Quant microcap investor, engineer, Founder of "GUTS" investing. Head of Evidence Based Research @MicroCapClub. Portfolio123 creator, ext. free trial below

How to get URL link on X (Twitter) App

The hedge fund AQR (led by Cliff Asness @CliffordAsness ) developed the QMJ strategy, which goes long quality stocks, and shorts junk stocks. Link to paper below.

The hedge fund AQR (led by Cliff Asness @CliffordAsness ) developed the QMJ strategy, which goes long quality stocks, and shorts junk stocks. Link to paper below.

Now take a cyclical microcap, $tayd. PE expansion and contraction (red) occurs before growth (and slowdown), orange.

Now take a cyclical microcap, $tayd. PE expansion and contraction (red) occurs before growth (and slowdown), orange.

https://x.com/RTelford_invest/status/1789109713809899859

And some other names earning 10X in the last 10 years:

And some other names earning 10X in the last 10 years:

This performance has outperformed the major indices by a wide margin as well, with $QQQ the closest.

This performance has outperformed the major indices by a wide margin as well, with $QQQ the closest.

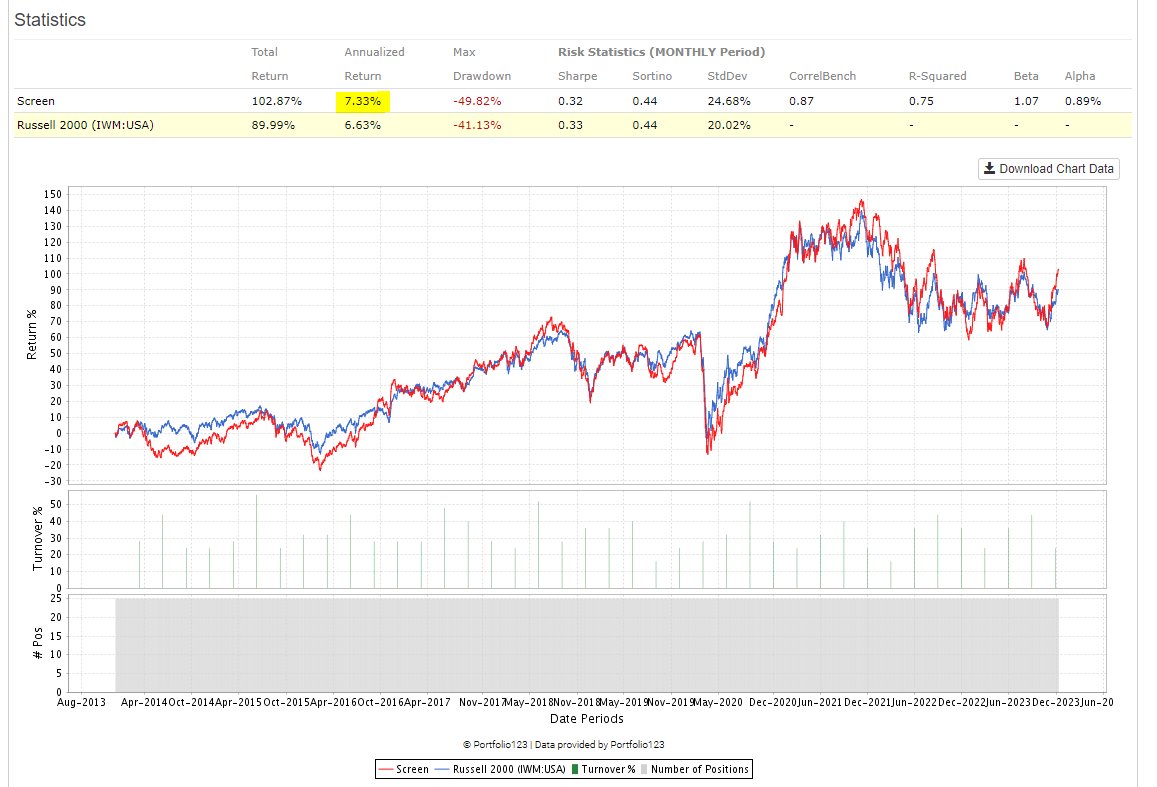

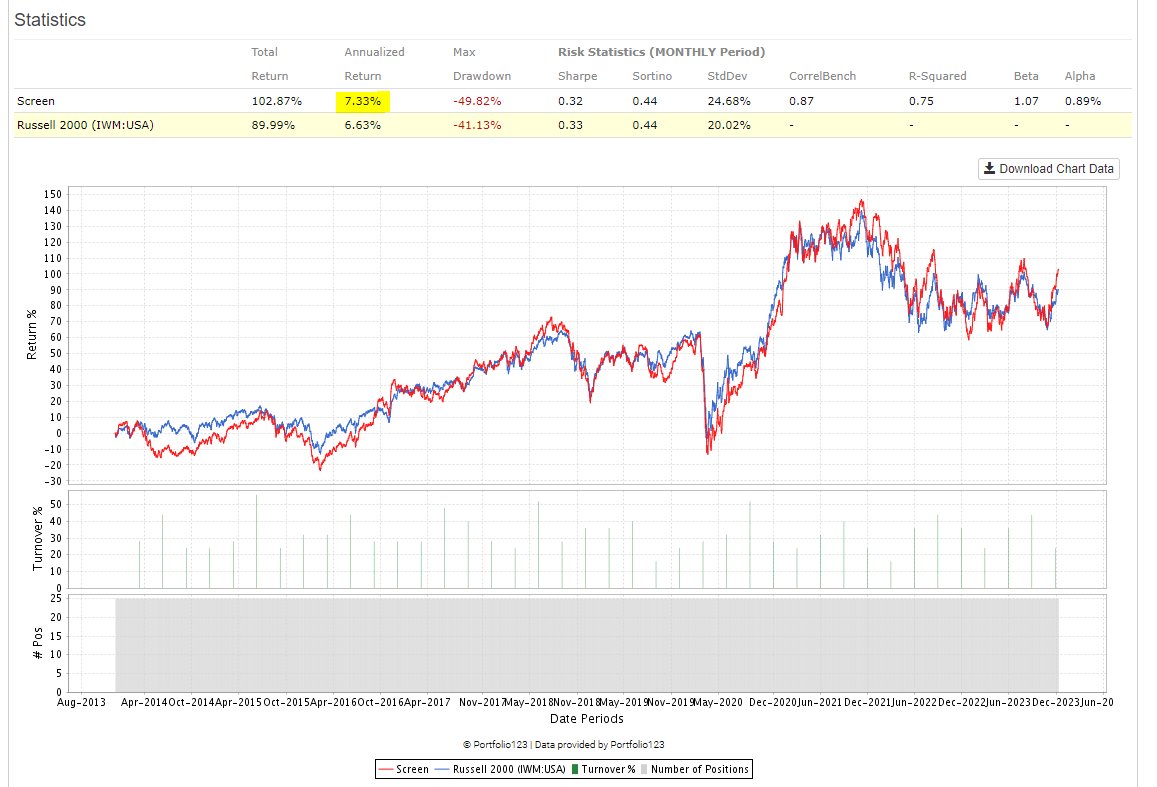

https://twitter.com/RTelford_invest/status/1736408715517911123Let's take a 25 stock portfolio of the highest ROIC stocks in the $SPY. Very good returns at ~20% CAGR. However also note the high concentration in tech (right).

ROIC is also a measure of how effectively a company is deploying capital.

ROIC is also a measure of how effectively a company is deploying capital.

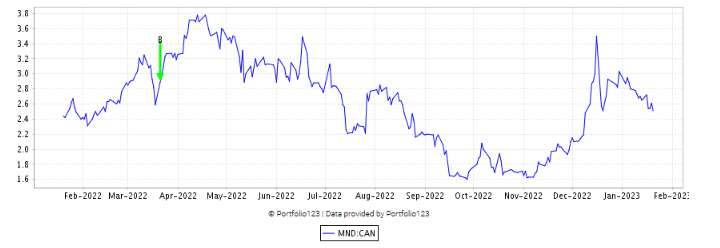

On the flipside, here's a stock that I've held for nearly 1 year, with flat return $mnd.to

On the flipside, here's a stock that I've held for nearly 1 year, with flat return $mnd.to