We publish research reports in the public interest. Not investment advice.

Our social media manager is dyslexic.

Disclaimer: https://t.co/O3NxrXlqpQ

How to get URL link on X (Twitter) App

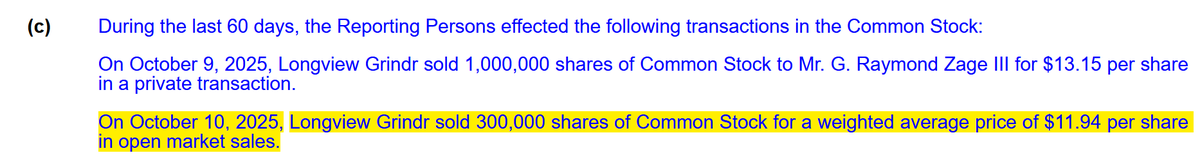

That $GRND margin call should’ve been disclosed in a Form 4.

That $GRND margin call should’ve been disclosed in a Form 4.

$COCO's supply chain, touted as a competitive advantage, is a mess. Inventory shortages have upset retailers, with Walmart downgrading shelf placement & reducing SKUs, leading to double-digit sales declines.

$COCO's supply chain, touted as a competitive advantage, is a mess. Inventory shortages have upset retailers, with Walmart downgrading shelf placement & reducing SKUs, leading to double-digit sales declines.

The most significant expansion has taken place in $MBIN's multifamily and healthcare loan book, growing from $529 million in 2017 to $6.6bn in Mid-2024.

The most significant expansion has taken place in $MBIN's multifamily and healthcare loan book, growing from $529 million in 2017 to $6.6bn in Mid-2024.

2/x On Friday, we checked Il Makiage's review section again, and more than 37,000 new low-star reviews were posted on the monitored products.

2/x On Friday, we checked Il Makiage's review section again, and more than 37,000 new low-star reviews were posted on the monitored products.

$WMT relies on Symbotic’s automation systems to achieve its strategic goals. But all products are still in prototype status, $SYM’s management acknowledged that. $SYM products lack innovation, while competitors introduced similar solutions decades ago.

$WMT relies on Symbotic’s automation systems to achieve its strategic goals. But all products are still in prototype status, $SYM’s management acknowledged that. $SYM products lack innovation, while competitors introduced similar solutions decades ago.

$ABR owns a toxic and worthless portfolio of mobile homes called Lexford/Empirian, loaded with $582m of debt. Arbor secretly invested millions into wholly-owned Lexford but shareholders only received 4.1% of total profits. More than $159m is missing.

$ABR owns a toxic and worthless portfolio of mobile homes called Lexford/Empirian, loaded with $582m of debt. Arbor secretly invested millions into wholly-owned Lexford but shareholders only received 4.1% of total profits. More than $159m is missing.

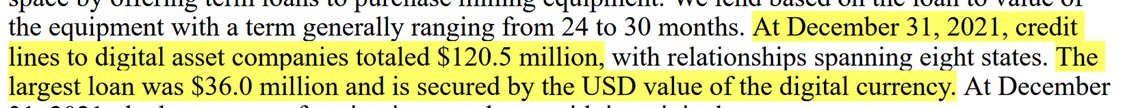

$PVBC expanded its #crypto lending business to $138m within 18 months and yesterday impaired more than half of it. A 200yr old #bank went tits-up in a matter of months. Read our report: bit.ly/3OisAKH

$PVBC expanded its #crypto lending business to $138m within 18 months and yesterday impaired more than half of it. A 200yr old #bank went tits-up in a matter of months. Read our report: bit.ly/3OisAKH