Doing things with crypto | Co-founder @weRate_Official | Host @CoinCompassHQ | bestselling author | Forbes 30U30 | Business & partnerships: @GavinVDL

How to get URL link on X (Twitter) App

✅ The GENIUS Act in simple terms:

✅ The GENIUS Act in simple terms:

2/ What is the cash-and-carry trade?

2/ What is the cash-and-carry trade?

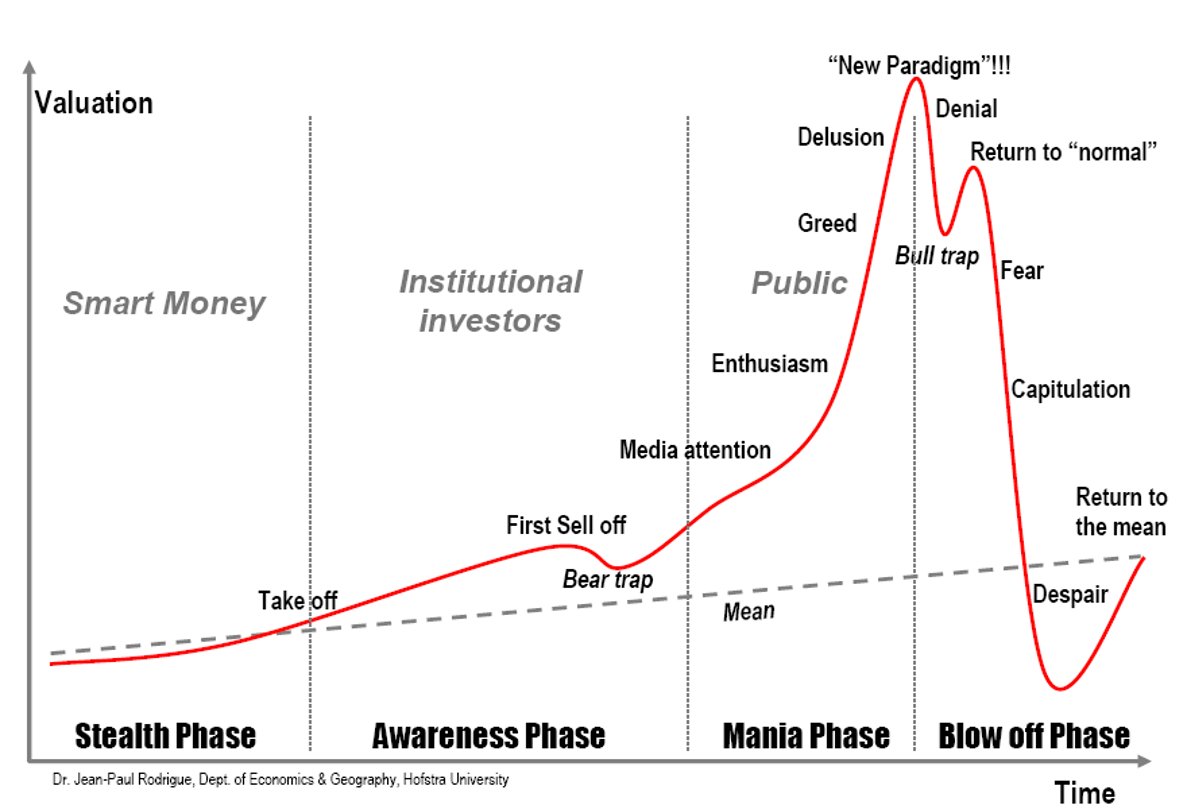

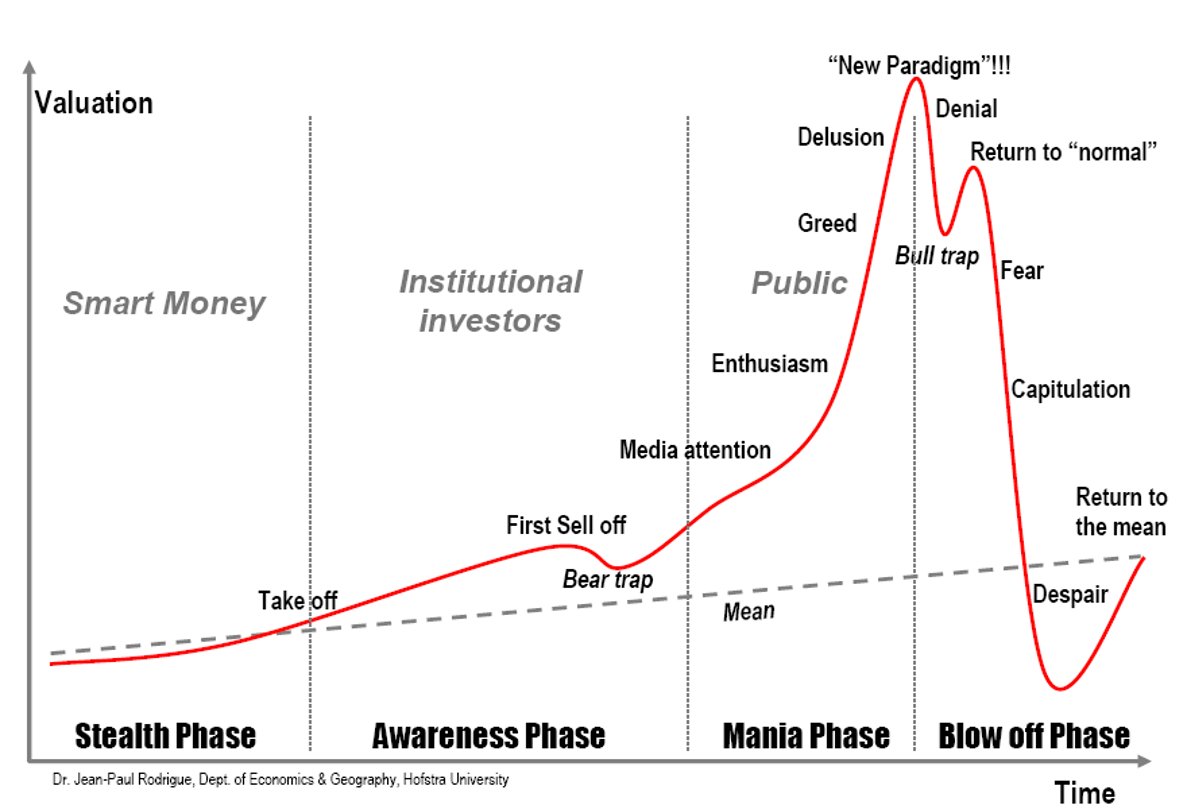

Every ~4 years a full cycle plays out entirely. Why does this happen every 4 years? Why so fast?

Every ~4 years a full cycle plays out entirely. Why does this happen every 4 years? Why so fast?

2/ Kujira is an L1 blockchain built on Cosmos.

2/ Kujira is an L1 blockchain built on Cosmos.

In the past:

In the past:

https://twitter.com/ernesturtasun/status/1542217821958115332- Unhosted wallets ARE the innovation! Regulating it this way will destroy all innovation around it.

Now, what does this mean? Historically we see the $BTC price bottom 6-9 months after this turning point. People are not longer willing to sell (or even move) their bitcoin and are simply holding it. Mainly because they think price increases are coming or accumulation is here.

Now, what does this mean? Historically we see the $BTC price bottom 6-9 months after this turning point. People are not longer willing to sell (or even move) their bitcoin and are simply holding it. Mainly because they think price increases are coming or accumulation is here.

1) First of all, in recent weeks we had an accumulation of bad news and events. But during this time, it was very remarkable to see how altcoins kept up versus Bitcoin. Even during the heaviest of news and fear in the market, altcoins held up strong compared to Bitcoin.

1) First of all, in recent weeks we had an accumulation of bad news and events. But during this time, it was very remarkable to see how altcoins kept up versus Bitcoin. Even during the heaviest of news and fear in the market, altcoins held up strong compared to Bitcoin.