How to get URL link on X (Twitter) App

https://twitter.com/peterrquinones/status/1810101322630189478

https://x.com/realstewpeters/status/1837554098528260560?s=46&t=IPq_vRSnPZokRJFmdbsW1Q

https://twitter.com/realstewpeters/status/1837554098528260560Israel is the enemy’s scapegoat. They know it gets spergy audiences mad & content creators engagement. Both become useful idiots of the regime. The real war being waged is the info war. If you’re knee-jerk reacting/worrying from news like this, you are serving the enemy & lost…

https://twitter.com/saifedean/status/18012915044989337762) The Fed was built to enrich bankers while the government gets a cut. However, it WAS NOT designed to loot the country (we the people) and compromise her sovereignty. Ending this arrangement & commercial banking’s private capital creation leads to complete government control…

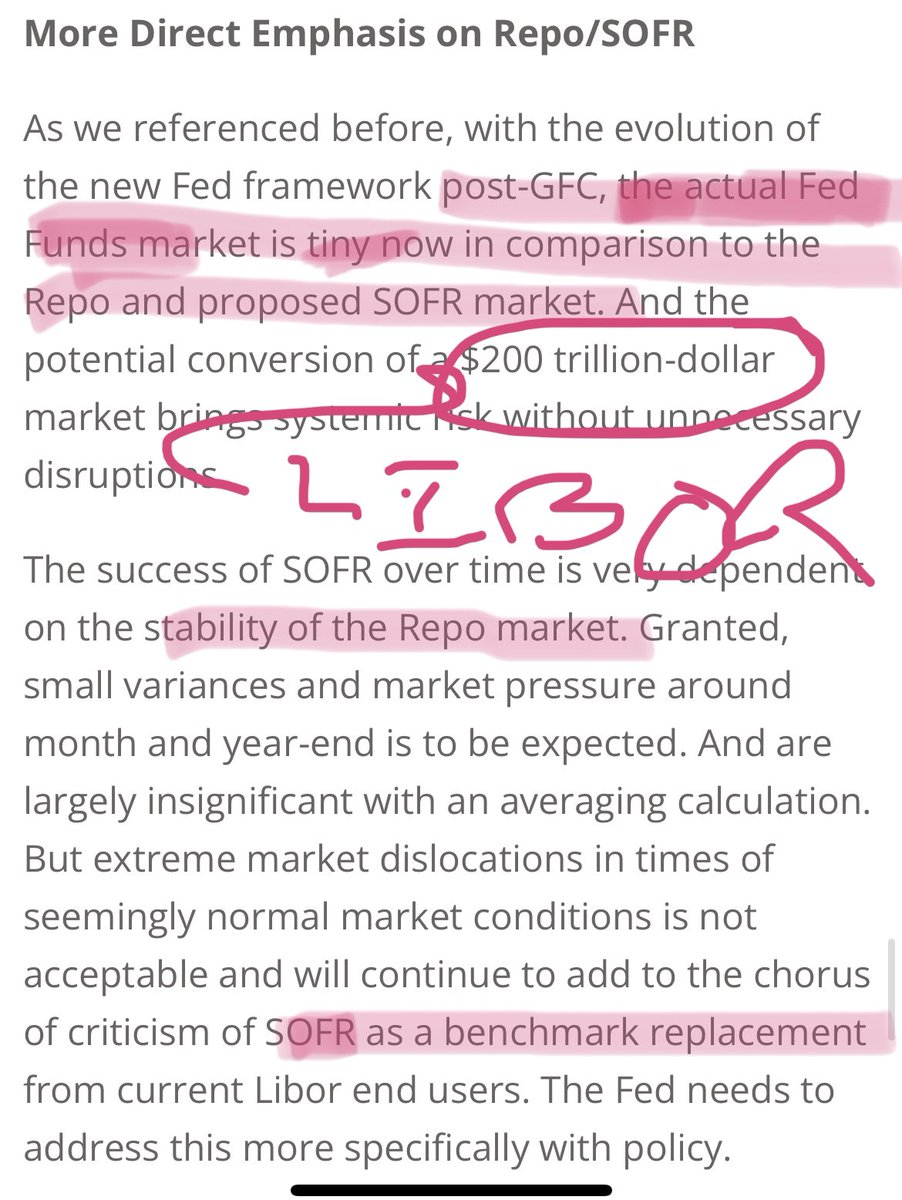

https://twitter.com/santiagoaufund/status/17131884015312408882) @SantiagoAuFund & @HodlMagoo’ premise assumes the Eurodollar market was decentralized to begin with. This is just incorrect. Plus Magoo claims SOFR is “centralizing of control of rates.” Sorta, but some context is def needed regardless . So, let’s sift through the nuance.

https://twitter.com/mollyelmore22/status/15864493625020948482) This has been due to the Fed’s policy of tightening via raising rates and sucking dollars into RRP. What would give the dollar even more value and prevent the hyper inflationary scenario is if the US follows the steps of Russia and China and enable a commodity-backed currency.

https://twitter.com/MrPseu/status/15719550181519564812) Yes, It's from 2019, but further confirms the move away from LIBOR and potentially replacing FFR (IMHO). Biggest confirmation was in the last paragraph I think

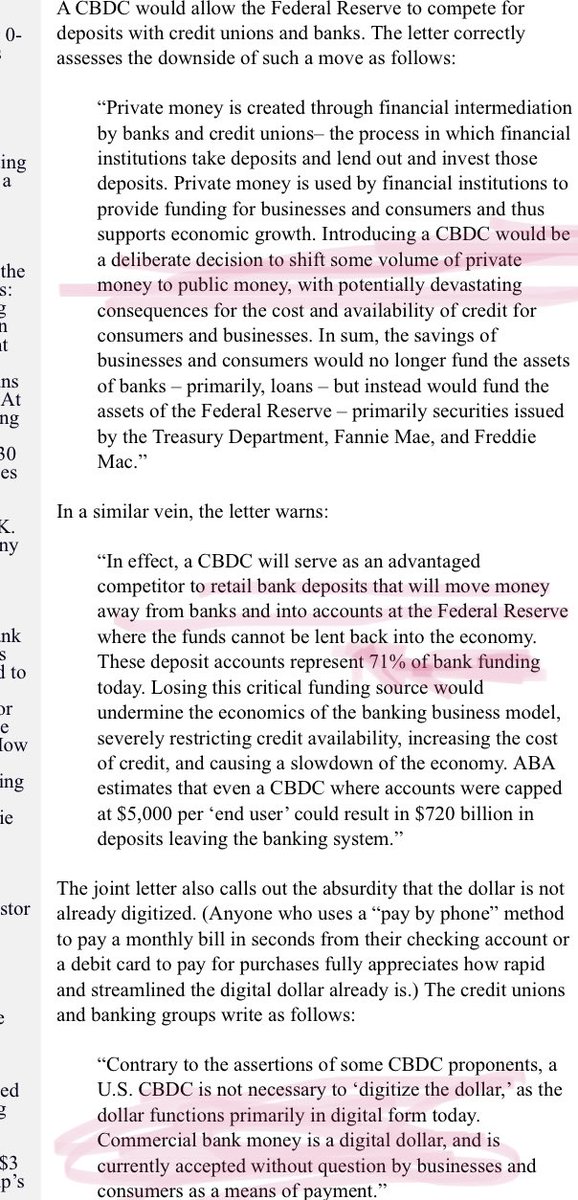

https://twitter.com/NikoJilch/status/1563446734184779779Sure, nobody really wants a surveillance coin, but THAT topic is the “hand waving.” THIS however is the REAL argument for why they won’t do a CBDC. You won’t hear anyone at the Fed talk about that though. That would be saying the quiet parts out loud.

https://twitter.com/petermccormack/status/1554482173079482369That Black Rock paper they discuss 40 minutes in is eye-opening. Essentially Davos used black rock to publish the strategy on how to bankrupt America by forcing the Fed to liquidate itself during COVID.