.02% in 2023 compared to the S&P 500, up 26.26%, and the Nasdaq Composite, up 44.70%.

SPRX was up 88.02% in 2023 compared to the S&P 500, up 26.26%, and the Nasdaq Composite, up 44.70%.

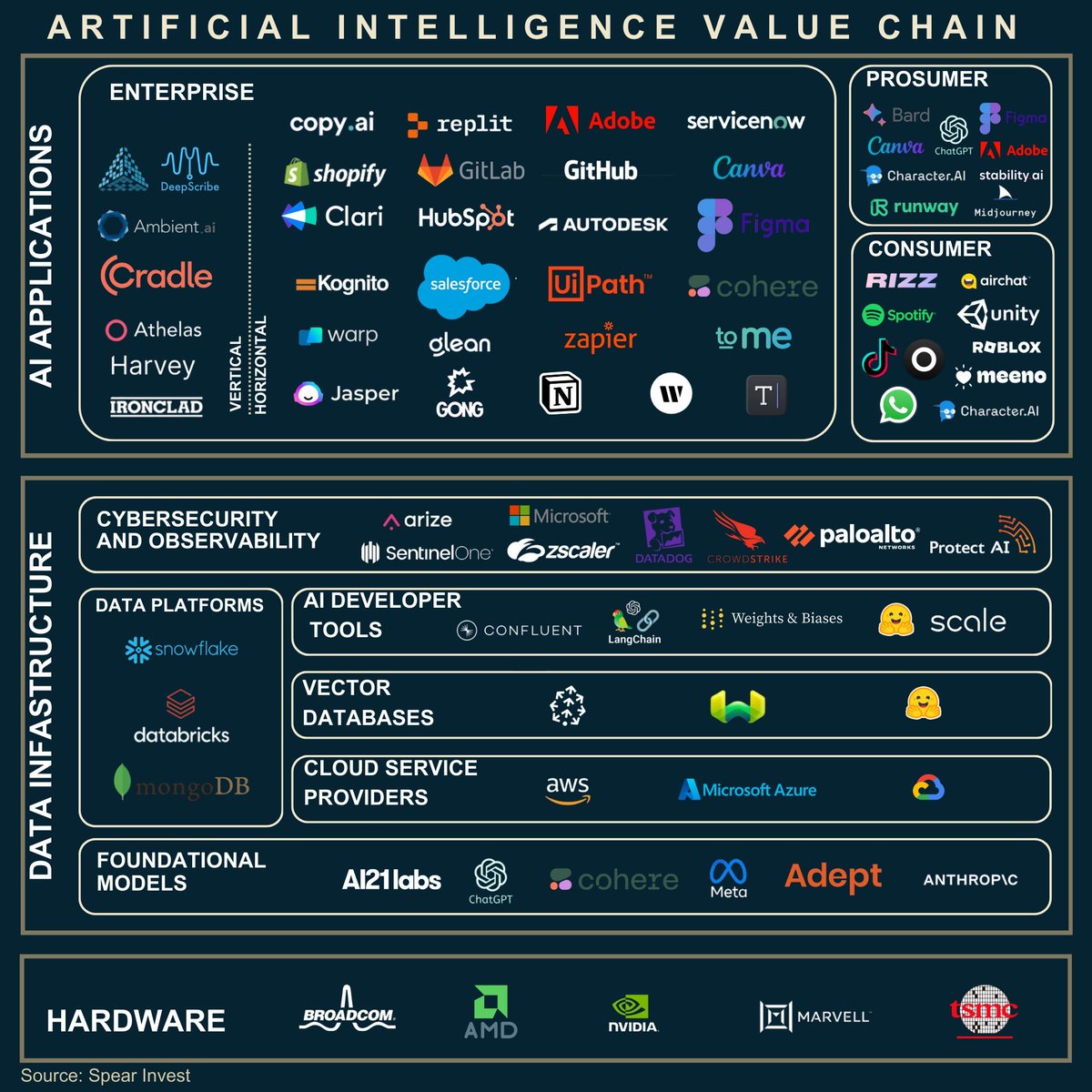

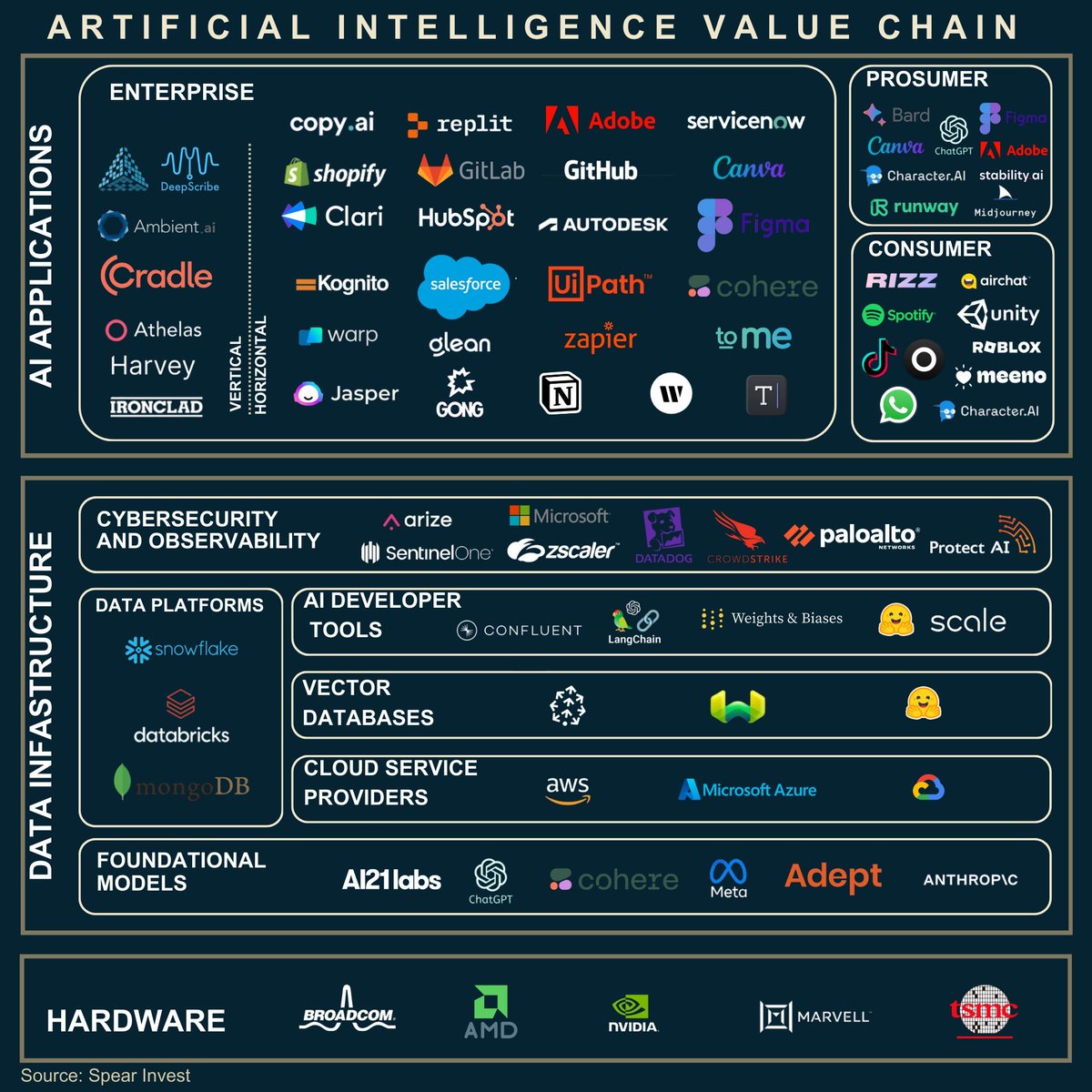

1. The Hardware Layer:

1. The Hardware Layer: