Bitcoin, Bitcoin Mining and Sustainability, Economist

Lead researcher at @melaniongreen

Newsletter: Bits of Bitcoin Research

⚡bitcoinishope@getalby.com ⚡

How to get URL link on X (Twitter) App

🇬🇧To the English newsletter this way. 👇

🇬🇧To the English newsletter this way. 👇

…coinmarketintelligenceen.substack.com/p/bitcoin-mark…

…coinmarketintelligenceen.substack.com/p/bitcoin-mark…

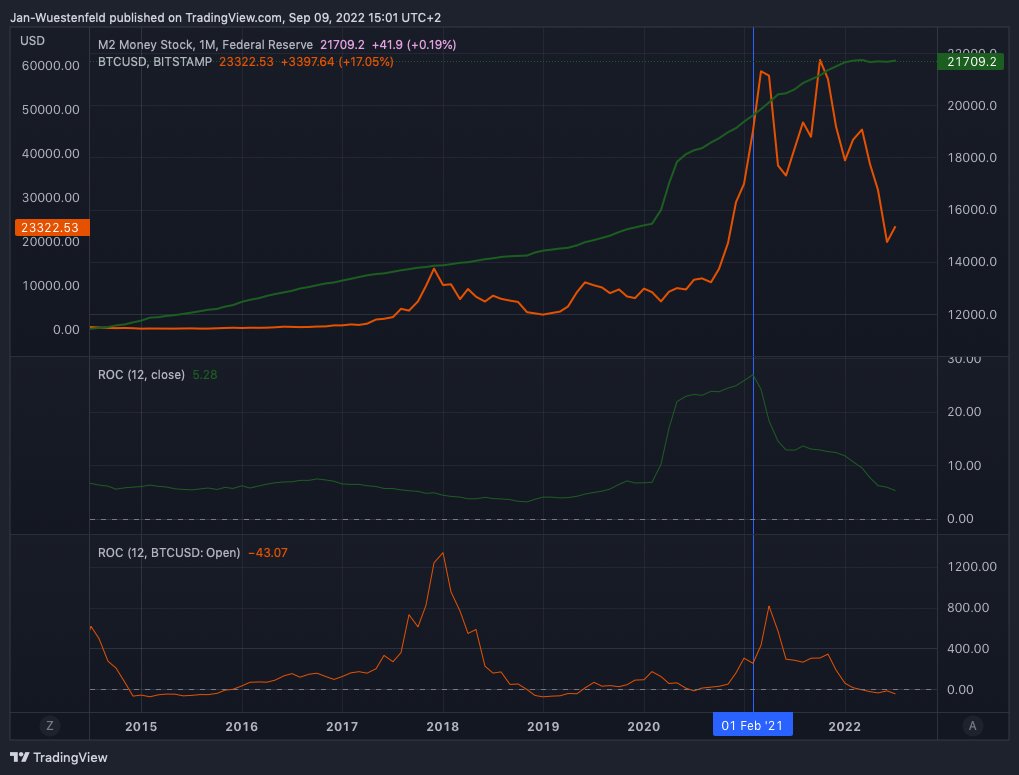

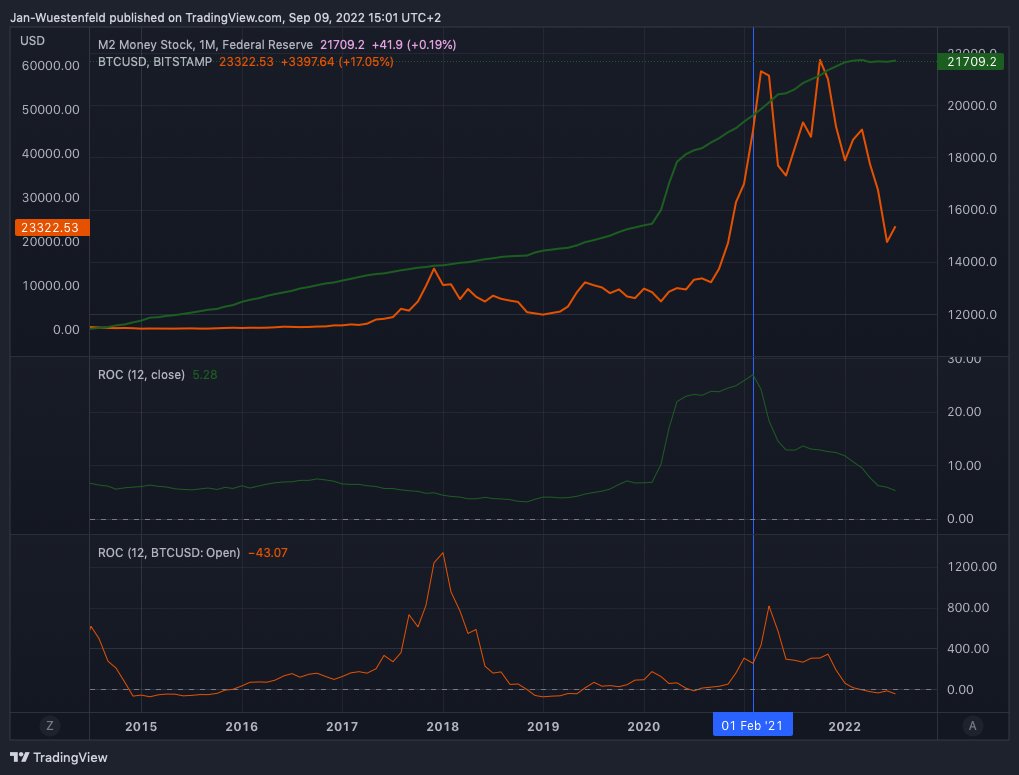

To me, it seems like it is working as it should. The growth of the money supply is accelerating and bitcoin's price follows. Central banks step on the brakes and bitcoin follows.

To me, it seems like it is working as it should. The growth of the money supply is accelerating and bitcoin's price follows. Central banks step on the brakes and bitcoin follows.

The value transacted on-chain has been picking up a bit on the second price peak in late 2021 but remained below that of the first peak. Currently it is closer to the capitulation levels after #Bitcoin's first ATH in 2021

The value transacted on-chain has been picking up a bit on the second price peak in late 2021 but remained below that of the first peak. Currently it is closer to the capitulation levels after #Bitcoin's first ATH in 2021

Looking at raw OI (OI that does not fluctuate in value based on #Bitcoin's price fluctuations), we can see that coin-margined contracts have decreased strongly. In contrast, stablecoin-margined contracts continue to be at high levels.

Looking at raw OI (OI that does not fluctuate in value based on #Bitcoin's price fluctuations), we can see that coin-margined contracts have decreased strongly. In contrast, stablecoin-margined contracts continue to be at high levels.

So #Bitcoin's supply can get overall thinner, but it does not have to be reflected in the price right now. Price action suggests that those in control of price currently are the ones that see bitcoin as a high-risk asset.

So #Bitcoin's supply can get overall thinner, but it does not have to be reflected in the price right now. Price action suggests that those in control of price currently are the ones that see bitcoin as a high-risk asset.

This shows once more that, even if we don't want it to be true, $BTC is not isolated from what is happening in the economy or what the FED is doing. Particularly the fact that Bitcoin is moving down with stocks etc., is somewhat concerning.

This shows once more that, even if we don't want it to be true, $BTC is not isolated from what is happening in the economy or what the FED is doing. Particularly the fact that Bitcoin is moving down with stocks etc., is somewhat concerning.

AUM then started to stall and even partially to decline since July. After #Bitcoin's price breaching a new ATH in October, interest has been coming back again, and AUM has started to increase a bit more substantially.

AUM then started to stall and even partially to decline since July. After #Bitcoin's price breaching a new ATH in October, interest has been coming back again, and AUM has started to increase a bit more substantially.

the rather exceptional decline in $BTC reserves held on exchanges during this cycle. While it was already exceptional as of the time of the writing of the article, the continuation of the decline after a period of inflows underlines the difference of this cycle to the previous /2

the rather exceptional decline in $BTC reserves held on exchanges during this cycle. While it was already exceptional as of the time of the writing of the article, the continuation of the decline after a period of inflows underlines the difference of this cycle to the previous /2