Jungle Rock is a systematic investment research and technology company. It runs a fintech platform for all market participants. @JungleRockCap

157 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/wifeyalpha/status/1544633358428344321

Fire and Ice: Confronting the Twin Perils of Inflation and Deflation

Fire and Ice: Confronting the Twin Perils of Inflation and Deflation

We estimate calendar-spread trading accounts on average for more than 50% and 30% of the overall trading volume in commodity and interest rate futures markets respectively. Similarly, less than 70% of the total open interest of rates and commodity futures is held directionally.

We estimate calendar-spread trading accounts on average for more than 50% and 30% of the overall trading volume in commodity and interest rate futures markets respectively. Similarly, less than 70% of the total open interest of rates and commodity futures is held directionally.

VolQ 3 Rs Research Process

VolQ 3 Rs Research Process

Global macro strategies have a positive skew in returns distribution. The positive skew, however, is not a guarantee of positive returns, as global macro strategies are still exposed to left tail risks, particularly during periods of market turbulence or unexpected events.

Global macro strategies have a positive skew in returns distribution. The positive skew, however, is not a guarantee of positive returns, as global macro strategies are still exposed to left tail risks, particularly during periods of market turbulence or unexpected events.

"Our country-level analysis—using the Synthetic Control Method (SCM) to compare outcomes in IT countries to a synthetic cohort—shows that IT adoption delivers significant inflation gains in about a third of the cases. At the same time, we also find limited support for the

"Our country-level analysis—using the Synthetic Control Method (SCM) to compare outcomes in IT countries to a synthetic cohort—shows that IT adoption delivers significant inflation gains in about a third of the cases. At the same time, we also find limited support for the

https://twitter.com/WifeyAlpha/status/1623435795918123009

https://twitter.com/WifeyAlpha/status/1636709782273900546?s=20

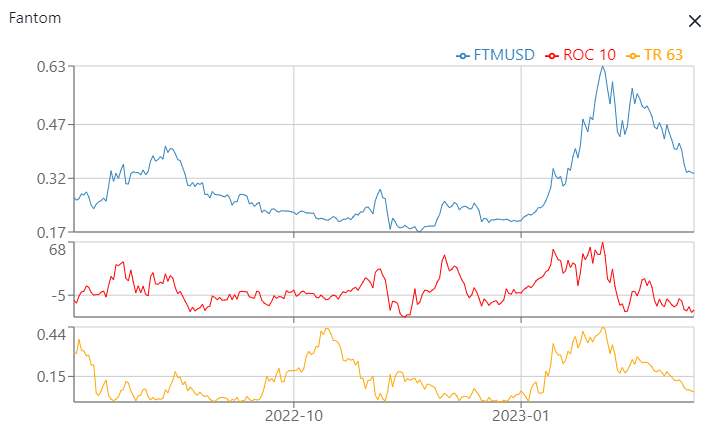

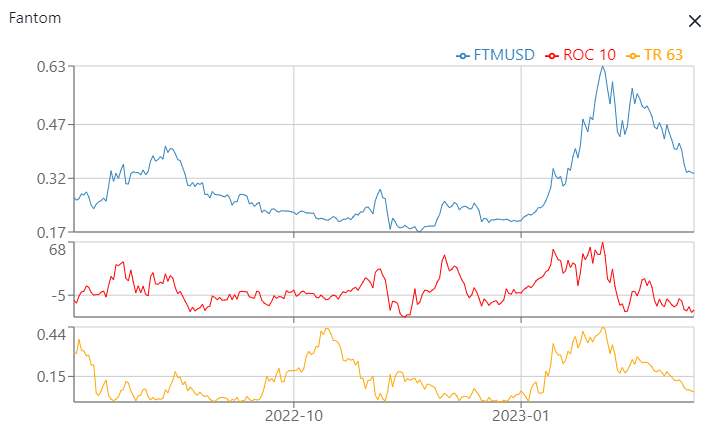

Summary: Strong bear momo in short term, strong bull momo in mid term. Weak bull momo in L-T. All timeframes have have low/falling Trend Ratio (yellow line). This shows us that the trend stability is weak on multiple timeframes. Conviction / trading leverage should be low.

Summary: Strong bear momo in short term, strong bull momo in mid term. Weak bull momo in L-T. All timeframes have have low/falling Trend Ratio (yellow line). This shows us that the trend stability is weak on multiple timeframes. Conviction / trading leverage should be low.

Full alts list below

Full alts list below

By blending the wifey fam views and equilibrium returns instead of relying only on historical asset returns, the Black-Litterman model provides a systematic way to estimate the mean and covariance of asset returns from the fam.

By blending the wifey fam views and equilibrium returns instead of relying only on historical asset returns, the Black-Litterman model provides a systematic way to estimate the mean and covariance of asset returns from the fam.

https://twitter.com/WifeyAlpha/status/1582105611449561090

Smart CQ (lil fucking bitch)

Smart CQ (lil fucking bitch) https://twitter.com/WifeyAlpha/status/1577703756195561473?s=20