Markets, NSE, Futures and Options.

Creator, Opstra Options Analytics.

For Opstra related queries write to opstra@definedge.com

8 subscribers

How to get URL link on X (Twitter) App

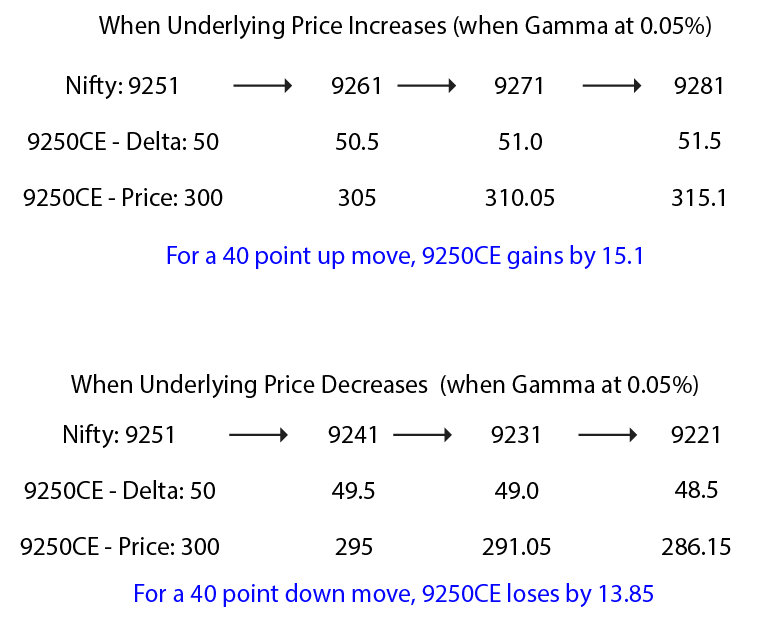

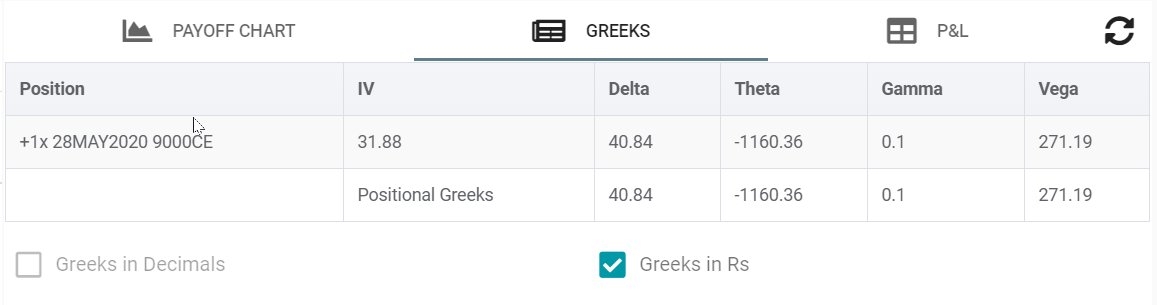

https://twitter.com/Raghunath_TL/status/1268426941540990976A 'Debit Spread' involves buying a near-the-money (NTM) option and selling an out-of-the-money (OTM) option, in effect paying more for buying the long option than you get the credit for selling a short option, hence the name Debit Spread.

https://twitter.com/Raghunath_TL/status/1259729103240015873?s=20An option's value is comprised of two components – intrinsic value &extrinsic value (also called time value). As time passes, the time value portion of the option gradually depreciates until expiry and at expiration the option value worth is exactly equal to the intrinsic value.

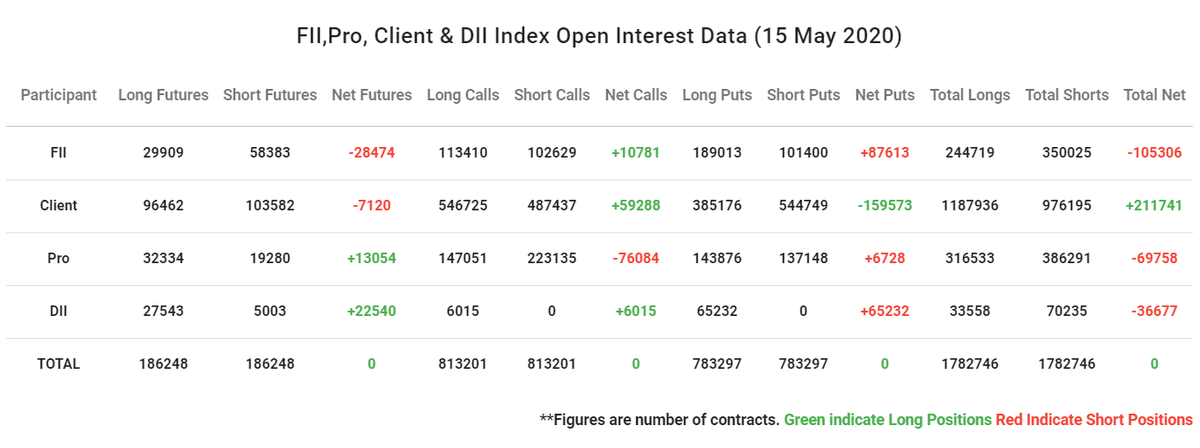

FIIs added more shorts and Retail went more long

FIIs added more shorts and Retail went more long