Bitcoin financial services built on Multi-Institution Custody

✉️ hello@onrampbitcoin.com

How to get URL link on X (Twitter) App

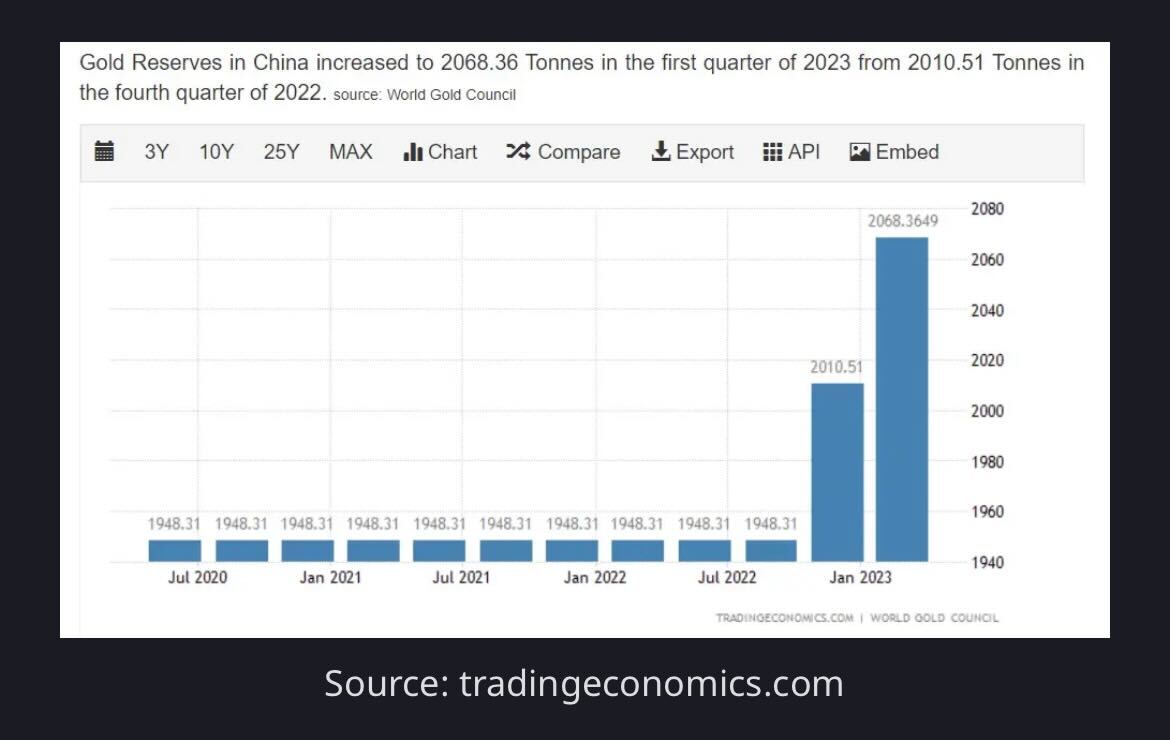

In recent years, Pozsar has garnered attention for introducing the concept of Bretton Woods III -- “a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Euro and also contribute to inflationary forces in the West.”

In recent years, Pozsar has garnered attention for introducing the concept of Bretton Woods III -- “a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Euro and also contribute to inflationary forces in the West.”

The 2021 bull market saw unique headwinds: a China ban, significant use of undue leverage, "paper bitcoin" issuance, and the Fed's shift to Quantitative Tightening. These factors likely led to a softened bull market peak, inhibiting a blow-off top.

The 2021 bull market saw unique headwinds: a China ban, significant use of undue leverage, "paper bitcoin" issuance, and the Fed's shift to Quantitative Tightening. These factors likely led to a softened bull market peak, inhibiting a blow-off top.

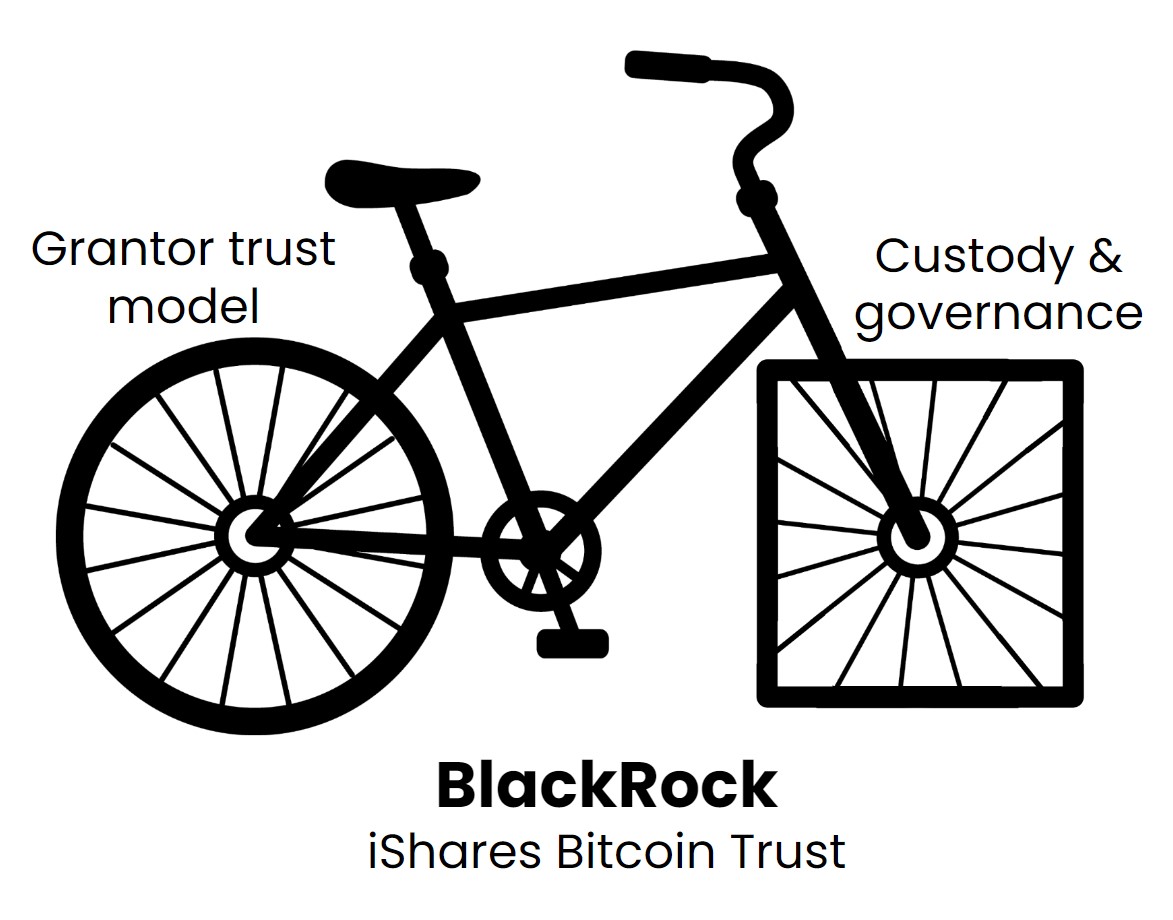

On June 15th, BlackRock filed an S-1 with the SEC, a registration statement detailing its intended Bitcoin Trust product.

On June 15th, BlackRock filed an S-1 with the SEC, a registration statement detailing its intended Bitcoin Trust product.

DeFi (decentralized finance) is the broad category of crypto projects and protocols aiming to replicate traditional finance functions through exotic blockchain applications.

DeFi (decentralized finance) is the broad category of crypto projects and protocols aiming to replicate traditional finance functions through exotic blockchain applications.