Financial Times Acting Whitehall Editor. Formerly FT Investigations and FT Energy Editor, but still dabbles in what makes the world go round. Ex-Reuters.

How to get URL link on X (Twitter) App

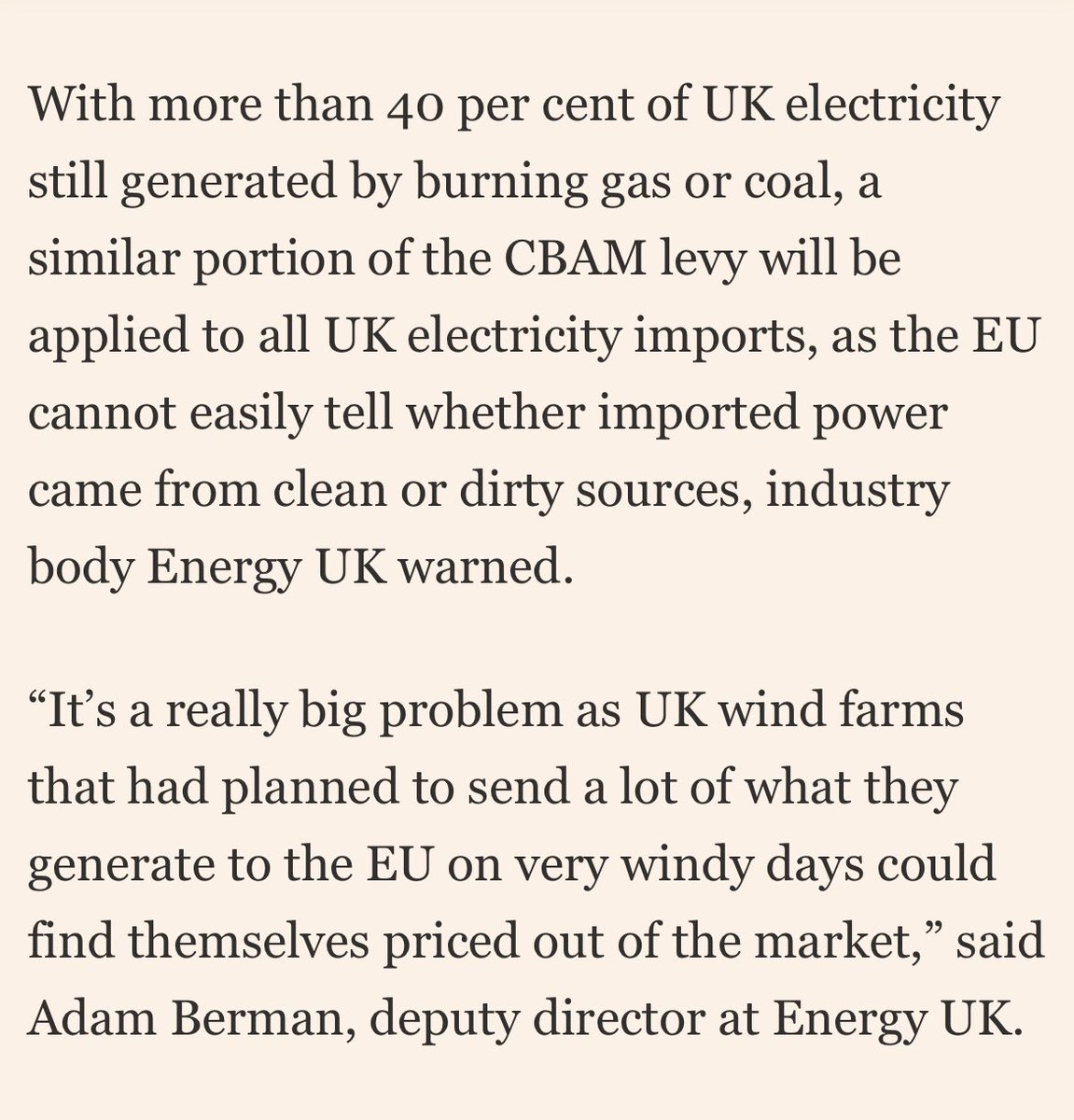

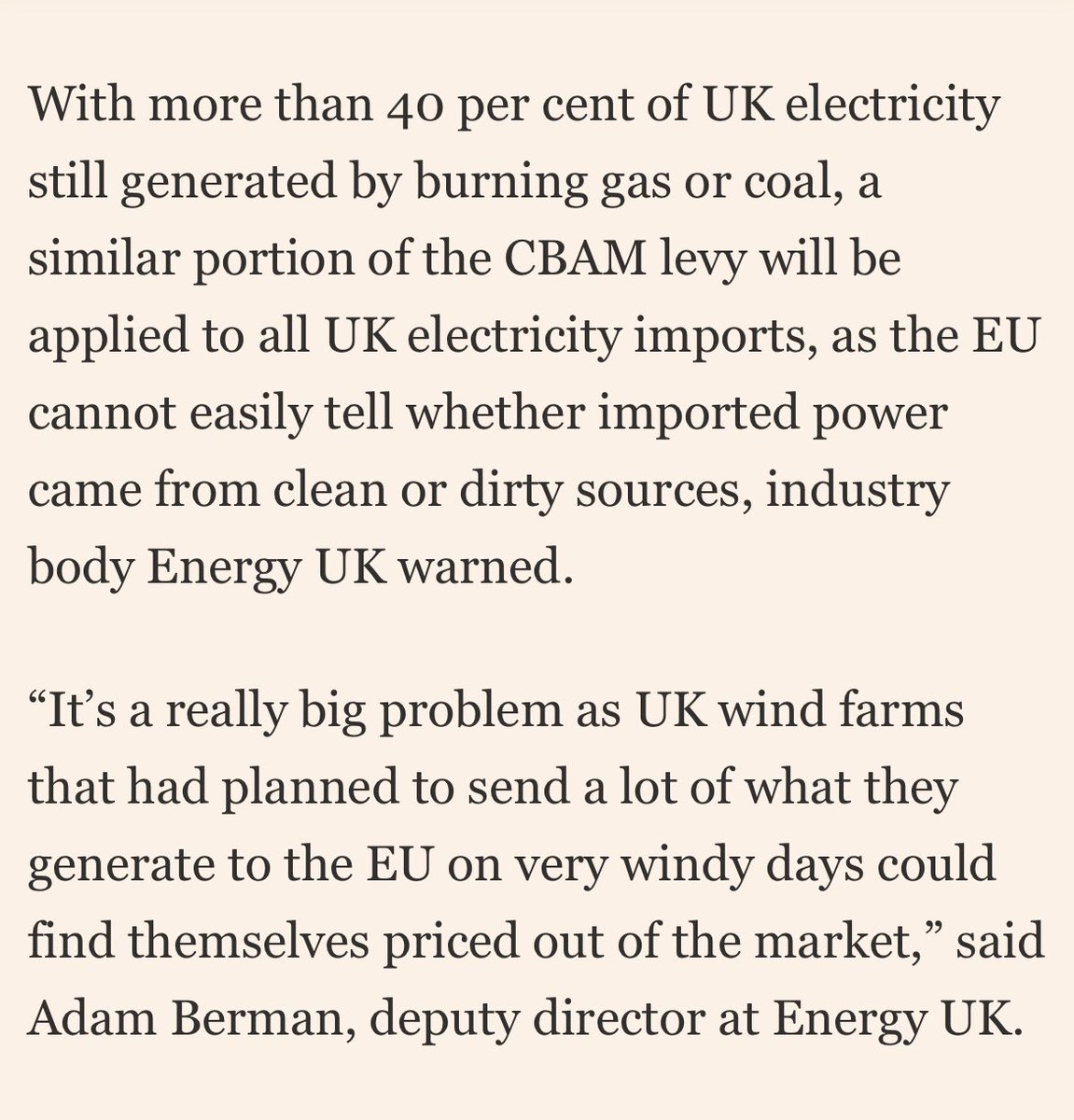

This is going to be a massive issue. The carbon price or UK ETS isn’t particularly well understood in UK political circles.

This is going to be a massive issue. The carbon price or UK ETS isn’t particularly well understood in UK political circles. https://twitter.com/OilSheppard/status/1607880631819853827And living in the UK you wouldn’t have a clue unless I was nerdily tweeting about it and you have the misfortune of following me

https://twitter.com/MacaesBruno/status/1510161750787821576There’s a seam of paranoia about the West having it in for them, despite almost all evidence suggesting a willingness to trade and rub along together, however awkwardly, rather than any grand ambition to see Russia overwhelmingly diminished

https://twitter.com/thomas_m_wilson/status/1500166289125519371Whether by direct request or design of the sanctions, Shell believes western governments want oil traders to keep buying Russian oil to ensure security of supply. That’s arguably fair enough - the sanctions have avoided hitting energy flows, so not only are no laws being broken..

https://twitter.com/OilSheppard/status/1491318745033486336Quite possibly.

In Group A, where the final games are ‘live’, we really want Turkey to come from behind to either beat or draw with Switzerland.

In Group A, where the final games are ‘live’, we really want Turkey to come from behind to either beat or draw with Switzerland.

Volumes of so-called TAS contracts were more than four times higher that Monday than on any day in 2019, and would be consistent with a large, not-particularly-sophisticated ETF or other oil-linked product looking to close out its position. #OOTT

Volumes of so-called TAS contracts were more than four times higher that Monday than on any day in 2019, and would be consistent with a large, not-particularly-sophisticated ETF or other oil-linked product looking to close out its position. #OOTT