Christian | Husband | Father | Lifter | Individual Investor | U.S. Navy OEFOIF #Veteran | Lover of DD

How to get URL link on X (Twitter) App

1/

1/

2/

2/

1/

1/

1/

1/

2/

2/https://x.com/McSqueezyTheCow/status/1763220643078664381?s=20

1/

1/

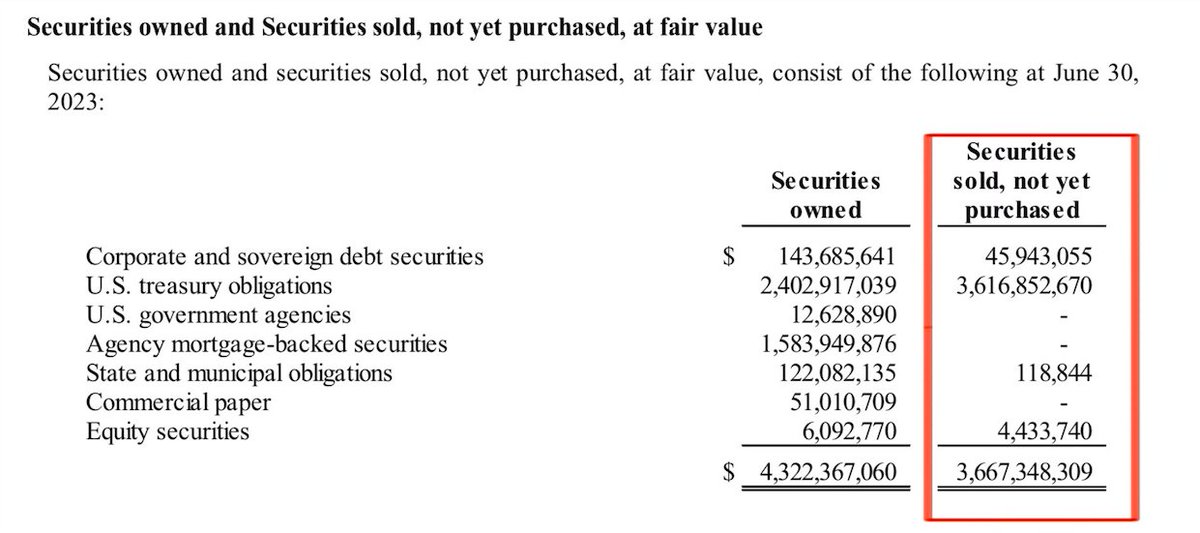

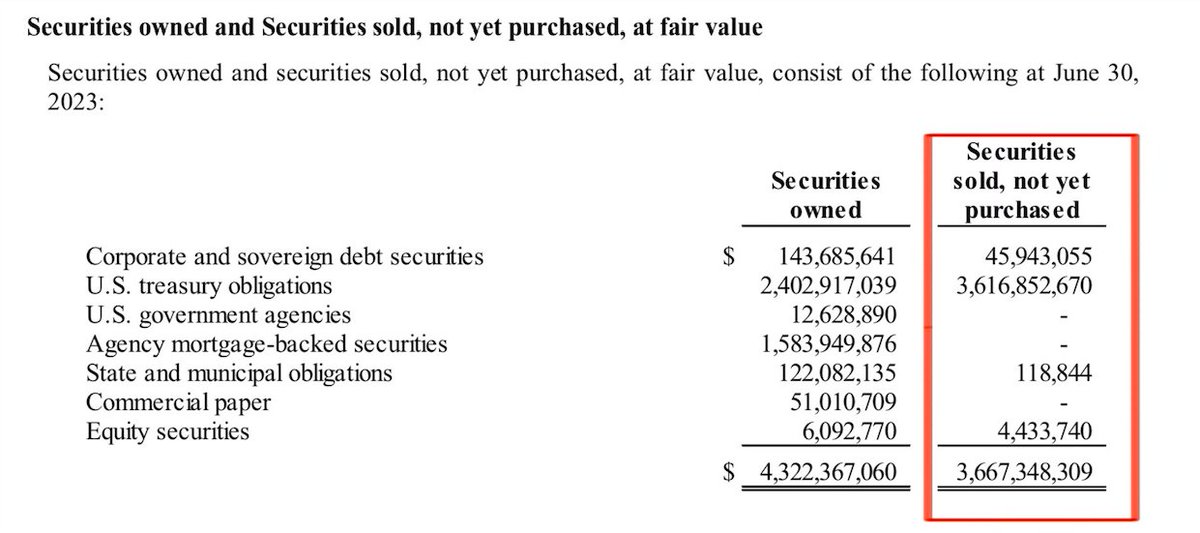

"Investment securities are a category of securities tradable financial assets such as equities or fixed income instruments—that are purchased with the intention of holding them for investment".

"Investment securities are a category of securities tradable financial assets such as equities or fixed income instruments—that are purchased with the intention of holding them for investment".

https://twitter.com/CEOAdam/status/1605926983145181184A reverse split is a "corporate action". 2/