Bitcoin, Tech, & Books.

Cofounder of TIP. GP @egodeathcapital.

Advisor at @primal_app and @debificom.

Nostr: https://t.co/DZDhdYp55P

31 subscribers

How to get URL link on X (Twitter) App

But, during this period of time the M2 money supply has aggressively grown. When you adjust the chart for M2, this is what it looks like. As you can see, a new high on their collective balance sheets wasn't achieved even though in non-M2 adjusted terms it had a massive jump. 2/4

But, during this period of time the M2 money supply has aggressively grown. When you adjust the chart for M2, this is what it looks like. As you can see, a new high on their collective balance sheets wasn't achieved even though in non-M2 adjusted terms it had a massive jump. 2/4

I suspect the answer is based on the idea that interest rates are like economic gravity. When rates are high like in the early 80’s it’s the equivalent of conducting business as if gravity on earth was 10X more stressing than it is today. For example if you want to lift …2/6

I suspect the answer is based on the idea that interest rates are like economic gravity. When rates are high like in the early 80’s it’s the equivalent of conducting business as if gravity on earth was 10X more stressing than it is today. For example if you want to lift …2/6

As we "birth" this new economic system, the inflationary periods will be accompanied with violent deflationary fits. This is simply the fiat currency failing. It should be expected. Right now, it appears the fixed income market and equity markets are starting their big

As we "birth" this new economic system, the inflationary periods will be accompanied with violent deflationary fits. This is simply the fiat currency failing. It should be expected. Right now, it appears the fixed income market and equity markets are starting their big

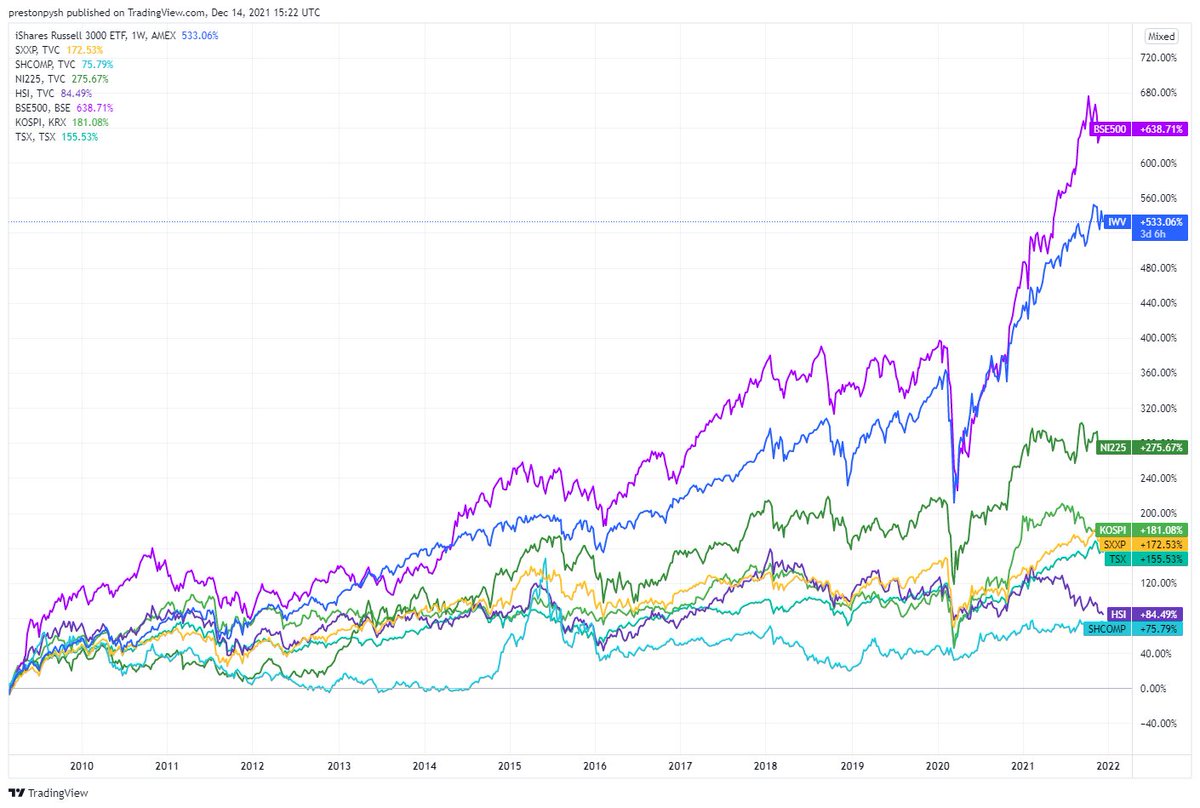

Let's start by looking at how the major stock indexes around the world have recovered since 2009.

Let's start by looking at how the major stock indexes around the world have recovered since 2009.

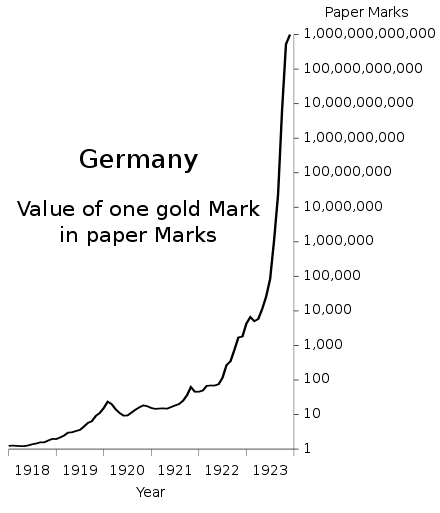

The headlines in Germany during OCT 1922 were of particular note, according to the Frankfurter Zeitung: "German economic life is dominated by a struggle over the survival of the Mark: Is it to remain the German currency, or is it doomed to extinction? During the past few months

The headlines in Germany during OCT 1922 were of particular note, according to the Frankfurter Zeitung: "German economic life is dominated by a struggle over the survival of the Mark: Is it to remain the German currency, or is it doomed to extinction? During the past few months

Update to August Chart.

Update to August Chart.

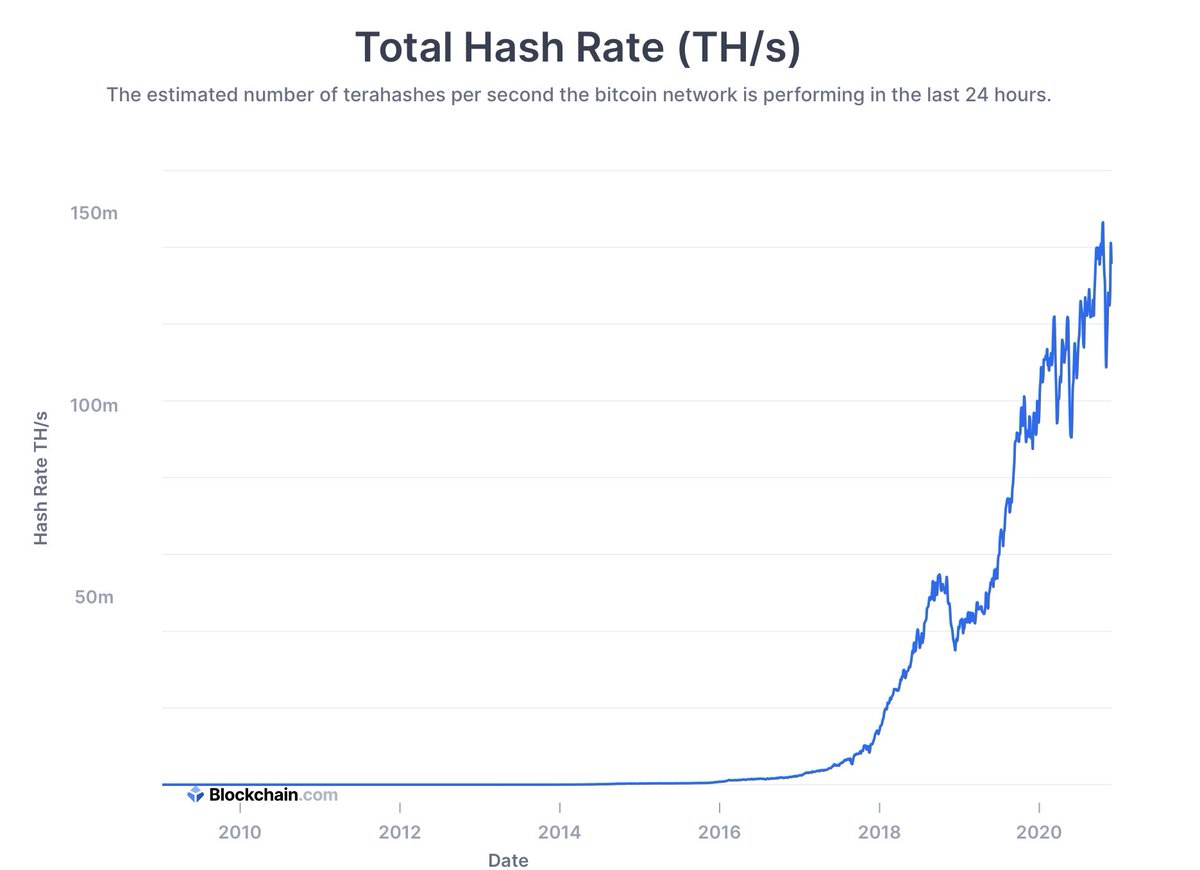

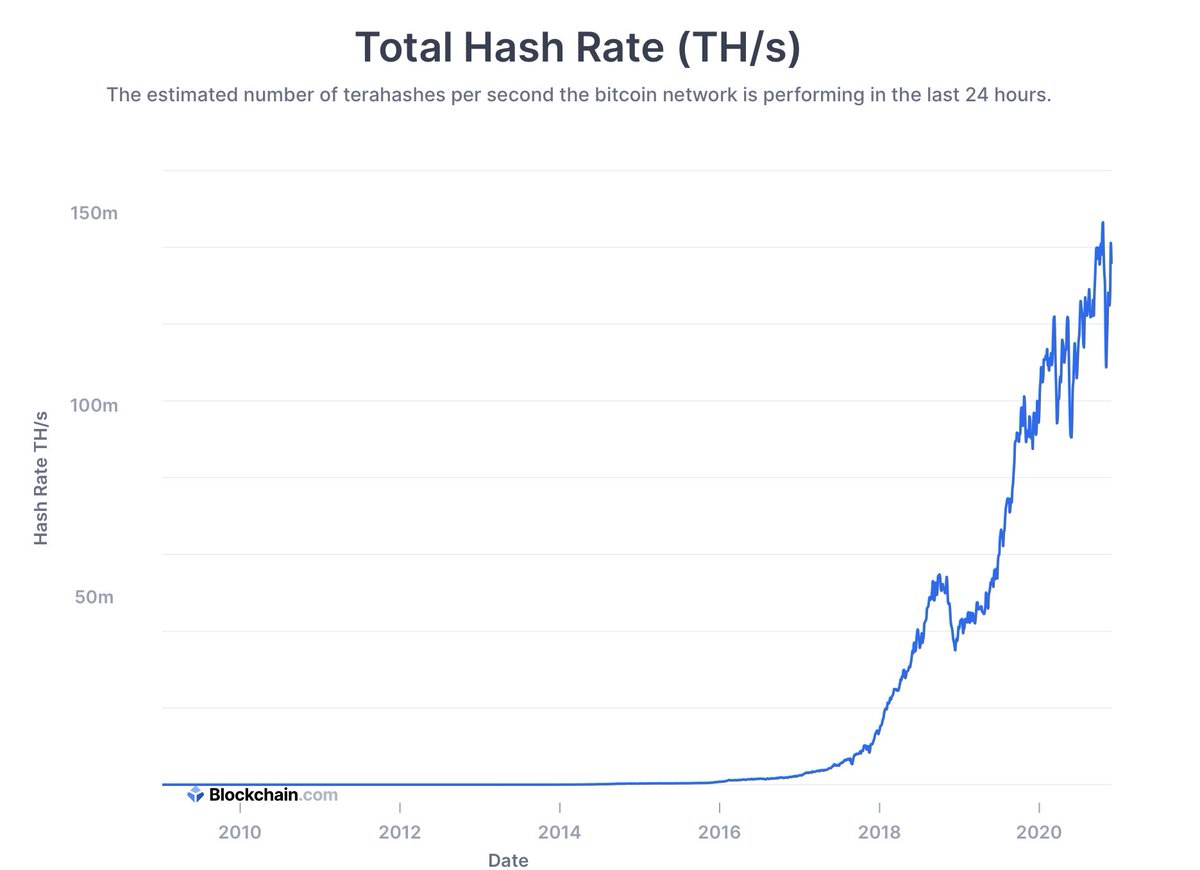

So you've probably heard your professor or resident expert economist tell you that #Bitcoin is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed

So you've probably heard your professor or resident expert economist tell you that #Bitcoin is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed