📆Want to escape your 9-5?(Check the link below)👇 🌎Lived in 55 countries & 133 cities since 2022💻 📺 +5M on YouTube powered by Stamp Seed 🔨

How to get URL link on X (Twitter) App

In their latest blog post, the ECB admitted their CBDC will have $500 “holding limits.”

In their latest blog post, the ECB admitted their CBDC will have $500 “holding limits.”

We're beginning to see a number of these cycles, originally meant to unwind by 2030, begin to accelerate...

We're beginning to see a number of these cycles, originally meant to unwind by 2030, begin to accelerate...

The biggest contention critics will have with this data will come down to how we agree to measure adoption.

The biggest contention critics will have with this data will come down to how we agree to measure adoption.

The 1st reason has to do with time and technology.⏰

The 1st reason has to do with time and technology.⏰

So, who was Germany's richest man in 1924, Hugo Stinnes?

So, who was Germany's richest man in 1924, Hugo Stinnes?

Everybody is hyperfocused on Michael Saylor especially as he approaches the 210,000 Bitcoin milestone.

Everybody is hyperfocused on Michael Saylor especially as he approaches the 210,000 Bitcoin milestone.

Before you call me crazy, many commonly held assumptions are breaking today:

Before you call me crazy, many commonly held assumptions are breaking today:

Every incumbent monopoly resists new, disruptive change.💥

Every incumbent monopoly resists new, disruptive change.💥

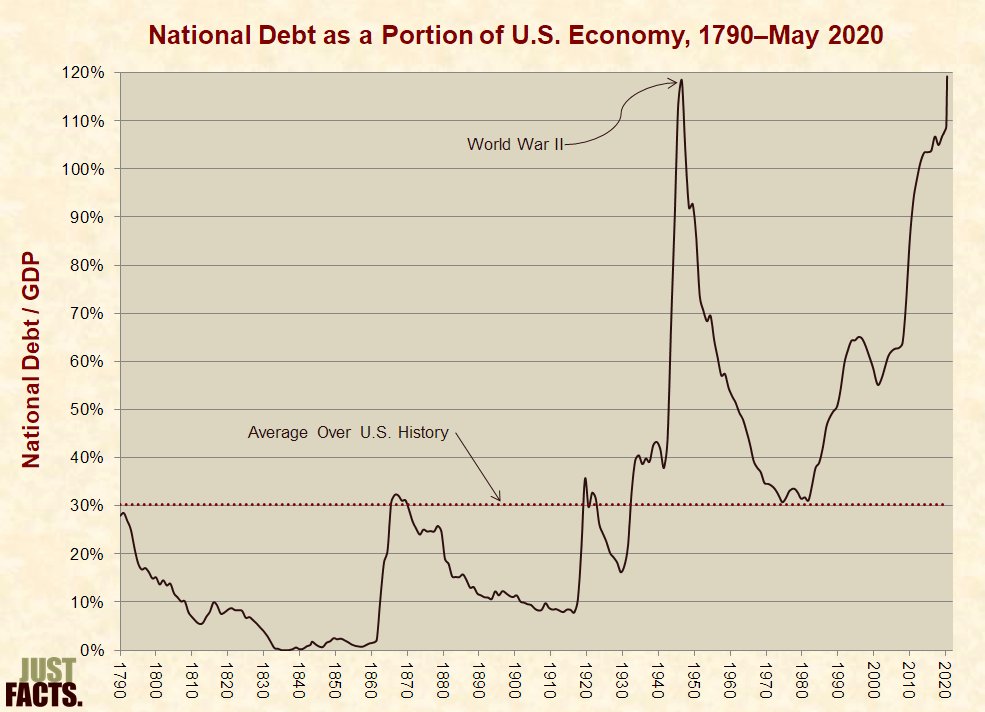

In 1991, Neil Howe’s book ''Generations'' predicted that there'd be a major crisis in the US by 2020. 👀

In 1991, Neil Howe’s book ''Generations'' predicted that there'd be a major crisis in the US by 2020. 👀

@nayibbukele announced El Salvador would become the 1st #Bitcoin country on June 5th 2021, EXACTLY 2 yrs ago

@nayibbukele announced El Salvador would become the 1st #Bitcoin country on June 5th 2021, EXACTLY 2 yrs ago

I failed my challenge, only spending BTC 300 times in 180 days, but found you can spend #Bitcoin at:

I failed my challenge, only spending BTC 300 times in 180 days, but found you can spend #Bitcoin at:

Most #Bitcoin maths calculations assume that all of the 21 million #Bitcoin is available for sale.

Most #Bitcoin maths calculations assume that all of the 21 million #Bitcoin is available for sale.

What happens when the bond market does some simple grade 11 maths @FossGregfoss ??

What happens when the bond market does some simple grade 11 maths @FossGregfoss ??

Hyperinflation; like technological adoptions, is a gradually then suddenly process.

Hyperinflation; like technological adoptions, is a gradually then suddenly process.